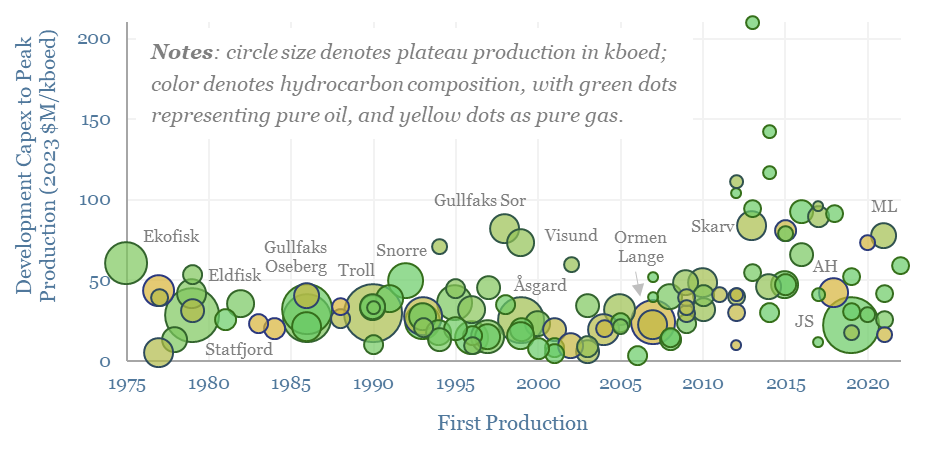

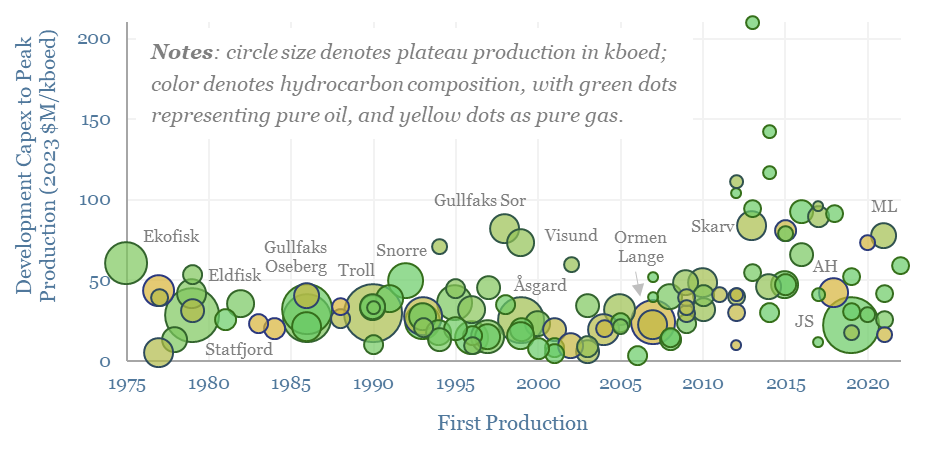

…the development capex for 130 oilfields offshore Norway, from 1975-2023, in real 2023 USD per flowing barrel. Specifically, data on each field are publicly available from the Norwegian Offshore Directorate,…

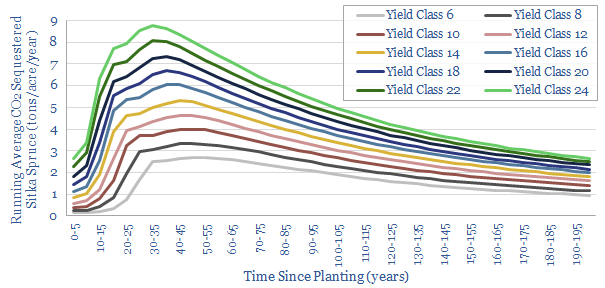

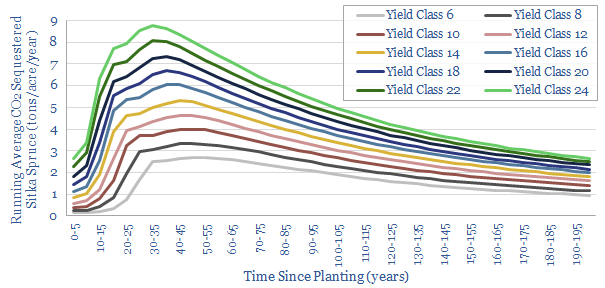

…France and Norway (although the latter now considers it invasive and is trying to phase it back). https://thundersaidenergy.com/downloads/global-reforestation-potential-by-country/ (3) Growing Conditions. Sitka spruce naturally extend from Alaska down into Northern…

