400 GW of nuclear reactors produce 2,800TWH of zero carbon electricity globally each year. But the numbers have been stagnant for two decades. This is now changing. This 14-page note explains why. We expect a >3% CAGR through 2030, and hope for a 2.5x ramp through 2050. A ‘nuclear renaissance’ helps the energy transition.

Nuclear capacity: forecasts, construction times, operating lives?

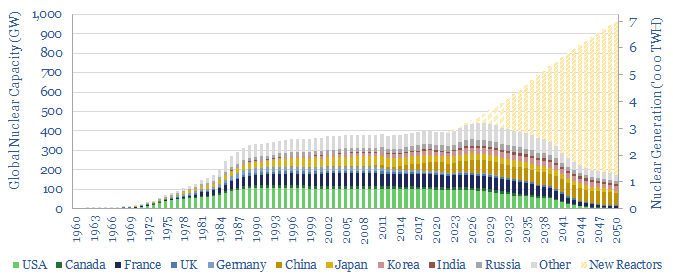

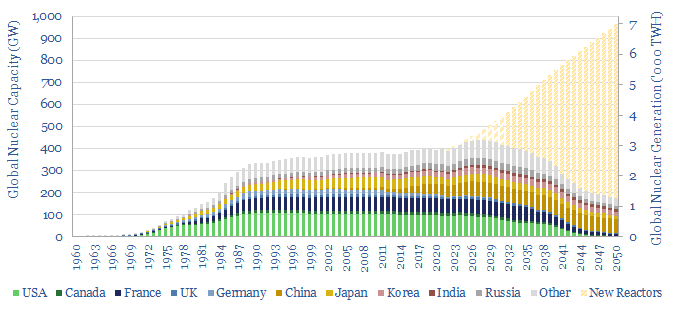

How much nuclear capacity would need to be constructed in our roadmap to net zero? This breakdown of global nuclear capacity forecasts that 30 GW of new reactors must be brought online each year through 2050, if the nuclear industry was to ramp up to 7,000 TWH of generation by 2050, which would be 6% of total global energy.

Our outlook for nuclear energy is evolving. Adding 30GW pa of new nuclear capacity per year would be a massive escalation from, as the world has only added around 6 GW per year of new capacity in the past decade.

However, there is precedent, as the world installed 25-30 GW pa of new nuclear reactors at peak, during the mid-1980s, and after a wave of project-sanctioning that followed major energy crises in 1973-74 and 1979-80.

The total base of active, installed nuclear capacity is around 400 GW today, for perspective. Leading countries include the US, with c100 GW of capacity, France with 60GW, China with 50GW and Russia with 30GW. Japan’s nuclear capacity is presently around 45GW, but a large portion of the installed base remains offline post-Fukushima.

Moreover, the average nuclear plant in the world today has been running for 36-years, which means that 10GW of reactor capacity could shut down each year through 2050.

Underlying the analysis is a database of 700 nuclear reactors, including c440 in operation, c200 that have been shut down or decommissioned and around 60 that are in construction. A helpful source in compiling our forecasts is publicly available data from the IAEA, which we have aggregated and cleaned.

The data also show operating lives of nuclear plants, and construction times of nuclear plants, which average 7.5 years from breaking ground through to first power; across different reactor designs and across different countries.

Finally, this breakdown of global nuclear capacity data-file allows you to filter upon individual countries, such as the US, Germany, France of China.

X Energy: nuclear fuel breakthrough?

X-Energy Technology Review. X-Energy is a private, next-generation nuclear company, founded in 2009, headquartered in Maryland, USA with c300-employees at the time of writing. Its reactor design is a high-temperature, gas-cooled reactor (HTGR), commercializing 80MWe of electricity from c200MWth of heat.

Progress and economics. A $2.4bn advanced demonstration project is being progressed in Washington State, for start-up in 2027, half of which will be funded by the DOE (the other main recipient is TerraPower). Ultimately, levelized costs of 6c/kWh are targeted (these are very competitive levelized costs).

