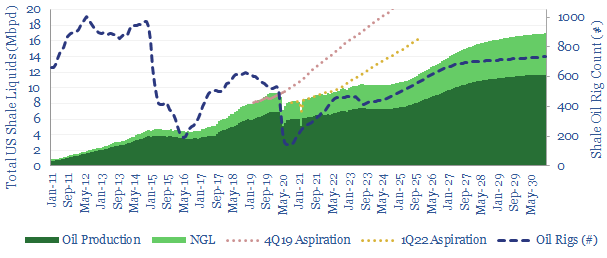

What outlook for US shale in the energy transition? This model sets out our US shale production forecasts by basin. It covers the Permian, Bakken and Eagle Ford, as a function of the rig count, drilling productivity, completion rates, well productivity and type curves. US shale likely adds +1Mbpd/year of production growth from 2023-2030, albeit flatlining in 2024, then re-accelerating on higher oil prices. Our shale outlook is also summarized below.

What outlook for shale in energy transition?

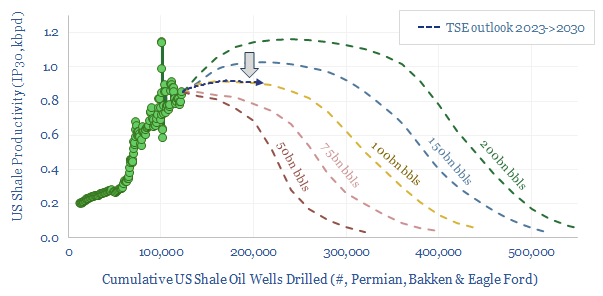

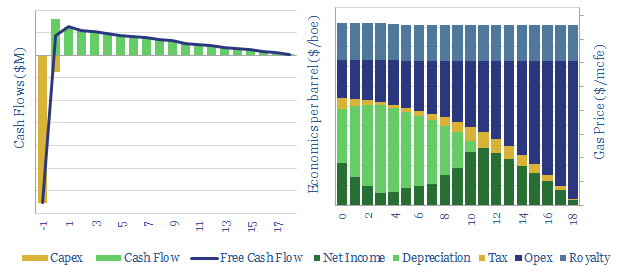

Shale is a technology paradigm where well productivity has risen by 3-7x over the past decade, through ever greater digitization. Shale economics are very strong, with 20% IRRs at $50/bbl oil on shale oil (model here) or at $2.8/mcf on shale gas (model here). We think 100bn bbls of recoverable shale resources remain in the US and ultimately, liquids production could be ramped up from 10Mbpd in 2023 to 17Mbpd by 2030 (note here), and most of this will be needed as energy shortages loom.

