The average major economy produces 70% of its own energy and imports the other 30%. This 12-page note explores energy self-sufficiency by country. We draw three key conclusions: into US isolationism; Europe’s survival; and the pace of EV adoption, both in China and in LNG-importing nations.

Global energy: supply-demand model?

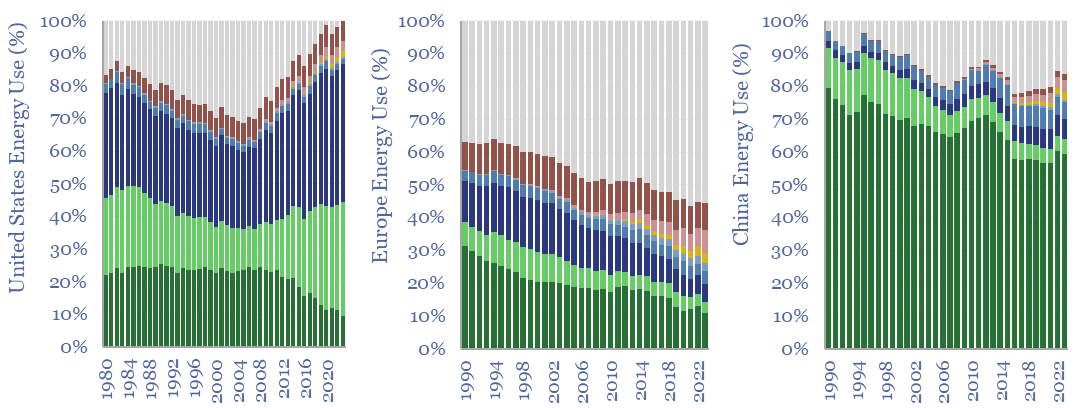

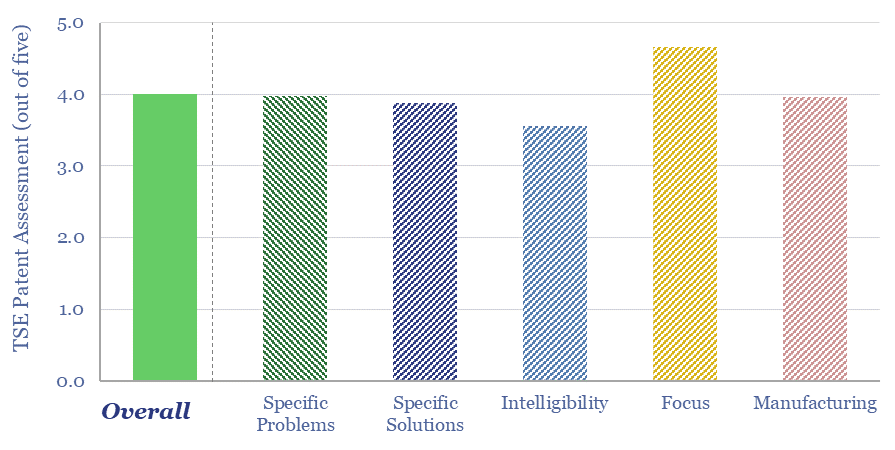

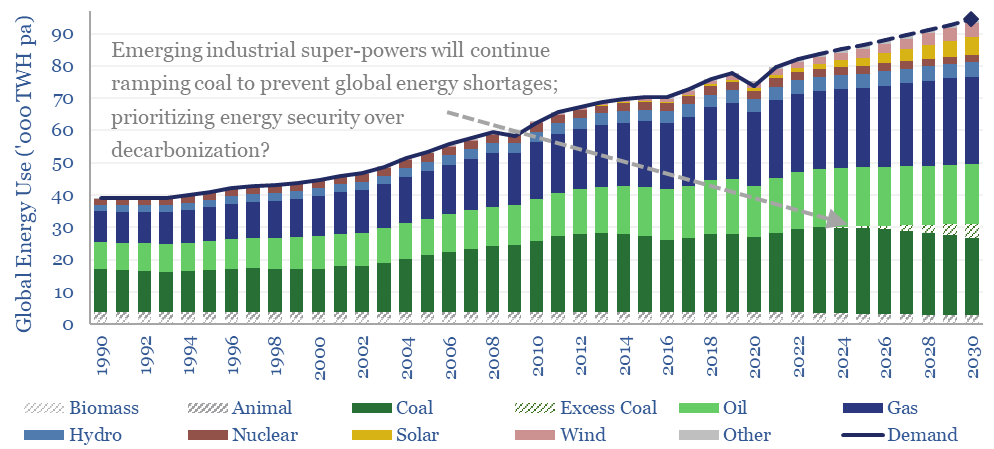

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. We fear chronic under-supply if the world decarbonizes, rising to 5% shortages in 2030. Another scenario is that emerging world countries bridge the gap by ramping coal. Numbers can be stress-tested in the model.

Useful global energy demand grew at a CAGR of +2.5% per year since 1990, and +3.0% per year since 2000. Demand would ‘want’ to grow by +2% per year through 2030, due to rising populations and rising living standards (model here). We have pencilled in +1.75% pa growth to this model to be conservative.

Combustion energy is seen flat-lining in our net zero scenario. This includes global coal use peaking at 8.4GTpa in 2024 then gently easing to 2010 levels by 2030 (model here). It includes oil demand, rising to 102Mbpd in 2024 (data here), then plateauing (model here) as OPEC and US shale (model here) offset the decline rate impacts of conventional under-investment. It includes risked LNG supplies rising +70% from 400MTpa in 2022 to almost 700MTpa by 2030 (model here). While our roadmap to net zero would need to see global gas growing at +2.5% per year through 2050 (model here), this data-file has pencilled in flat production in 2022->30, as we think that latter scenario currently looks more likely to transpire.

Renewable energy is exploding. Our model of wind and solar capacity additions is linked here and discussed here. In our roadmap to net zero, solar more than doubles from c220GW of new adds in 2022 to 500GW by 2030, while wind rises from c100GW of new adds in 2022 to 150GW by 2030.

Other variables in the model include rising energy efficiency (note here), the need for a nuclear renaissance (note here) and other variables that can be flexed.

What is wrong with this balance is that it does not balance. The assumptions pencilled into the model see an under-supply of global energy of about 3% in 2025, rising to 5% in 2030. I.e., by 2030, the world will be “half a Europe” short of energy. The first law of thermodynamics dictates that energy demand cannot exceed supplies. So what would it take to restore the balance? Well, pick your poison…

(1) Slower demand growth could re-balance the model. Very high energy prices might mute demand growth to only +1.25% per year, although this would be the slowest pace of demand growth since the Great Depression, lower even than during the oil shocks (useful data here). Unfortunately, our view is that pricing people out of the global energy system in this way is in itself an ESG catastrophe.

