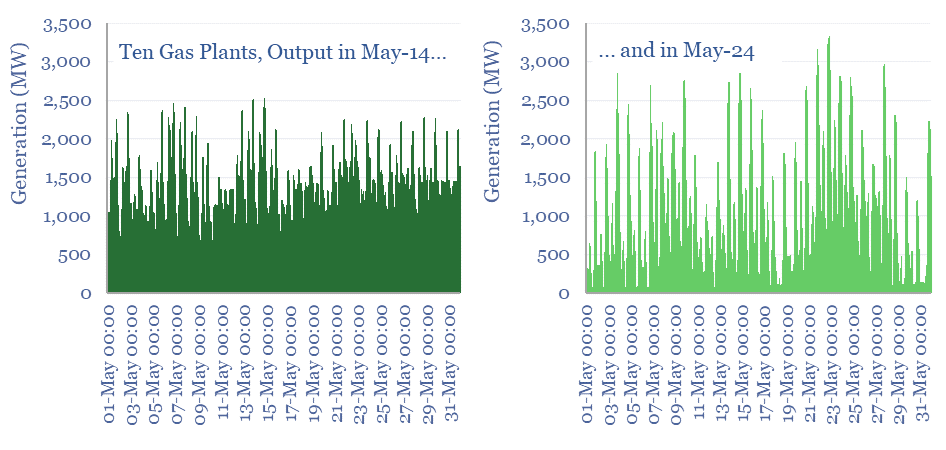

This 12-page note studies the output from 10 of the largest gas power plants in Australia, at 5-minute intervals, comparing 2024 versus 2014. Ramping renewables to c30% of Australia’s electricity mix has not only entrenched gas-fired back-up generation, but actually increased the need for peakers?

Levelized cost of electricity: stress-testing LCOE?

