Over 100 attacks on global energy assets made major news headlines in the past decade. The majority were small-scale, targeting pipelines in conflict-regions, because this was the infrastructure most accessible to aggressors. However, a new and devastating wave of drone technologies could place the world’s largest and most vulnerable facilities into the firing line, threatening multiple millions of barrels per day. This short note outlines the latest in drone technologies and why they concern us.

Historical attacks on energy assets

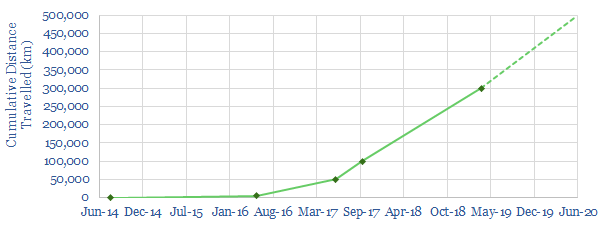

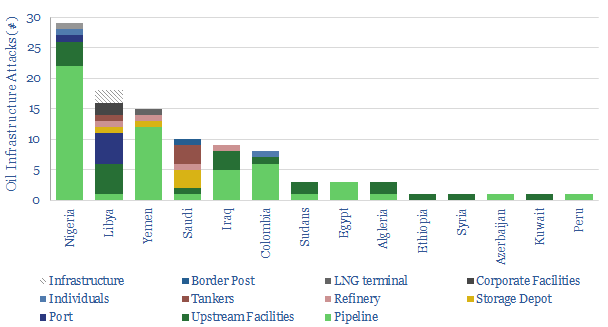

Supply disruptions have been a feature of oil markets over the past ten years. For example, in the chart below, we have counted 100 violent attacks on energy infrastructure from major news stories. However, the majority were small-scale and located in active conflict-zones. Most oil infrastructure has heretofore been safe.

Here are the numbers: 90% of the prior attacks in our sample were low impact, when we assessed their severity. c60% were concentrated on pipeline infrastructure, which is relatively easy to repair. 70% of the upstream attacks were on wells or small processing units. 80% were localised within active war-zones such as Libya, Nigeria, Iraq, Yemen and the Sudans, rather than in stable countries. These attacks were nevertheless numerous. They shuttered 1Mbpd of Nigerian output between 2006 and 2016, 1Mbpd of Libyan output in 2011 and c0.5Mbpd of output in Yemen and Syria.

The more dangerous and worrying attacks have been full-scale assaults on large industrial assets. The worst example, many will remember, was Al Qaeda’s January-2013 attack on Algeria’s 9bcm pa In Amenas gas facility. 39 hostages were killed, as well as 29 terrorists. In addition, it took until June-2016 to bring production back to full capacity. The impacts of such incidents are hard-felt and long-lasting. Another legacy is that security measures have been escalated in high-risk regions.

On 14th September 2019, another industry-changing attack took place, on Saudi Arabia’s Abqaiq and Khurais oilfields. 5.7Mbpd of oil production was curtailed, constituting the largest supply-disruption on record. Repairing the damage will cost hundreds of millions of dollars. The latest suggestion is that the damage was inflicted by 20 drones, plus additional cruise missiles, which may have been guided to their targets by the drones. Unfortunately, this attack raises the spectre of further incidents, owing to the rise of drone swarm technology.