(2) Ramping renewables faster could re-balance the model, although it would require an average of 1 TW pa of wind and solar capacity additions each year in 2024-30, and over 2 TW pa of wind and solar additions by 2030 itself, which is 3x higher than in our roadmap to net zero (discussion here). For perspective, this +2TWpa solution requires primary energy investment to quadruple from $1trn pa to at least $4trn pa, which all needs to be financed in a world of rising rates. It means that global wind and solar projects will consume over 200MTpa of steel, which is 2x total US steel production, and yet steel would not even qualify as a ‘top ten’ bottleneck, in our wind bill of materials or solar bill of materials. This scenario also requires a 3x faster expansion of power grids and power electronics than our base case estimates (see the links). Is any of this remotely possible?

(3) Continue ramping coal? The main source of global energy demand growth is the emerging world. The emerging world is more likely to favor cheap, dirty coal. Or worse, deforestation for firewood. Thus another way to ameliorate under-supply in our global energy supply-demand balance is if global coal continues growing, reaching a new peak of 9GTpa in 2030. Unfortunately, this scenario also sees global CO2 hitting a new peak of 54GTpa in 2030.

(4) Pragmatic gas? Another means of re-balancing the global energy system is if global gas production rises at 2.5% per year, which is the number required, and that is possible, on the TSE roadmap to net zero (model here). This scenario does see global CO2 falling by 2030. The main problem here is that pragmatic natural gas investment has become stranded in no man’s land, within a Manichean duality of fantasies and crises.

(5) Some combination? The world is complex. It is unlikely that a single lever will be pulled to resolve under-supply in our global energy supply-demand balance. In 2023, we think economic weakness will mask energy under-supply, mute energy prices, and lure many decision makers into looking at spot pricing and thinking “everything is fine”. Please download the model to stress-test the numbers, and different re-balancing solutions…

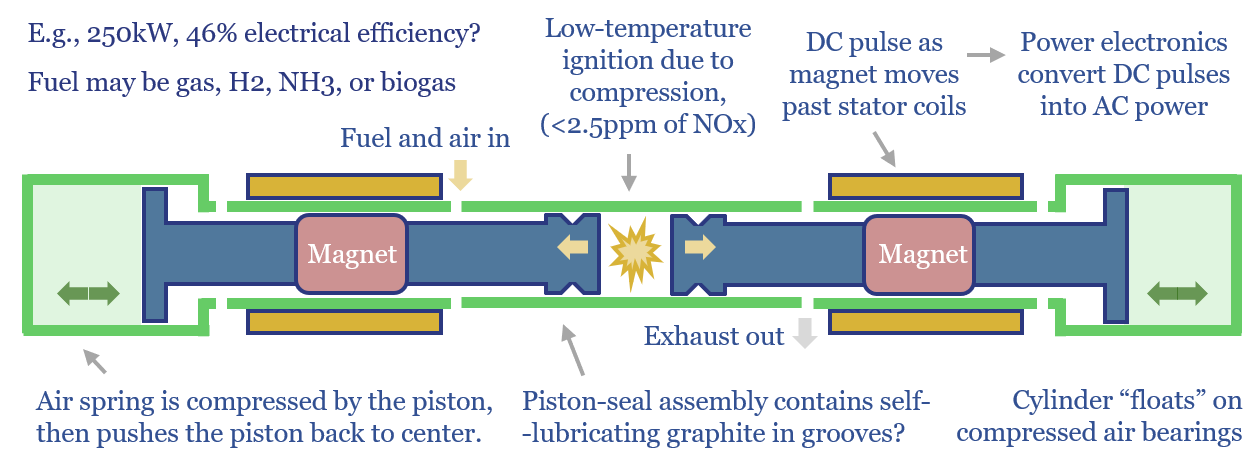

Mainspring Energy: linear generator breakthrough?

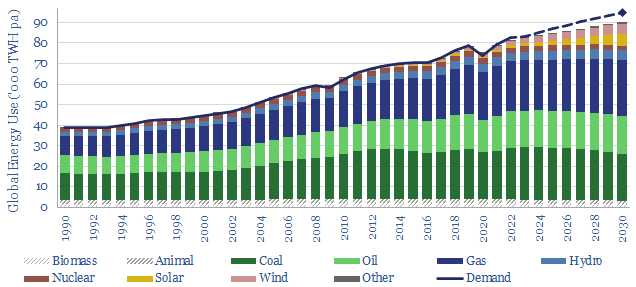

Linear generator technology can convert any gaseous fuel into electricity, with c45% electrical efficiency, and >80% efficiency in CHP mode. This data-file reviews Mainspring Energy’s patents. We conclude that the company has locked up the IP for piston-seal assemblies in a linear generator with air bearings, but longevity/maintenance could be a key challenge to explore.

EtaGen was founded in 2010 by three Stanford engineers, and rebranded as Mainspring Energy in 2020. Its headquarters are in Menlo Park, California; and the company has c400 employees, having closed a $290M Series E financing in 2022.

Mainspring is commercializing a linear generator, which is low-cost, reliable, flexible and can use any clean fuel (e.g., natural gas, biogas, hydrogen, ammonia), in sizes from 230kW to multiple-MW, >45% electrical efficiency and >80% total thermal efficiency in CHP mode.

In a linear generator, the compression of fuel and air causes a uniform and flameless combustion reaction to occur, releasing the energy from the fuel, but creating no NOx emissions. The energy from combustion pushes a piston through a cylinder (or in Mainspring’s case, two pistons, through two cylinders). Stator magnets in each piston move past coils in each cylinder, inducing a current. An air spring on the other side of the cylinder is thereby compressed, and re-expands to drive the piston back to its starting point.

The main advantages are the simplicity, which could in principle translate into lower capex, compared to the blades and precision-engineered compression and turbine stages within a gas turbine.

Higher efficiency can also be unlocked by harnessing the expansion of combustion gases directly, rather than having to convert it into rotary motion, per the loss attributions for conventional thermal generation. On the other hand, maximum efficiency will always be lower for low-temperature combustion, due to the laws of thermodynamics.

From reviewing Mainspring’s patents, we think there are three main challenges for commercializing linear generators. The main challenge is linked to longevity and maintenance.

Mainspring’s patents focus upon piston-seal assemblies, and seem to have locked up the IP for its linear generator designs. This may also be relevant to other companies aiming to commercialize linear generators, such as Hyliion in the vehicle sector.

Energy intensity of AI: chomping at the bit?