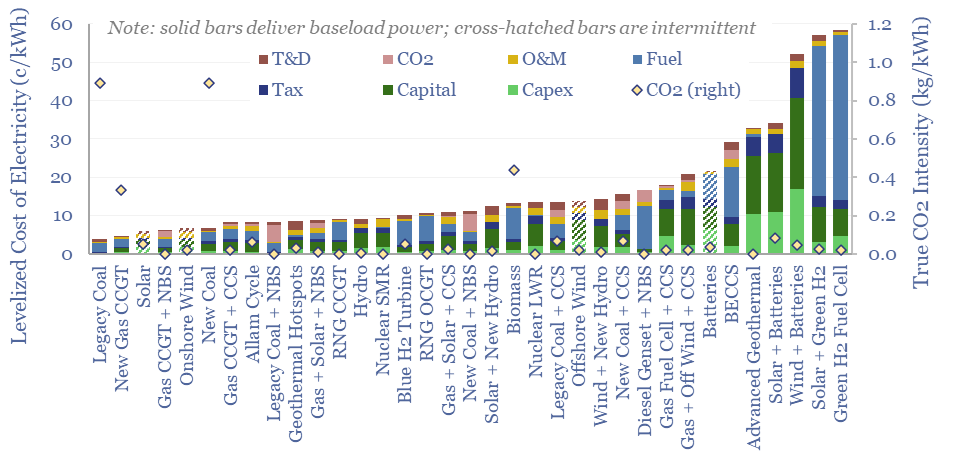

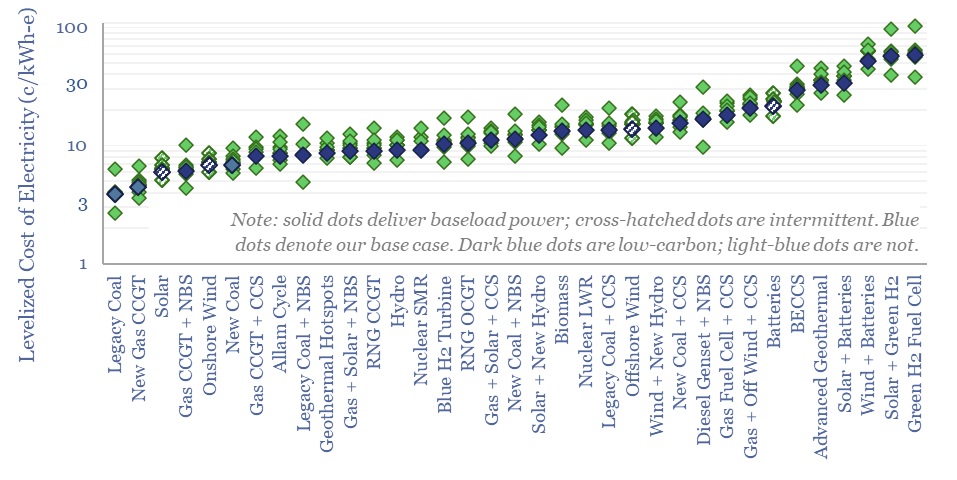

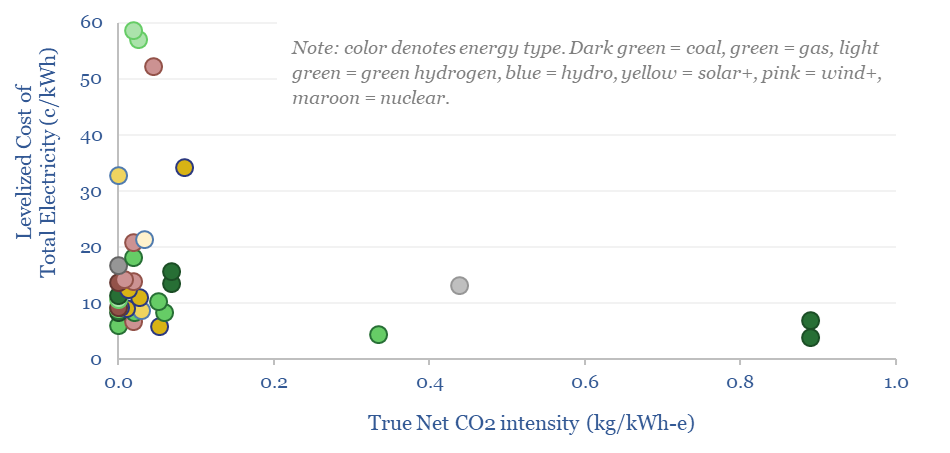

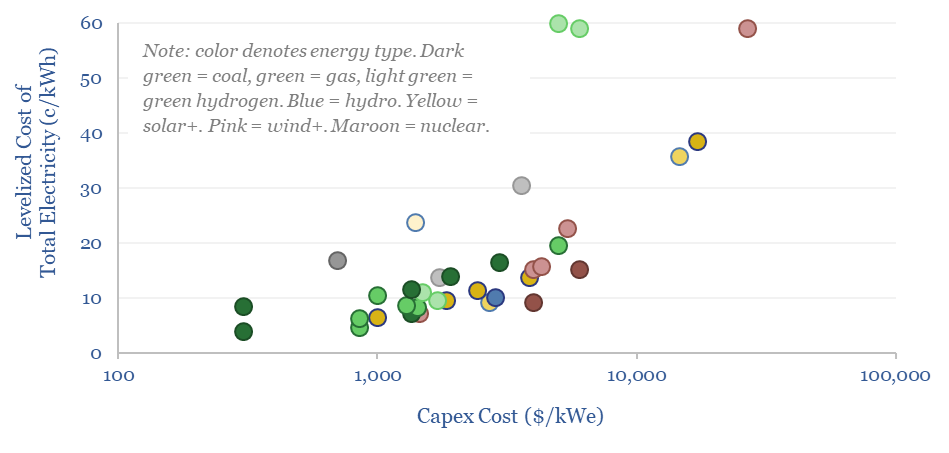

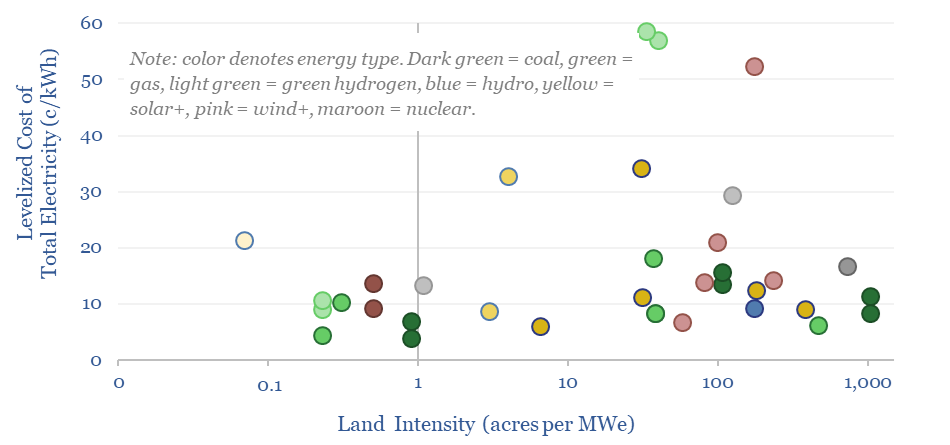

This data-file summarizes the levelized cost of electricity (LCOE), across 35 different generation sources, covering 20 different data-fields for each source. Costs of generating electricity can vary from 2-200 c/kWh. There is more variability within categories than between them. All the numbers can readily be stress-tested in the data-file.