Ten Characteristics of Drone Swarms

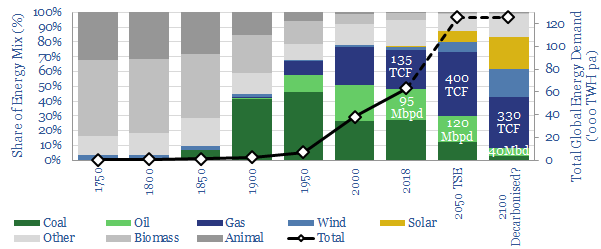

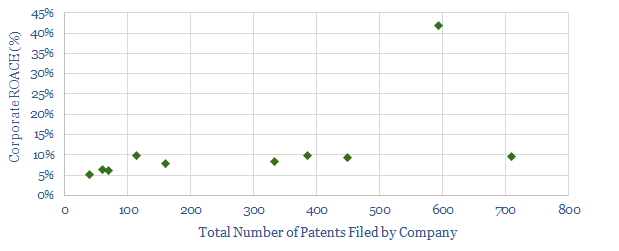

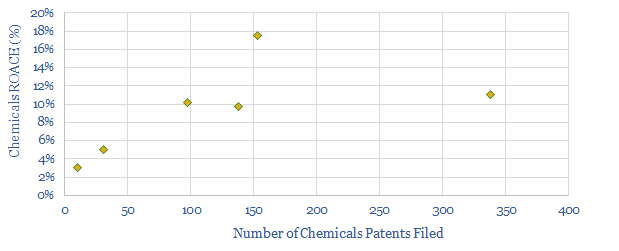

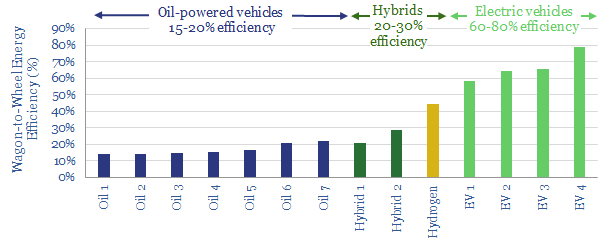

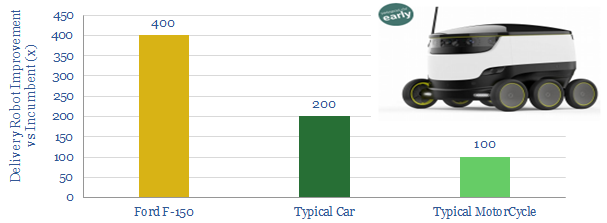

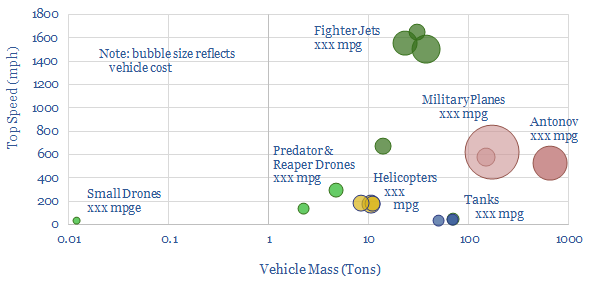

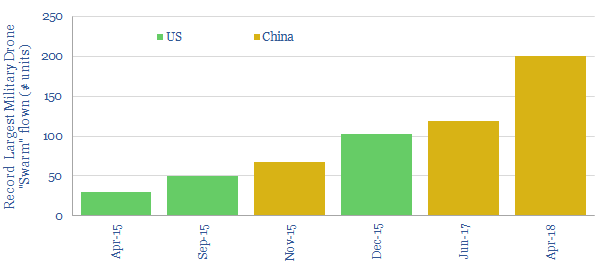

Drone swarms could emerge as the most devastating weapon of 21st century warfare, outflanking large, high-speed, high-cost military vehicles of the past (Hambling, 2015; chart below, data here). They pose much greater risk to high-value infrastructure than prior weaponry that was available to aggressors. To understand why, it is necessary to review ten properties of drone swarms.

(1) Easy to access. Most military equipment is not openly available for purchase on the internet or in consumer electronic stores. However, hundreds of models of drones are now available in the consumer sector. They can be modified and retro-fitted to inflict violence or damage. Similarly, in the military sphere, one expects large super-powers such as the US, Russia and China to develop leading military technologies, but advanced drones are also being developed in smaller countries such as Israel, Iran, Turkey, Korea. The technology is not always closely contained. In particular, Iran has been found to donate its Ababil drones and Quds missiles to allies such as the Houthis; and Islamic State was able to use drones to drop grenades in Northern Iraq in 2016-17.