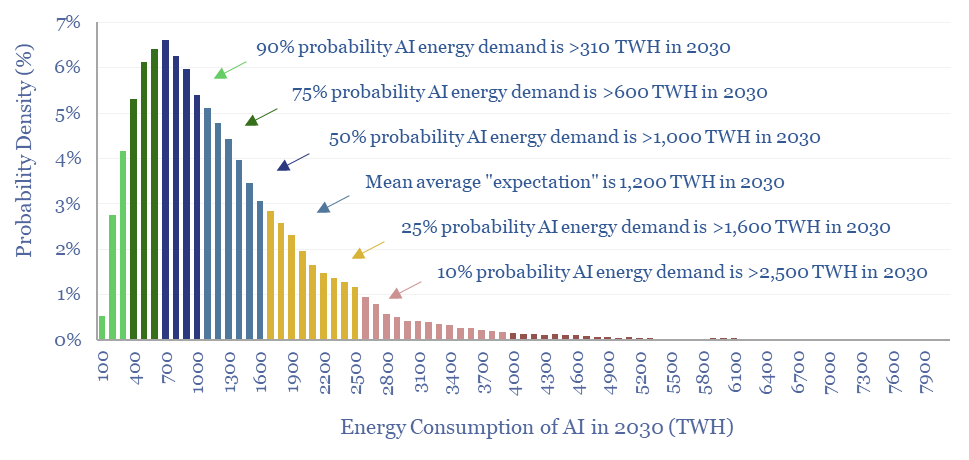

Rising energy demands of AI are now the biggest uncertainty in all of global energy. To understand why, this 17-page note is an overview of AI computing from first principles, across transistors, DRAM, GPUs and deep learning. GPU efficiency will inevitably increase, but compute increases faster. AI most likely uses 300-2,500 TWH in 2030, with a base case of 1,000 TWH.

Industrial cooling: chillers and evaporators?

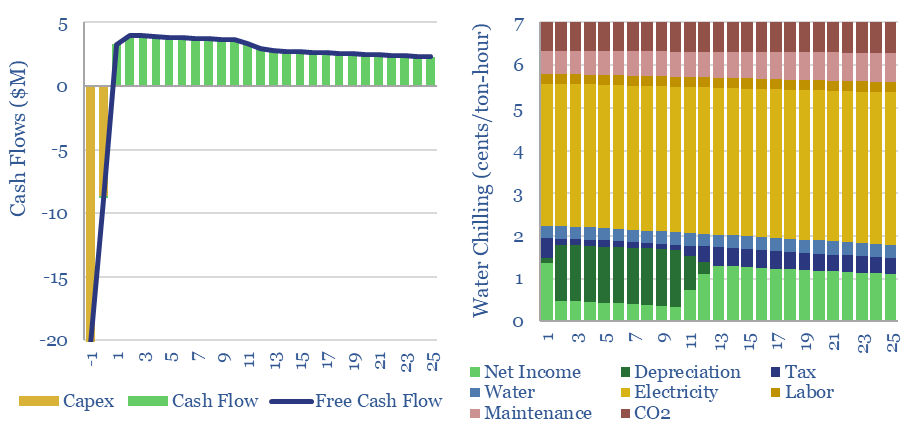

This data-file captures the costs of industrial cooling, especially liquid cooling using commercial HVAC equipment, across heat-exchangers, cooling tower evaporators and chillers. Our base case is that removing 100MW-th of heat has capex costs of $1,000/ton, equivalent to c$300/kW-th, expending 0.12 kWh-e of electricity per kWh-th, with a total cost of 7 c/ton-hour.

Across the US cooling market, the most common metric for measuring cooling capacity is in ‘tons’. This is shorthand for the coolness provided by 1 US ton of ice melting over the course of a day, equating to 3.52kW-th of heat removal. Providing 3.52 kW-th of cooling for one hour can thus also be called 1 ton-hour.

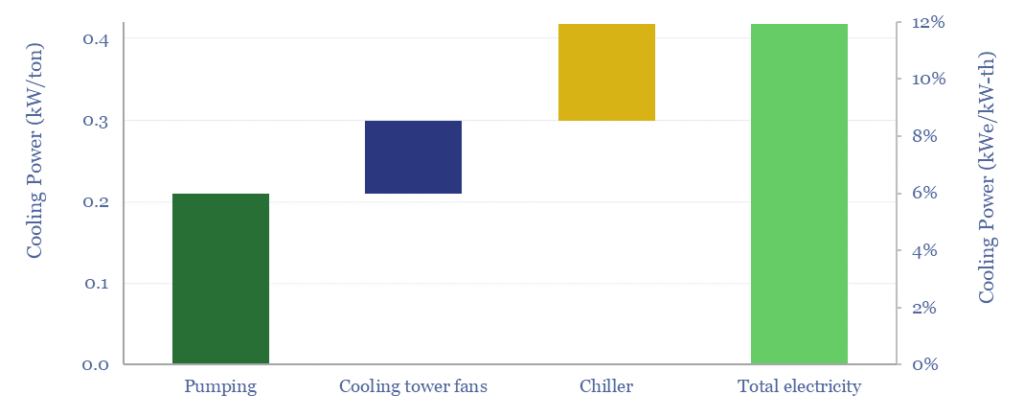

Cooling can be delivered via three mechanisms: simple heat exchange with ambient air or water (depends on ambient temperatures), evaporating some of the water in an evaporating tower (depends on water availability) and chilling a working fluid using a refrigeration cycle. In practice, all three may be used in combination (as exemplified in the chart below).

