Mero Revolutions: countering CO2 in pre-salt Brazil?

The super-giant Mero field in pre-salt Brazil is not like its predecessors. While prolific, it has a 2x higher gas cut, of which c45% is corrosive and environmentally unpalatable CO2….

The super-giant Mero field in pre-salt Brazil is not like its predecessors. While prolific, it has a 2x higher gas cut, of which c45% is corrosive and environmentally unpalatable CO2….

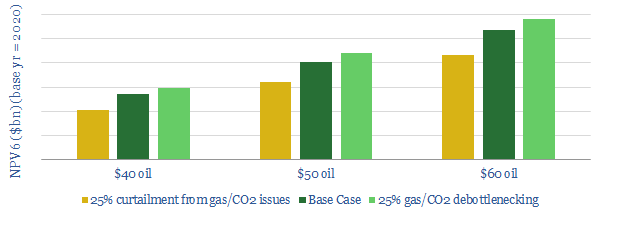

Petrobras has patented next-generation riser designs, to handle sour-service crude from pre-salt Brazil. This is needed after prior cases of riser-failure, e.g., at Lula. Its new solution could also support…

This data-file tracks the construction progress of 30 FPSOs that are being deployed in the Brazilian pre-salt oil province. In each case, we quantify the vessel’s oil and gas handling…

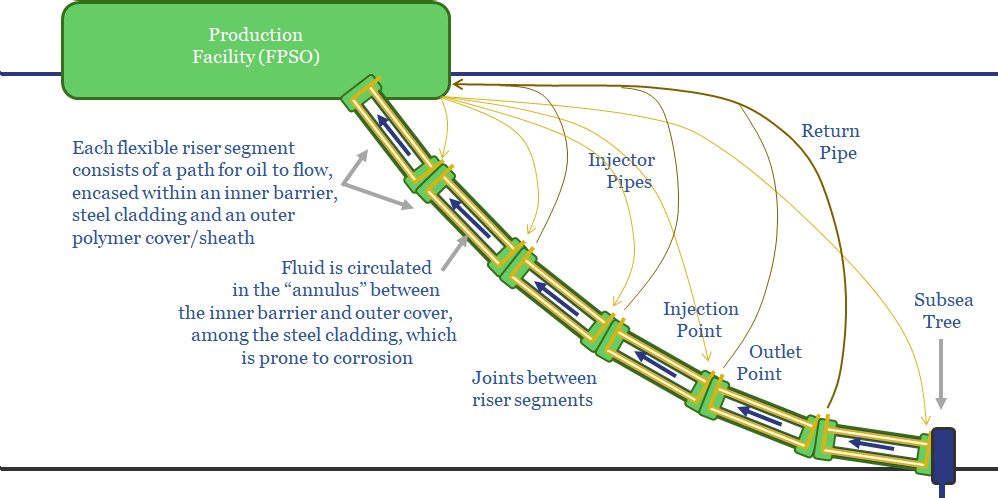

…international diplomacy. Inflammatory statements? In September-2019, Bolsonaro defended his environmental policies in a speech at the UN General Assembly. International critics were accused of assaulting Brazil’s sovereignty. Brazil considers itself…

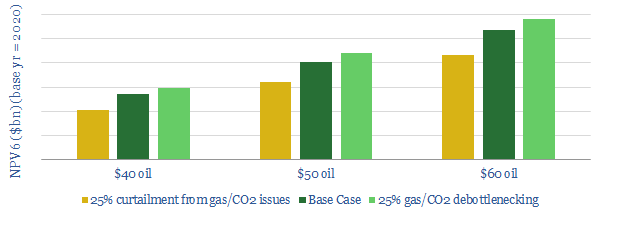

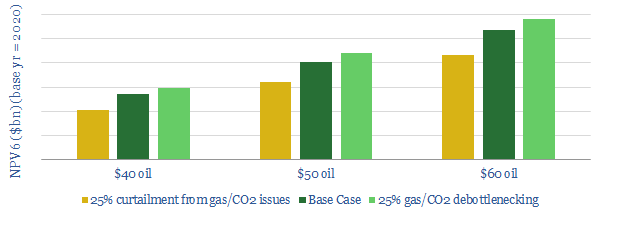

Petrobras, Shell, TOTAL and two Chinese Majors are pushing the boundaries of deep-water technology to develop the Mero oilfield. But the distribution of possible NPV outcomes is very broad, at…