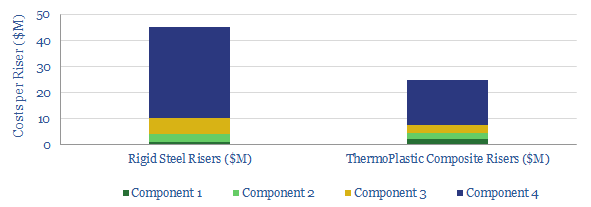

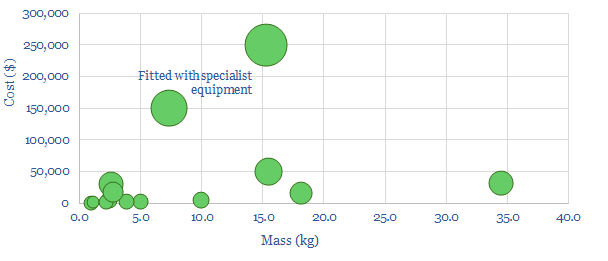

(2) Easy to fund. These drones have price points in the thousands of dollars, rather than the millions, which makes them accessible to small groups of aggressors rather than just to nation-states. Out of 15 high-spec consumer drones that we reviewed recently, the median cost was $10,000 (chart below, data here). Half-a-dozen priced below $2,500. This not only makes them accessible, compared to cruise missiles costing $150k to $1.5M; but also expendable, compared to fighter jets costing $30-150M.

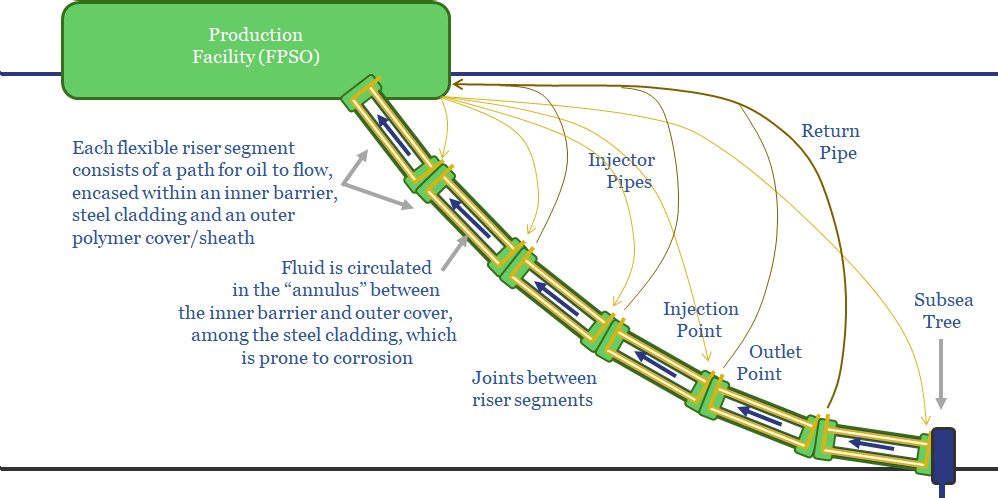

(3) Easy to launch. There is no need for runways, special hangers or refuelling facilities. Drones can launch from any terrain and travel tens or hundreds of miles. The fact that drones can be launched and travel to their targets brings a much wider array of assets into the firing line. This will include facilities deep within protected territory, such as Abqaiq and Khurais; or offshore assets, which have repeatedly been considered as targets by Nigerian militants, but have been protected by their offshore locations.