X-Energy’s key innovation is using an inherently safe TRISO fuel. TRISO fuel comprises ‘TRI-structural ISO-tropic fuel” particles. Each of these particles is around 0.85mm wide, and contains a 15.5% enriched uranium core (HALEU), surrounded by a porous layer of graphite, then three further containment layers of dense carbon and ceramic, to make the particle “the most robust nuclear fuel on Earth”. It cannot melt or melt down. This enables a simplified reactor design, using 220,000 x 60mm ‘fuel pebbles’, each containing around 19,000 TRISO fuel particles.

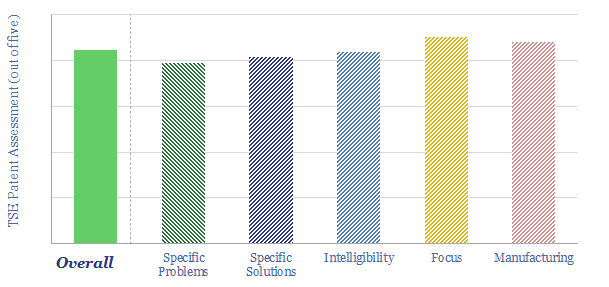

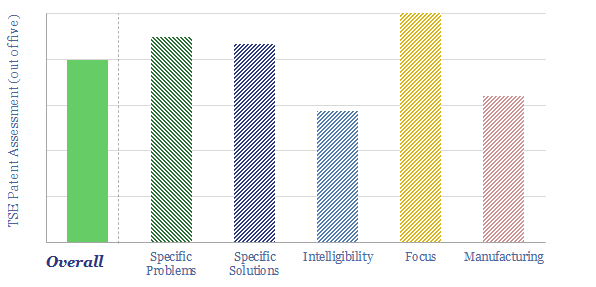

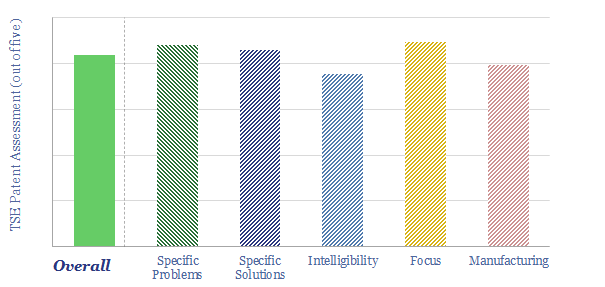

What stands out about X Energy’s patents is that they are substantively all focused on manufacturing its TRISO fuel, and they score very highly on our usual patent framework. Specifically, our work reviews a concentrated library of patents focused on manufacturing TRISO particles from gels of enriched uranium oxides, which are then coated with protective layers, using chemical vapor deposition. Many of the patents specify precise reagents and reaction conditions, backed up with experimental data and detailed design drawings. Hence our X-Energy technology review suggests a moat around the core IP.

TerraPower: nuclear breakthrough?

TerraPower was founded in Washington State in 2008, employs around 600 people and has received early and consistent backing from Bill Gates. Our TerraPower technology review is based on its patents.

TerraPower describes itself as a nuclear/energy technology company, whose centrepiece technology is a traveling wave reactor for next-generation nuclear energy. 300-1,000MWe reactors were designed. But a 2015 MoU to develop the TWR technology further, with China’s National Nuclear Corporation, was abandoned in 2019 due to technology transfer limitations from the Trump administration. TerraPower has more recently seemed to de-prioritize the traveling wave reactor, instead developing a 345MWe, sodium fast reactor called Natrium, under a partnership with GE-Hitachi.

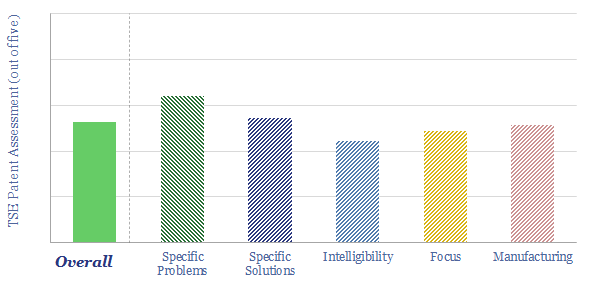

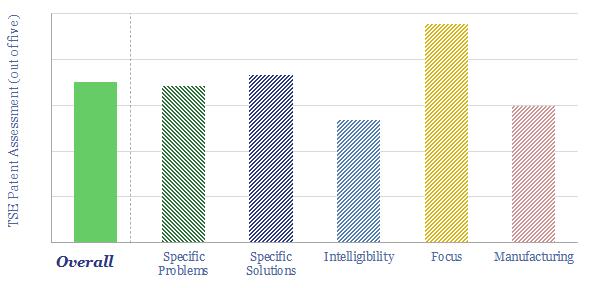

Our usual patent search returned 143 distinct patents for TerraPower, which is more than other next-gen nuclear, or other pre-revenue companies we have reviewed.

