The Ascent of LNG?

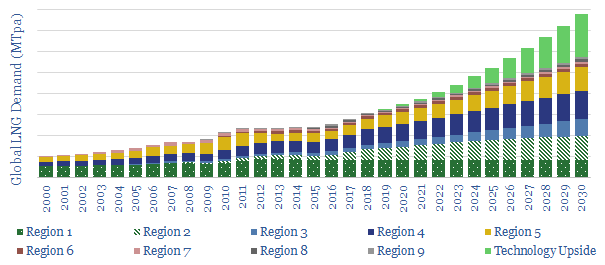

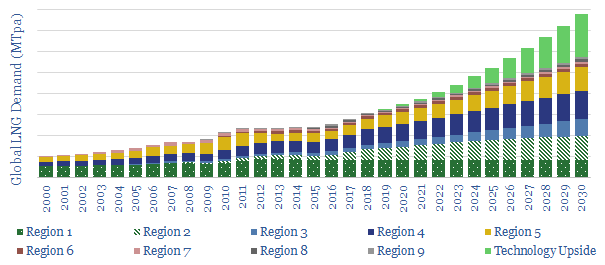

…and their CO2 content, downloadable here. Our positive outlook on US LNG is further underpinned by our positive outlook on US shale. Conclusions: path dependency? The numbers above are not…

…and their CO2 content, downloadable here. Our positive outlook on US LNG is further underpinned by our positive outlook on US shale. Conclusions: path dependency? The numbers above are not…

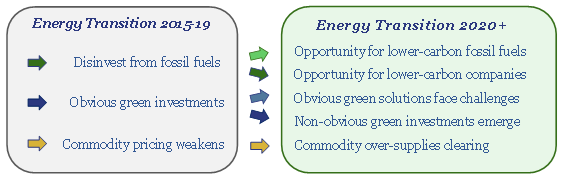

…present their low carbon credentials in order to re-attract capital and potentially re-rate. Theme #5 is our outlook for the US shale industry in 2020, following on from Themes 2-4….

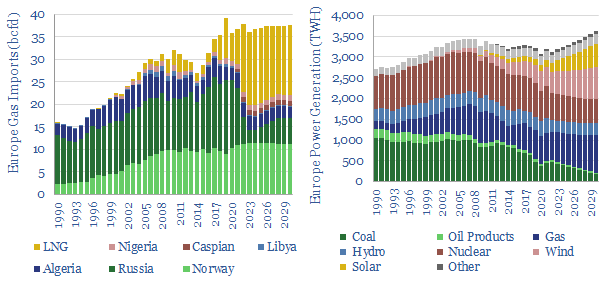

…supply disruptions of 2022, there is no sign yet that Europe is seriously considering long term supply growth. Although there is vast potential in European shale. Europe has doubled its…

…alternative is to allocate more capital to companies that offer attractive returns and also have lower carbon contributions than their peers: such as lower-CO2 oil and gas producers, shale producers,…

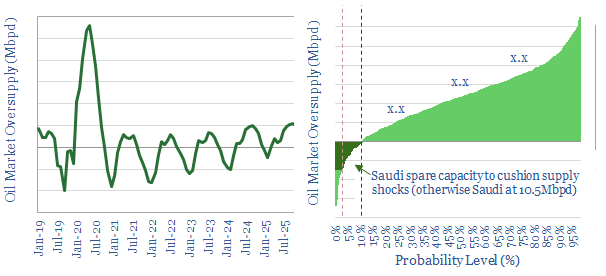

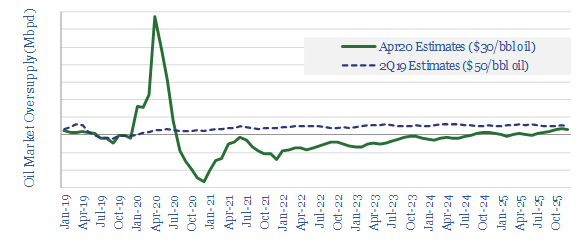

…year, denting oil to $30/bbl, and halving the US rig count. A 1Mbpd YoY shale curtailment by April 2021 brings the market back into balance by 2022. But there is…

