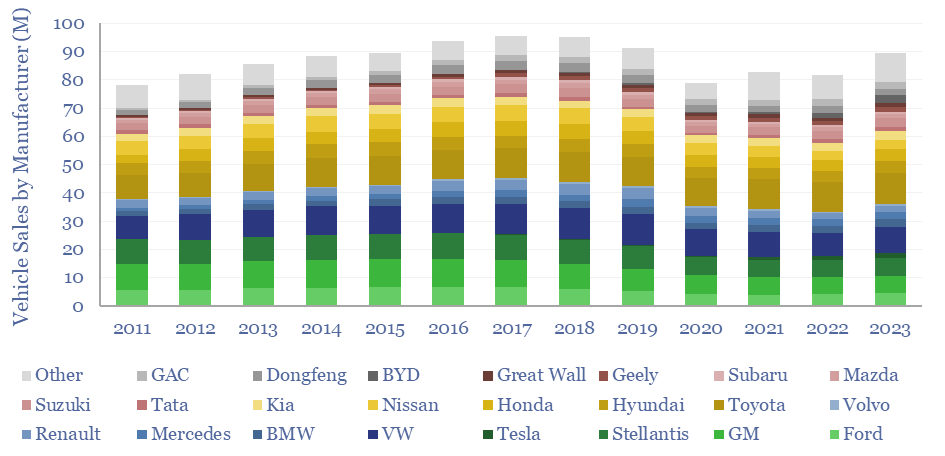

Vehicles transport people and freight around the world, explaining 70% of global oil demand, 30% of global energy use, 20% of global CO2e emissions. This overview summarizes all of our research into vehicles, and key conclusions for the energy transition.

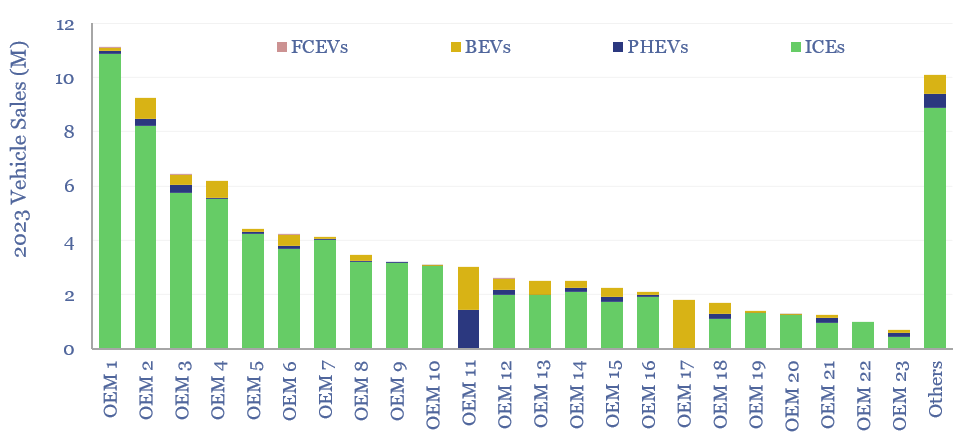

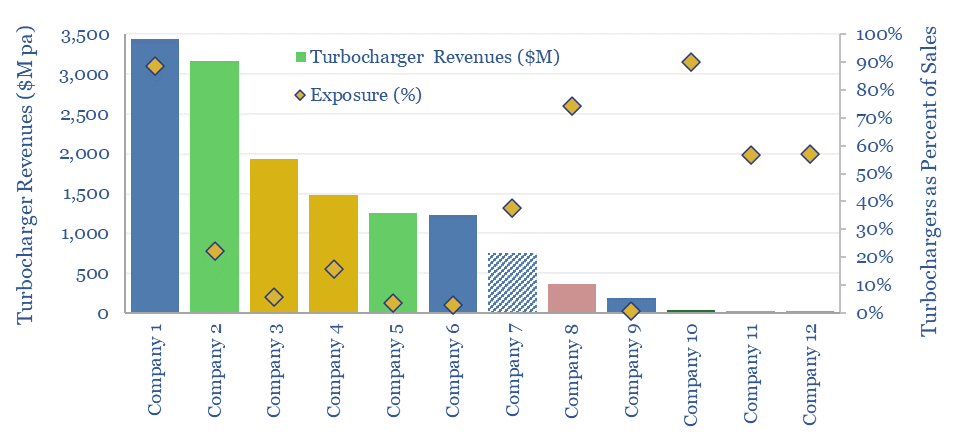

Electrification is a revolution for small vehicles, a mega-trend of the 21st century. We also believe that large and long-range transportation will remain predominantly combustion-fueled due to unrivalled energy density and practicality. It is most cost-effectively decarbonized via promoting efficiency gains, lower-carbon fuels and CO2 removals.

