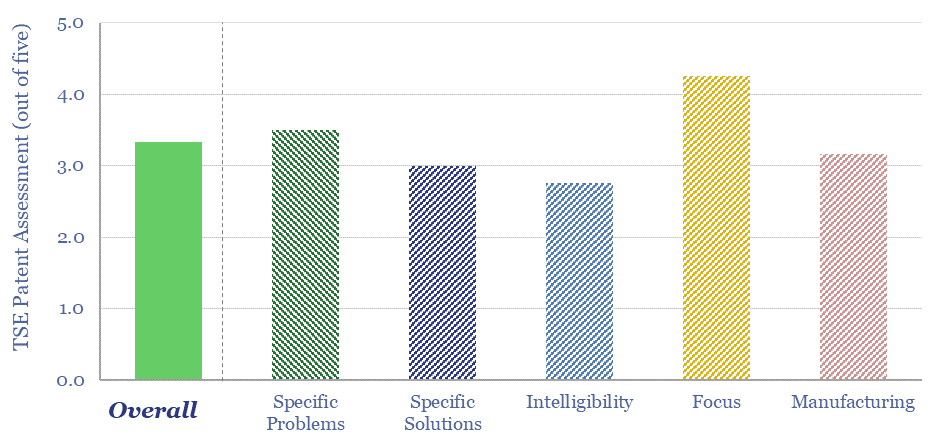

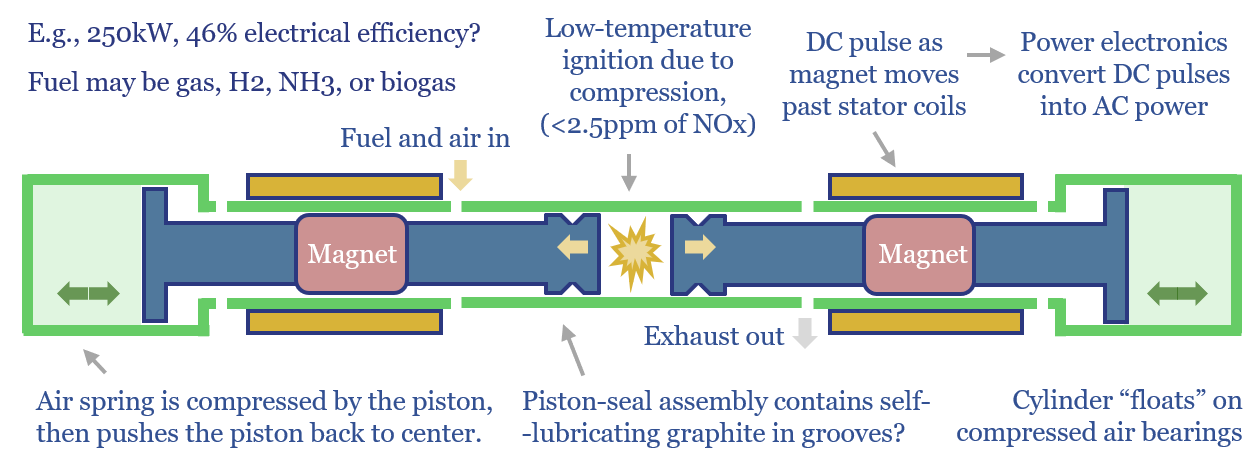

Linear generator technology can convert any gaseous fuel into electricity, with c45% electrical efficiency, and >80% efficiency in CHP mode. This data-file reviews Mainspring Energy’s patents. We conclude that the company has locked up the IP for piston-seal assemblies in a linear generator with air bearings, but longevity/maintenance could be a key challenge to explore.

EtaGen was founded in 2010 by three Stanford engineers, and rebranded as Mainspring Energy in 2020. Its headquarters are in Menlo Park, California; and the company has c400 employees, having closed a $290M Series E financing in 2022.

Mainspring is commercializing a linear generator, which is low-cost, reliable, flexible and can use any clean fuel (e.g., natural gas, biogas, hydrogen, ammonia), in sizes from 230kW to multiple-MW, >45% electrical efficiency and >80% total thermal efficiency in CHP mode.

In a linear generator, the compression of fuel and air causes a uniform and flameless combustion reaction to occur, releasing the energy from the fuel, but creating no NOx emissions. The energy from combustion pushes a piston through a cylinder (or in Mainspring’s case, two pistons, through two cylinders). Stator magnets in each piston move past coils in each cylinder, inducing a current. An air spring on the other side of the cylinder is thereby compressed, and re-expands to drive the piston back to its starting point.

