Is the nascent market for nature based carbon offsets working? We appraised five projects in 2022, and contributed $7,700 to capture 440 tons of CO2, which is 20x our own CO2 footprint. This 11-page note presents our top five conclusions. Today’s market lacks depth and efficiency. High-quality credits are most bottlenecked. Prices will likely rise further in 2023. As a result, a new wave of exponentially better projects is emerging?

The market for nature based carbon offsets has a crucial role in the energy transition, removing up to 20GTpa of CO2 from the atmosphere, at long-term prices averaging $50/ton of CO2. The goal is to pull CO2 out of the atmosphere and store it in a natural eco-system, such as a forest. This directly offsets the impact of unavoidable emissions (e.g., 85Mbpd of oil, 300TCF pa of gas, in 2050, per our energy market models). Five advantages make this market increasingly important, as reviewed on pages 2-3.

But is the market working? Since July-2022, we have evaluated one nature based carbon removal project each month, using a five point scale. Buyers want to ensure projects are real, incremental, measurable, long-lasting and biodiverse. To illustrate each of these challenges, an example is given on page 4.

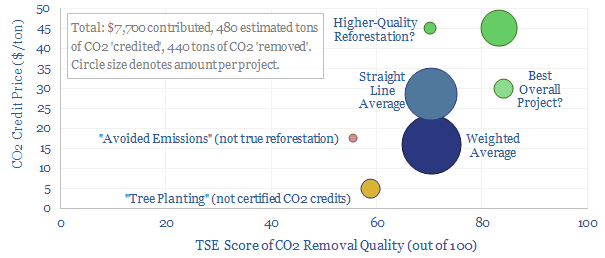

Portfolio perspectives. So far, we have appraised five nature based projects and allocated $7,700 to these projects. Our best mid-point estimate is that this will directly offset 440 tons of risked, net present CO2. There are also clear portfolio benefits. Allocating to multiple projects lowers risk and uncertainty. Some satisfying Monte Carlo analysis is presented on pages 5-6.

But today’s market for nature based carbon offsets lacks depth, as it comprises a relatively small number of projects, which were initiated between 3-25 years ago. Sourcing high-quality credits was more challenging than we expected. The average project scored 70/100 on our framework. But three of the five projects in our sample had drawbacks in their additionality, measurability, or biodiversity. And all could have had better permanence (pages 7-9).

The market is also not entirely efficient. In a mature and efficient market for nature based CO2 removal credits, we would envisage that price and quality would correlate very closely. Projects that are demonstrably real, incremental, measurable, long-lasting and biodiverse should command a premium, possibly in the range of $50-100/ton. Our review shows only a loose correlation today (page 10).

Our conclusion from 2022 is that the market for high-quality nature-based CO2 removal credits is currently bottlenecked. As a result, we expect further price inflation in 2023. But we are also aware of a new generation, of especially high-quality projects, coming to the market. The step-change feels similar to the contrast between modern renewables and the small, inefficient wind and solar plants being constructed in the mid-2000s. We offer up some predictions on page 11.