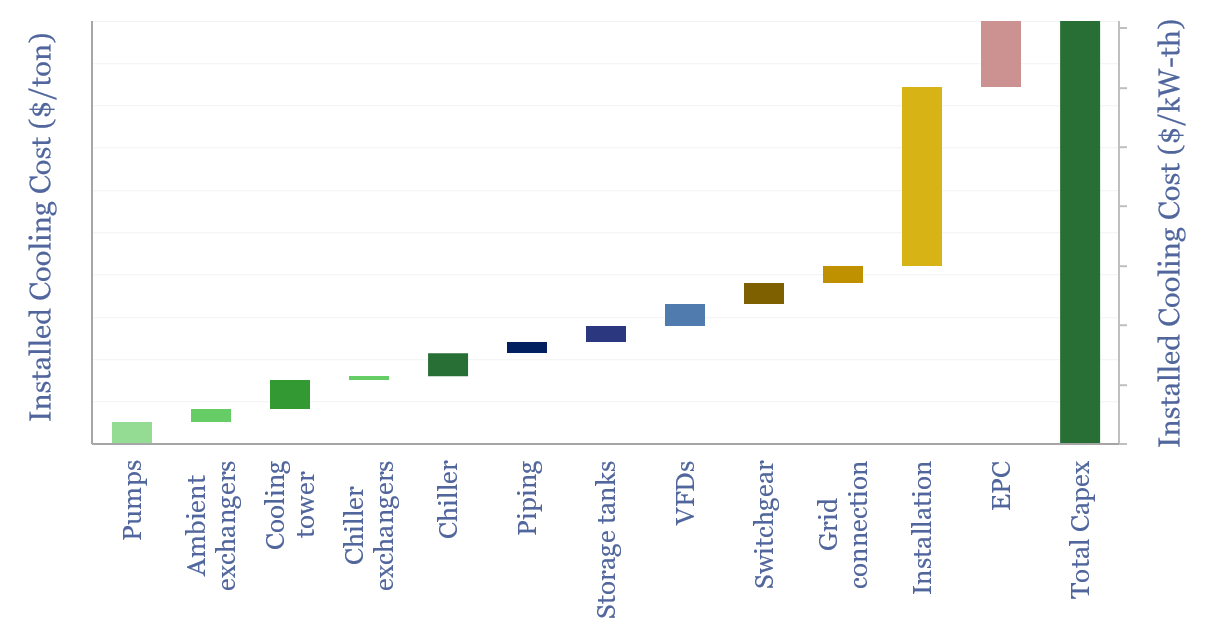

Capex costs of industrial cooling depend on the precise combination of equipment that is used, but a good ballpark is $1,000/ton, equivalent to $300/kW-th, based on our models of compressors, heat-exchangers, pumps, fans and blowers, storage tanks, piping, VFDs, switchgear, grid connections, engineering and construction.

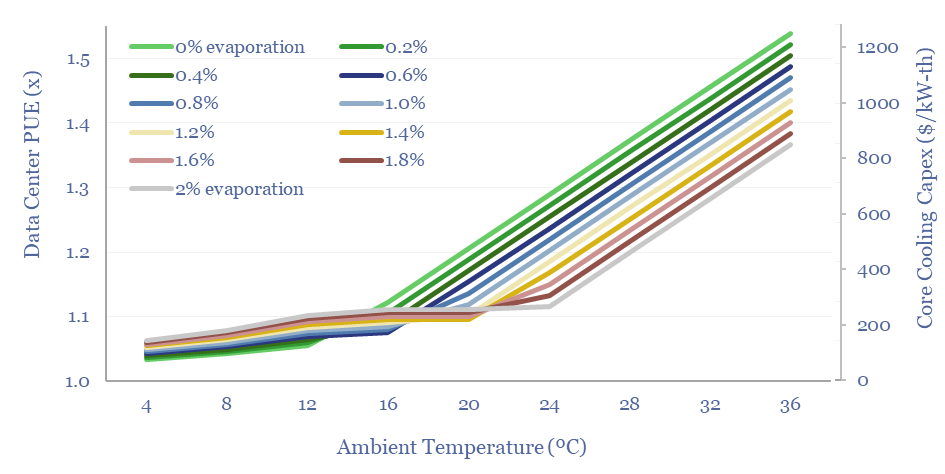

Removing each kWh-th of heat requires 0.12 kWh-e of electricity, in our base case, but the numbers vary as a function of water evaporation rates and ambient temperatures, running anywhere from 0.03 to 0.5 kWh-e per kWh-th. Cooling in water-scarce and hot climates is c60% more costly than in water-abundant and cool climates.

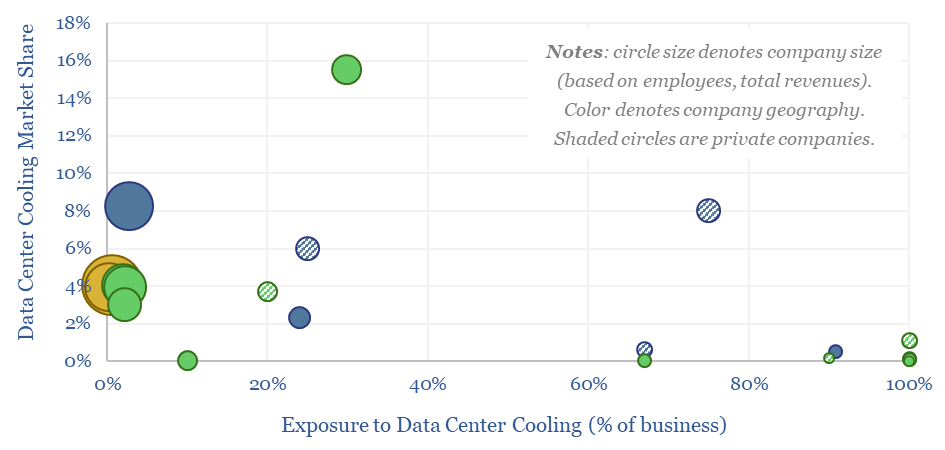

Base case numbers in our commercial cooling model are primarily geared to data-centers, where 10-20% of total installed costs will be on cooling, in order to keep chips below a thermal limit of 27ºC or cooler. Water intensity of AI computing can thus be estimated in the range of 1,000-3,000 liters per MWH, meaning that each ChatGPT query consumes as much as 10-30ml of water. Or alternatively, PUEs can be increased by c5-10% to avoid any water use in evaporators. Hence the data-file also screens 20 companies, with 65% of the market in data-center cooling.

All of our numbers into the costs of industrial cooling can be stress-tested in the data-file. Backup tabs of the model contain details of companies and our notes from technical papers.

Energy and AI: the power and the glory?

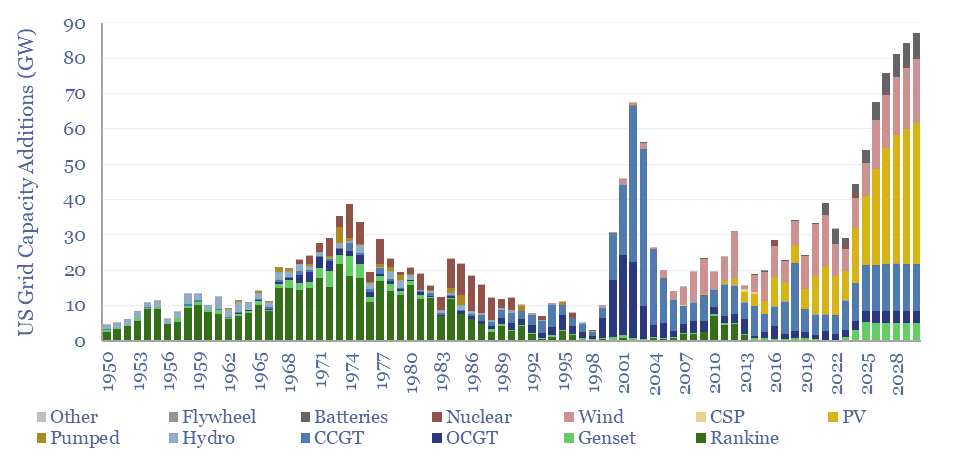

The power demands of AI will contribute to the largest growth of new generation capacity in history. This 18-page note evaluates the power implications of AI data-centers. Reliability is crucial. Gas demand grows. Annual sales of CCGTs and back-up gensets in the US both rise by 2.5x?

