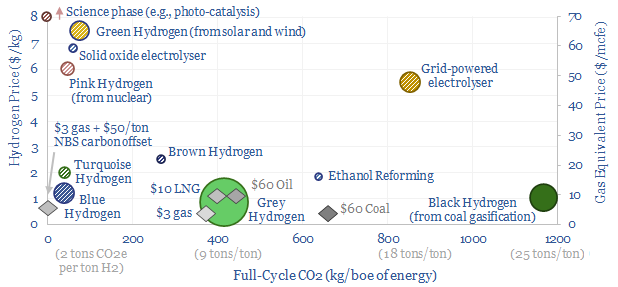

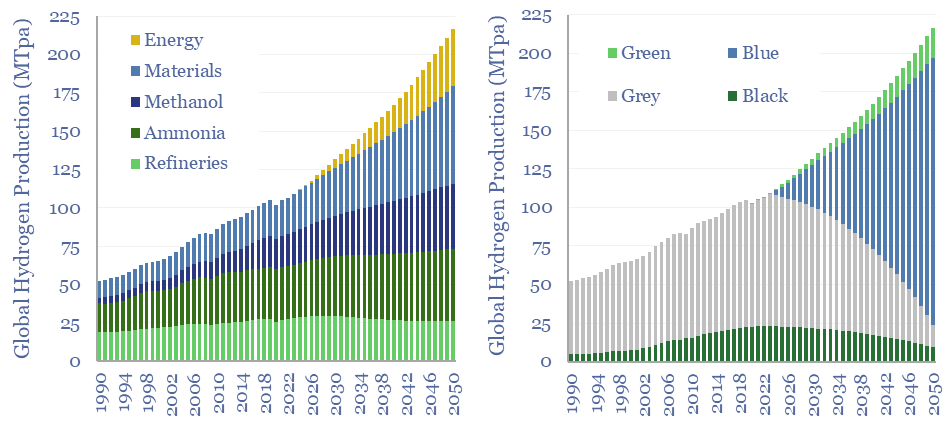

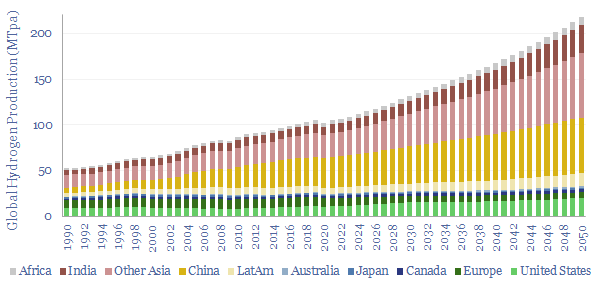

The best opportunities for hydrogen in the energy transition will be to decarbonize gas at source via blue and turquoise hydrogen, displacing ‘black hydrogen’ that currently comes from coal, and to produce small-scale feedstock on site via electrolysis for select industries. Some see green hydrogen becoming widespread in the future energy system. We think there may be options elsewhere, to drive more decarbonization, with lower costs, lower losses and higher practicality.

(1) Green hydrogen economy? Our main question mark is over “economy”. Costs are modeled at $7/kg, equivalent to $70/mcf natural gas, after generating renewable electricity, electrolysing water into hydrogen and storing the hydrogen. Levelized costs of electricity then reach 60-80c/kWh, for generating clean electricity in a fuel cell power plant, yielding a CO2 abatement cost of $600-1,200/ton (note here). We think costs matter in the energy transition and the entire world can be decarbonized via other means, for an average cost of $40/ton in the TSE roadmap to net zero.

(2) Fuels derived from green hydrogen are by definition going to be more expensive than the hydrogen itself. We have evaluated electro-fuels, green methanol, sustainable aviation fuels, hydrogen trucks, again finding CO2 abatement costs above $1,000/ton. Again, we think transportation can be decarbonized cost-effectively via other means.