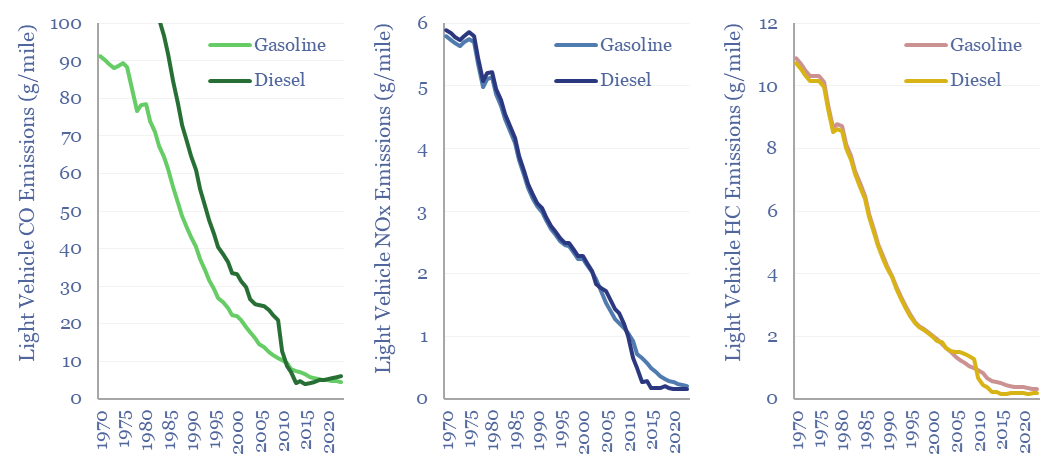

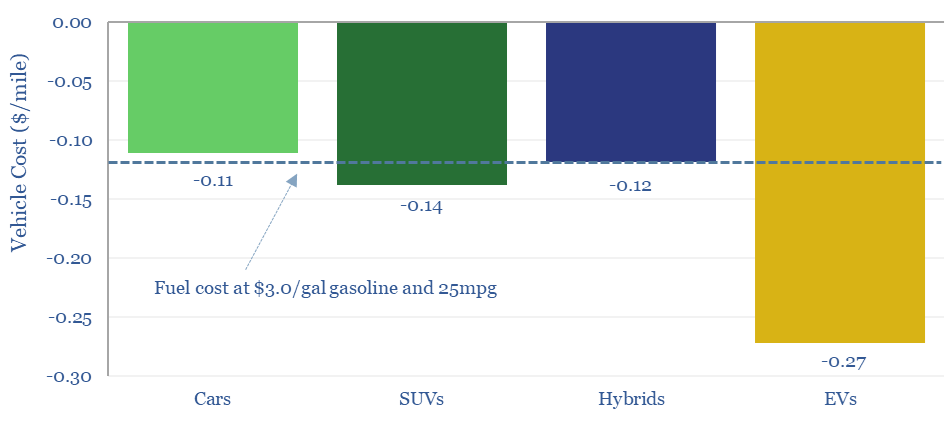

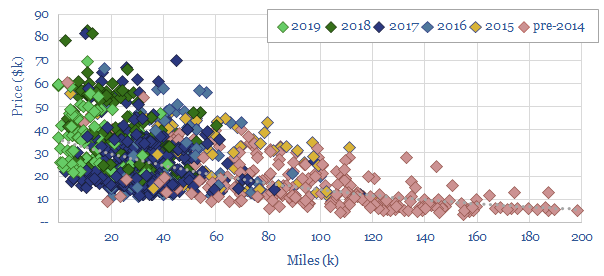

(1) Electrification is a game changer for light-vehicles, with 3-5x greater fuel economy than combustion vehicles (database here), due to inexorable thermodynamic differences between electric motors and heat engines (overview note here).