We reviewed TerraPower’s 20 most recent patent filings, to see where it is currently focused. This shows a large library of process enhancements around different energy technologies, mostly fission technologies, and most recently, sodium fast reactors fueled by the circulating flow of radioactive salts. However, given the broad range of patents, it was difficult for us to identify what is the “front-runner” closest to commercialization, and which patents de-risk it or create a moat around it. Full details are in the data-file.

To read more about our TerraPower technology review, please see our article here.

Terrestrial Energy: small modular reactor breakthrough?

Our Terrestrial Energy technology review focuses on a next-generation nuclear fission company, founded in 2013, based in Ontario, Canada, has c100 employees and is aiming to build a small modular reactor, more specifically, an Integral Molten Salt Reactor.

Game-changer? A plant with 2 x 442MWth and 2 x 195MWe reactors might use 7 hectares of land, get constructed within 4-years, and for less than $1bn per reactor (long-term target is $2,600/kWe), yielding levelized costs of 5c/kWh (company target, we get to 5-7c/kWh for a 5-10% equity IRR in our own models), a CO2 intensity below 0.005 kg/kWh and multiple ways to back-up renewables.

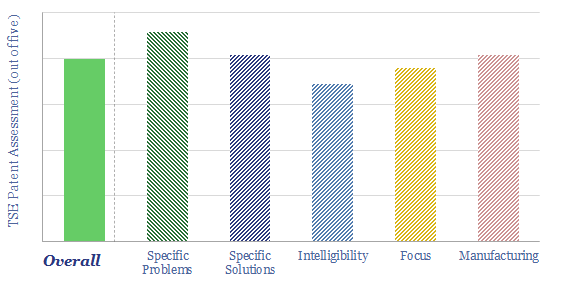

Our patent review shows one of the strongest patent libraries to cross our screens from a pre-revenue company. 80 patents, filed in 25 geographies, lock up 8 core innovations, and give a clear picture for how the reactor achieves high efficiency, high safety and low complexity.

To read more about our Terrestrial Energy technology review. please see our article here.

General Fusion: magnetized fusion breakthrough?

General Fusion technology review. General Fusion is developing a magnetized target fusion reactor, to fuse heavy isotopes of hydrogen (deuterium and tritium). It confines 100MºC plasma within a vortex of liquid lithium/lead, then compresses the plasma via hundreds of high-pressure pistons (effectively a modern-day update of the Linus concept).

It is currently working towards building a 70%-scale demonstration plant by 2025 in Oxfordshire; and ultimately hopes to build a $4bn order book by 2027-30, commercializing a 100-200MWe fusion reactor with 5-6.5c/kWh levelized costs of electricity.

Our patent review allows us to de-risk the idea that General Fusion has made genuine, specific and practical innovations towards development of a magnetized target fusion reactor.

The downside of such a candid patent library is that it also highlights the complexity of its ambitions. There are four focus areas which we would highlight in our General Fusion Technology Review.

To read more about General Fusion innovations, please see our see our article here. Fusion remains a theme that could be a game-changer for energy transition. Other companies with good innovations have also crossed our screen. A summary of all this research can be found here.

Japan: nuclear re-start tracker?

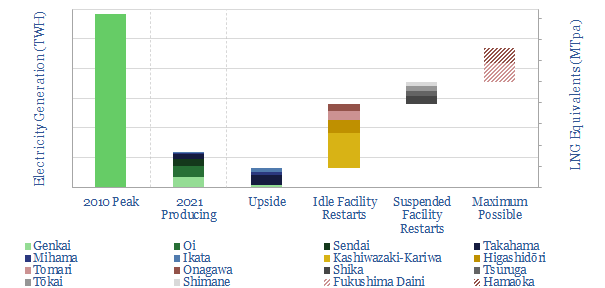

This data-file on looks through 17 major nuclear plants in Japan with 45GW of operable capacity, covering the key parameters and re-start news on each facility.

