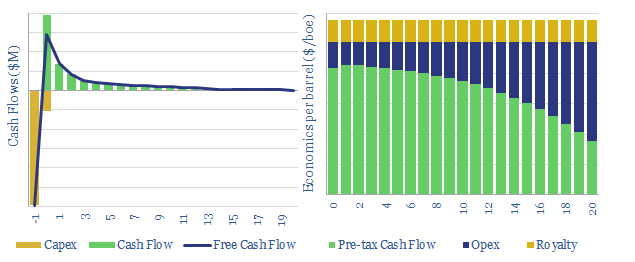

This data-model breaks down the economics of US shale, in order to calculate NPVs, IRRs and oil price break-evens of future drilling in major US basins (predominantly the Permian, but also Bakken and Eagle Ford).

Our base case conclusion is that a $40/bbl oil price is required for a 10% IRR on a $7.0M shale well with 1.0 kboed of IP30 production. Break-evens mostly vary within a range of $35-50/bbl. They are most sensitive to productivity, which can genuinely unlock triple-digit IRRs, even at $40/bbl.

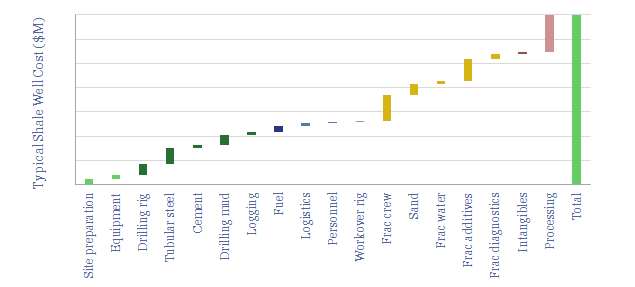

Underlying the analysis is a granular model of capex costs, broken down across 18 components (chart below). Shale economics are calculated off of input variables such as rig rates, frac crew costs, diesel prices, sand prices, tubular steel prices, cement prices and other more niche services.

Stress-testing the model. You can flex input assumptions in the ‘NPV’ and ‘CostBuildUp’ tabs of the model, in order to assess economic consequences. For a similar model of shale gas, please see our model here.