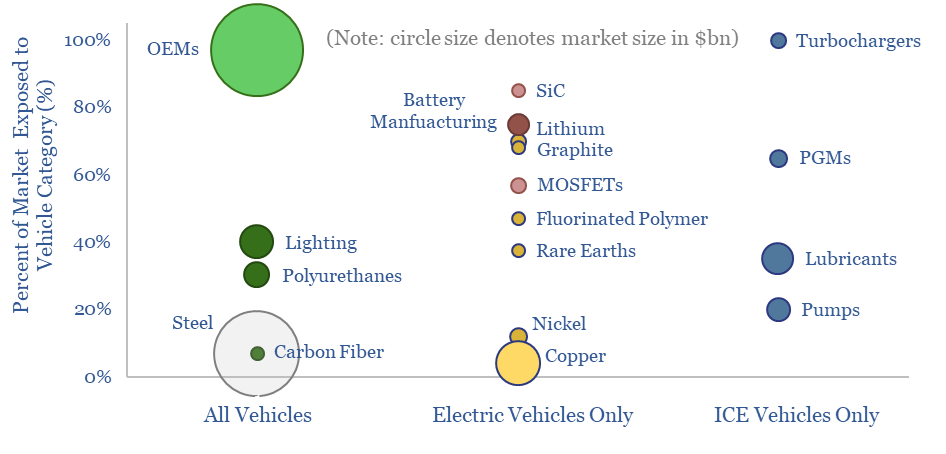

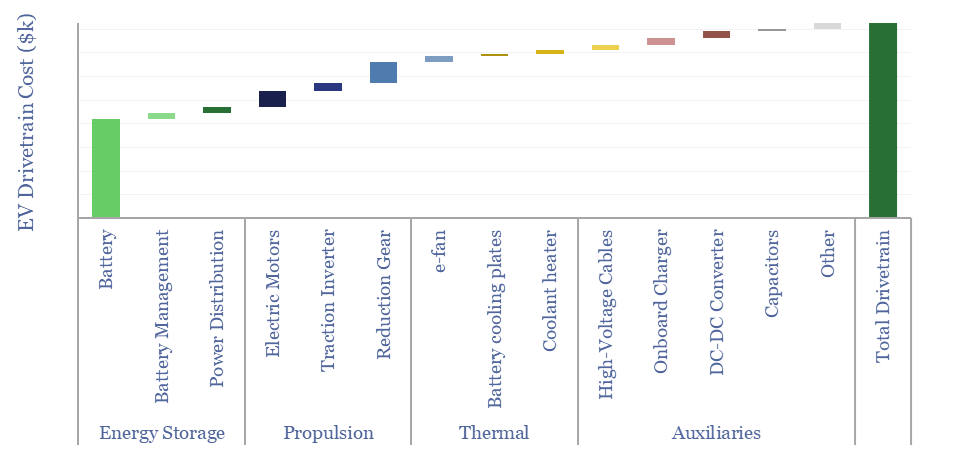

(2) Electric vehicle technology continues to improve, in an early innings, with multi-decade running room, which makes it an interesting area for decision makers to explore. We have profiled axial flux motors, which promise 2-3x higher power densities, even versus Tesla’s world-leading PMSRMs while surpassing 96% efficiencies (note here). And SiC power electronics that unlock faster and more efficient switching in the power MOSFETs underlying EV traction inverters.

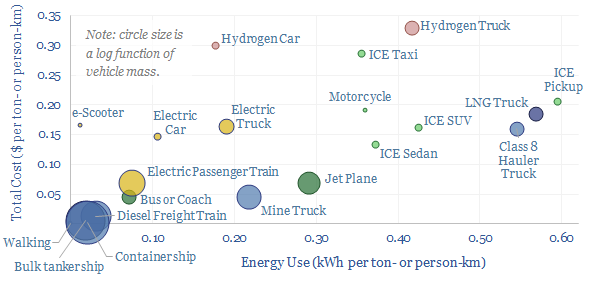

(3) New and world-changing vehicle types will also be unlocked by electric motors’ greater compactness, simplicity and controllability. e-mobility provides an example with the lowest energy costs per passenger on our chart above. Albeit futuristic, we have also written on opportunities in aerial vehicles, drones and droids, robotics, airships, military technologies, inspection technologies.

