Carbon capture and storage (CCS) prevents CO2 from entering the atmosphere. Options include the amine process, blue hydrogen, novel combustion technologies and cutting edge sorbents and membranes. Total CCS costs range from $80-130/ton, while blue value chains seem to be accelerating rapidly in the US. This article summarizes the top conclusions from our carbon capture and storage research.

What is carbon capture and storage? CO2 is a greenhouse gas. But it is also an inevitable product of many energy-releasing reactions, from biology, to materials, to industrial energy, because of the high enthalpy of the C=O bond, at 1,072 kJ/mol. Carbon capture and storage technologies therefore aim to capture unavoidable CO2, purify it, transport it, and sequester it, to prevent it from contributing to climate change.

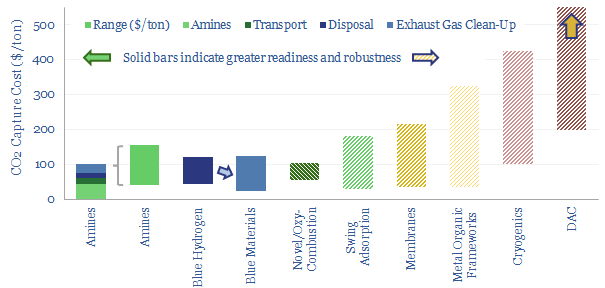

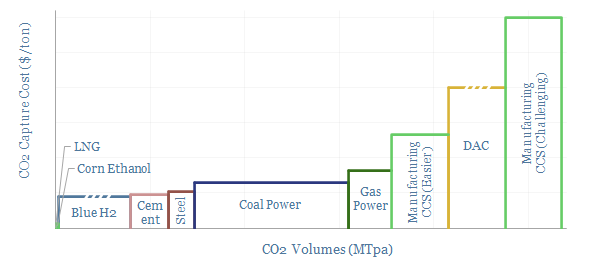

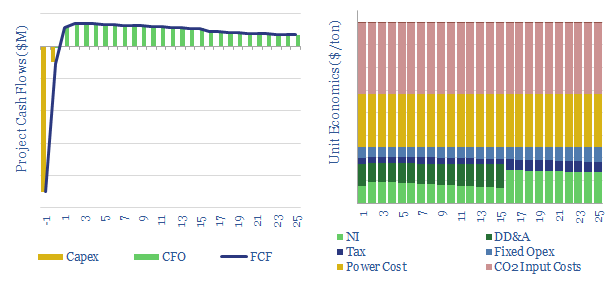

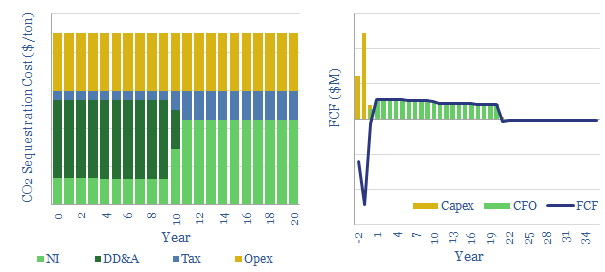

What are the costs of carbon capture and storage? 10-20% of all decarbonization in our roadmap to net zero will come from CCS, with the limit set by economic costs, ranging from $80-130/ton on today’s technologies, which is towards the upper end of what is affordable. Costs vary by CO2 concentration, by industry, by process unit, but will hopefully be deflated by emerging technologies.

Amines are the incumbent technology among 40MTpa of past carbon capture and storage projects, bubbling CO2-containing exhaust gases through an absorber column of lean amines, which react with CO2 to form rich amines. The CO2 can later be re-released and concentrated by steam-treating the amines in a regenerator. Base case costs are $40-50/ton to absorb the CO2 (model here). Energy costs range from 2.5-3.7GJ/ton. Energy penalties are 15-45% (note here). But a possible operational show-stopper is the emissions of amines and toxic degradation products (note here), with MEA breaking down at 1.75 kg/ton into a nasty soup (data here). Avoiding amine degradation is crucial and usually requires treatment of exhaust gases, to remove dusts, SO2, NOXs, a post-wash and limits on the ramp rates of power plants. This all adds costs.

Leading amines for CCS, which have been de-risked by use in multiple world-scale projects are MHI KS-1/KS-21 and Shell CANSOLV. We have also screened novel amines developed by Aker Carbon Capture (JustCatch), Advantage Energy (Entropy) and Carbon Clean. And alternatives to amines such as potassium carbonates. In our view, this space holds exciting potential, although decision-makers should consider the correct baselines, hidden costs and technology risks.

Blue hydrogen is an alternative to post-combustion CCS, directly converting the methane molecule (CH4) into relatively pure streams of H2, as an energy carrier or feedstock, and CO2 as a waste product for disposal. The two gases are separated via swing adsorption. The technology is mature, there are no issues with toxic emissions, and the world already produces 110MTpa of grey hydrogen, including 10MTpa in the US (data here), mostly via SMRs, emitting 9 tons of CO2 per ton of H2. 60% of the CO2 from an SMR is highly concentrated, and can readily be captured. An adapted design, ATR, can capture over 90% of the CO2 and is also technically mature (note here). Our economic model for blue hydrogen is here. An ATR technology leader is Topsoe.

Blue materials. The US seems to be leading in CCS, over 500MTpa of projects could proceed in the next decade (note here), and 45Q reforms under the Inflation Reduction Act are already kickstarting a boom in blue value chains, from blue ammonia, to blue steel, to blue chemicals. This exciting theme is gathering momentum at a fast pace and could even disrupt global gas balances and LNG exports (note here).