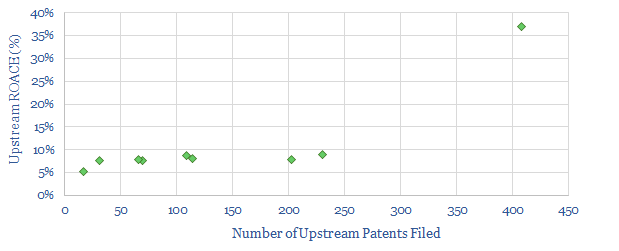

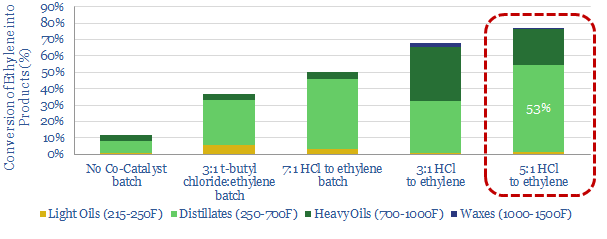

(4) Increasingly large swarms. In 2015, the largest drone swarms being flown numbered 30-50. However, China’s CETC flew drone swarms numbering 100-200 in 2018 (chart below). Israel is developing technologies where a single operator could fly an entire swarm of drones, in a single, controllable formation. This matters because the larger the swarm, the harder it is to neutralize. Using a swarm of 20 drones may be one reason why the latest attack on Saudi infrastructure succeeded, while dozens of prior attacks from 2017-18 were thwarted.

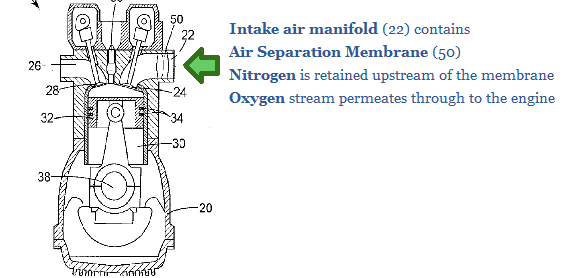

(5) Increasingly autonomous swarms. The most effective counter-measure against military drones in the past has been to “jam” the controllers used for steering them. This tactic was used, for example, against Islamic State, in Northern Iraq. But now, some of the leading commercial drones use neural network algorithms to auto-navigate. Thus they cannot be “jammed”. For example, the Skydio R1 uses a NVIDIA Jetson processor with 192 processing cores, which is less power hungry than prior chips. Qualcomm is also making ‘simultaneous location and mapping’ hardware the size of a credit card, allowing drones to navigate by sight alone.

(6) Potency. A large drone may carry a warhead or missile; smaller drones can carry grenades, IEDs or firearms and small drones may illuminate targets (e.g., with lasers) in order to direct larger incoming missiles. Any of these could do very significant damage to facilities that contain live hydrocarbons.

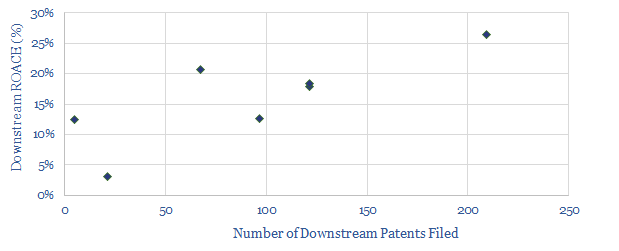

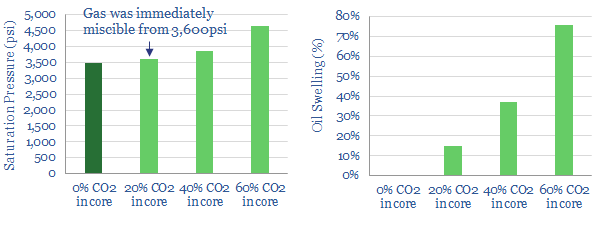

(7) Precision. Autonomous drones can attack very specific targets. This level of precision was seen in the recent Saudi attacks, where individual missiles hit each spheroid tank at Abqaiq, in almost the same identical location (US satellite images below). Another example in the civilian sector is being used at beaches in Australia, where ‘SharkSpotter’ deep learning software is used to identify sharks with 90% accuracy, compared with 30% for human operators. Training a drone to identify sharks versus dolphins is computationally similar to identifying vulnerable versus non-vulnerable processing units at energy infrastructure.

