Fears over the energy transition are now restricting investment in fossil fuels, based on our new paper, published in conjunction with the Oxford Institute for Energy Studies, linked here.

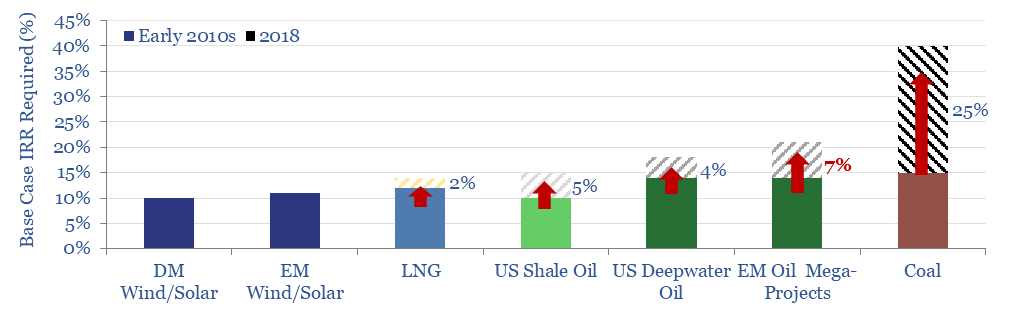

They have elevated capital costs by 4-7% for oil and by c25% for coal, compared with the early 2010s.

- One consequence will be to concentrate capital into renewables, gas, and shorter-cycle oil projects (i.e., shale).

- But there will also be negative consequences, risking long-run supply shortages of oil and coal.

- Companies are also being pressured to ‘harvest’ their existing assets, rather than maximising potential value in the 2020s, which may impact valuations.

For further details please see the full paper, linked here, or contact us.