Novel combustion technologies are also maturing rapidly, which may facilitate CCS without amines. NET Power has developed a breakthrough power generation technology, combusting natural gas and pure oxygen in an atmosphere of pure CO2. Thus the combustion products are a pure mix of CO2 and H2O. The CO2 can easily be sequestered, yielding CO2 intensity of 0.04-0.08 kg/kWh, 98-99% below the current US power grid. Costs are 6-8c/kWh (note here, model here). We have also explored similar concepts ranging from chemical looping combustion to molten carbonate fuel cells and solid oxide fuel cells.

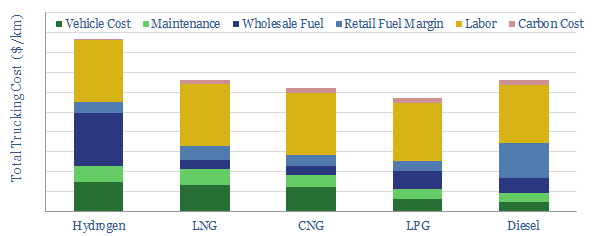

Transporting CO2 usually costs $4/ton/100km in a pipeline (model here). But CO2 is a strange gas to compress (note here). CO2 pipelines run above 100-bar, where CO2 becomes super-critical and behaves more like a liquid (e.g., it can be pumped). CO2 can also be liquefied 80% more easily than other gases, for a cost of $15/ton, merely by pressurizing it above 5.2-bar then chilling to -40C (model here). This opens up the possibility of trucking small-scale CO2 for c$17/ton per 100-miles (note here, model here). Similarly, seaborne transport of CO2 costs $8/ton/1,000-miles (model here), and this also opens up a possibility for the LNG industry to ship LNG out, CO2 back (note here). Ships could also capture their own CO2 with onboard CCS for $100/ton (note here).

CO2 disposal requires injecting CO2 into disposal wells at 60-120 bar of pressure. Our base case cost is $20/ton, but can vary from $5-50/ton (model here) and there can be risks (data here). CO2-EOR can re-coup costs of sequestration with an oil price around $50/bbl (note here, model here) and in the past we had hoped this would also drive a subsequent wave of low-carbon production via shale-EOR (note here).

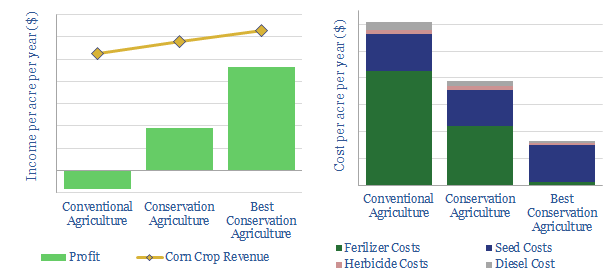

CO2 utilization aims to make valuable use of the CO2 molecules rather than simply pumping them into the ground. Enhancing the concentration of CO2 in greenhouses can improve agricultural yields by c30% (note here). Some chemical pathways use CO2 directly, making methanol, formaldehyde and polyurethanes. The CO2 molecule can also be electrolysed to produce other feedstocks, but costs are c$800/ton (model here). CO2 utilization for curing cement industry is being explored by Solidia and CarbonCure. Other CO2 utilization companies are screened here. The challenge in all of these niches is scaling up to absorb GTpa-scale CO2 within MTpa-scale supply chains.

Direct air capture is a frontier for CCS that aims to absorb CO2, not from an exhaust gas with 4-40% concentration, but from the atmosphere, with 0.04% concentration. On the one hand, this is obviously more thermodynamically demanding, as dictated by the entropy of mixing, but on the other hand, the minimum theoretical energy for DAC is only 140kWh/ton, and the world has simply not invented a process yet that is more than 5-10% thermodynamically efficient. We have modeled solutions from Carbon Engineering at c$300/ton and from Climeworks at c$1,000/ton. Our DAC cost model is here.

Membranes. Next-generation membranes could separate 95% of the CO2 in a flue gas, into 95% pure permeate, for a cost of $20/ton and an energy penalty below 10%, which exceeds the best amines (note here). But today’s costs are higher, especially for pipeline grade CO2 at 99% purity (model here). A CCS membrane leader is MTR (screened here).

Metal organic frameworks are a novel class of materials with high porosity and exceptional tunability, which could become a CCS game-changer, but cannot yet be de-risked (note here). We have screened companies such as Svante in our work.

Cryogenics. The costs to separate the 20% oxygen fraction from air in a cryogenic air separation unit average $100/ton using 300kWh/ton of electricity (model here). If you have a concentrated CO2 stream (e.g., 10-40%) then cryogenics may be an option.

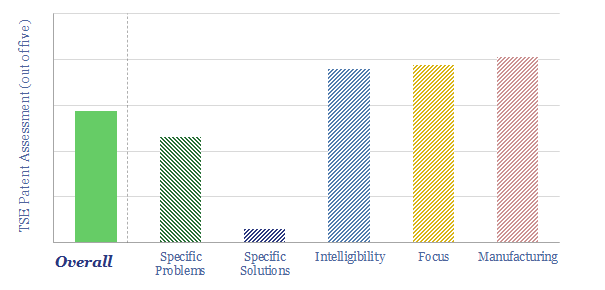

Some summary charts, workings and data-points from our carbon capture and storage research are aggregated in this data-file. All of our broader CCS research is summarized on our CCS category pages.