Ramping new energies is creating bottlenecks in materials. But how much can material use be thrifted away? This 13-page note is a case study of silver use in solar. Silver intensity halved in the past decade, and could halve again? Conclusions matter for solar companies, silver markets, other bottlenecks.

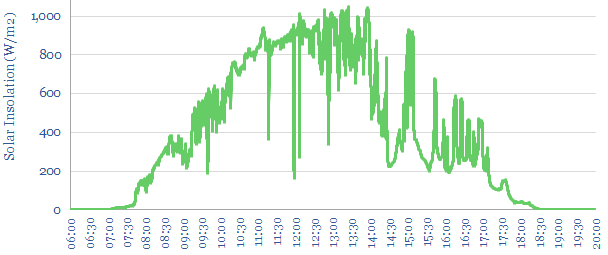

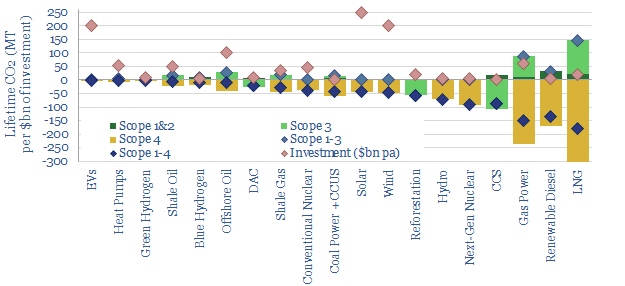

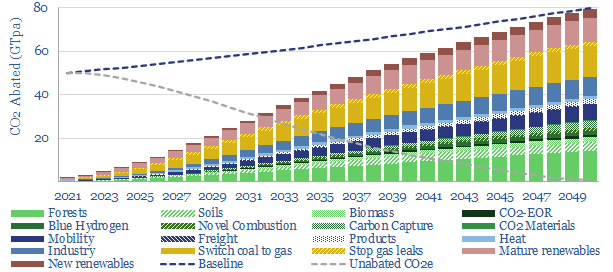

An important goal for curing energy shortages and accelerating the energy transition is to accelerate solar capacity additions. Our solar forecasts are discussed here, modelled here and re-capped on page 2.

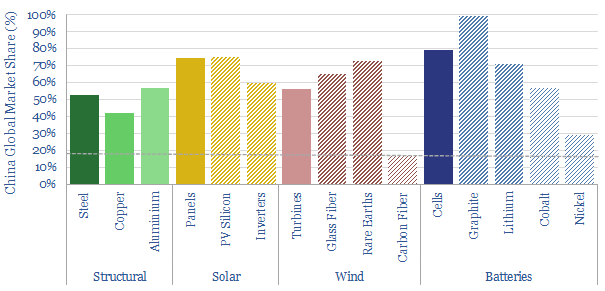

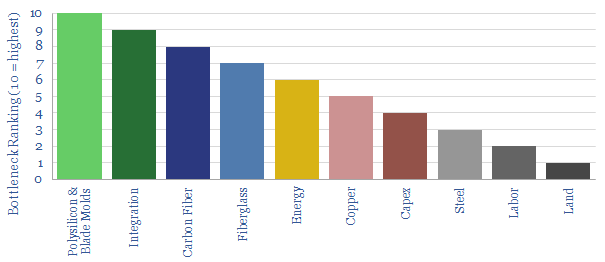

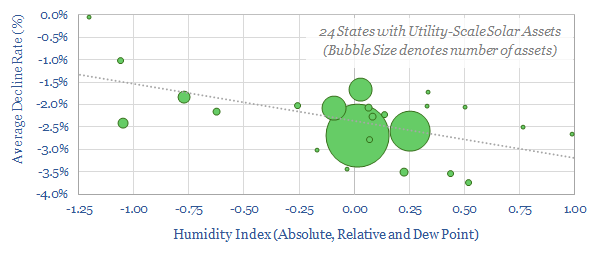

Solar bottlenecks. There are seven separate materials where our solar ramp-up is likely to consume well over 20% of today’s total global market balances. However, this is assuming materials intensity remains constant (in grams/kW or kg/kW) (page 3).

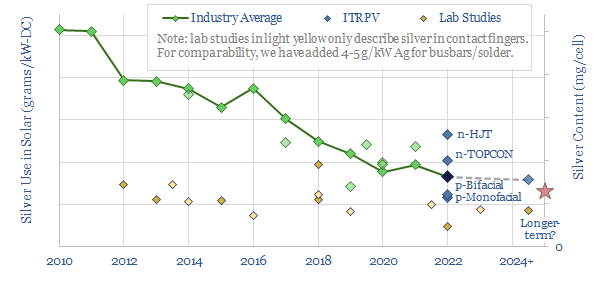

A silver case study. Silver intensity of the average installed solar module has recently halved. So can it halve again? Important uses of silver are in the front contact fingers, busbars and solder of modern solar cells. This is explained on pages 4-6.

What determines the amount of silver use in solar? To answer this question, we have modeled the losses on the surface of a solar cell, due to resistance in the emitter layer, resistance in the contact layer and due to shading. The engineering equations are strangely beautiful (pages 7-8).

Can you thrift silver from a solar cell? The answer is yes. Especially if silver prices explode. It is easy if you don’t mind sacrificing electrical efficiency. Trade-offs and quantities are explored on page 9.

Can you reduce silver use in solar, while also increasing efficiency? Intriguingly, the answer here is also yes. To an extent. Especially with improved printing technologies (pages 10-11).

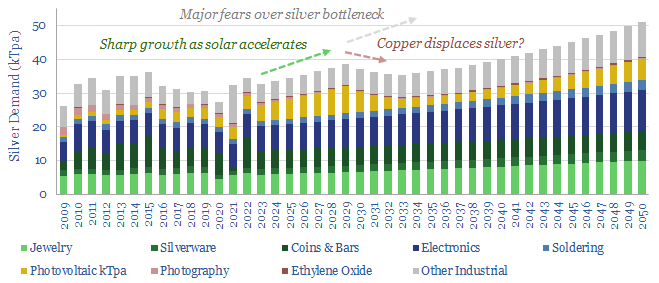

Silver markets. Our conclusions for silver markets are updated (in kTpa terms). We still see solar tightening silver markets, after balancing volume growth, changing cell designs (e.g., TOPCons) and thrifting. But continued thrifting partly mutes the upside (page 12).

Company implications. Leading solar manufacturers that optimize silver loadings can easily derive 0.3 – 1.0% benefits in operating margins. We think silver is a soft bottleneck for solar’s ascent and not a hard bottleneck (distinction here). Improved contact printing technologies may also be pulled into the money (page 13).