(8) Hard to predict. Because swarms of drones are created with standard electronics equipment, much of it available in the civilian sector, “manufacture [of drone swarms] would be relatively hard to spot—compared to the production of traditional military hardware such as manned aircraft, ships or ballistic missiles—as it would resemble any other consumer electronics assembly” (Hambling, 2018).

(9) Hard to stop. The challenge of stopping a large swarm of drones is that there may simply be too many units to neutralize, especially when they are moving quickly. Laser cannons may stop a few units. A battery of missiles may stop many more. However “shooting down a $1,000 drone with a $5,000 missile is not a winning strategy” (Hambling, 2015). Assuming similar budgets, the drone attackers may outnumber the missile defenders. Acknowledging this challenge, the US has budgeted $1.5bn over the next year, to investigate potential solutions. But outside the military, and back in the realm of energy assets, we doubt that any of today’s onshore or offshore processing facilities have the capacity to stop drone attacks.

(10). Hard to retaliate. Drone attacks are very different from prior cases where armed insurgents attacked oil infrastructure, risking their own lives in the melee. Drones are by their nature remotely operated. Furthermore, reading through the history of recent drone attacks (e.g., in Yemen and Syria), it has often been impossible even to identify the culprit. In some cases, their identity still remains disputed. Failure to pinpoint the perpetrator makes it difficult to strike back. In turn, this removes the usual deterrent to attacking an enemy.

Implications for Oil Markets and Companies

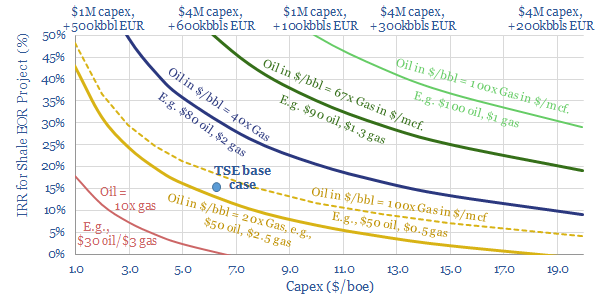

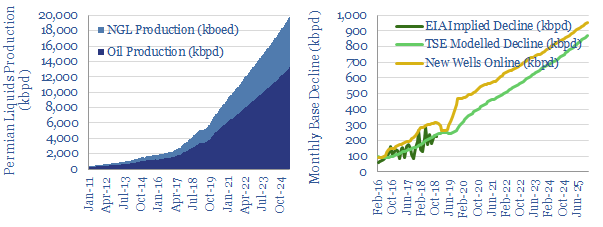

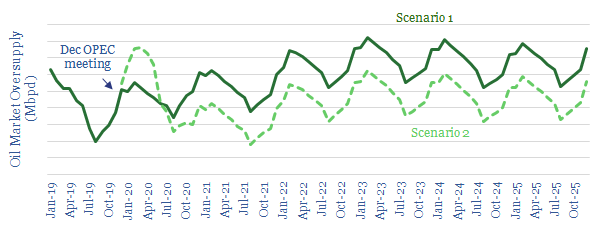

Our latest oil market forecasts point to 1-2Mbpd of over-supply each year in the 2020s, assuming steady demand growth of 1.3Mbpd per annum. However, these base case forecasts do not incorporate any impact of supply disruptions from further attacks, which could sway the balance, and cause significant price spikes.

For energy companies, we think it will be crucial to mitigate against the risk of drone strikes, to the best extent possible. This may include diversification, counter-measures, and a growing preference to operate in lower-risk countries. We would be very happy to introduce clients of Thunder Said Energy to our contacts in the military drone space, who may be able to provide further observations.

[restrict]

References

Hambling, D. (2018). Change in the air: Disruptive Developments in Armed UAV Technology.

Hambling, D. (2015). Swarm Troopers. How Small Drones will Conquer the World.

[/restrict]