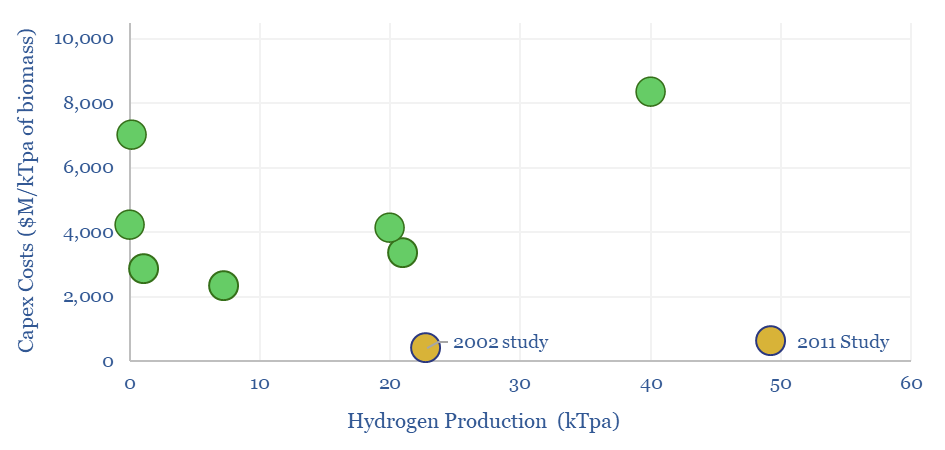

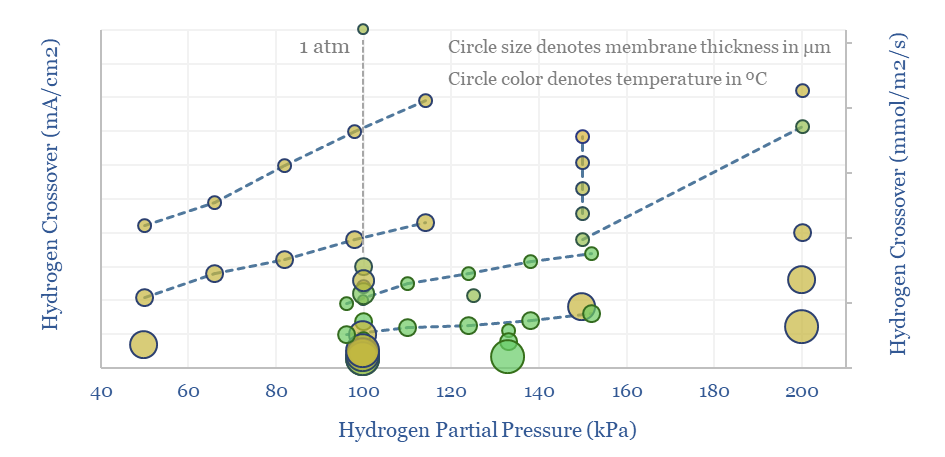

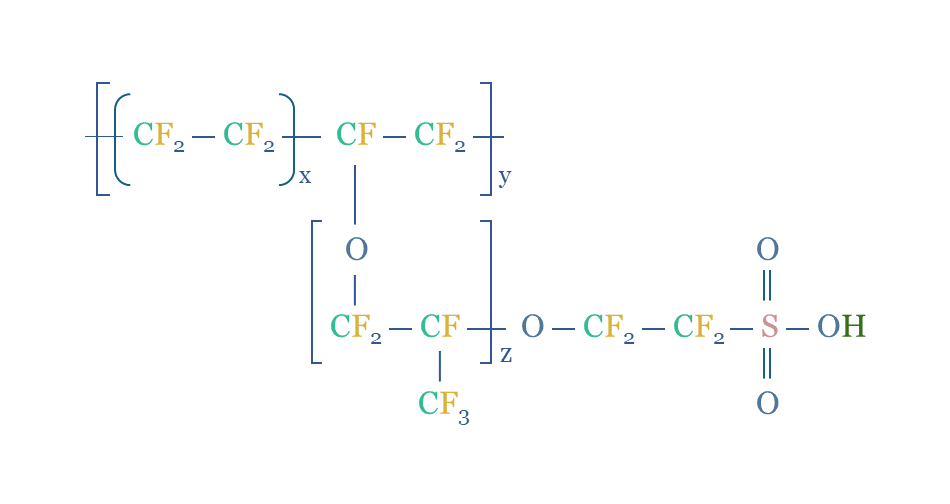

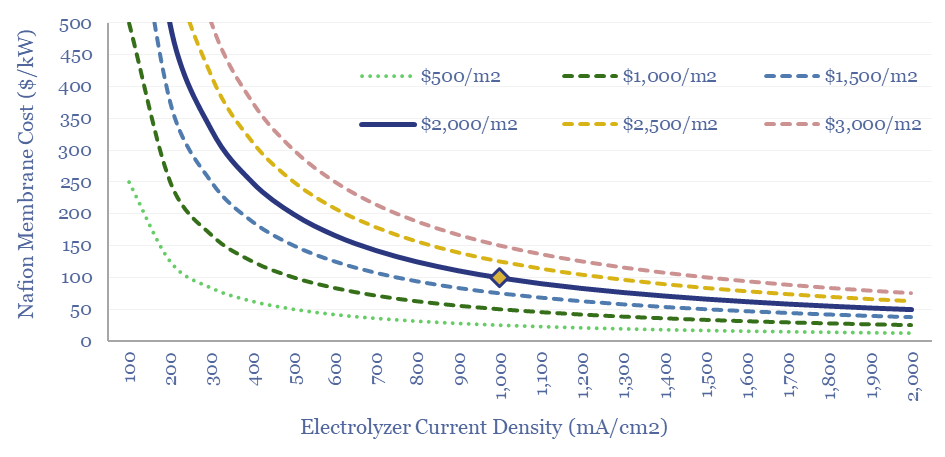

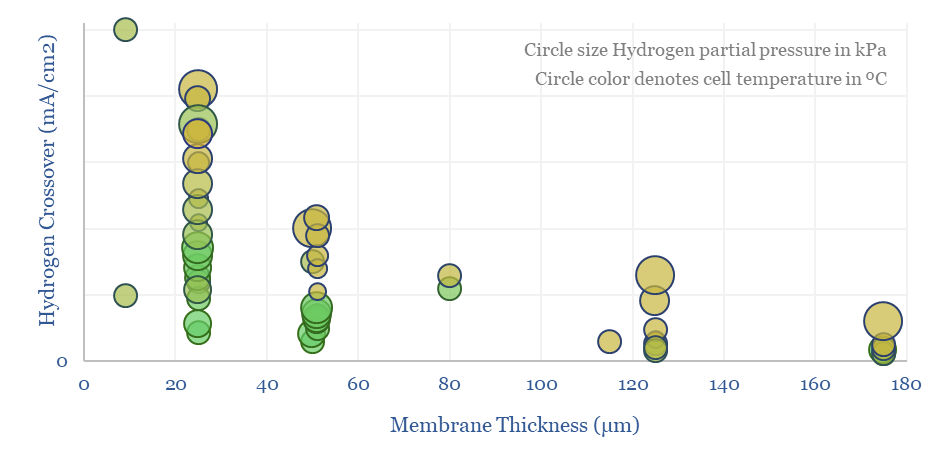

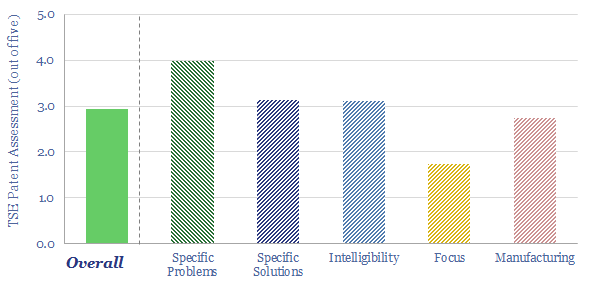

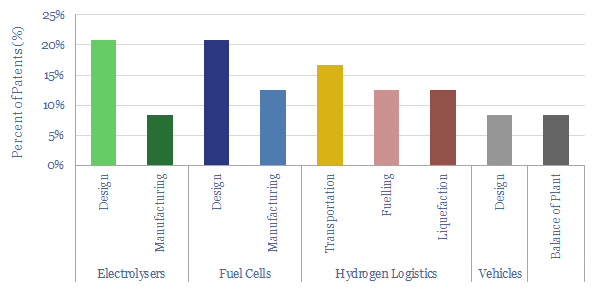

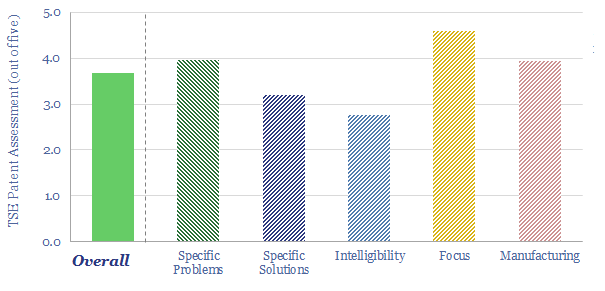

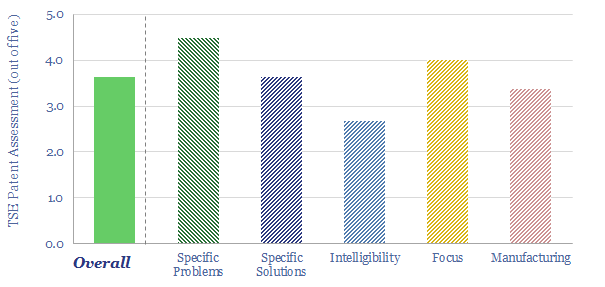

(3) How much can capex costs come down? There is an aspiration for electrolyser costs (presently around $1,000/kW on a full, installed basis) to deflate by over 75%. However, we have reviewed electrolyser costs line by line and wonder whether 15-25% deflation is more realistic (note here). Alkaline electrolysers vs PEMs are contrasted here. We have recently screened NEL’s patents to explore future cost deflation in electrolysers.

