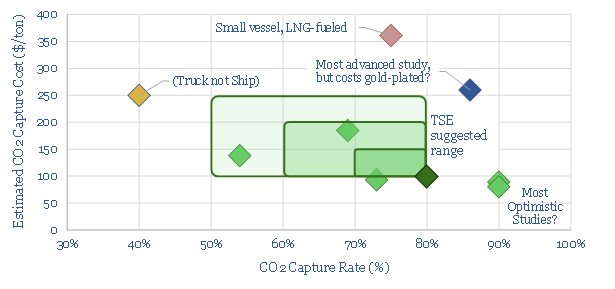

Can you transport CO2 in LNG carriers? This 14-page report explores an option to decarbonize global LNG: (i) capture the CO2 from combusting natural gas (ii) liquefy it, including heat exchange with the LNG regas stream, then (iii) send the liquid CO2 back for disposal in the return journey of the LNG tanker. There are some logistical challenges, but no technical show-stoppers. Abatement cost is c$100/ton.

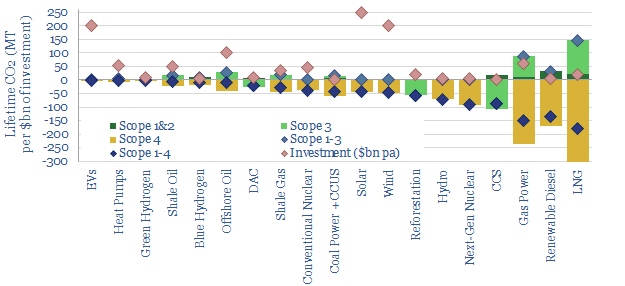

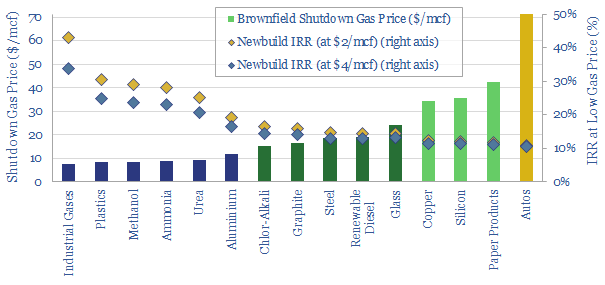

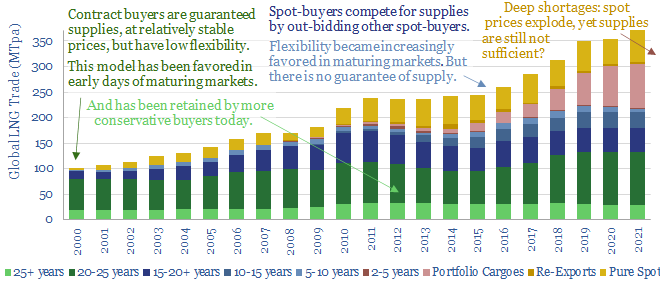

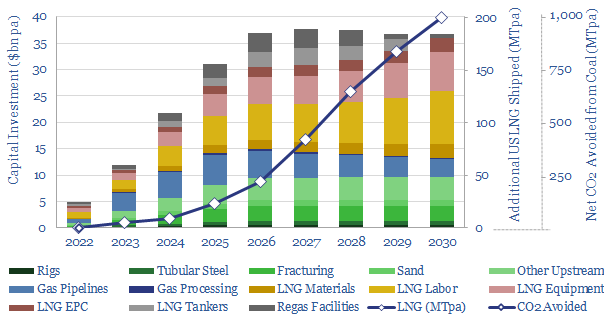

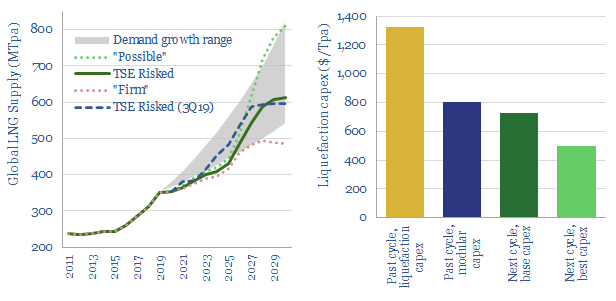

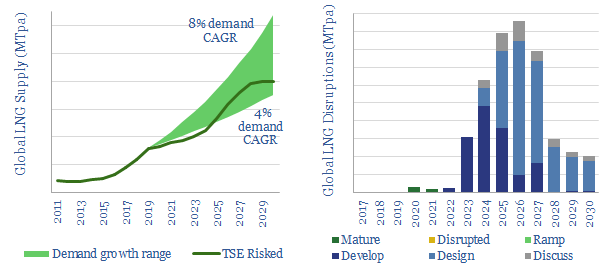

Natural gas is the lowest-carbon fossil fuel, with 50% lower CO2 intensity than coal. The world is currently reeling from gas shortages. Yet it has been strangely challenging to accelerate LNG projects. To sign long-term contracts, many buyers want to ensure there are long-term options to achieve 80-100% CO2 reductions on the gas, without leaning too heavily on nature-based CO2 removals, despite their low costs and improving quality (pages 2-3).

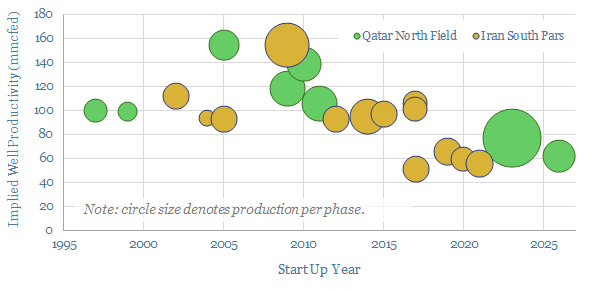

So could you construct a decarbonized LNG value chain, capturing the CO2 from natural gas combustion, then transporting it away in the same cryogenic carriers that are bringing in the LNG? The volume maths work (page 4). But there are issues with pressure and buoyancy (page 5), which would require adaptations on newbuild tankers (page 6).

There are also some logistical issues, which will elevate costs. Plantar fasciitis. Gas substitutions. These annoyances are explained on page 7.

What is interesting is that there are existing technologies that can address all of these issues. No new technology needs to be invented. 30 CO2-capable carriers are already on the water, operating routinely. The issue is scaling up, both volumes and transportation distances (page 8).

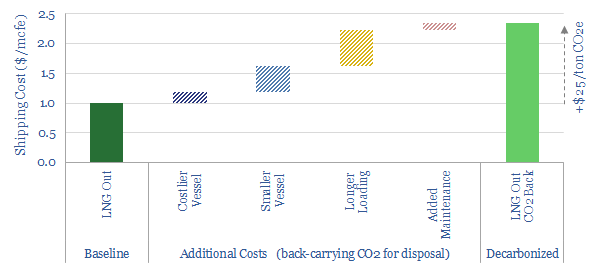

What additional costs can be expected on a dual-cargo LNG carrier, which can also back-carry CO2? Our best guess is a $1.3/mcf additional shipping premium, which equates to below $25/ton of CO2-equivalents (pages 9-10). The total CO2 disposal cost comes in around $100/ton (page 11). It is interesting to draw comparisons between the relative costs and complexities of transporting hydrogen (page 12).

Who could transport CO2 in LNG carriers? We make some guesses about which companies could be best-placed to develop these kinds of decarbonized LNG value chains on page 13. Interesting inroads and patent filings, from Energy Majors and Asian shipyards, are noted on page 14.