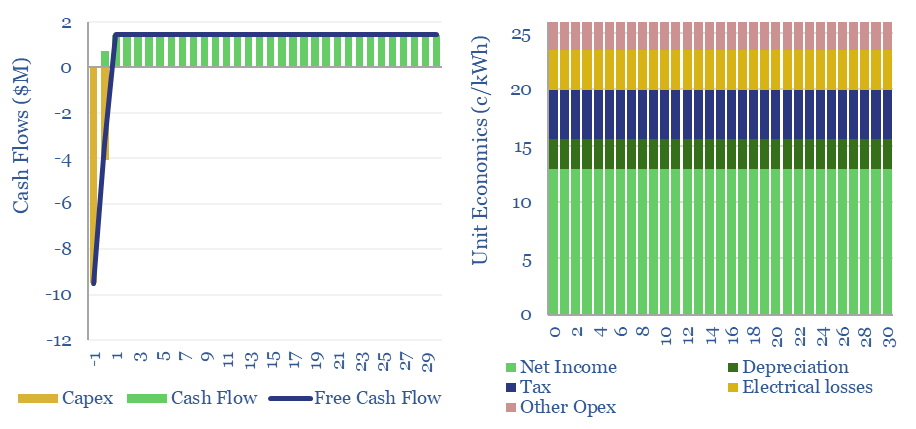

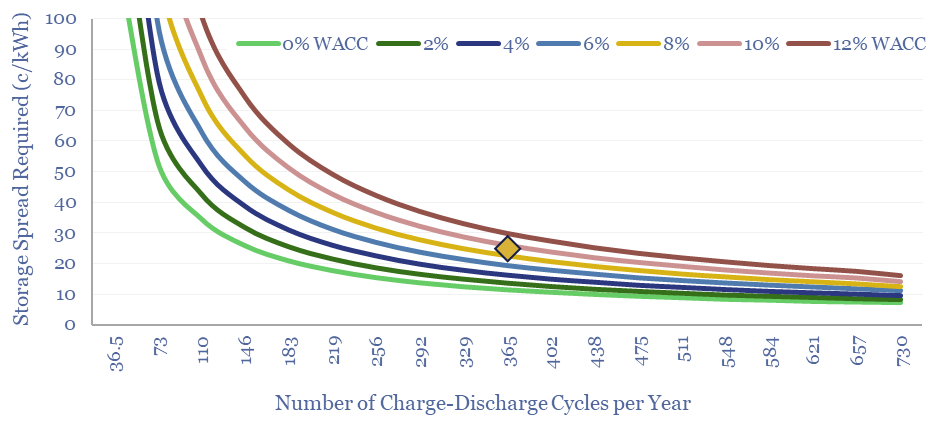

Our base case for Compressed Air Energy Storage costs require a 26c/kWh storage spread to generate a 10% IRR at a $1,350/kW CAES facility, with 63% round-trip efficiency, charging and discharging 365 days per year. Our numbers are based on top-down project data and bottom up calculations, both for CAES capex (in $/kW) and CAES efficiency (in %) and can be stress-tested in the model. What opportunities?

