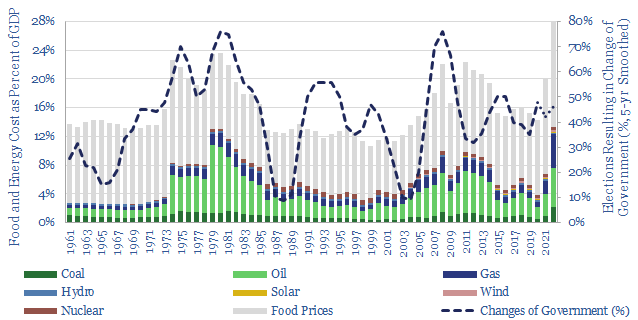

We tabulated data from 138 elections over 60 years in 7 countries. When food and energy prices spike, there is a 75% chance of government change. Revolutions can sometimes be triggered by food-energy shortages too. Hence this 14-page note evaluates whether major policy changes are coming?

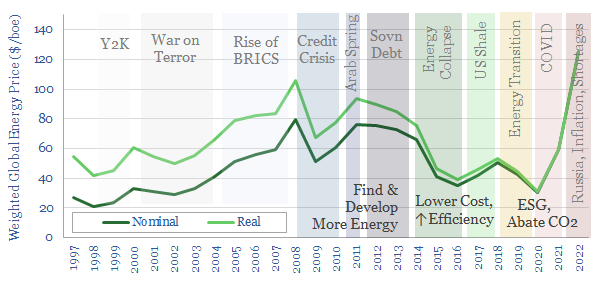

Energy shortages and inflation have been recurring topics in our research over the past 18-months. Their causes, consequences and underlying ideologies are spelled out on pages 2-4. We fear that deeply held ideologies may soon be uprooted by political shifts.

Do rising food and energy prices cause revolutions? We looked back at a dozen examples on pages 5-7. Outright revolutions can be triggered by food and energy shortages, per the French Revolution in 1789, or the Arab Spring in 2011. But some revolutions had no antecedent food-energy shortages (Iran 1979, Cuba 1957, Ethiopia 1974). And many past shortages did not produce revolutions. So the causality is loose.

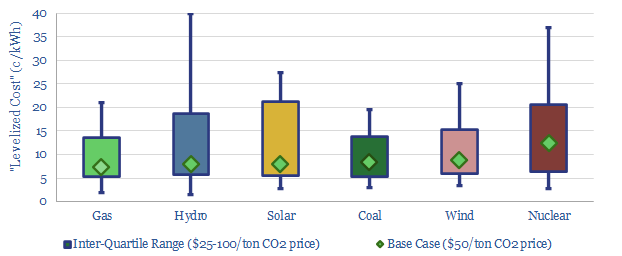

However democratic changes of government are 60% correlated with food and energy prices (chart above). Economic shocks yield a >70% chance of regime change at the next election. And the government that later oversees a stabilization tends to remain in power for a decade. This is the history from 138 general elections reviewed on pages 8-11.

What does it mean for upcoming energy and ESG policies? On pages 12-14, we present our conclusions. We suggest the ‘least bad’ path for today’s policy-makers to avoid crushing electoral defeats in 2024-25. This could yield enormous and surprising policy shifts in 2022-24. Otherwise, we fear the rise of populist governments, which may walk back today’s policies: prioritizing living costs, overlooking moral and environmental costs?

Further research. Our outlook on how deepening energy shortages could affect low-income countries is linked here. Our global energy supply-demand balance is linked here.