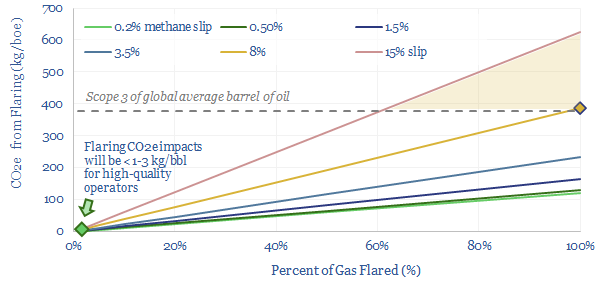

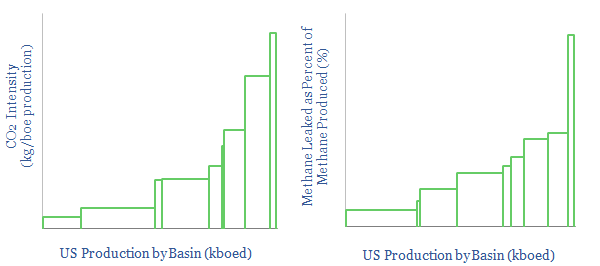

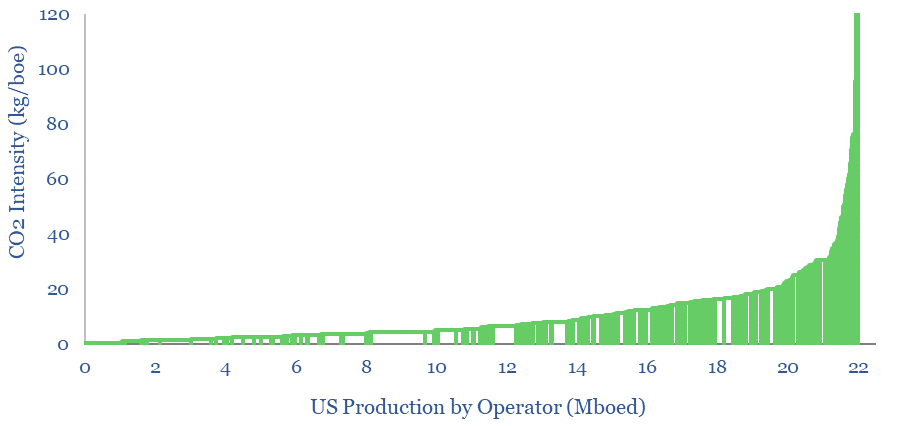

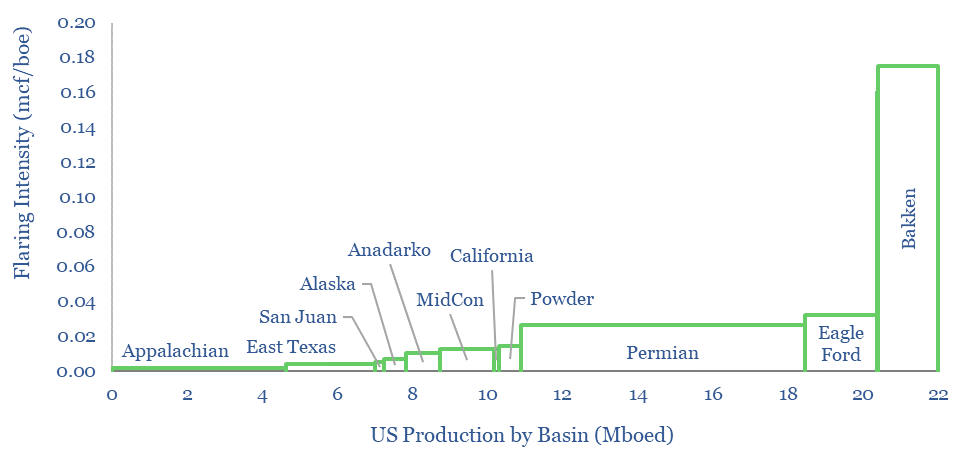

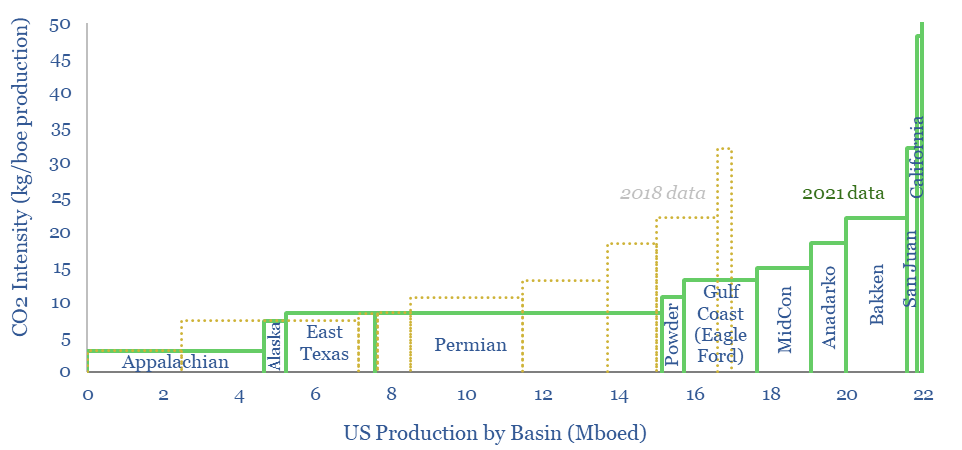

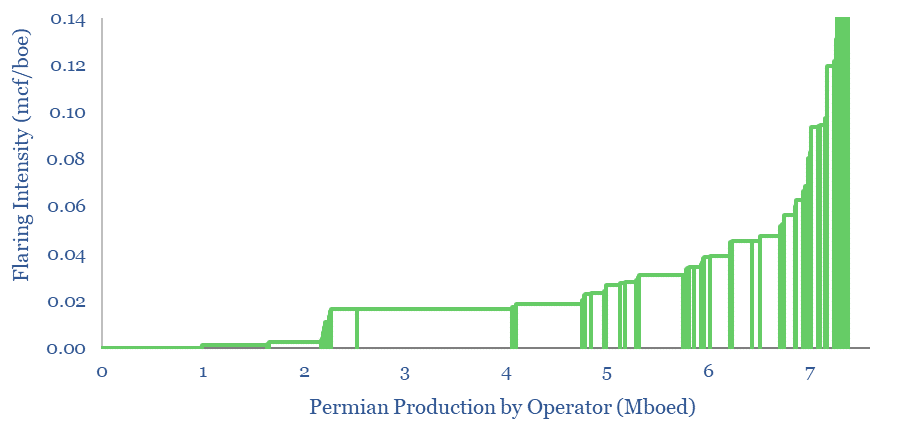

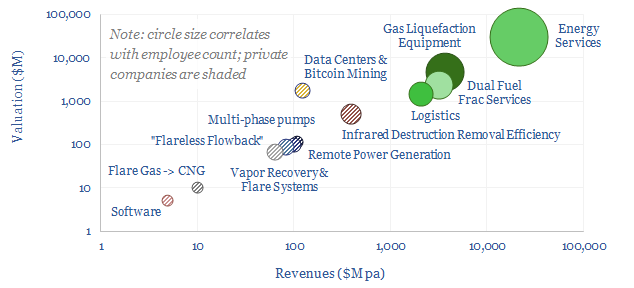

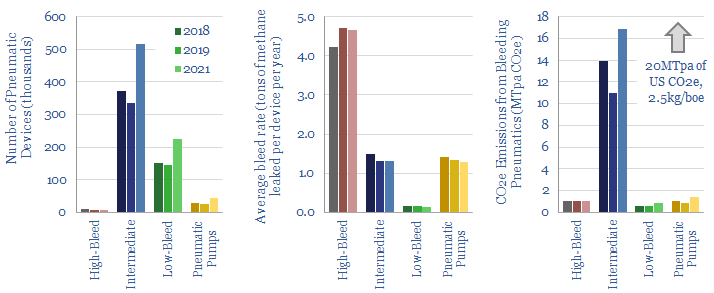

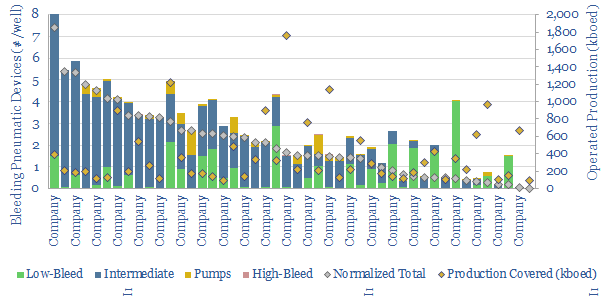

However the US shale industry has shifted its focus towards capital discipline and ESG. US shale averages 10kg/boe on a Scope 1 upstream basis (data here), shale oil averages 25kg/boe on a full Scope 1&2 basis running up to the refinery gate (data here) and 55kg/boe on a refined basis running up to the point of combustion (data here). The spread is wide, after comparing and contrasting 425 companies here and here. The best decarbonization opportunities for shale are mitigating flaring and methane leaks followed by electrification. Ultimately, we think the best operators could reach CO2 neutrality.

The most important questions on shale are how the resource base and well productivity will trend. This has been the topic of our shale research, and our latest views are covered in our 2024 shale outlook. Historically, we have also undertaken large reviews of the pace of shale technology progress, based on technical papers (examples here and here). There are fifty variables to optimize. And we are most excited about big data techniques, fiber optics and shale-EOR.

Modelling US shale production by basin?

Our model for US shale production looks at each of the main basins, using a factor breakdown. Total production in month T1 = Total production in month T0 + new additions – base declines. To calculate new monthly additions, we multiply (a) number of rigs running (b) wells drilled per rig per month (c) wells completed per well drilled (d) initial production of newly completed wells (IP30). And to calculate the base declines, we fit a best-fit type curve onto the new additions from past months. This model has worked quite smoothly for 6-years now, including history going back to 2011 and forecasts going out through 2030.