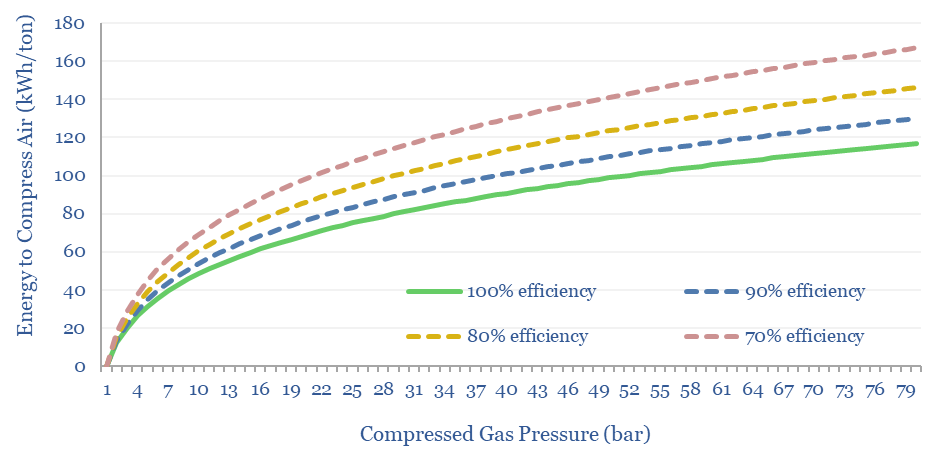

Compressed Air Energy Storage (CAES) seeks to smooth out power grids, using excess electricity to compress air into storage tanks or underground reservoirs at high pressures (e.g., 40-80 bar). The energy needed to compress air to different temperatures is plotted below. Electricity can later be recovered later by expanding these high-pressure gases across a turbine.

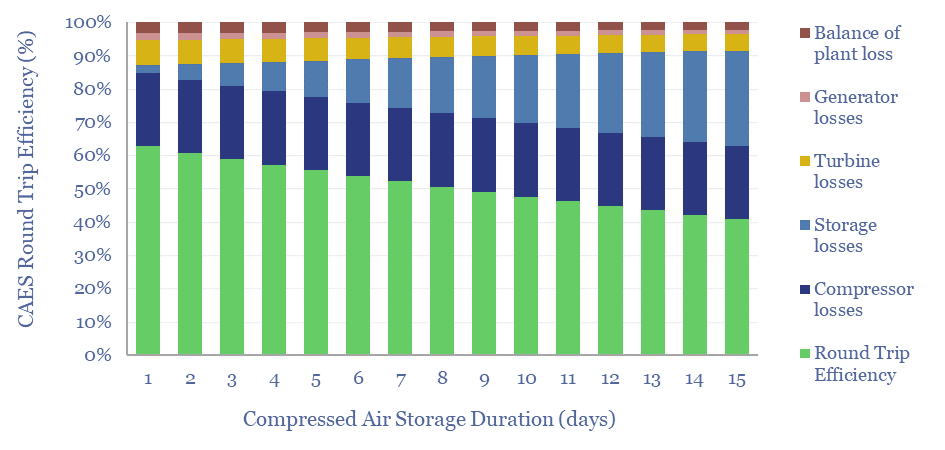

The round trip efficiency of CAES averages 60-65%, across projects that are sampled in the data-file. We can break down these numbers from first principles, assuming 78% compressor efficiency, 90% turbine efficiency and 97% generator efficiency (matching the numbers in our power plant loss attributions). Another 3-30% will be lost due to compressed gases cooling during storage (see below).

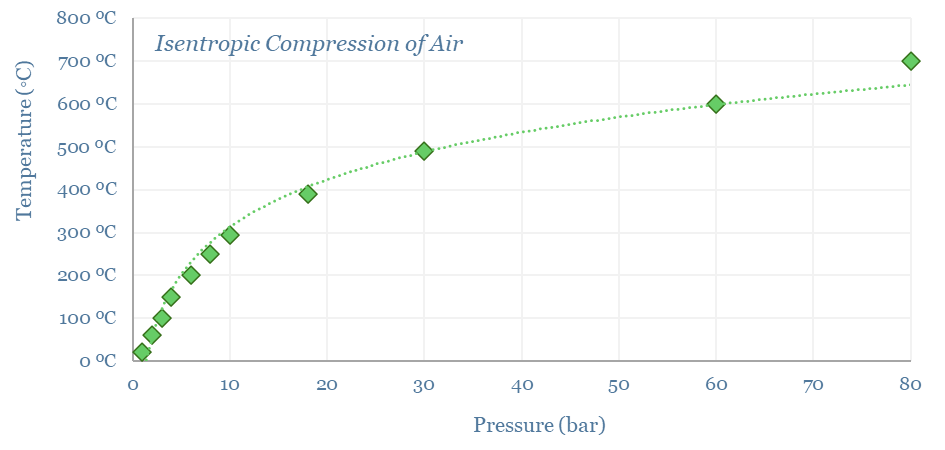

When gases are compressed they tend to heat up. For example, in an isentropic process — where heat is not exchanged with the external environment — compressing air to 30-60 bar will also tend to increase its temperature to 500-600°C. Inevitably, when the gas is stored, however, some of this heat does leak to the external environment, which means that there will be less energy to recover from the gas when it is expanded across the turbine. For more, please see our overview of thermodynamics.

