Energy trading: value in volatility?

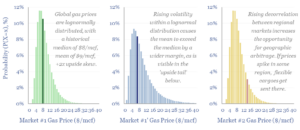

Could renewables increase hydrocarbon realizations? Or possibly even double the value in flexible LNG portfolios? Our reasoning includes rising regional arbitrages, and growing volatility amidst lognormal price distributions (i.e., prices deviate more to the upside than the downside). This 14-page note explores the upside for energy trading in the energy transition. What implications and who benefits?