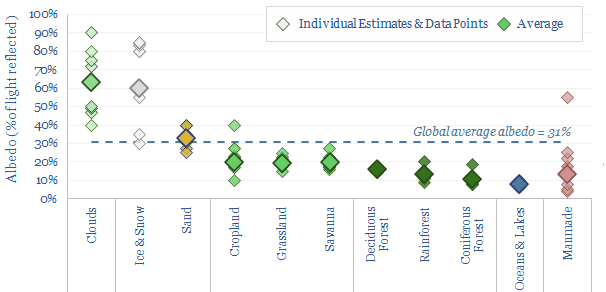

Forests are darker than their surroundings? So does their low albedo curb our enthusiasm for nature-based solutions? This data-file aggregates the average albedo of different landscapes, based on technical papers and internet sources. The albedo impact of reforestation seems numerically very small. There is even an intriguing link where forests can increase the formation of clouds, which have the highest average albedo of any reflective category.

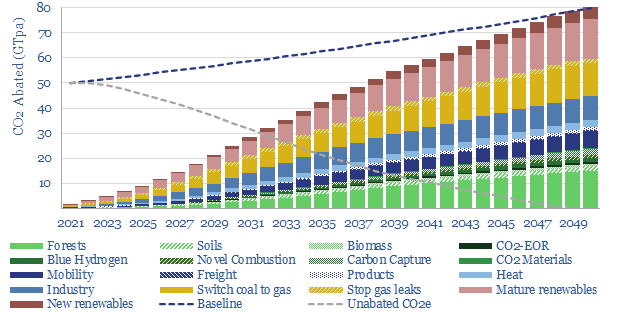

Our latest roadmap to net zero assumes that c20% of all decarbonization of the 2050 energy system will come from new forests and other nature-based solutions to climate change. These solutions need to prove they are real, incremental, measurable, long-lasting and have other social and ecological benefits, to score highly on our nature-based project screens.

However, some commentators have criticized that forests are a not a good climate solution, because they are darker than the surrounding landscape. Forests have an average albedo of 13% versus open landscapes at 20%. Thus they absorb more heat. Thus could planting more forests increase warming in addition to the impacts of CO2?

Four observations on this argument are summarized below, and supported by the data in this data-file.

(1) Starting with a definition: Albedo is the percentage of incoming radiation that a surface reflects. This includes both visible light (from violet at 380nm to red at 700nm), which is c43% of the incoming energy reaching the Earth’s surface; and infra-red radiation, which is 49%; and ultra-violet light, which is the remaining 8%. Physics’s theoretical ‘black body‘ has an albedo near 0%, and the brightest whites have an albedo near 100%. So it is true that land uses with a lower albedo will absorb more heat. But how much more heat?

(2) Albedo impacts are a rounding error? Overall, our roadmap to net zero sees 3bn acres of the planet going from ‘not forest’ to ‘forest’ (note here), which is 8% of the world’s total land (40 bn acres in total) and 2.4% of the planet’s total surface (126bn acres in total) (database here). Moreover, where land use is moving from ‘not forest’ to ‘forest’ in our models, it is mainly moving from pastureland or grassland (average albedo of 20%) to forest. We are not reforesting ice sheets (average albedo of 60%) or the Sahara desert (average albedo of 35%). And there may even be some areas where albedo increases, if reforestation occurs on dark and bare soils (albedo of 10%) or when planting mangroves that fill in open bodies of water (albedo of 8%). However, overall, a 7pp heat absorption delta on 2.4% of the world’s land is a rounding error. And it may itself be counteracted…

(3) Clouds and the cooling impacts of transpiration. One of the most interesting links in technical literature is that forests may increase cloud cover, and in turn, clouds have an average albedo of 63%, which is the highest of any surface condition that is averaged in our data-file. The best paper to cross our screen evaluated 10-years of satellite data over large oak and pine forests in Europe, finding 5-15pp higher absolute cloud cover during summer months over the forests (compared with surrounding cropland), and consistently higher cloud cover downwind of the forest. The downwind effect was most pronounced when wind speeds were higher, and absolute cloud cover decreased by 20pp after a large portion of one of these forests was damaged by a storm in 2009 (see Teuling, et al, 2017). Another recent study also found increased cloud cover over forests, and calculated that this would amplify the net carbon benefits of reforestation, especially at mid-latitudes (see Cerasoli, et al, 2020).

(4) Conflicting conclusions. It should also be highlighted that other technical papers have found more mixed links between forest cover and cloud cover. From the technical papers that crossed our screens, there seems to be much less certainty and much more debate than in other areas of climate science that we have reviewed. Even the science of measuring albedo is quite full of controversy, varying over time, with the seasons, with weather conditions. Some commentators argue that in winter, Arctic-latitude forests are much darker than snow, but to this I say, come visit me in Estonia in December-January, and see how little daylight there is to absorb/reflect!! Our summaries of different technical papers are in the data-file, along with average values for the albedo of different landscapes.

Overall, we still think that protecting and restoring nature is climate-positive, as well as being a philosophical virtue in the eyes of any true environmentalist (almost as a defining criterion!). We will continue to screen nature based CO2 removals in our research in 2023, and hope to see a new array of exponentially improved projects coming to the market.