CO2 is a strange gas. This matters as energy transition will require over 120 GW of compressors for 6GTpa of CCUS. This 13-page note explains CO2 compression and CO2’s strange properties. This helps to fine-tune appropriate risking factors for vanilla CCS, blue hydrogen, CO2-EOR, CO2 shipping and super-critical CO2 power cycles. There is a wide moat around leading turbomachinery companies.

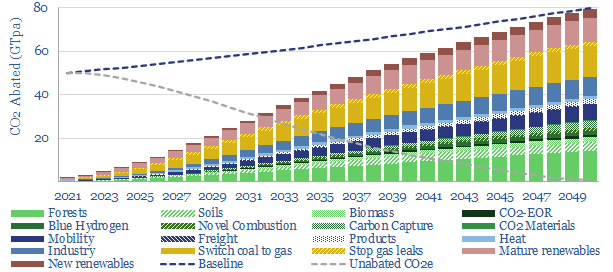

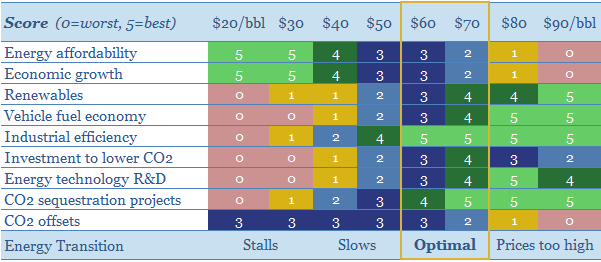

The objective of the energy transition is to meet the energy needs of human civilization, somewhere in the range of 120,000 TWH pa in 2050, while simultaneously eliminating net CO2 emissions, which could otherwise reach 80GTpa.

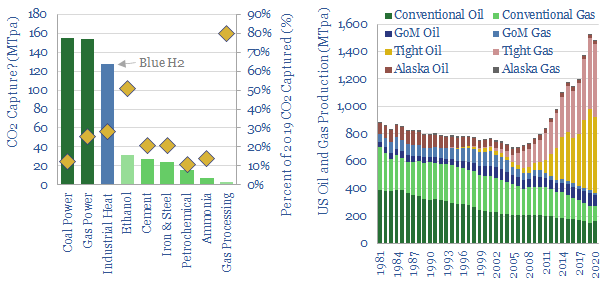

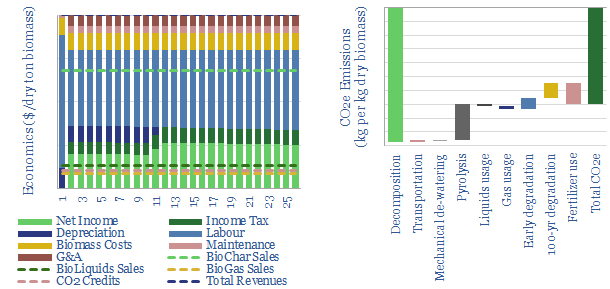

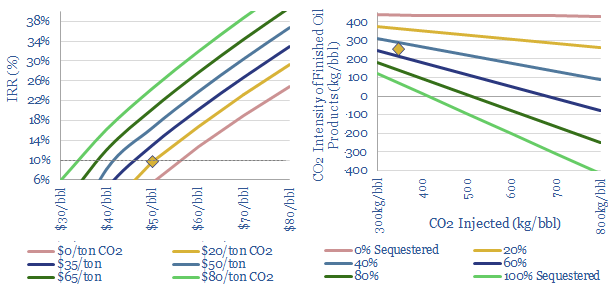

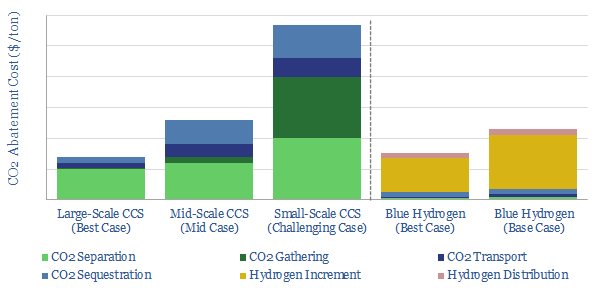

After four years of research, our roadmap to net zero includes 6GTpa of CCUS, a broad category that includes vanilla CCS, blue (and turquoise) hydrogen, novel power cycles like oxy-combustion, CO2-EOR and CO2-to-materials.