Levelized cost of electricity (LCOE) breaks down the costs of adding new electricity generation, across capex, capital, tax, fuel, O&M, CO2 and T&D, distilled down in c/kWh terms, or $/MWH terms.

We have constructed over 200 economic models calculating the specific levelized costs of onshore wind, offshore wind, solar, hydro, nuclear, gas power, coal power, biomass, RNG, diesel gensets, geothermal, hydrogen, fuel cells, power transmission, batteries, thermal storage, redox flow, pumped hydro, compressed air, flywheels, CCS and nature-based CO2 removals.

The goal in this data-file is to allow for easy comparisons between different power generation options, across 20 different dimensions. We have written that we hate levelized cost, because it is often portrayed as though one energy source will emerge “to rule them all”, whereas there is more variability within each category than between them (see below).

The simple chart below shows how our levelized cost estimates change if we make simple changes in this comparison file: flexing risk-free rates between 1-5%, flexing fuel costs +/- 50%, flexing capex costs by +/- 50%, or changing the distances needed for AC power transmission, CCS pipelines, or other variables.

This kind of stress-testing is really the main point of the data-file, asking questions like: how do levelized costs change with WACCs? Or how do levelized costs change with higher gas prices? How do levelized costs change with capex deflation? What are the best options for lowering CO2 intensities of grids (chart below) without inflating total costs? The data-file answers these questions across several dimensions…

Capex costs are broken down for each category and are defined as the total installed capex, in $/kWe, which can then be divided by the total number of lifetime operating hours, yielding a number in c/kWh. Usually, the capex estimates in our underlying models draw from both top-down surveys of past projects and bottom-up build-ups.

Capital costs can be described as the after-tax income that needs to be earned on top of recovering the capex to derive a passable IRR (usually 7-12%), after whatever build-time is incurred prior to start-up (usually 2-6 years). We have taken this requisite after-tax income level from our individual underlying models, where it captures nuances such as time value of money, decline curves, and volatility.

Tax costs come on top of after-tax income. For simplicity, our models assume a 25% corporate tax rate across the board, but not tax breaks or changeable policies. Thus, we can think about the numbers in our data-file as being true economic costs.

Fuel costs cover the costs of buying gas for a gas plant, coal for a coal plant, hydrogen for a hydrogen plant, etc. By contrast, fuel costs are often zero for renewables. Again, these can readily be flexed in the model, which is especially important for gas value chains, amidst high dispersion in global gas prices.

O&M costs cover operations and maintenance; and are generally going to be lowest for large and simple systems.

T&D costs cover transmission and distribution, to move power to the load center. An advantage for on-site generation is that power can be used directly, whereas the average offshore wind farm in the North Sea needs to be transmitted 20km back to shore, then onwards. AC transmission costs 1.5c/kWh/100km at large scale. For CCS value chains, we also include $3/ton/100km for CO2 transport in the T&D line.

CO2 costs cover the cost for offsetting or disposing of gross CO2 emissions: either via nature-based CO2 removals, using high-quality reforestation at $50/ton; or for CO2 geological disposal in subsurface reservoirs with a base case cost of $15/ton. Otherwise, for CCS value chains, additional costs are reflected in higher up-front capex, higher fueling costs due to energy penalties, and higher maintenance costs.

Other dimensions are also compared for all of the generation sources in our database: TRLs, logistical risks, development times, efficiency factors, CO2 intensity (kg/kWh), typical load factors (%) and land intensity (acres per MW) (see below).

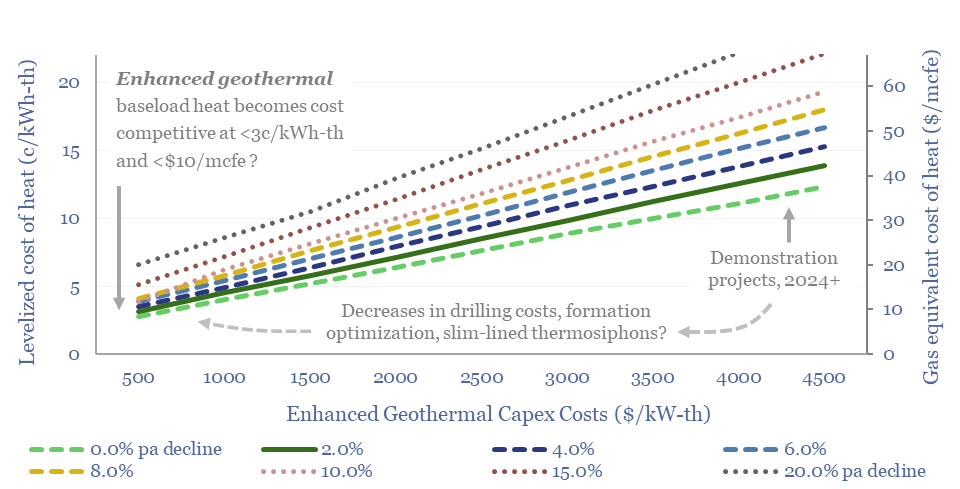

Enhanced geothermal: digging deeper?