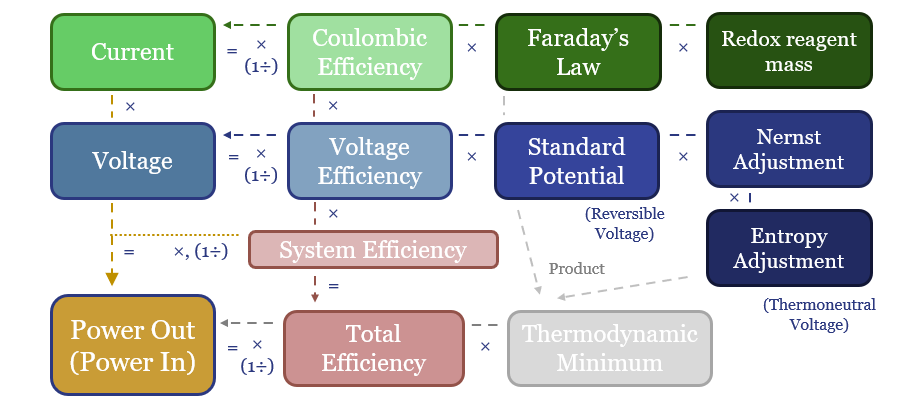

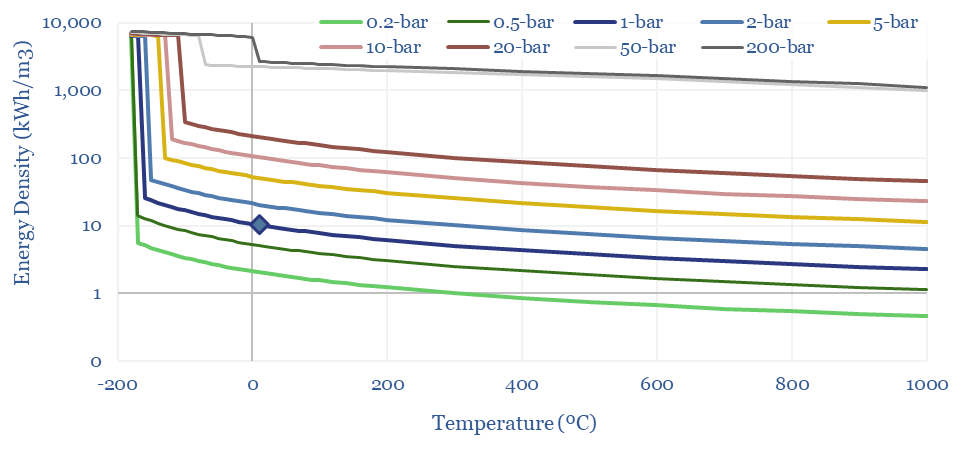

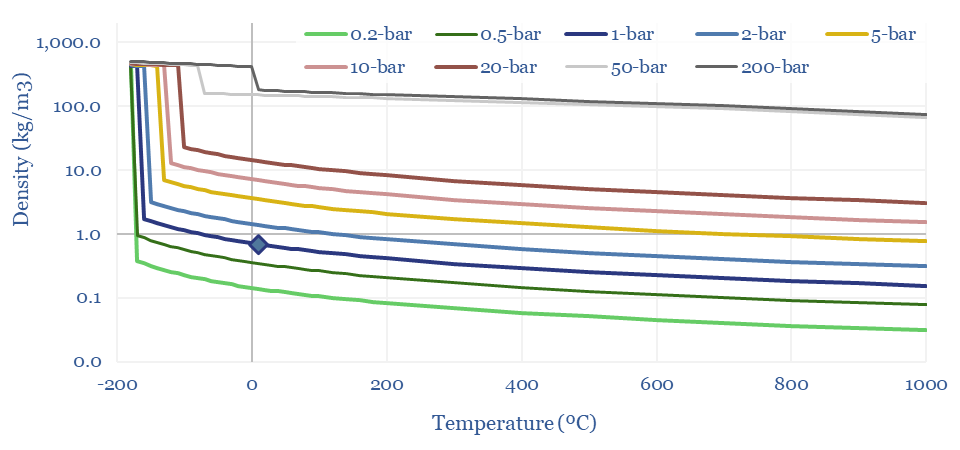

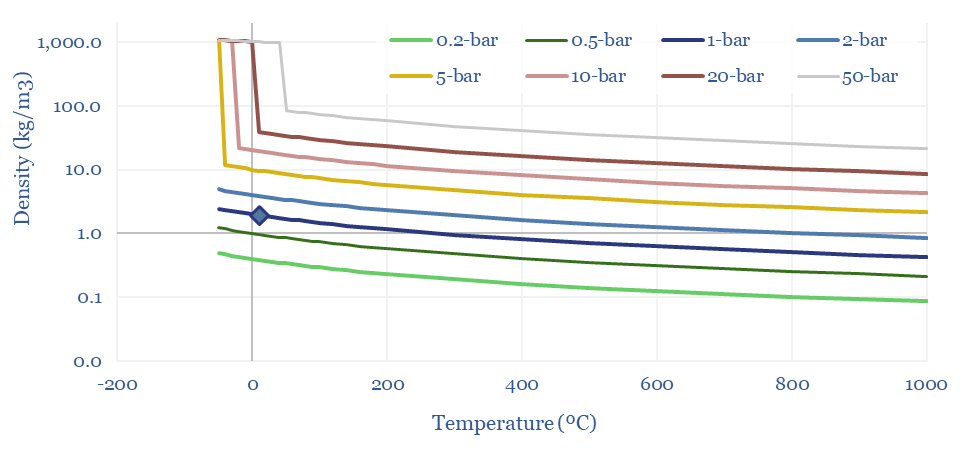

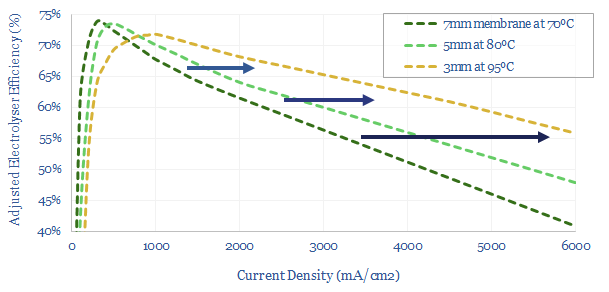

(4) Efficiency: the second law of thermodynamics. The absolute magic of renewables and electrification is their thermodynamics. These technologies can be 85-95% efficient end-to-end, precisely controlled, and ultra-powerful. A world-changing improvement on heat engines and an energy mega-trend for the 21st century. However, the thermodynamics of hydrogen depart from the trend, converting high-quality electricity back into a fuel. The maximum theoretical efficiency of water electrolysis is 83% (entropy increases). Real world electrolysers will be c65% efficient. End-to-end hydrogen value chains will be c30-50% efficient. We want to decarbonize the global energy system. It therefore seems strange to take 100MWH of usable, high-grade, low-carbon electricity, and convert it into 40MWH of hydrogen energy, when you could have displaced 100MWH of high-carbon electricity directly (e.g., from coal). And all the more so, amidst painful energy shortages.