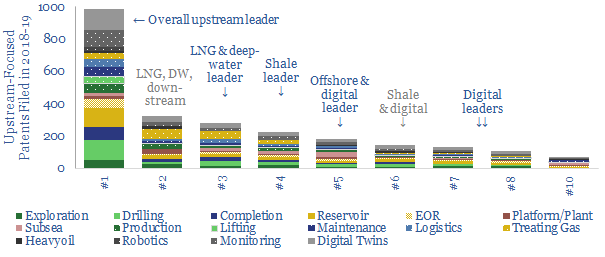

…to determine which Energy Majors are best-placed to weather the downturn, benefit from dislocation and thrive in the recovery. We find clear leaders in onshore, offshore, shale, LNG and digital….

…suggest an 85% chance of under-supplied markets from mid-2021 onwards, following the loss of 4.5Mbpd of shale growth and c3Mbpd of greenfield growth. This 4-page note argues it is not…

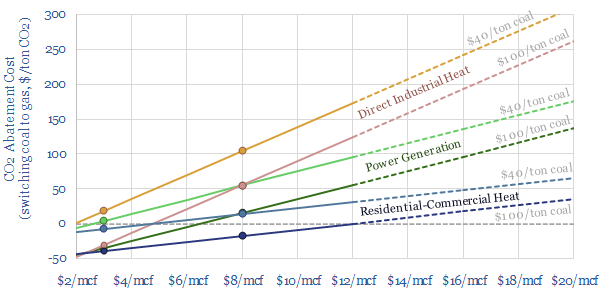

…from 90bcfd of gas production in 2021 to 130-150bcfd of gas production by mid-late decade (model here). The marginal hub-level cost to ramp US shale gas is $2-3/mcf (model here)….

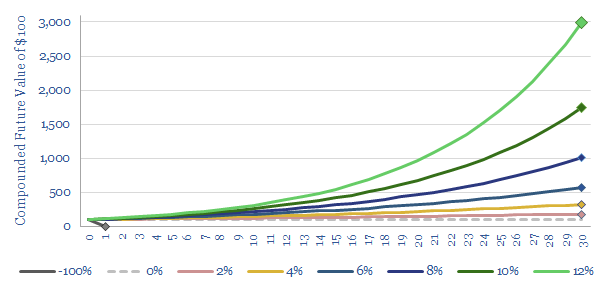

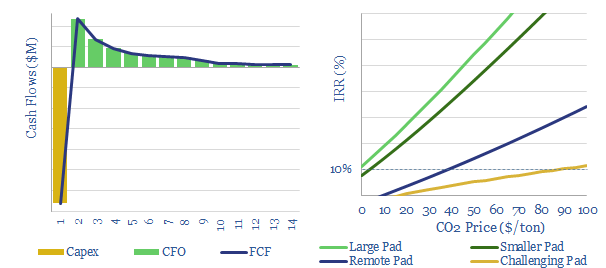

…the gas, cleaning the gas, and compressing the gas into a regional pipeline. $399.00 – Purchase Checkout Added to cart Generally, double-digit returns are achievable at a large new shale pad, by…

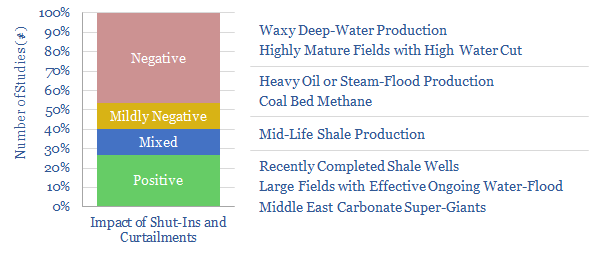

…but generally we expect shut-ins and deferrals during the 2020 COVID crisis will lower effective production capacity. The Winners. Generally, super-giant Middle East carbonate reservoirs and recently completed shale wells…