(4) EV Charging. Each 1,000 EVs will ultimately require 40 Level 2 (30-40kW) and 3.5 Level 3 (100+ kW) chargers (NREL estimates). But we wonder if EV charging infrastructures will ultimately get overbuilt (for reasons in our note here). Is there a moat in the patents of EV charging specialists, such as Chargepoint? Or Nio? As a result, we are particularly excited by the shovel-makers, the suppliers of materials and electronic components, that will feed into chargers, especially fast chargers. Granular costs of EV chargers are modelled here, and can be compared with the 17c/gallon net margins of conventional fuel retail stations here. An amazing statistic is that a conventional fuel pump dispenses 100x more fuel per minute than a 150kW fast-charger, and we wonder if fast-chargers will stoke demand for CHPs (note here).

(5) Large vehicles that cover large distances face different constraints. For example, once the battery in a heavy truck surpasses 8 tons, yielding c50% of the range of a diesel truck, then additional battery weight starts eating into cargo capacity (data here). And the range of a purely battery powered plane is currently around 90km (data here).

(5a) For trucks, an excellent data-file comparing diesel, LNG, CNG, LPG and H2 fuelling is here. There may be some niche deployments of electric trucks and hydrogen trucks. But we think the majority of long distance, inter-continental trucking will remain powered by liquid fuels, i.e., oil products. Although they may improve efficiency by hybridizing (energy saving data here), including using super-capacitors (note here).

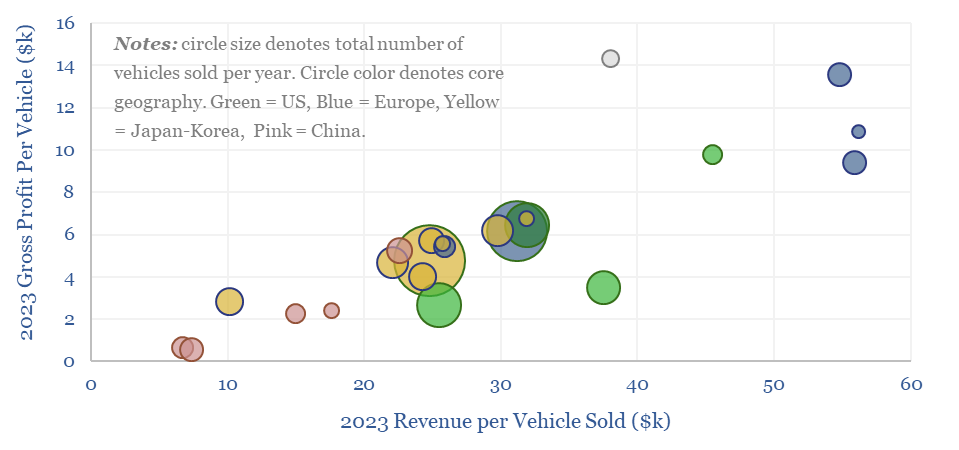

(6) Economies of scale. Larger vessels, which carry more passengers and more freight are inherently more energy efficient. This is visible in the title chart. And we have modelled the economics of container ships, bulk carriers, LNG shipping, commercial aviation, mine trucks, electric railways, pipelines and other offshore vessels.