Momentum behind enhanced geothermal has accelerated 3x in the past half-decade, especially in energy-short Europe, and as pilot projects have de-risked novel well designs. This 18-page report re-evaluates the energy economics of geothermal from first principles. Is there a path to cost-competitive, zero-carbon baseload heat?

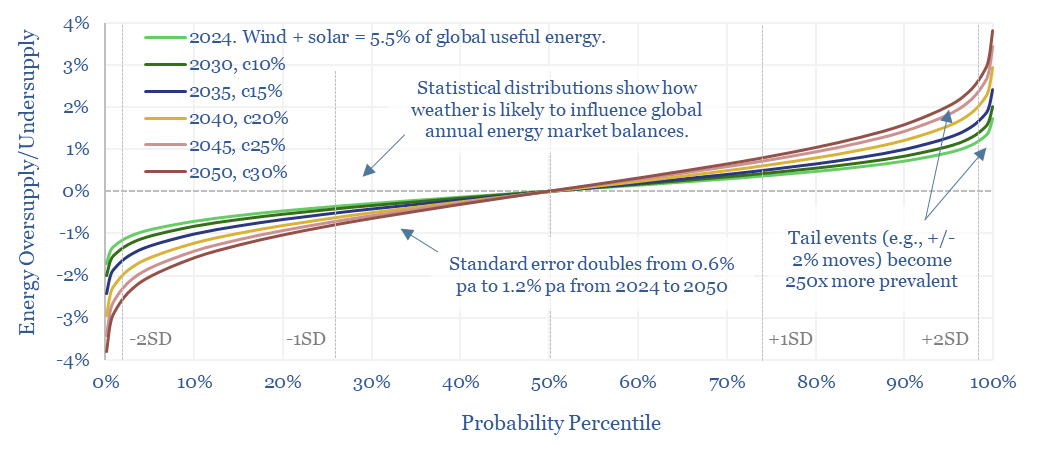

Energy market volatility: climate change?

This 14-page note predicts a staggering increase in global energy market volatility, which doubles by 2050, while extreme events that sway energy balances by +/- 2% will become 250x more frequent. A key reason is that the annual output from wind, solar and hydro all vary by +/- 3-5% each year, while wind and solar will ramp from 5.5% to 30% of all global energy. Rising volatility can be a kingmaker for midstream companies? What other implications?

New energies: filter feeder?

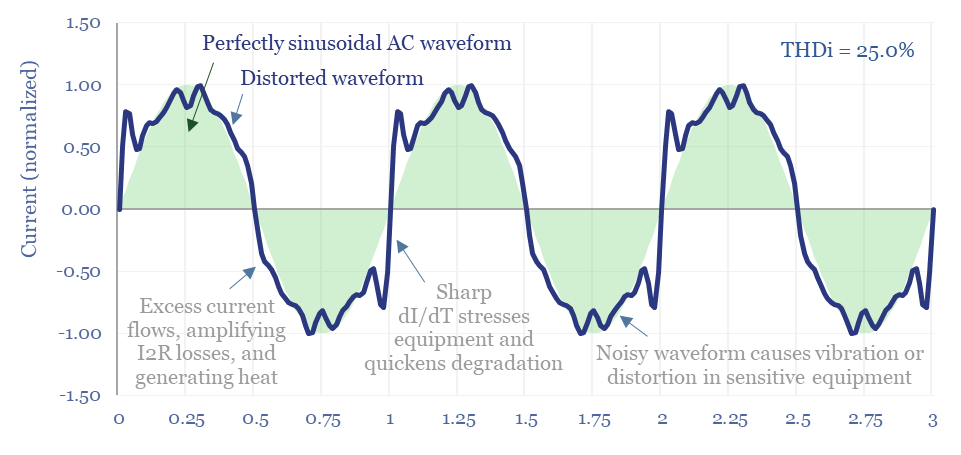

The $1bn pa harmonic filter market likely expands by 10x in the energy transition, as almost all new energies and digital technologies inject harmonic distortion to the grid. This 17-page note argues for premiumization in power electronics, including around solar, and screens for who benefits?

Solar inverters: companies, products and costs?