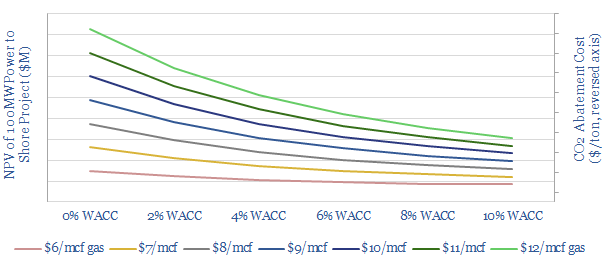

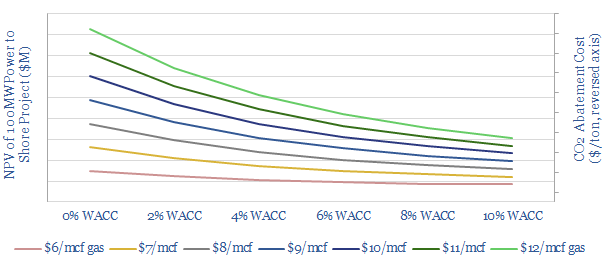

…total power rating, while a project launched by Equinor in 2022 will add a 420kV power line to supply this load from Norwegian hydro and reduce Norway’s total annual emissions…

…impact capital costs. What are the impacts on decarbonisation? Impacts of Eco-Labelling? A Norwegian study has measured a 9% reduction in meat consumption, after adding traffic-light eco-labels in a University…

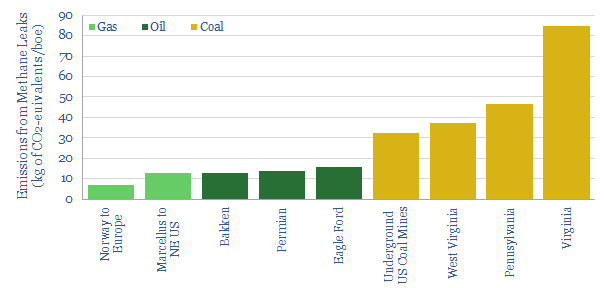

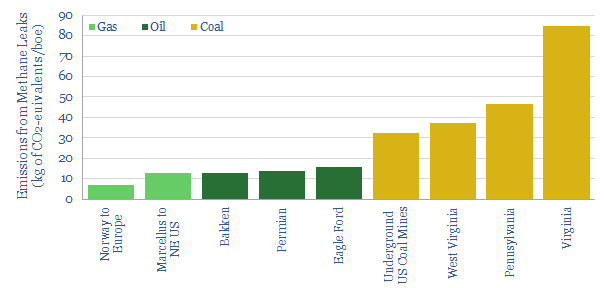

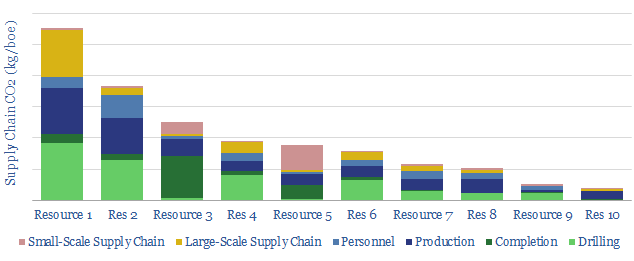

…methane leaks to 0.6% of commercialised gas. Leading the industry, we find the total end-to-end value chain taking Norwegian gas to European consumers leaks around 0.23% of the methane (note…

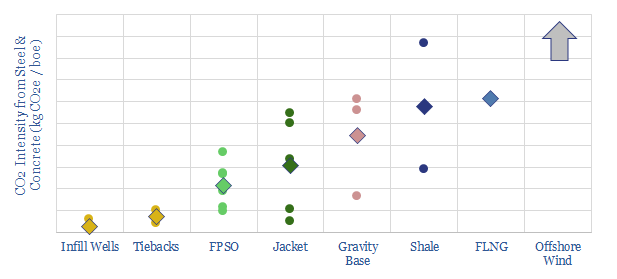

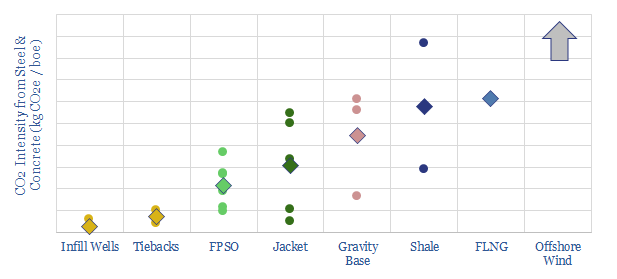

…Brazil and offshore Norway. Infill wells, tiebacks and FPSOs make the most efficient use of construction materials per barrel of production. Fixed leg platforms are higher, then gravity based structures,…

