This 14-page note explains the crucial power-electronics in an electric vehicle fast-charging station, running at 150-350kW, to charge up an entire EV in 10-30 minutes. Most important are power-MOSFETs, comprising c5-10% of charger costs. The market trebles by the late 2020s. We explore who benefits?

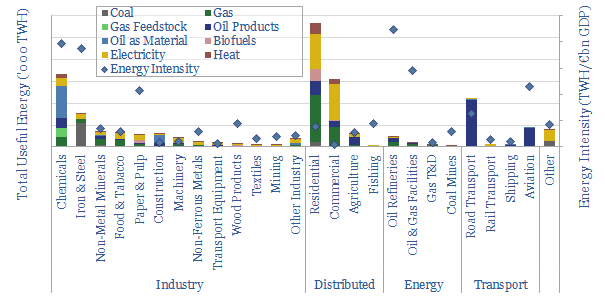

The importance of electric vehicles in the energy transition is re-capped on page 2, including the key numbers. But who are the ‘shovel-makers’ that will benefit if charging stations get over-built?

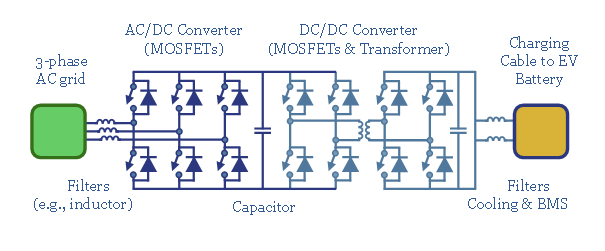

The simple power electronics for electric vehicle charging are outlined from first principles on pages 3-5, explaining the key parameters of fast-chargers being deployed today.

The AC/DC rectifier stage has moved towards power-MOSFETs, and away from simple diode bridges. We explain what this means, and why it is happening, on pages 6-8.

The DC/DC rectifier stage is crucial for safety and reliability, and has also moved towards using power-MOSFETs, as explained on pages 9.

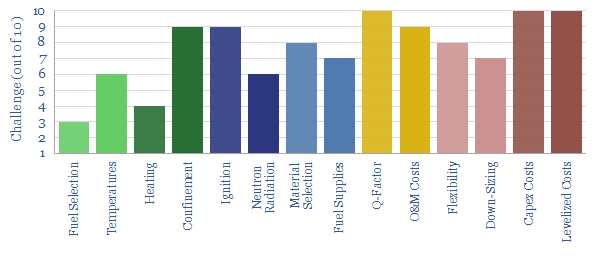

Hence an EV fast-charger is going to have 15-200 high-spec power MOSFETs. Silicon carbide is a crucial enabler, and has been accelerating since it was adopted by Tesla (page 10).

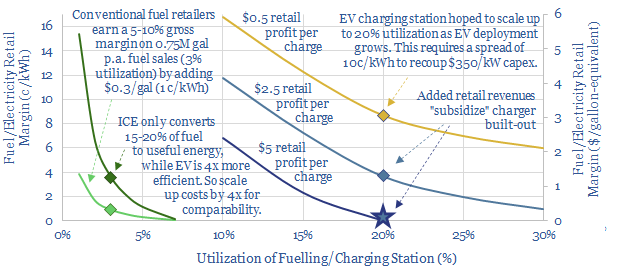

Costs and complexities are explored on pages 11-12. Specifically, we have assessed the pricing of individual companies’ MOSFET gates, to quantify input costs for EV fast-chargers.

Who benefits? The note ends with a screen of seven public companies, which make power-MOSFETs, silicon carbide materials and/or have a technical edge, in this fast-expanding market.

We compared the economics of EV charging stations with conventional fuel retail stations here.