Data-centers: the economics?

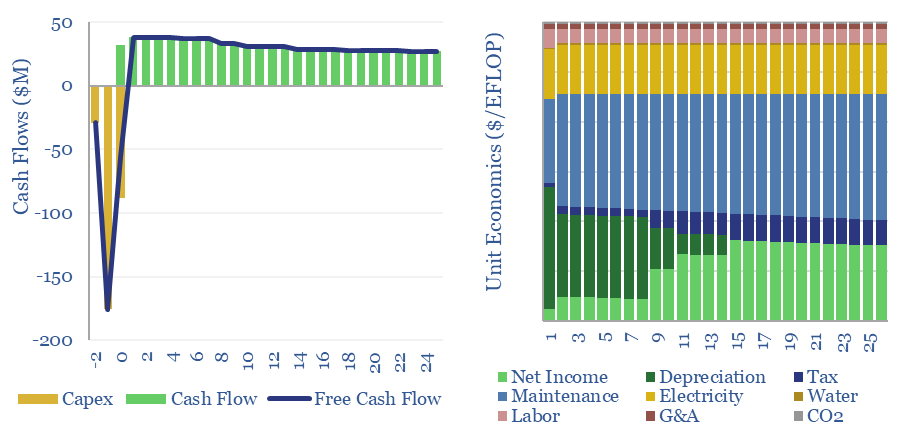

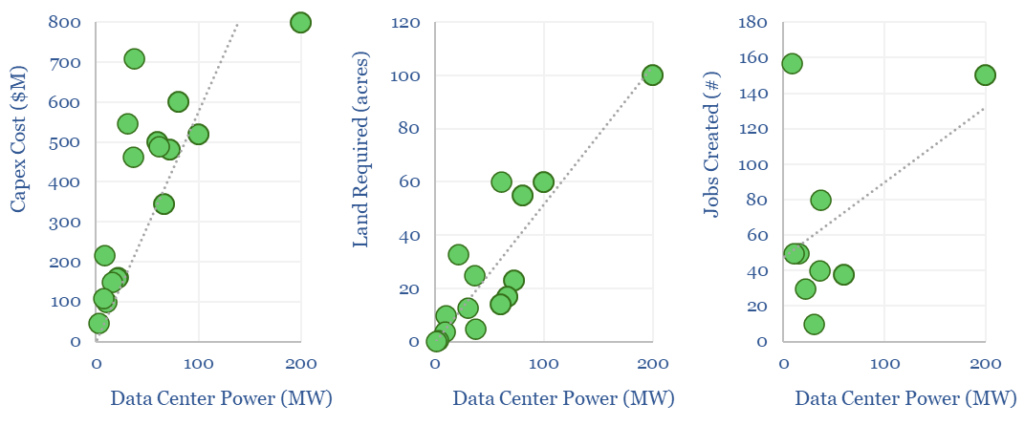

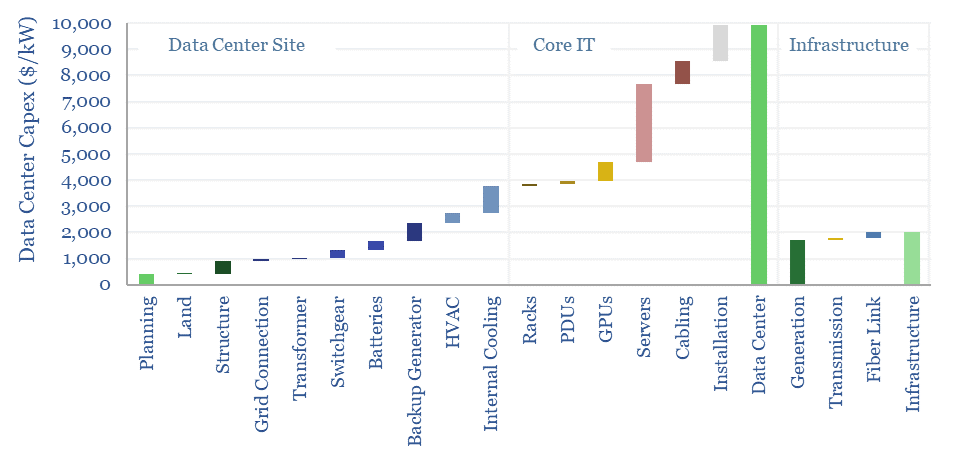

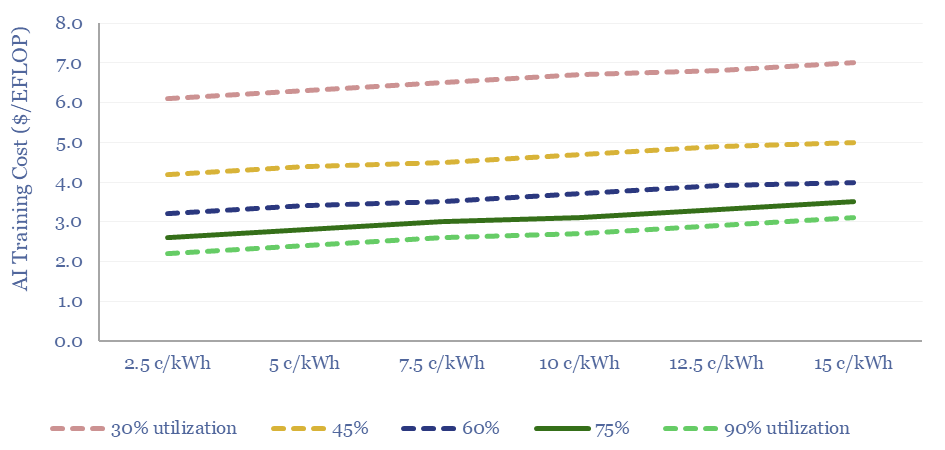

The capex costs of data-centers are typically $10M/MW, with opex costs dominated by maintenance (c40%), electricity (c15-25%), labor, water, G&A and other. A 30MW data-center must generate $100M of revenues for a 10% IRR, while an AI data-center in 2024 may need to charge $3M/EFLOP of compute.

Data-centers underpin the rise of the internet and the rise of AI, hence this model captures the costs of data-centers, from first principles, across capex, opex, land use and other input variables (see below).

In 2023, the global data-center industry is $250bn, across 500 large facilities, 20,000 total facilities, and around 40 GW of capacity, which likely rises by 2-5x by 2030.

A 30MW mid-scale data-center, costing $10M/MW of capex, must generate $100M pa of revenues, in order to earn a 10% IRR, after deducting electricity costs and maintenance.