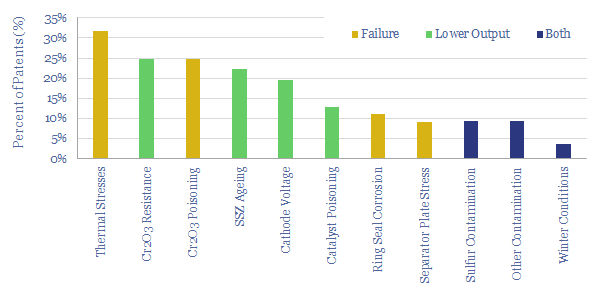

(5) Backing up renewables? It is often argued that renewables will eventually become so abundant, especially during windy/sunny moments, that the inputs to hydrogen electrolysers will become free. We think this is a fantasy. Instead, industrial facilities and consumers will demand shift. Conversely, we are not even sure an electrolyser can run off of a volatile renewables input feed without incurring 5-10% pa degradation, or worse (if you read one TSE note on green hydrogen, we recommend this one).

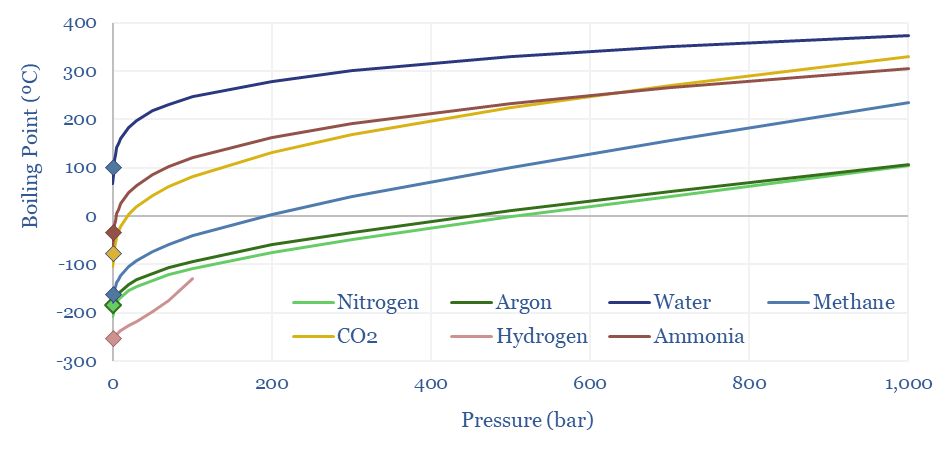

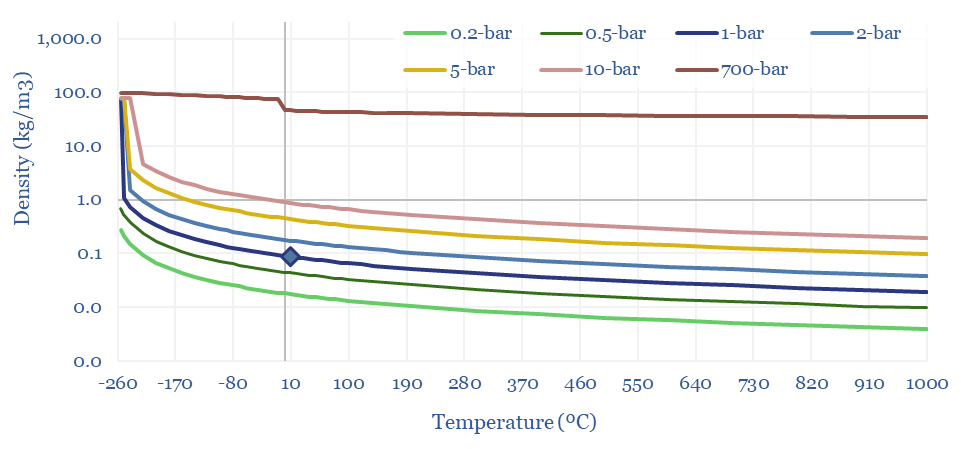

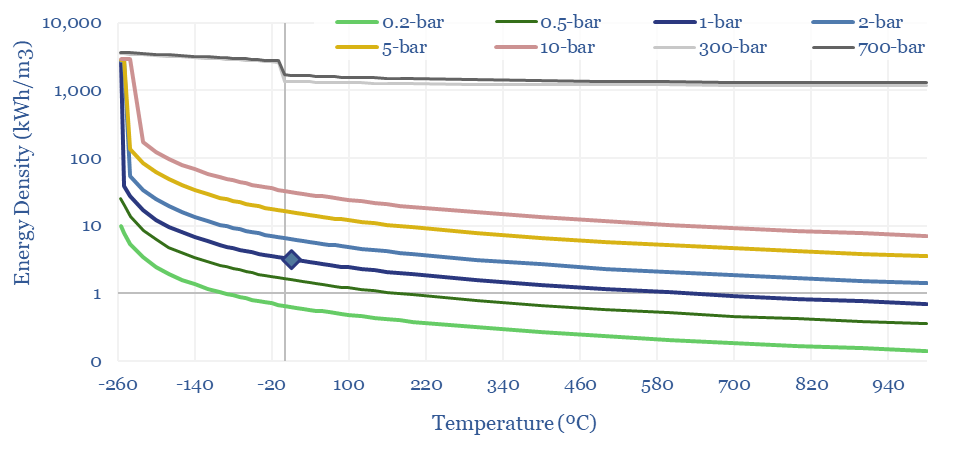

(6) Operations, transport, logistics all feel strangely challenging. Our studies of patents suggest that electrolysers and fuel cells can be the Goldilocks of energy equipment. Past installations have declined at over 5% per year. Due to its small molecular size, 35-75% of hydrogen produced in today’s reformers can be lost. Some vehicles seek to store hydrogen fuel at 10,000 psi, which is 1.5x the pressure of hydraulic fracturing. Even in the space industry, rocket makers have been de-prioritizing hydrogen in favor of LNG (!) because of logistical issues. The costs of hydrogen transport will be 2-10x higher than comparable gas value chains, while up to 50% of the embedded energy may be lost in transportation: our overview into hydrogen transport is here, covering cryogenic trucks, hydrogen pipelines, pipeline blending, ammonia and toluene. Is a hydrogen truck really comparable with a diesel truck? (note here, models here). Finally, the gas industry is bending over backwards to stem methane leaks, due to methane’s GWP of 25x CO2, but hydrogen itself may have a GWP as high as 13x CO2.

(7) Will policy help? We are not sure. We are tempted to draw analogies to the Synthetic Fuels Corporation, bequeathed $88bn of US government money in 1980 amidst the oil shocks, which in today’s money is similar to the $325bn Inflation Reduction Act. It completely missed its targets of unleashing 2Mbpd of synfuels by 1992, due to challenging economics, thermodynamics, technical issues, logistical issues. What evidence can we find that green hydrogen will prove different to this historical case study?