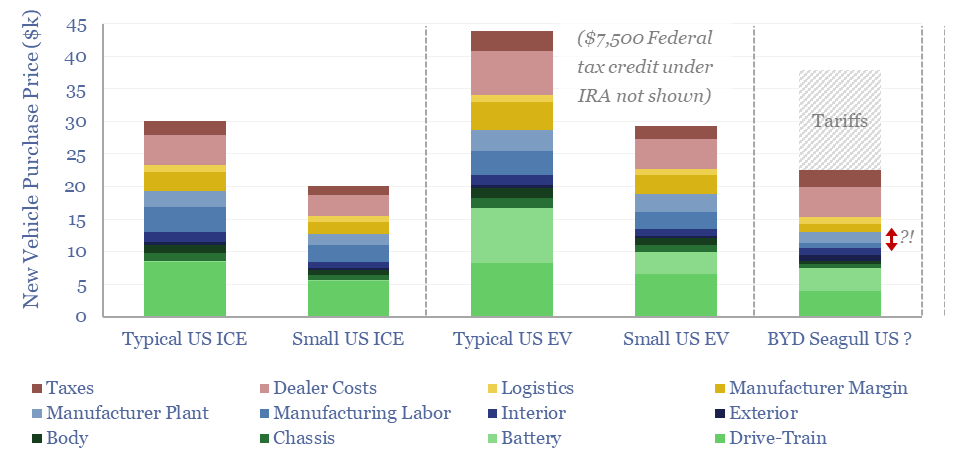

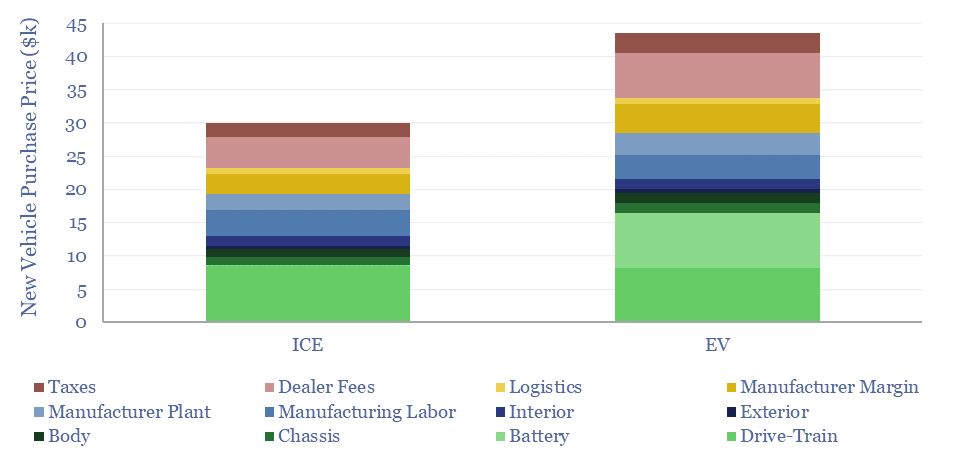

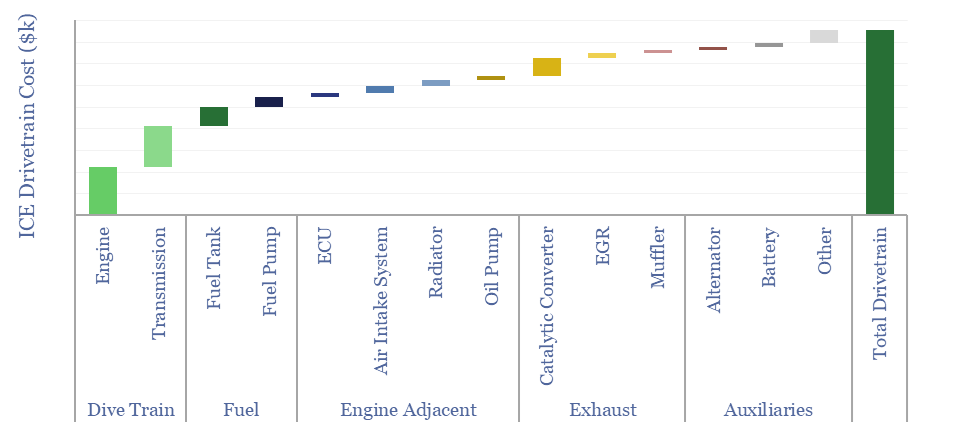

(7) Light-weighting also improves fuel economy, as energy consumption is a linear function of mass, and replacing 10% of a vehicle’s steel with carbon fiber can improve fuel economy by 16% (vehicle masses are built up here). Polymers research here. This can be compared with typical vehicle manufacturing costs.

(8) Automating vehicles can also make them 15-35% more efficient (note here), although we also wonder whether the improved convenience would also result in more demand for long-distance road travel…