The capex breakdown for a typical non-AI data center is built up in the data-file, drawing on cost data for various IT components, cooling, chillers, transformers, switchgear, battery UPS, backup generators, plus broader infrastructure such as generation, transmission and fiber links.

If the data-center is computation heavy, e.g., for AI applications, this might equate to a cost of around $3/EFLOP of compute in 2023. This fits with disclosures from OpenAI, stating that training GPT 4 had a total compute of 60M EFLOPs and a training cost of around $160M.

However, new generations of chips from NVIDIA will increase the proportionate hardware costs and may lower the proportionate energy costs (see ComputePerformance tab). An AI-enabled data-center can easily cost 2x more than a conventional one, surpassing $20M/MW.

Reliability is also crucial to the economics of data-centers: uptime and utilization have a 5x higher impact on overall economics than electricity prices. This makes it less likely that AI data-centers will be demand-flexed to power them using the raw output from renewable electricity sources, such as wind and solar?

Economic considerations may tip the market towards sourcing the most reliable power possible, especially amidst grid bottlenecks, and it also explains the routine use of backup power generation.

Another major theme is the growing power density per rack, rising from 4-10kW to >100kW, and requiring closed-loop liquid cooling.

Please download the data-file to stress-test the costs of a data-center, performance of an AI data-center, and we will also continue adding to this model over time. Notes from recent technical papers are in the final tab.

Generac: power generation products?

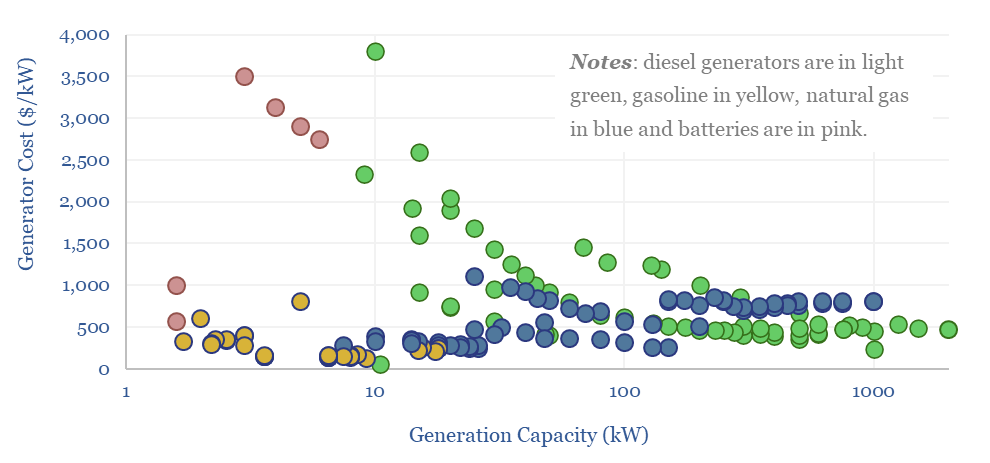

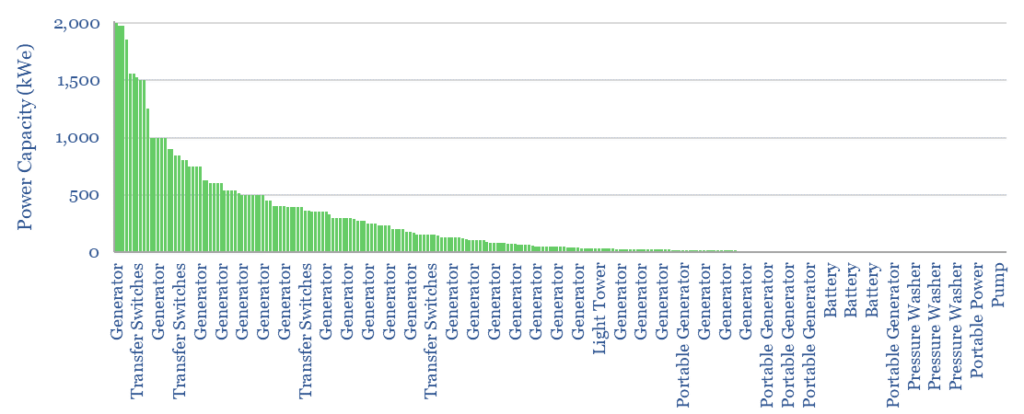

Generac is a US-specialist in residential- and commercial-scale power generation solutions, founded in 1959, headquartered in Wisconsin, with 8,800 employees and $7bn of market cap. What outlook amidst power grid bottlenecks? To answer this question, we have tabulated data on 250 Generac products.

Generac‘s $4bn pa of sales, in 2023, were >50% residential, >35% commercial, 10% other. 80% was domestic within the US, and 20% was international. 12% is attributed to ‘energy technologies’ which includes storage, solar MLPE, EV charging, smart thermostats, electrification, etc. But what about the product mix? How is it exposed to power grid bottlenecks? Or indeed a broader US construction boom?

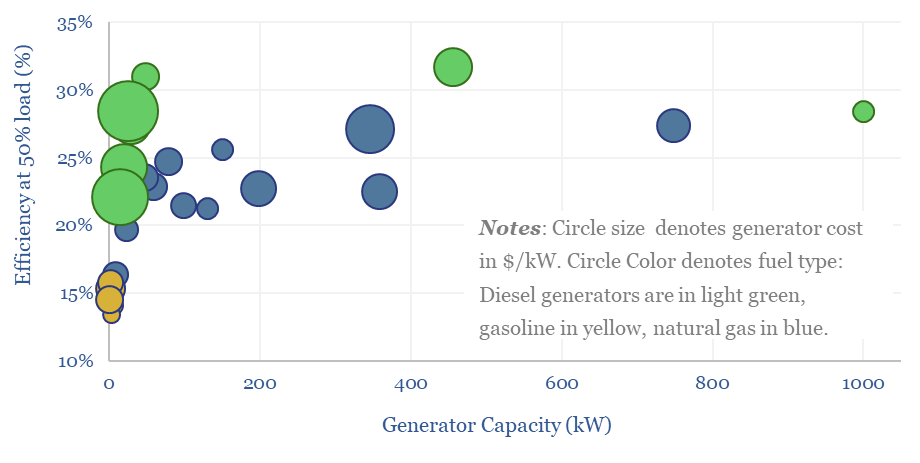

In this data-file, we have tabulated details on 250 Generac Products. 70% are generators, and another c10% are transfer switches to connect generators to loads. Our data show the breakdown of units by size, fuel, prices and other technical parameters.

Residential solutions comprise 55% of Generac’s revenues, as 6% of US homes now have standby generators, but a smaller share of the SKUs. Our data show the average size (in kW), list prices (in $) and costs (in $/kW), but we also think low efficiency in some of these residential generation units is not entirely helpful for decarbonization aspirations.