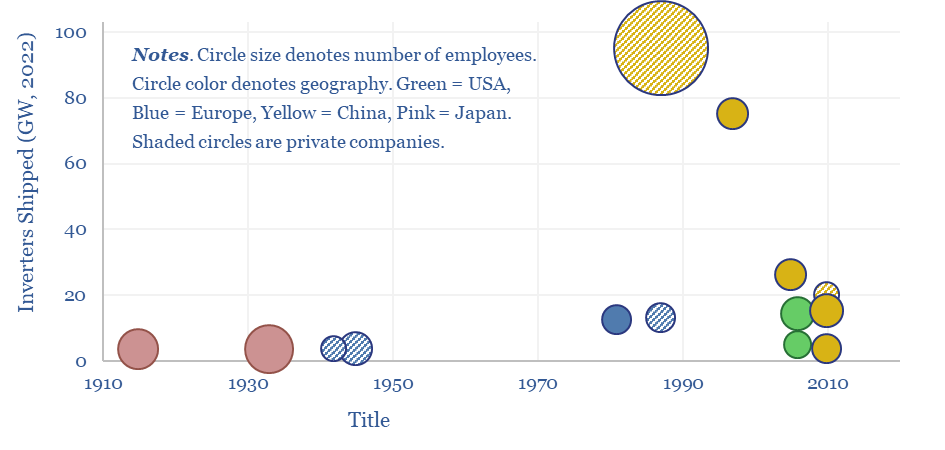

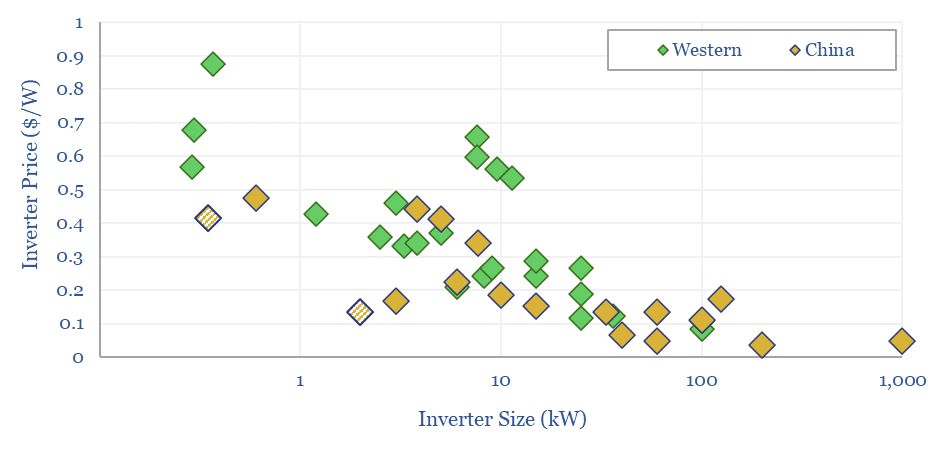

This data-file tracks some of the leading solar inverter companies and inverter costs, efficiency and power electronic properties. As China now supplies 85% of all global inverters, at 30-50% lower $/W pricing than Western companies, a key question explored in the data-file is around price versus quality.

Solar inverters convert the DC output from solar modules in an AC waveform that can be transmitted across power grids or used in electronic devices. This is achieved via pulse width modulation (explained here) using IGBTs and MOSFETs (explained here).

This data-file covers solar inverter companies and the costs of solar inverters. Twenty companies account for about 90% of global inverter shipments, and the ‘top five’ account for two-thirds of inverters, of which four are Chinese companies, such as Huawei and Sungrow, while we have also explored electronics from SolarEdge.

Our utility-scale solar cost models assume $0.1/W inverter costs, and this is borne out by the data-file. Although costs per watt approximately double for every 10x reduction in inverter size.

Chinese manufacturers sell inverters for 30-50% less than Western companies, suggesting challenged margins and strong competition.

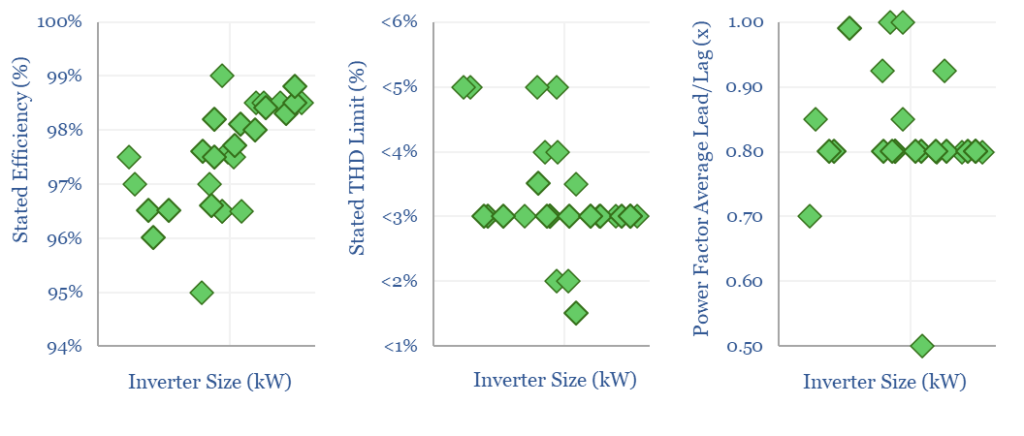

Decent inverters on the market in 2024 convert 98% of the incoming DC electricity into AC electricity, and have advanced power electronics. The ability to control reactive power with a +/- 0.8 leading/lagging power factor is typical. As is the ability to limit total harmonic distortion below 3% (charts below).

