This model captures the energy economics of gas pipelines, CO2 pipelines and hydrogen pipelines. Specifically, we have modelled energy requirements using simple fluid mechanics, and modelled capex costs using past projects and technical papers, which are tabulated in the data-file.

In gas value chains, the midstream industry is responsible for moving natural gas, and possibly also CO2 for CCS and hydrogen: from the place of production, through processing facilities and ultimately to the places of consumption.

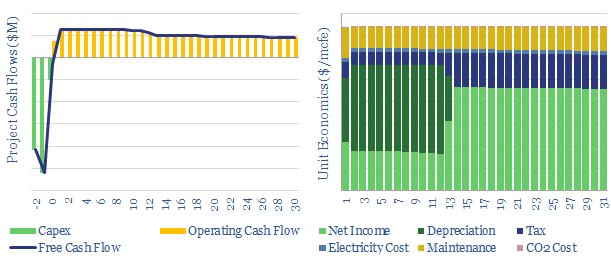

This economic model captures pipeline costs as a function of input variables, such as capex costs, pipeline distance, transport volumes, compression energy, energy costs, operating and maintenance costs.

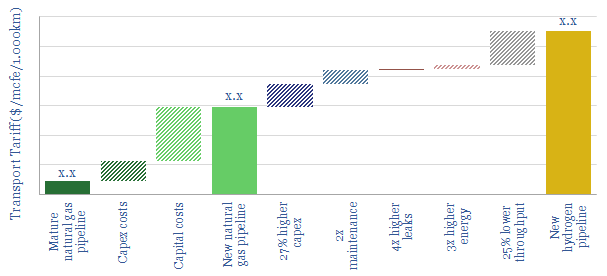

Our conclusion is that new hydrogen pipelines will cost 2x new gas pipelines and 10x existing gas pipelines, per mcf-equivalent of energy transport (chart below), while the CO2 costs of transporting hydrogen are c3x higher.

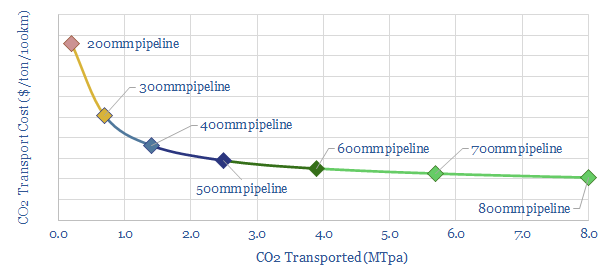

Unit costs of all pipelines decrease as a function of their size. This matters particularly for CO2 transport and disposal, where it will be advantageous to enter the industry at scale (chart below). Another variable that matters is the pipeline pressure and compression.

You can stress test the economics directly in the model, by varying pipeline tariffs, capex costs, energy costs, CO2 prices, maintenance costs, pipeline diameter, pipeline distance, pipeline elevation, pipeline materials and compressor efficiencies.