This 11-page note looks back at 175 patents filed by Theranos, which promised a world-changing medical testing technology, but ultimately turned out to be a fraud. The analysis has helped us create a new framework, which we will be using to assess new energy technologies, on a scale of 0-5. This matters for models of energy transition and for SPAC valuations.

300 companies have already raised $100bn via SPACs in 2021. Many are early stage. Hence how can we derive comfort around their technologies? We outline how patents can help with this process on pages 2-3.

Companies with few patents but many bold claims are easy to identify as ‘higher-risk’. We give a recent example from the hydrogen industry on page 4.

But companies with many patents and very bold claims are harder to identify. Specifically, Theranos filed over 175 patents. Some are very detailed. Others contain “experimental results” demonstrating their technology. Examples are given on page 5.

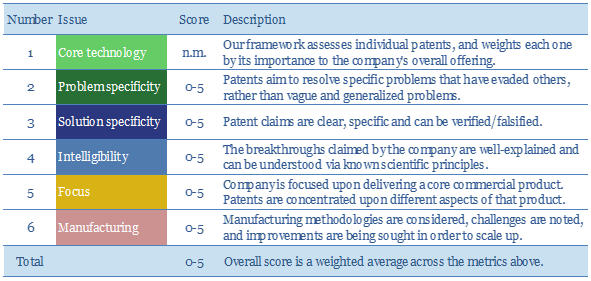

This note reviews Theranos’s patents, finding five signs which may have helped decision-makers to adjust their risking factors. We give examples of each sign on pages 6-10. For each sign, we explore a reassuring example from the patent literature, and a less reassuring example from the Theranos patent library.

Our conclusion is to start applying this new framework consistently, when appraising early-stage technology companies, as explained on page 11.