While Chinese-made inverters are 30-50% lower cost than Western-made inverters, a key question explored in the data-file is whether this also comes at the cost of lower power quality. Our views and their implications are summarized in the first tab of the data-file. The backup tabs contain the full data behind all of the other charts above.

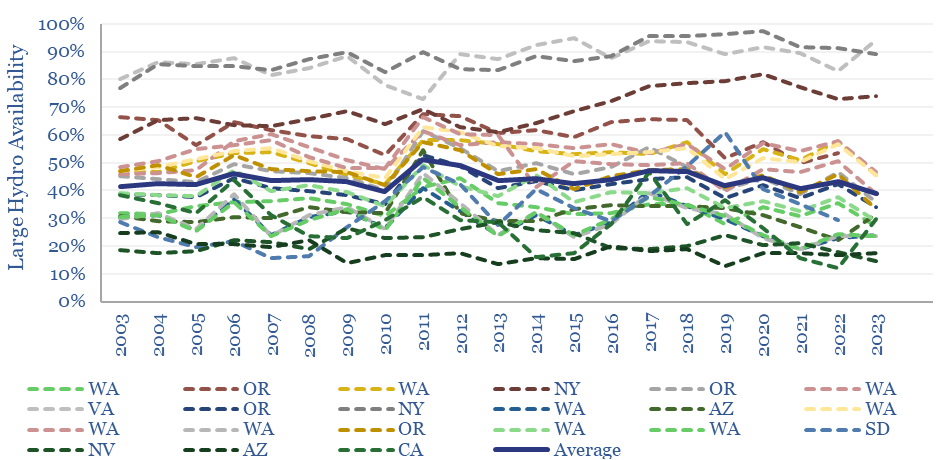

Hydro power: generation by facility, availability over time?

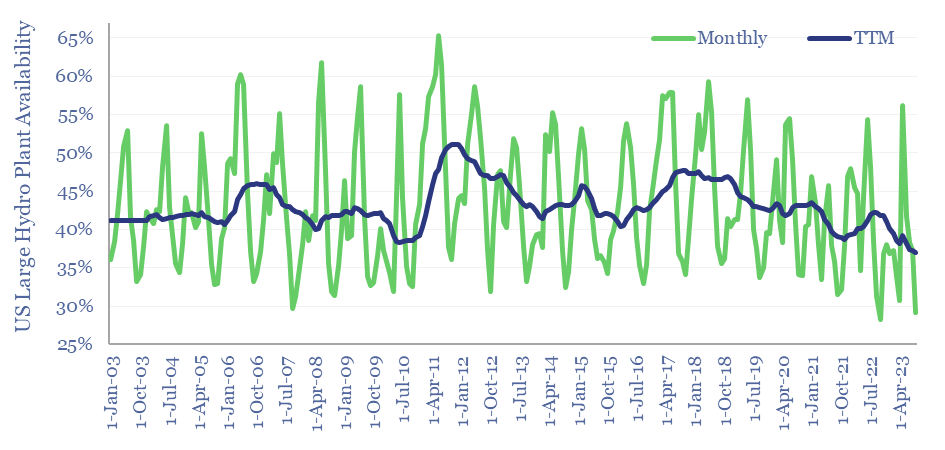

Hydro power generation by facility is tabulated in this data-file for the 20 largest hydro-electric plants in the US. The average US hydro facility achieves 43% availability, varying from 39% in hot-dry years to 51% in wet years; and from 33% at the seasonal trough in September-October to 53% at the seasonal peak in May-June. What implications for energy markets and backstopping renewables?

The US generates 260 TWH of hydro power per year, 6% of its total electricity, of which 130 TWH comes from its top twenty largest hydro facilities, with over 30 GW of combined capacity. For further details, please see our US energy and CO2 model.

Month-by-month hydro power generation is tabulated in this data-file, for the top twenty largest US hydro-power plants. For example, the single largest hydro facility in the US is the Grand Coulee Dam, on Washington State’s Columbia River, built in 1967, and now with 6.8 GW of nameplate capacity. However, different plants vary (chart below), so it is useful to average out the data (chart above).

