Alternative truck fuels: how economic?

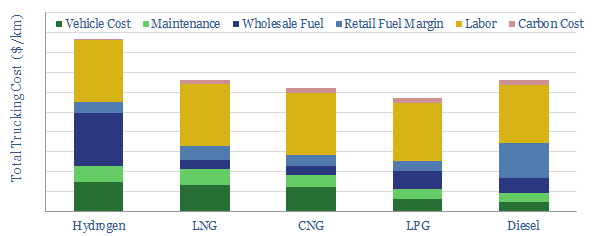

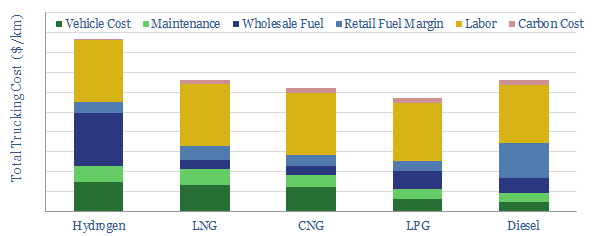

This data-file compares different trucking fuels — diesel, CNG, LNG, LPG and Hydrogen — across 35 variables. Most important are the economics, which are fully modelled, in the 2020s in…

This data-file compares different trucking fuels — diesel, CNG, LNG, LPG and Hydrogen — across 35 variables. Most important are the economics, which are fully modelled, in the 2020s in…

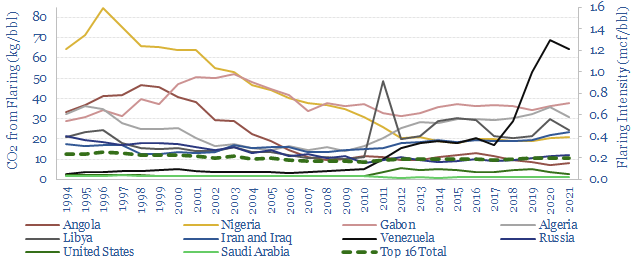

…1990s). LNG’s positive role in reducing flaring stands out from the data. LNG exports were 94% correlated with Nigeria’s flaring reduction since NLNG started up in 1999. Angola has also…

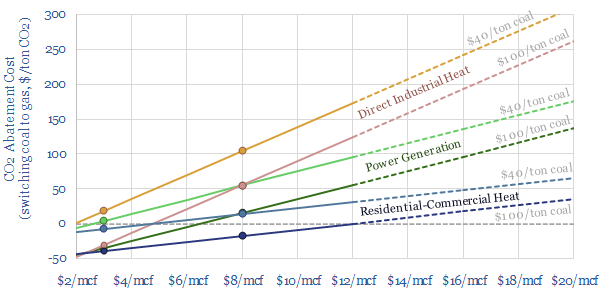

…with gas would have required the equivalent of 40MTpa of LNG imports, over 10% of overnight tightening in global LNG market. Philosophical problem #1: historical volatility? Commodity prices volatility raises…

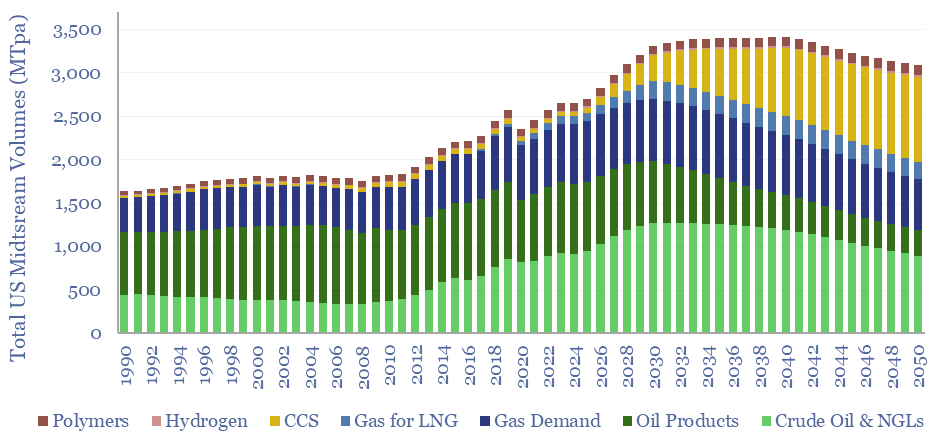

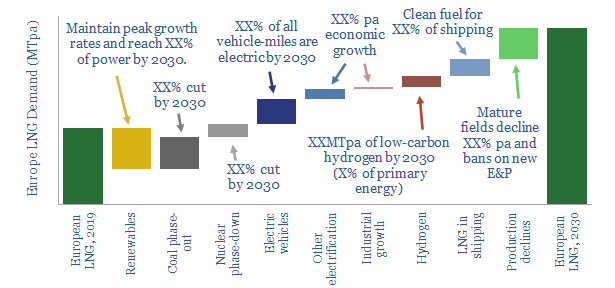

…such as oil. (2) Global gas demand doubles in our roadmap to net zero, in order to displace coal; global LNG trebles; while another under-appreciated angle is that growing applications…