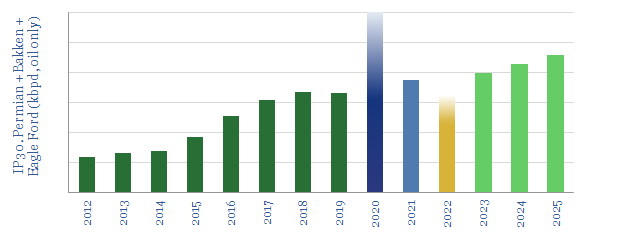

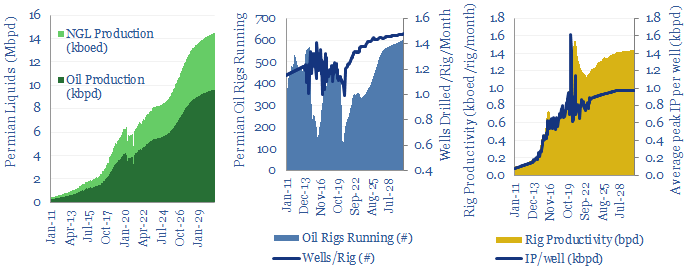

The Permian basin is the largest US shale oil basin, with 8Mbpd of total liquids production in 2023. Over the past six years from 2017-2023, the Permian basin has seen an average of 340 rigs running, drilling an average of 1.2 wells per rig per month, completing 1.06 wells for every well drilled (DUC drawdown) at an initial production rate of 780bpd (IP30 basis), adding +850kbpd/year of new supply to global oil markets. We still see strong growth potential, and the Permian could reach 14Mbpd of total liquids production by 2030, amidst higher activity and oil prices. All of these variables can be stress-tested in the model.

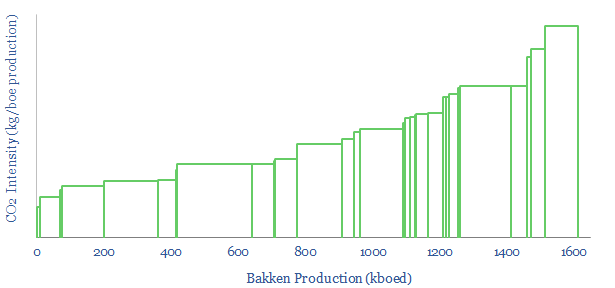

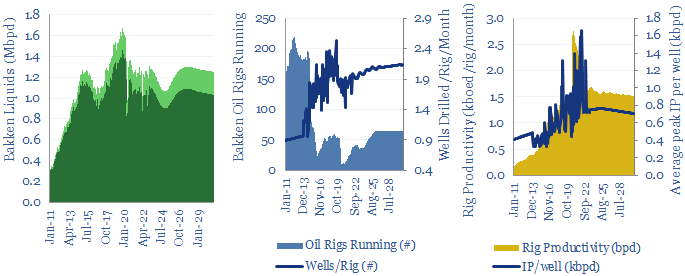

The Bakken is the second largest US shale oil basin, with 1.3Mbpd of total liquids production in 2023. Over the past six years from 2017-2023, the Bakken has seen an average of 40 rigs running, drilling an average of 1.9 wells per rig per month, completing 1.15 wells for every well drilled (DUC drawdown) at an initial production rate of 780bpd (IP30 basis), adding +20kbpd/year of new supply to global oil markets. We see a decline in 2024, a recovery in 2025-26 and a plateau through 2030.

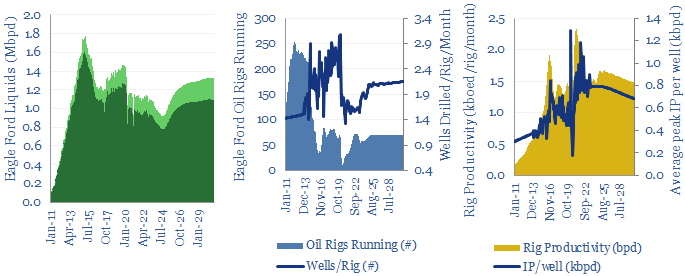

The Eagle Ford is the third largest US shale oil basin, with 1.1Mbpd of liquids production in 2023. Over the past six years from 2017-2023, the Eagle Ford has seen an average of 60 liquids-focused rigs running, drilling an average of 2.1 wells per rig per month, completing 1.22 wells for every well drilled (DUC drawdown) at an initial production rate of 680bpd (IP30 basis), but liquids production has actually declined, especially during the volatility of the COVID years. We see a decline in 2024, a recovery in 2025-26 and a plateau through 2030.