Generac’s larger industrial generators range from 100kW to 2MW in size. Generac’s diesel-fired units cost $500/kW and are c30% efficient, while its larger gas-fired units cost $700/kW and are c25% efficient. These units tend to generate 10-40 kW/m3 of space, and discharge exhaust at 700-800ºC, so they could find application amidst grid bottlenecks?

In our base case model for a diesel genset, we assume a 16-20c/kWh LCOE is needed for a $700/kW installation of a 10MW unit with 42% efficiency buying wholesale diesel. Generac units would appear to have higher costs for reasons in the data-file.

In our base case model for a CCGT, we need a 6.5c/kWh LCOE at an $850/kW installation of a 300MW unit with 55% efficiency buying $4/mcf wholesale natural gas. Again, for the Generac units, we get to a higher LCOE, yes this is the area we think could be most economically justified by growing power grid bottlenecks, especially at industrial facilities that can harness the 700-800ºC waste heat.

Outside of the generation business, remaining SKUs comprise transfer switches to connect generators to loads, pressure washers, light towers for construction, pumps, batteries and mobile heaters, hence there may be heavy exposure to construction and infrastructure projects.

Internet energy consumption: data, models, forecasts?

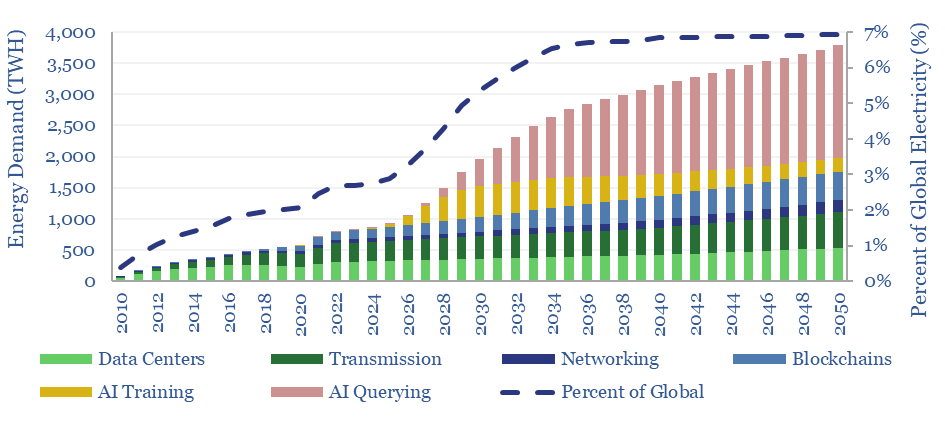

This data-file forecasts the energy consumption of the internet, rising from 800 TWH in 2022 to 2,000 TWH in 2030 and 3,750 TWH by 2050. The main driver is the energy consumption of AI, plus blockchains, rising traffic, and offset by rising efficiency. Input assumptions to the model can be flexed. Underlying data are from technical papers.

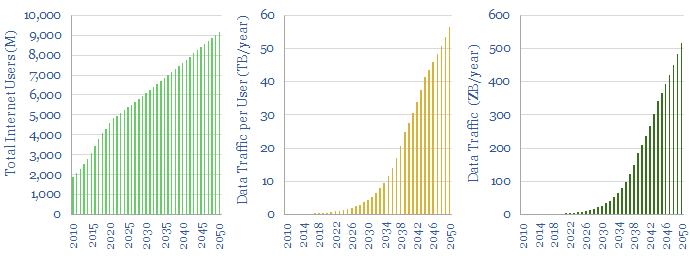

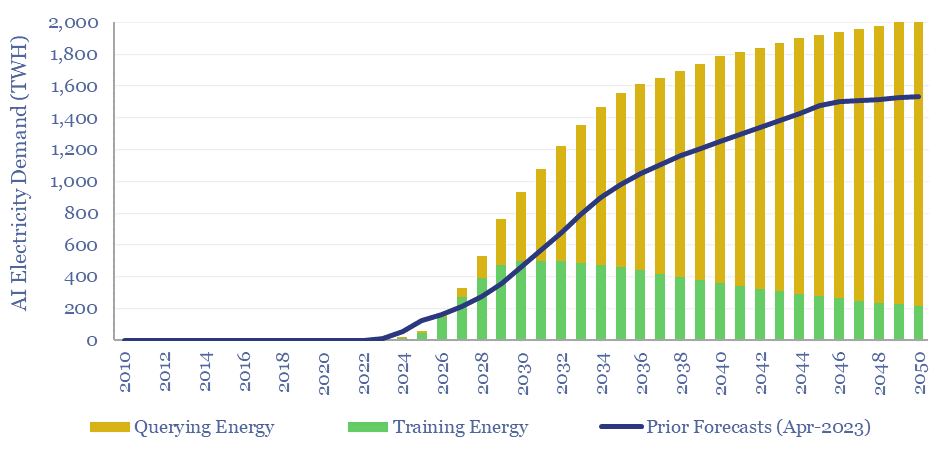

Our best estimate is that the internet accounted for 800 TWH of global electricity in 2022, which is 2.5% of all global electricity. Despite this area being a kind of analytical minefield, we have attempted to construct a simple model for the future energy demands of the internet, which decision-makers can flex, based on data and assumptions (chart below).

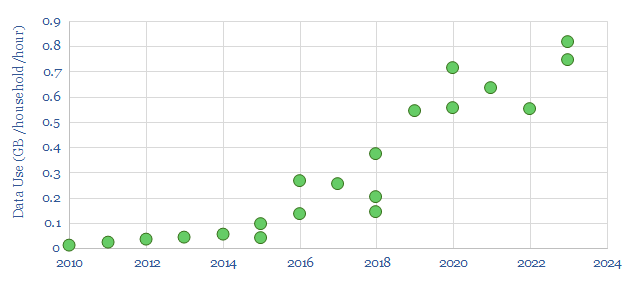

Internet traffic has been rising at a CAGR of 30%, as shown by the data use of developed world households, rising to almost 3 TB per user per year by 2023. The scatter also shows a common theme in this data-file, which is that different estimates from different sources can vary widely.

Future internet traffic is likely to continue rising. By 2022 there were 5bn global internet users underpinning 4.7 Zettabytes (ZB) of internet traffic. Users will grow. Traffic per user will likely grow. We have pencilled in some estimates, but uncertainty is high.