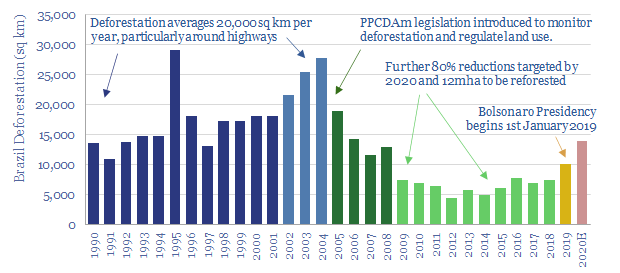

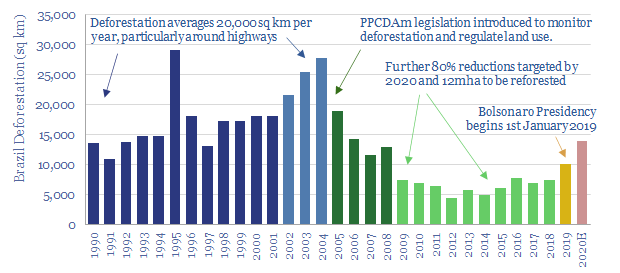

…Specifically, the ‘Amazon Fund’ was created in 2008. It is managed by Brazil’s state-owned development bank, BNDES. $1.3bn has been donated to the fund, from Norway (94%), Germany (5%) and…

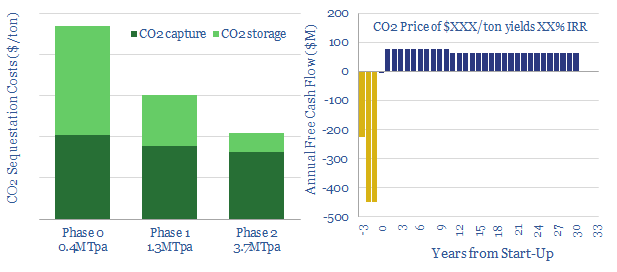

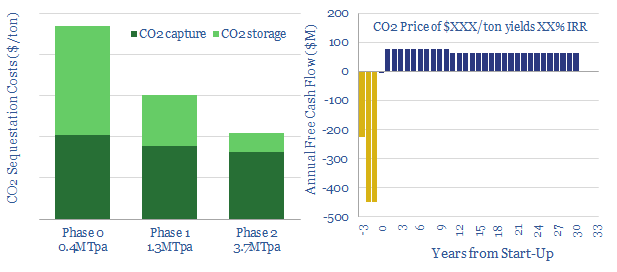

…average, around 70%; for a base case cost of $50-100/ton. $399.00 – Purchase Checkout Added to cart Our numbers are derived from reviewing technical papers, plus ten prior projects (mostly in Norway),…

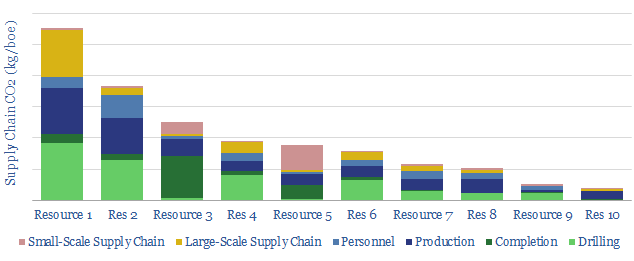

…can be ranked on this measure of supply chain CO2-intensity: such as the Permian, the Gulf of Mexico, offshore Norway, Guyana, pre-salt Brazil and Middle East onshore production (chart above)….

…capturing industrial CO2, liquefying it, transporting it in ships, receiving it onshore in Norway, piping it 110km offshore, then injecting it 3,000m below the seabed. Phase 1 will likely sequester…