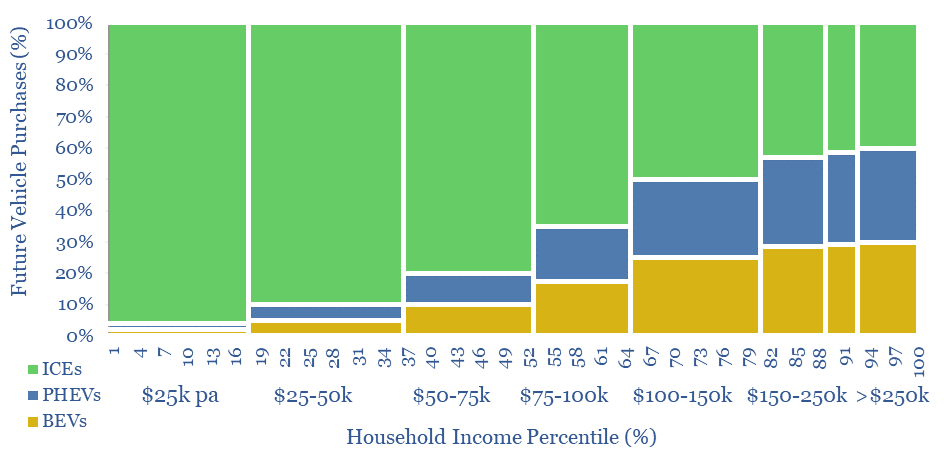

(9) Changing demand patterns? Autos are c95% of <500-mile trips today, planes are c90% of >1,000-mile trips; while long distance travel is c50% leisure and visiting friends (data here). Travel demand correlates with income across all categories (data here). Travel speeds have also improved by over 100x since pre-industrial times (excellent data here, breaking down travel by purpose, vehicle and demographics). We estimate the distribution chain for the typical US consumer costs 1.5bbls of fuel, 600kg of CO2 and $1,000 per annum, across container ships, railways, trucks, delivery vans and cars (data here). But displacing travel demand delivers the deepest reductions of all, in the energy intensity of transportation. Thus we would also consider remote work (note here), digitization (category here), traffic optimization and recycling (here) together with vehicle efficiency technologies. They are all related. But as always, there are good debates to be had about future energy demand and fears over Jevons Paradox.

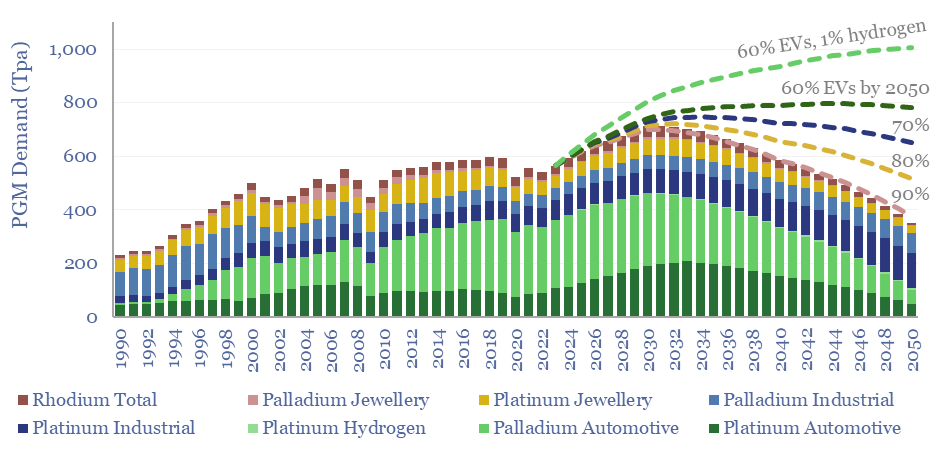

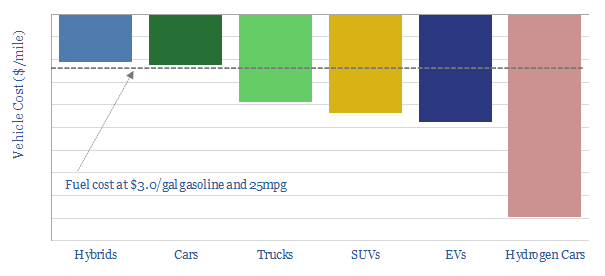

(10) Hydrogen vehicles. Despite looking for opportunities in hydrogen vehicles and e-fuels, we think there may be more exciting decarbonization opportunities elsewhere: due to higher costs, high energy penalties and challenging practicalities. This follows notes into hydrogen trucks; and data-files into Goldilocks-like fuel cells and hydrogen fuelling stations. A summary of all of our hydrogen research is linked here.

The data-file linked below summarizes all of our research to-date into vehicles, which follows below in chronological order. Note that we have generally shown energy use on a wagon-to-wheel basis and assume 2.0 passengers per passenger vehicle. You can stress test all of the different inputs ($/gal fuel, c/kWh electricity, $/kg hydrogen) in the data-file. Other excellent comparison files are here (EVs vs ICEs, ICEs vs H2 vehicles, diesel vs LNG vs H2 trucks). We have also published similar overviews for our research into batteries, electrification, battery metals and other important materials in the energy transition.