The main advantages are the simplicity, which could in principle translate into lower capex, compared to the blades and precision-engineered compression and turbine stages within a gas turbine.

Higher efficiency can also be unlocked by harnessing the expansion of combustion gases directly, rather than having to convert it into rotary motion, per the loss attributions for conventional thermal generation. On the other hand, maximum efficiency will always be lower for low-temperature combustion, due to the laws of thermodynamics.

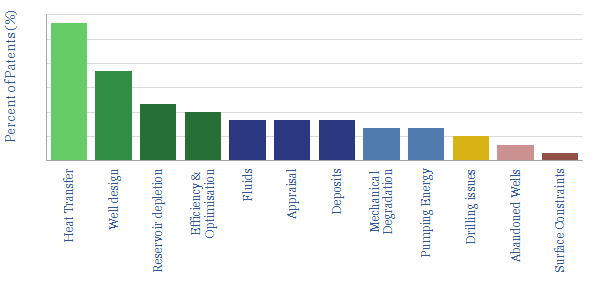

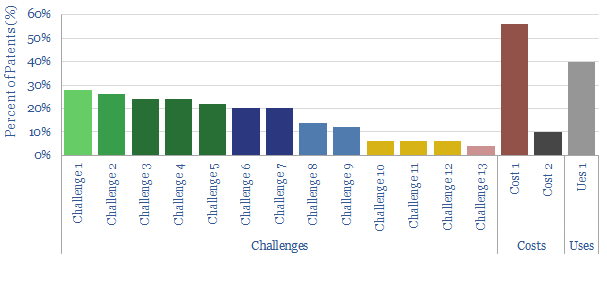

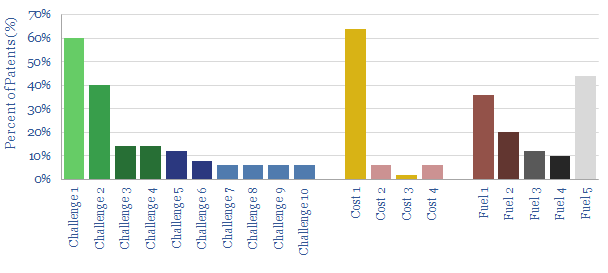

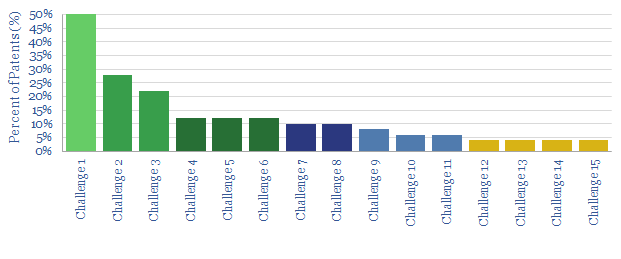

From reviewing Mainspring’s patents, we think there are three main challenges for commercializing linear generators. The main challenge is linked to longevity and maintenance.

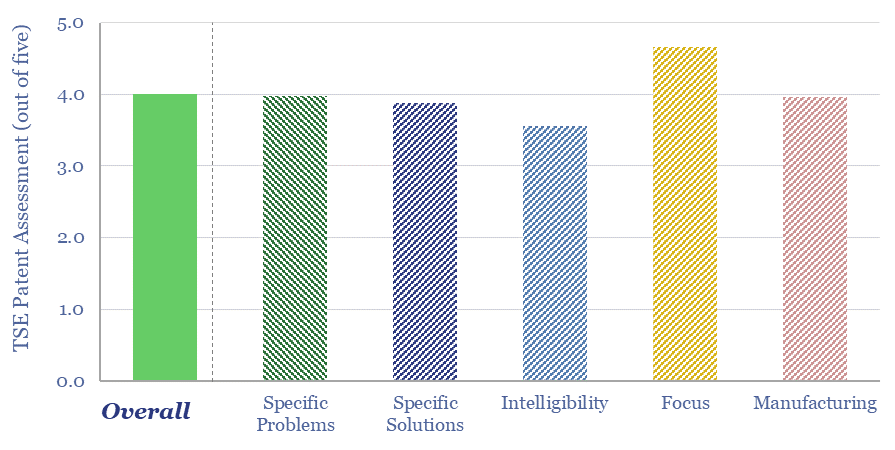

Mainspring’s patents focus upon piston-seal assemblies, and seem to have locked up the IP for its linear generator designs. This may also be relevant to other companies aiming to commercialize linear generators, such as Hyliion in the vehicle sector.