Challenges and controversies for US shale?

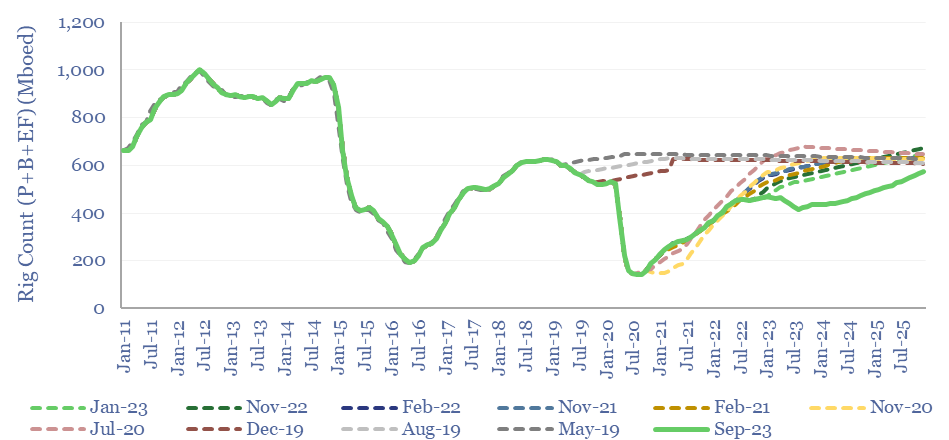

The main revisions to our shale production models have been because of lower activity, as capital discipline has entrenched through the shale industry. The chart below shows our forecasts for activity levels at different, prior publication dates of this model. We have compiled similar charts for all of the different variables and basins, in the ‘revisions’ tab, to show how our shale numbers have changed.

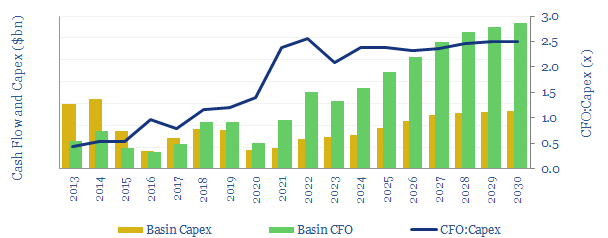

Our shale outlook for 2023-2030 sees the potential for +1Mbpd of annual production growth as the industry also generates $150-200bn per year of annual free cash flow. You can stress test input variables such as oil prices in the model.

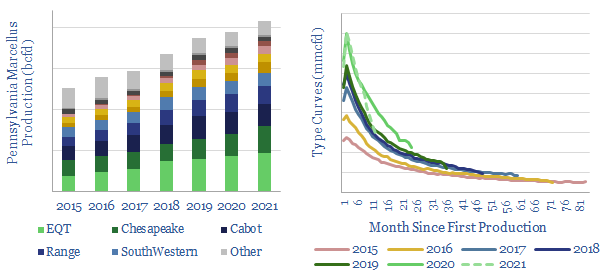

We have also modeled the Marcellus and Haynesville shale gas plays, using the same framework, in further tabs of the data-file. Amazingly, there is potential to underpin a 100-200MTpa US LNG expansion here, with just 20-50 additional rigs. Although recently we wonder whether the US blue hydrogen boom will absorb more gas and outcompete LNG, especially as the US Gulf Coast becomes the most powerful clean industrial hub on the planet (note here).

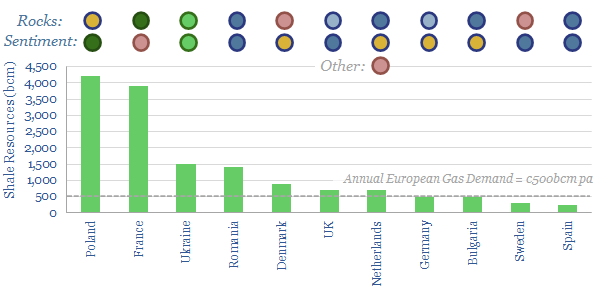

International shale? We have found it harder to get excited about international shale, but there is strong potential in other large hydrocarbon basins, if European shale is ever considered to rescue Europe from persistent gas shortages, and less so in China.

Please download the data-file to stress-test our US shale production forecasts by basin.