In 2010, before the Fukushima crisis, Japan produced 292 TWH of nuclear electricity, which would have required about 40MTpa of LNG imports if it had all been generated by gas instead.

With all its nuclear plants shut down in 2011-12, LNG imports jumped by around 20MTpa, while the remaining shortfall was covered by ramping oil-fired power back upwards by c600kbpd.

In early-2022, we estimate there is 30TWH of upside from ramping up facilities that have partially restarted (saving 5MTpa of LNG). There is another 100TWH of upside from ramping relatively safe but idle facilities (saving 15MTpa of LNG). There is another 100TWH of upside from ramping more controversial facilities, where debates still linger over their integrity amidst the tail-risk of a direct hit from a massive earthquake (another 15MTpa of LNG), although these facilities could in principle re-start temporarily amidst a war or energy crisis.

Total global nuclear generation is around 2,800 TWH pa, so this scenario also presents meaningful uranium upside.

Commonwealth Fusion: nuclear fusion breakthrough?

Commonwealth Fusion Systems spun out of MIT in 2018. The company is based in Massachusetts, has 165 employees and made headlines in November-2021 as it raised $1.8bn in Series B funding, which we think is the largest capital raise of any private fusion company to-date.

CFS aims to be the “fastest and lowest cost path to commercial fusion energy” by creating a commercial nuclear fusion reactor, the SPARC tokamak, which could be around 98% smaller than ITER. A single test magnet using 267km of its HTS tape sustained 20 Tesla magnetic fields in 2021.

Our patent review found CFS to have a high-quality patent library, of specific, intelligible, practical and commercially-minded innovations to densify the magnets that would confine plasma in a Tokamak. Specific details, and minor hesitations are in the data-file.

Nuclear fusion: what are the challenges?

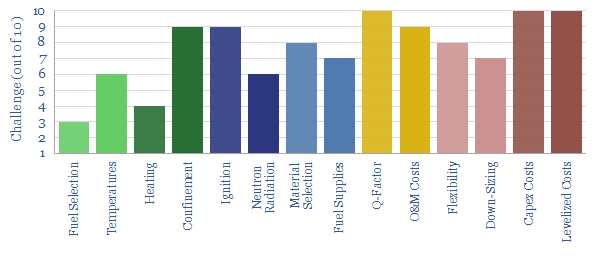

Nuclear fusion could provide a limitless supply of zero-carbon energy from the 2030s onwards. Thus 30 private companies have raised $4bn to progress new ideas. But the goal of this 20-page note is simply to understand the challenges for fusion reactors, especially deuterium-tritium tokamaks. Innovations need to improve EROI, stability, longevity and ultimate costs.

NuScale: small modular reactor breakthrough?

NuScale was founded in 2007 and is developing a small modular reactor (SMR), measuring 2.7m wide x 20m tall, weighting 700T and producing 250MWth of heat, for 77MWe of power. NuScale’s small modular reactor is part of a renaissance of new technology progress and pragmatism.

Recent progress is strong. It is the first design of its kind to win US regulatory approval, unlocking the first plants in 2029-30. In November-2021, plans were also announced to build SMRs in Romania, by 2028, displacing coal power.

NuScale’s patents scored well on our framework, with multiple, clear innovations to improve the safety, compactness and cost-effectiveness of SMRs. This could enable nuclear plants to be constructed for costs below $3,000/kW. Details that impressed us are in the data-file.

Our roadmap to net zero sees nuclear increasing from 2,800TWH in 2023 to 7,000TWH by 2050 at a 3% CAGR, with global useful energy demand growing by ca 50% to 120,000TWH in the same timeframe. But as old plants need to be continuously phased out and replaced, the real need for nuclear is higher. We think NuScale small modular reactor designs can be a part of supplying that demand while also abating CO2 emissions and displacing coal.