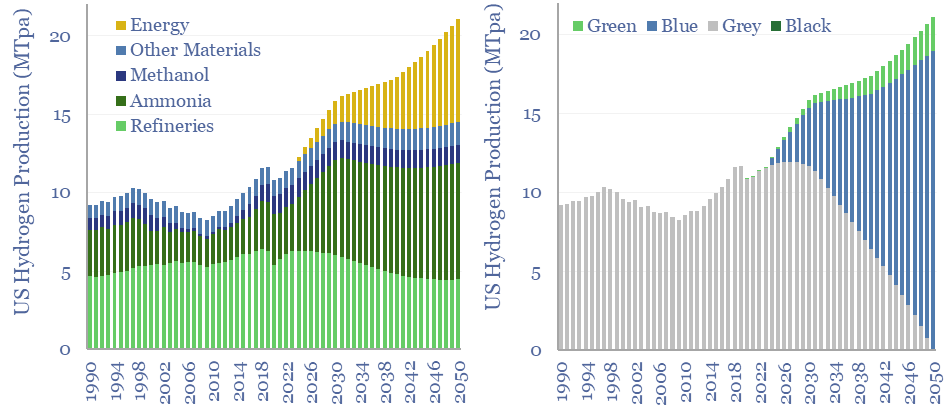

(8) Niche applications can however be very interesting, where clean hydrogen is used as an industrial feedstock. An overview of today’s 110MTpa hydrogen market is here and underlying data are here. At large scale, we are currently most excited by using clean hydrogen in ammonia value chains and steel value chains, as the technology is fully mature and looking highly economical. It is also booming in the US. Elsewhere, an excellent large-scale application is to displace black hydrogen (made from coal), which is 20% of today’s hydrogen market and has a staggering CO2 intensity of 25 tons/ton. At smaller scale, there is also a weird and wonderful industrial landscape, using hydrogen to make products such as margarine or automotive glass. Putting an electrolyser on site beats shipping in hydrogen via cryogenic trucks. But these are also quite niche applications.

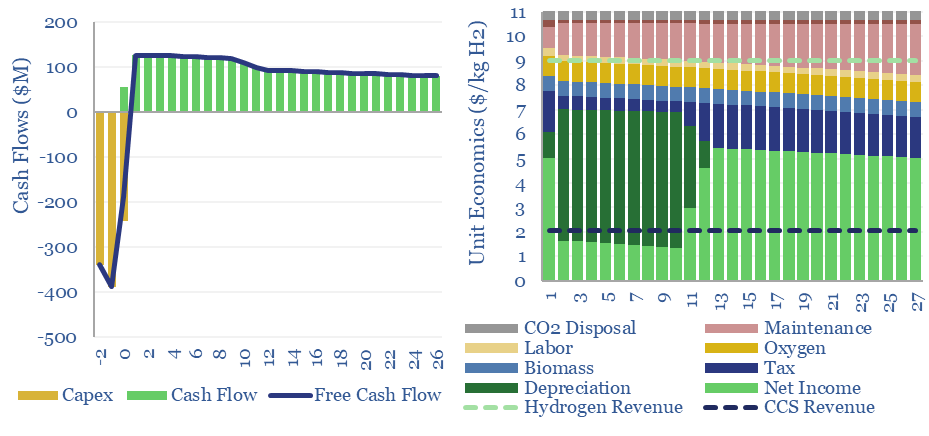

(9) Blue hydrogen is the most economical, low-carbon hydrogen concept we have found. Effectively this is decarbonizing natural gas at source, by reforming the methane molecule into H2 and CO2, the latter of which is sent directly for CCS. Our best overview of the topic is linked here. There are still c15% energy penalties. Costs are $1-1.5/kg in our models, to eliminate c90% of natural gas CO2.

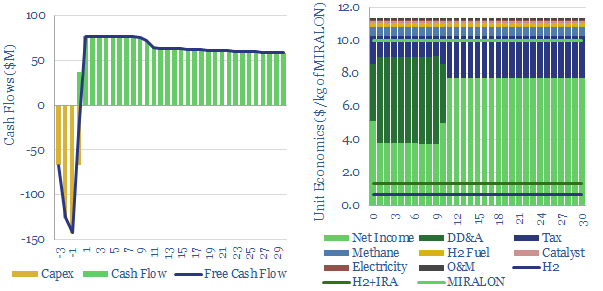

(10) Turquoise hydrogen is also among the more interesting concepts, pyrolysing the methane molecule at 600-1,200◦C into H2 and carbon black. Our base case cost is $2/kg, with a $500/kg price for carbon black. But if you can realize $1,000/kg for the carbon black, you could give the hydrogen away for free. We have screened patents from Monolith and expect others to come to market with technologies and projects.

Around 40 reports and data-files into hydrogen have led us to these conclusions above; listed in chronological order on our hydrogen category page. The best way to access our PDF reports and data-files is through a subscription to TSE research.