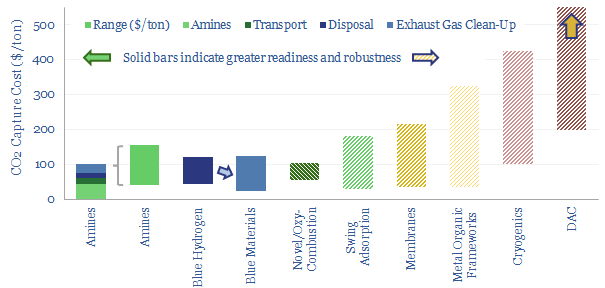

…fast pace and could even disrupt global gas balances and LNG exports (note here). Novel combustion technologies are also maturing rapidly, which may facilitate CCS without amines. NET Power has…

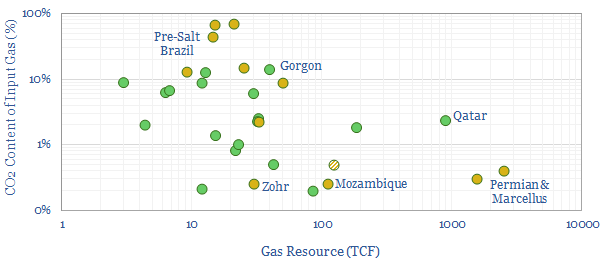

…gas value chains to be around 56 kg/mcf. Large, low-CO2 resources like the Permian, Marcellus and Mozambique are well-positioned to dominate future LNG growth. LNG markets are set to treble…

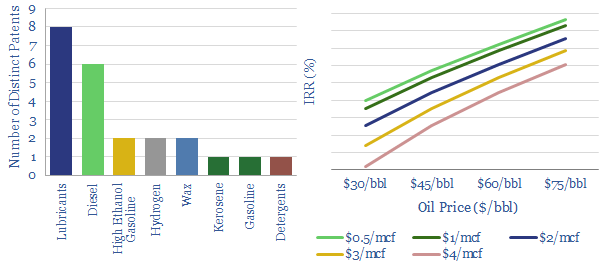

…emanating from the Permian; and produce these advantaged products. It would also help reduce the risk of US LNG projects glutting the market. We therefore model the economics in this…

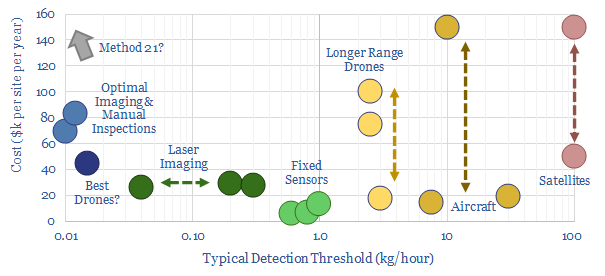

…interesting companies and innovations. Page 28-29 screens methane emissions across the different Energy Majors, and resultant CO2-intensities for different gas plays. Page 30 advocates new LNG developments, particularly small-scale LNG,…

…into low carbon hydrogen. To achieve this, an incremental 85MTpa of LNG must be sourced by 2030, absorbing one third of new global LNG supplies, and stoking mid-2020s LNG shortages….

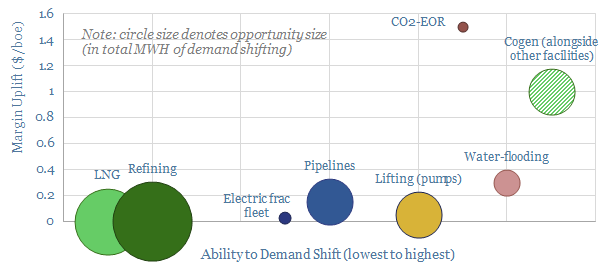

…lead the screen, with utilization rates sometimes surpassing 90%. It takes days to re-start a refinery or an LNG plant after an outage. This makes them poorly placed for demand…