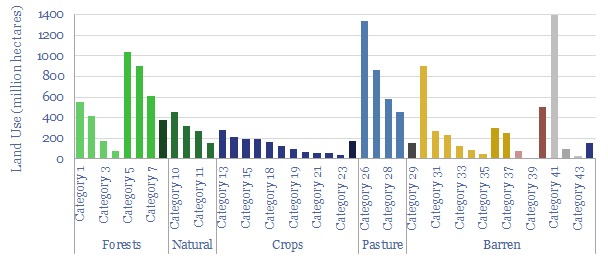

This database of global land uses shows how 40bn acres of land on planet Earth is used, in order to quantify how much land is available for nature based solutions such as reforestation. We think 3bn acres can be reforested, creating a 15-20GTpa carbon sink, abating 20% of all the CO2 in our roadmap to net zero.

The surface of Planet Earth covers 510 million square kilometers in size, of which two-thirds is ocean and one-third is land. This equates to almost 40bn acres of land, or around 15bn hectares.

The deforestation of 5bn acres of land has historically released almost 1 trillion tons of CO2, which is 25-30% of all anthropogenic CO2 emissions (model here), which even contributed to the dust bowl (note here). Reforestation still continues, at a pace of around 25M acres per year, releaseing 6.5GTpa of CO2-equivalents, a comparable number to all of the world’s passenger vehicles (model here).

Preventing deforestation and reforesting previously deforested areas therefore needs to be a clear part of any sensible roadmap to net zero. But is there enough land for reforestation?

The data-file includes a breakdown of land use, across 40 different categories, estimates of carbon stocks across these different land types, and more granular detail into agricultural lands, grasslands, degraded lands and reforestable lands.

Estimates in this data-file are derived from technical papers. Notes from select technical papers are also included in the data-file.

The best opportunity for reforestation is from the world’s stock of 2bn hectares of degraded/abandoned land, 8bn acres that is currently under pasture (sometimes grazed only very infrequently), while there is 3bn acres where tree cover be increased (although it is not always appropriate, per our note into savanna landscapes).

No cheating is allowed in the model either. 4bn acres of the world’s surface is icy or glacier, and another 7bn is barren as it is desertified, salty or rocky (although we have looked at reforestation in semi-arid climates, in a research note here).

Another 10bn acres of the world’s land remains forested, and while it is clearly not possible to re-forest an existing forest, there are data-points showing that actively managed forecasts can absorb more carbon than mature forests (summary here, wood carbon credentials here). We still think Finland’s forestry industry makes for a very interesting case study here.

Other complexities explored in our reforestation resarch are how changing forest cover changes global albedo, per the short article here.

A PDF research report, discussing how much land is available for reforestation is published here. All of our research into nature-based solutions to absorb CO2 is summarized here. Numbers into global land use are built up in the data-file, including other technical papers covering reforestation potential.