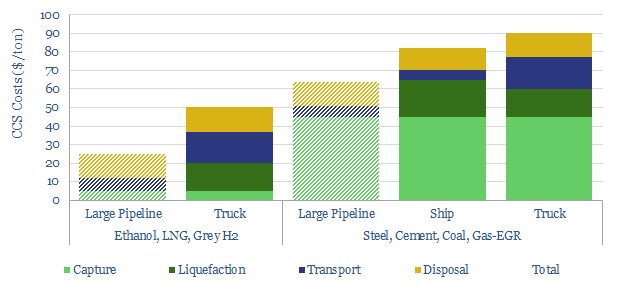

CO2 compression is required for almost all of these examples. Atmospheric pressure is 1-bar. The typical pressures involved in different CCUS applications above are explained on page 2.

The energy needed for CO2 compression is a function of input variables, such as mass, temperature, compressibility, heat capacity ratio and efficiency. This is captured in our compression models and explained on page 3.

But CO2 is strange. A CO2 molecule is not a billiard ball. This linear molecule has regions of negative and positive charge, and different acentricity versus other atmospheric gases (page 4).

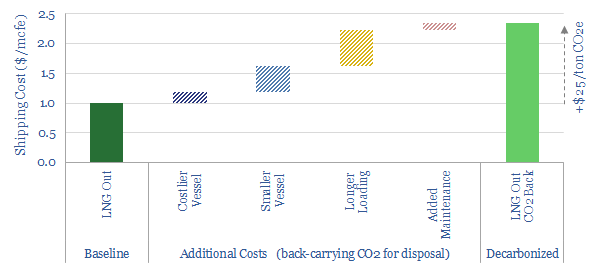

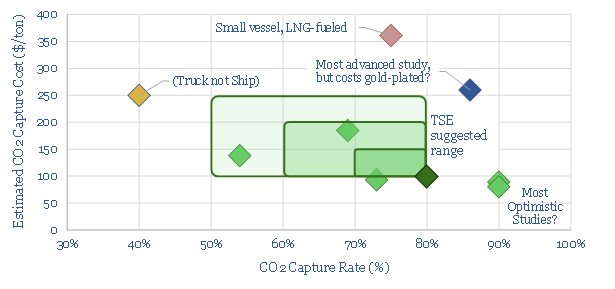

Liquid CO2 needs to be pressurized beyond 5.2-bar. This actually makes CO2 liquefaction for CO2 shipping or CO2 trucking up to 80% easier than for other gases (page 5).

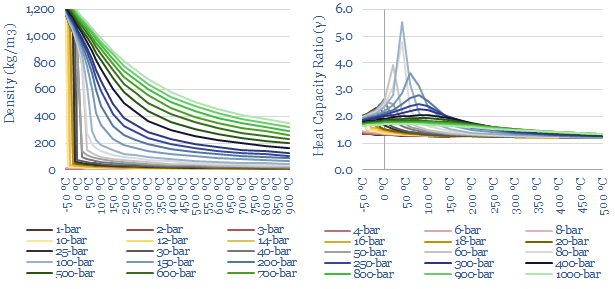

Densities are 2-10x higher than other gases, especially around/above pressures of 75-bar. This means turbomachinery, vessels and pipes for high-pressure CO2 can be smaller but likely also need to be more rugged versus other gases (page 6).

Wild fluctuations in Cp, Gamma and Compressibility occur. This makes the calculations for compressors and heat exchangers truly complex, which is worth understanding, in order to help with risking factors for novel CO2 technologies (pages 7-9).

The energy requirements for CO2 compression follow from the discussion on pages 3-9. I.e., what compression power (in MW) is required to take 1MTpa of CO2 and increase it to 5 – 200 bar of pressure? (page 10).

These complexities matter because they suggest a strong moat for leading companies in turbomachinery, and some other CO2 specialists. Three public companies stand out from technical papers and past projects, while others at the cutting edge are also discussed (pages 12-13).