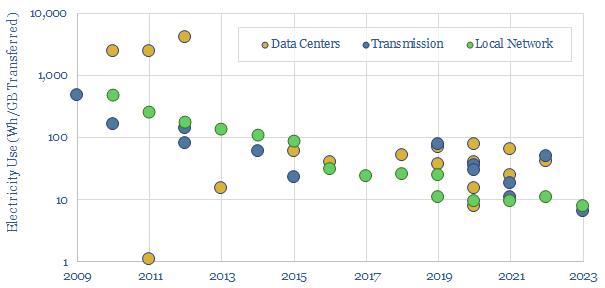

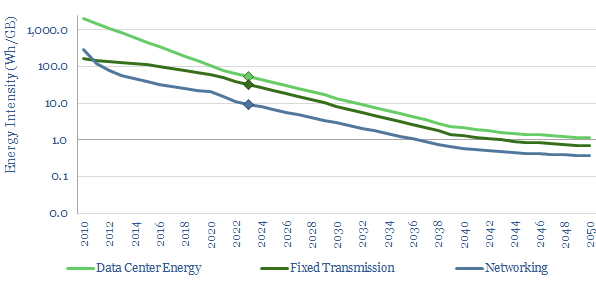

The energy intensity of internet traffic spans across data-centers, transmission networks and local networking equipment. Again, different estimates from different technical papers can vary by an order of magnitude. But a first general rule is that the numbers have declined sharply, sometimes halving every 2-3 years.

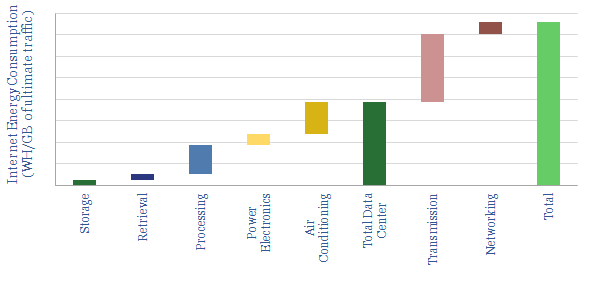

The current energy intensity of the internet is thus estimated at 140 Wh/GB in our base case, broken down in the waterfall chart below, using our findings from technical papers and the spec sheets of underlying products (e.g., offered by companies such as Dell).

Energy intensity of internet processes will almost certainly decline in the future, as traffic volumes rise. Again, we have pencilled in some estimates to our models, which can be flexed.

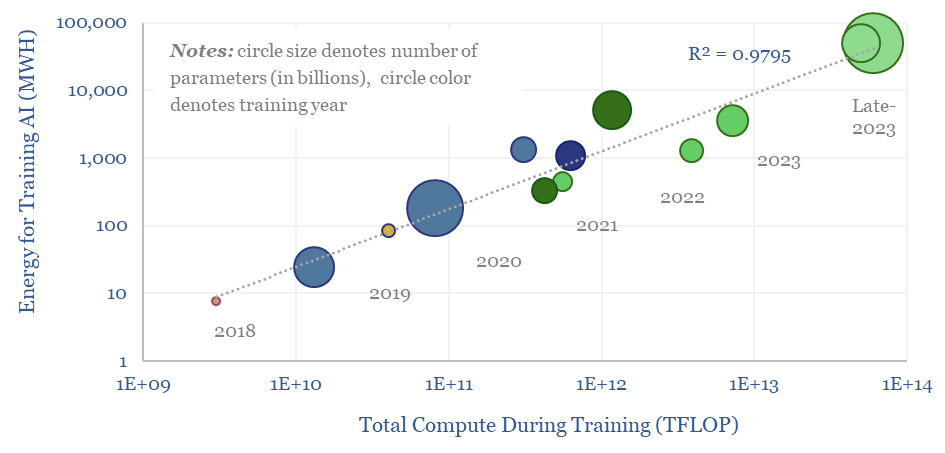

However the energy needed for AI is now rising exponentially. Training Chat GPT-3 in 2020 used 1.3 GWH to absorb 175bn parameters. But training chat GPT-4 in 2023 used 50 GWH to absorb 1.8trn parameters. We find a 98% correlation between AI training energy and the total compute during training.

AI querying energy is also correlated with the complexity of the AI model, and thus will likely continue rising in the future. Average energy use is estimated at 3.6 Wh per query today, which is 4x more than an email (1 Wh) and 10x more than a google search (0.3 Wh).

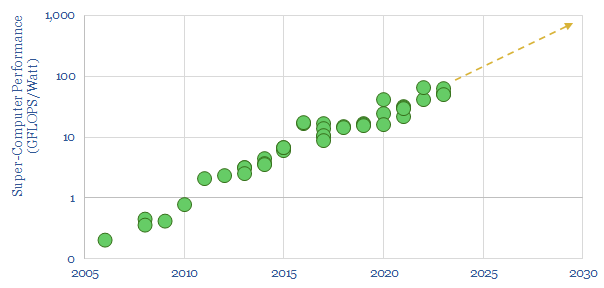

Muting the impacts of larger data-processing volumes, we expect a 40x increase in future computer performance in GFLOPS per Watt (chart below). This yields 900 TWH of AI demand around 2030, revised up from 500 TWH in April-2023 (chart above).

Please download the model to stress-test your own estimates for the energy intensity of the internet. It is not impossible for total electricity demand to ‘go sideways’ (i.e., it does not increase). It is also possible for the electricity demand of the internet to exceed our estimates by a factor of 2-3x if the pace of productivity improvements slows down.

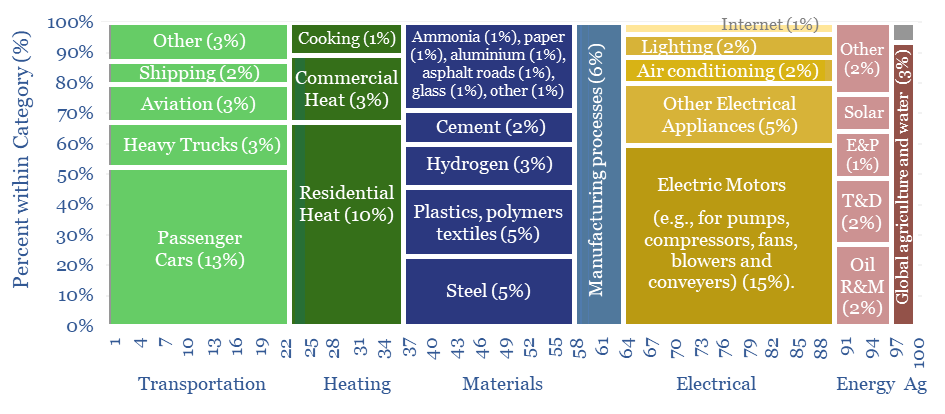

Global energy demand: nervous breakdown?

We have attempted a detailed breakdown of global energy demand across 50 categories, to identify emerging opportunities in the energy transition, and suggesting upside to energy demand forecasts? This 12-page note sets out our conclusions and is intended as a useful reference.