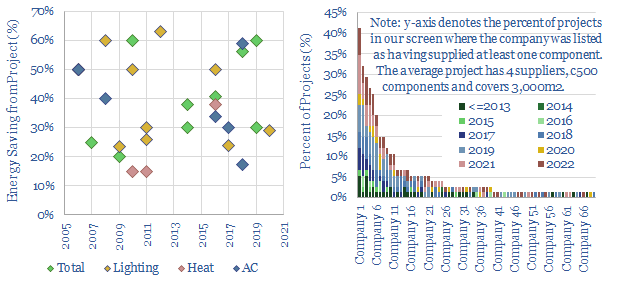

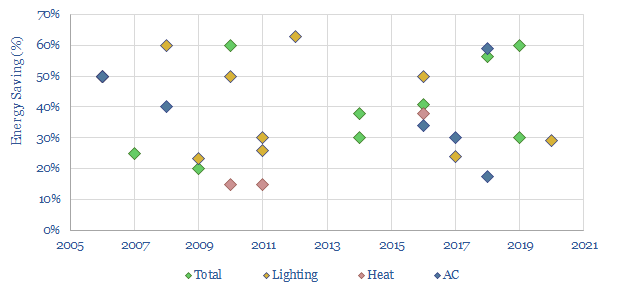

High-quality building automation typically saves 30-40% of the energy needed for lighting, heating and cooling. This matters amidst energy shortages, and reduces payback times on $100-500k up-front capex. This data-file aggregates case studies of KNX energy savings, and screens 70 companies, from Capital Goods giants to private pure-plays.

KNX is an open standard for building automation. Thus a smart building can be given a central nervous system, called a bus, which is a green cable running throughout the electricals of the building. 500 hardware and software vendors from 45 countries make sensors, controllers, actuators and appliances that can be connected to the bus, and communicate with each other via KNX.

This data-file has reviewed 20 case studies of KNX building automation projects. Their average energy saving is 40%. In other words, well-automated ‘smart buildings’ use 40% less energy than they did prior to the building automation project.

In lighting, the average energy saving is 40%. For example, the KNX system might use a presence detector to switch off the lights if no one is in a room. Or it might use a lighting sensor to turn off lights if enough sunlight is already streaming in through the windows. Particularly sophisticated systems will detect ambient light across an entire room, and maintain a constant, pre-determined brightness level, which might mean dimming/amplifying lights nearer to/further from the windows.

In heating, the average energy saving is 30%. The KNX system might use temperature sensors to avoid over-heating a room, especially if no one is present, or scheduled to be present, or at night. Some systems link to window-sensors, and will not heat a room if a window is open. Or air quality sensors in ventilation ducts avoid over-ventilating a room and thereby cooling it.

In air conditioning, the average energy saving is 40%. Typical functionality is similar to heating described above. In addition, the KNX system might close blinds during the day to prevent heat gain in a room where no one is present, or automatically open windows at night to release heat when outside temperatures are cool.

Energy savings are clearly helpful amidst a protracted energy shortage. It is notable from the data-file that KNX projects have historically been expensive, costing $100-500k at a large commercial building where 3,000 KNX devices might be installed over >5,000m2. Payback times are around 5-10 years in normal times. But they are also a direct function of energy prices.

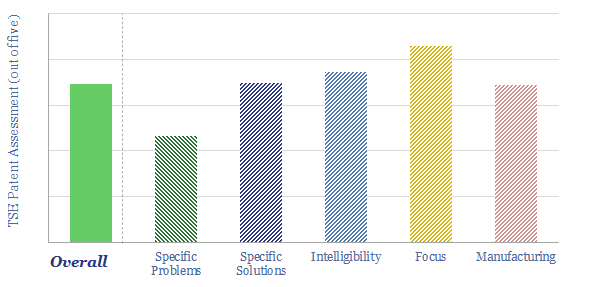

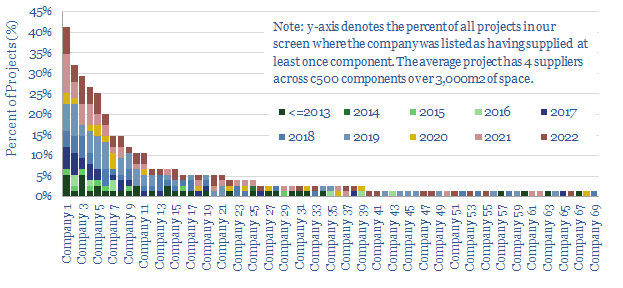

Thus we have screened 70 leading providers of KNX products. It is a large landscape of companies. But we think 30-40% of projects will typically feature at least some components from large European Capital Goods giants, such as ABB, Siemens and Schneider. 7-30% of projects feature components from a dozen, private, specialist companies (chart below).

The data behind the building automation energy savings, KNX case studies, and the full screen of leading companies can be downloaded via the button below.