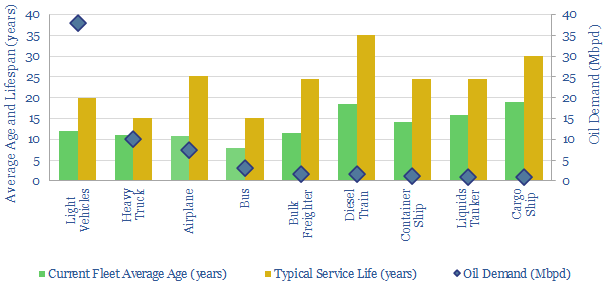

…to China’s Hainan Airlines (5.1-years), Saudia (5.1-years), Sichuan Airlines (5.7-years) and Brazil’s Azul Linhas (6.0-years). Likewise, the excellent “global bus survey” notes that the age of the average bus in…

…(Mar-2020, 21-pages) Johan Sverdrup: Don’t Decline? (July-2019, 15-pages) Guyana: will low carbon credentials lower capital costs? (Oct-2019, 17-pages) Mero Revolutions: countering CO2 in pre-salt Brazil? (Aug-2019, 16-pages) Can technology revive…

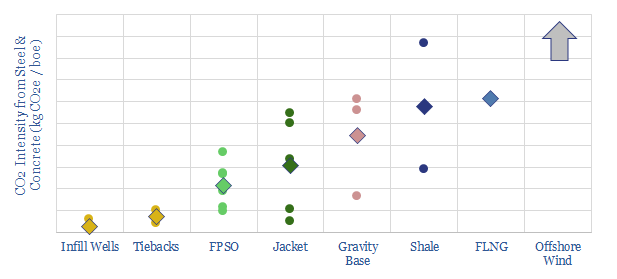

…Brazil and offshore Norway. Infill wells, tiebacks and FPSOs make the most efficient use of construction materials per barrel of production. Fixed leg platforms are higher, then gravity based structures,…

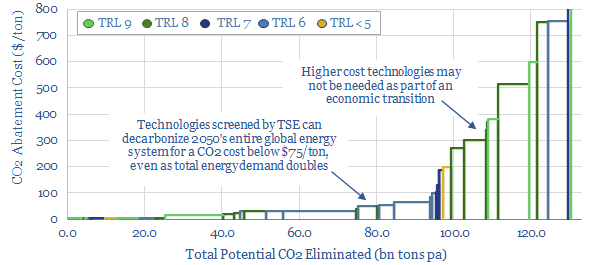

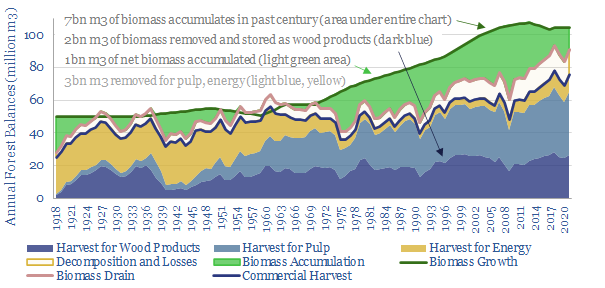

…CO2 removals are spelled out on pages 17-19. 110 countries, with 5bn acres of land, have a 1-5x better environment for growing forests than icy Finland. For Brazil, for example,…

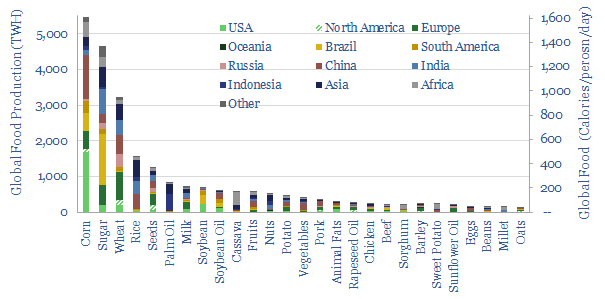

…by country-region. Brazil produces 4x its own calorific needs. The US produces 3x. Europe produces 1.1x. But emerging Asia is only 0.7x. Africa is only 0.5x. Alleviating food shortages may…