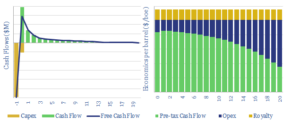

This model breaks down the economics of US shale, including a granular build-up of capex costs across 18 different categories. Our base case requires a $40/bbl oil price for a 10% IRR at a $7.0M shale well with a 1.0 kboed IP30. Economics range from $35-50/bbl. They are most sensitive to productivity.

$699.00