How well suited is hydro for backstopping renewables? In the short term, from minutes to days, hydro is an excellent backstop for solar and wind (note below), with fast start-up times, fast ramp-rates and flexibility suggested by an average availability factor of 44% for large hydro facilities over the past 20-years. In other words, there is scope to dial hydro plants up or down.

For longer-duration renewables volatility, hydro may be a less effective backstop, however. Especially for solar. The availability factors of hydro follow a clear annual pattern, ranging from 30-65%, peaking at 53% on average in May-June fed by meltwater from spring, troughing at 33-34% in September-October after hot and drought-prone summers. Seasonality is plotted in the data-file.

To ensure resiliency in renewables-heavy grids, it should be noted that some years are rainier than others. Hence the annual availability across all large US power plants ranges from 39% to 51%.

The trend also appears to show hydro availability gently falling in recent years, possibly linked to hotter weather. Different studies vary but have estimated that climate change could lower hydro generation by around 10% by mid-century on average. Details in the data-file.

Hydro variability can impact global energy balances. Global electricity demand was 30,000 TWH in 2023. We find that a particularly wet or dry year, across the board, can sway global electricity market balances by as much as a full percentage point.

Please download the data-file for the underlying numbers into hydro power generation by facility, at the twenty largest US hydro plants, month-by-month, going back 20-years to 2003.

Solar and wind: what decarbonization costs?

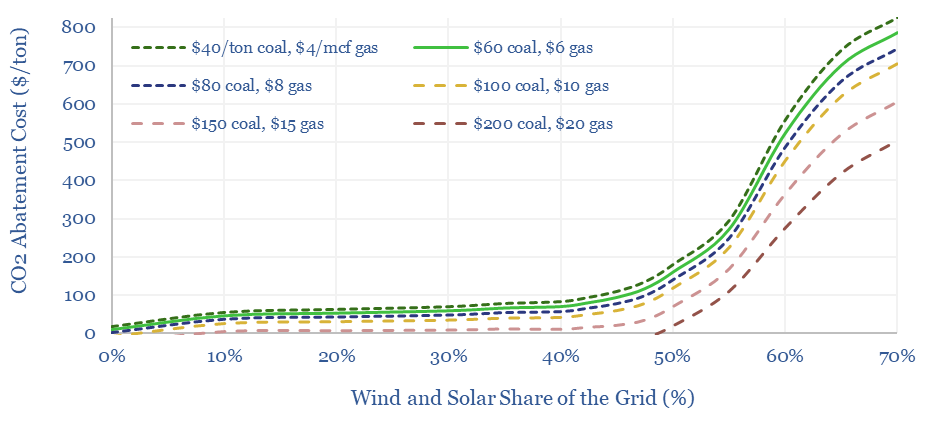

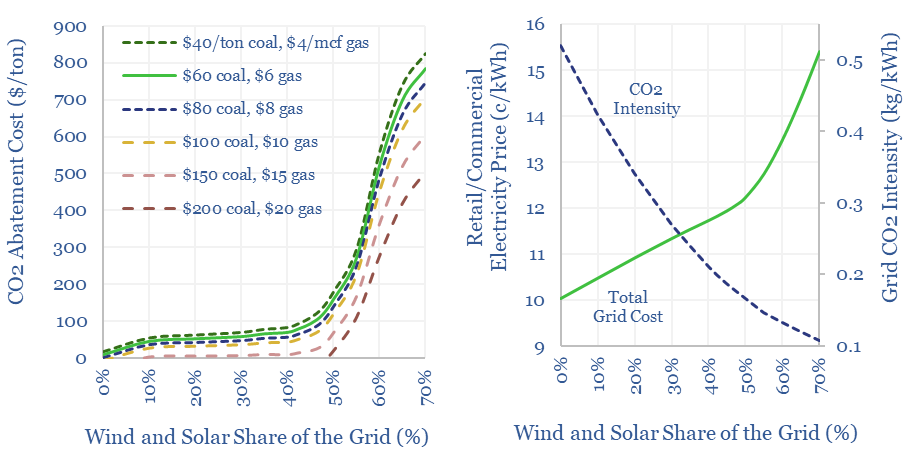

The costs of decarbonizing by ramping up solar and wind depend on the context. But our best estimate is that solar and wind can reach 40% of the global grid for a $60/ton average CO2 abatement cost. This is a relatively low cost. Yet it still raises retail electricity prices from 10c/kWh to 12c/kWh. This 7-page note explores numbers and implications.

Wind and solar: what CO2 abatement costs of renewables?

The costs of decarbonizing by ramping up solar and wind are highly dependent on context. The purpose of this data-file is to enable stress-testing of the CO2 abatement costs of renewables, in different contexts and at different grid penetrations. Our own estimate is that solar and wind can reach 40% of the global grid for a $60/ton average CO2 abatement cost of wind and solar.

