We are all hoping for ‘normalization’ in 2022. But what if the world is instead entering a full-blown energy crisis, as severe and persistent as the first ‘oil shock’? This 21-page note lays out ten hypotheses, drawing on history. Everything we know about energy transition may change this year.

The purpose of this research report is to explore three enormous questions that are increasingly on our minds:

(1) How would the world look different if the record gas and power prices seen in winter-2021/22 were not some isolated blip, associated with supply chains ‘going a bit funny’ amidst COVID, but the start of a structural and sustained energy crisis?

(2) What evidence might we see in 2022, to confirm (or disprove) whether we are on this dangerous path?

(3) What are the consequences of a sustained energy crisis for decision-makers, for energy transition and for the world in 2022-23?

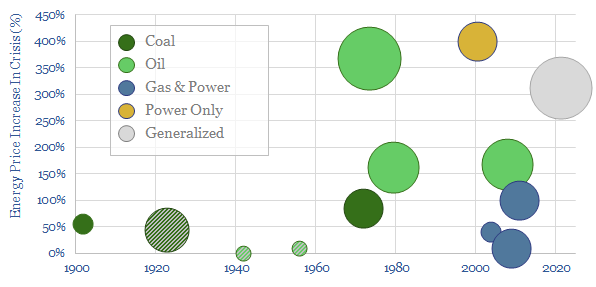

Analogies with historical energy crises are drawn on pages 2-7, focusing in particular on their causes and consequences. The oil shock of 1973-74 makes for a fascinating case study to compare and contrast with 2021-22.

Escaping from energy under-supply is the focus on pages 8-13, as we present updated outlooks for coal, oil, gas and renewables investment. So far, fantasies for perfect, hypothetical future energy have de-railed the appetite for good, real and ready CO2 reductions. But emerging from the 2021-22 crisis will change the narrative around energy transition.

Inflation is seen reaching double-digit levels in 2022, if we are in an energy crisis. Recession has also followed 60% of past energy crises. Rate rises would help dampen inflation, but compound the risks of recession (page 14).

Mitigating the crisis creates opportunities in efficiency technologies (pages 15-17), nuclear (page 18) and non-cyclical transition commodities (page 19). Hence we outline these opportunities in depth.

Emerging from the crisis will re-prioritize practical and economical pathways to net zero. The leading themes likely to gain ground in 2022 are laid out on page 20.

Wild-cards and tail-risks are also rendered more probable by deeply under-supplied energy markets, and the note ends with some scary speculations on page 21.