Thunder Said Energy is a research firm focused on energy technologies and energy transition. In our roadmap to net zero, we have plotted hundreds of different options on a cost curve, according to their CO2 abatement cost, i.e., what is the cost in $/ton to remove each ton of CO2 from the global energy system?

The costs of wind and solar are often quoted in c/kWh terms, but what is their cost in CO2 abatement terms, i.e., in $/ton of CO2 avoided. We have written a research note (below) aiming to answer this question and this data-file contains the underlying modelling.

The CO2 abatement costs of solar and wind are highly context-dependent. For example, a utility scale solar assets that prevents having to build a new diesel genset has deeply negative CO2 abatement cots, while new offshore wind farm that displaces a fully depreciated nuclear plant has a CO2 abatement cost of infinity!

This data-file enables stress-testing of the CO2 abatement costs of solar and wind. The proper way to calculate this is on a total grid basis, dividing the total change in the cost of the grid (in c/kWh) by the total change in the CO2 intensity of the grid (in kg/kWh) and then juggling the units.

Calculating CO2 abatement costs of renewables in this way is necessary, because otherwise the numbers will not reflect the CO2 intensity of what is being displaced, falling grid utilization, rising curtailment rates and the concomitant rise in total grid costs.

In the model, you can also flex your assumed costs and grid shares for wind, solar, hydro, nuclear, gas and coal, the share of displaced generation that is assumed to be ully depreciated versus greenfield, and the rise in transmission costs associated with increasing renewables.

Wind and solar: curtailments over time?

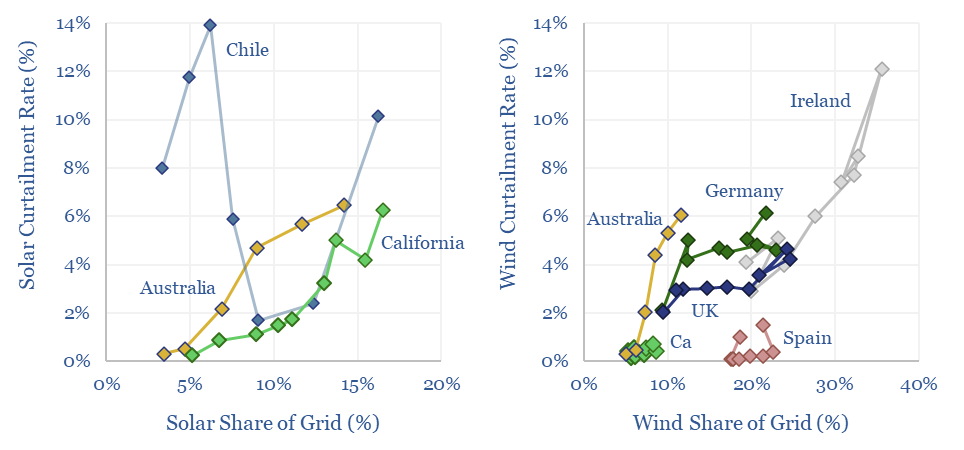

Wind and solar curtailments average 5% across different grids that we have evaluated in this data-file, and have generally been rising over time, especially in the last half-decade. The key reason is grid bottlenecks. Grid expansions are crucial for wind and solar to continue expanding.

Curtailments occur when wind and solar are capable of generating electricity, but operators cannot dispatch that electricity into the grid.

This data-file tabulates curtailment rates in California, Australia, the UK, Germany, Spain, Chile and Ireland, averaging c5% in 2022.

The main reason for curtailment is bottlenecks in the grid — i.e., moving renewables from points of generation, to points of unmet demand — rather than renewables having saturated total grid demand.

In a recent research report into the ultimate share of renewables in power grids, we calculated that based on their statistical distributions, solar would only start meeting 100% of a grid’s total demand around 1% of the time when solar was providing c30% of the total grid, while wind would only start meeting 100% of a grid’s total demand around 1% of the time when wind was providing 40% of the total grid (see below). We are not at these levels yet, in the countries in this sample.

The bottleneck is power grids. You might have a 100MW grid, composed of 10 x 10MW inter-connected nodes, and the issue causing curtailment is trying to flow 20MW through a 10MW node.

This confirms that meeting the theoretical potential of renewables (per the note above) requires vast grid expansion, and indeed, countries that have seen YoY reductions in curtailment rates have often achieved this by building new interconnectors.

Second, it gives a new lens on energy storage. Battery deployments can absorb low-cost renewables and prevent curtailment, by circumventing grid bottlenecks, especially for renewables developers who fear bottlenecks in the grid will be persistent.