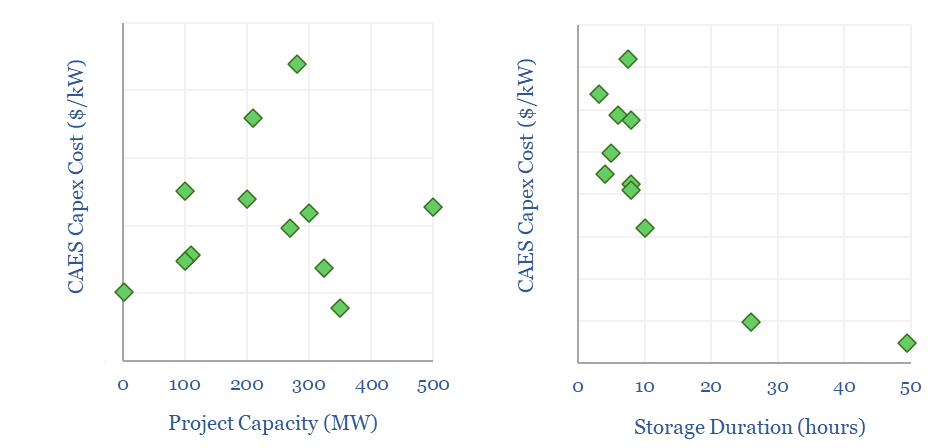

We can model the capex costs of Compressed Air Energy Storage from first principles in the model, by combining our models of compressor costs, storage facility costs and turbine costs. Our numbers also match top-down costs reported for past projects and technical papers into CAES.

Hence our base case estimates for CAES costs require a 26c/kWh storage spread to generate a 10% IRR at a $1,350/kW CAES facility, with 63% round-trip efficiency, charging and discharging 365 days per year. As always, costs vary with WACCs, duration and the number of charge-discharge cycles (chart below).

But generally, CAES costs 30% more than a lithium ion battery storage system. Key reasons are the lower efficiency (discussed above) and 5-10x higher maintenance costs for the moving parts in a CAES system (compared to a LiB with no moving parts).

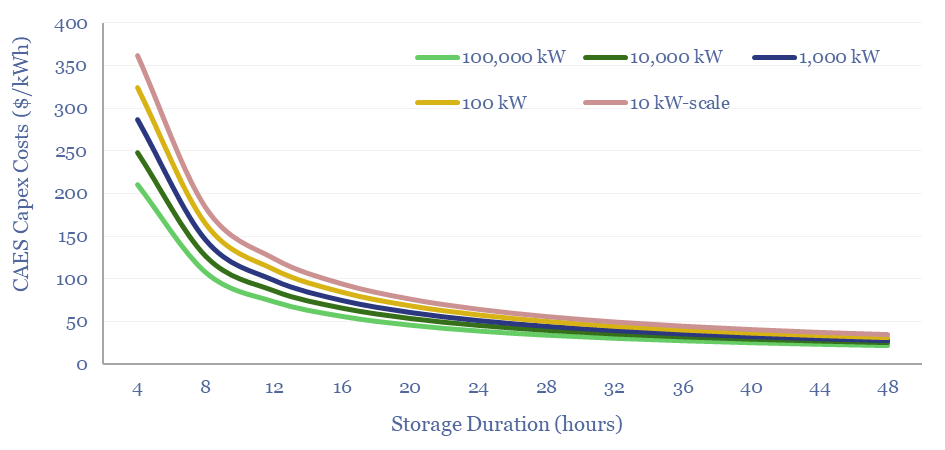

CAES economics are most competitive when input electricity costs are low and storage duration is increased. One advantage of a CAES system is that it can easily be scaled if the facility has access to a large underground storage reservoir, possibly ranging across thousands-millions of m3, with a tolerance for 40-300 bar pressures. In this case, we think capex costs could fall below $50/kWh for a long-duration battery (LiB comparison here).

Long duration storage leader? In theory a CAES system could thus provide 24-hours of storage for as little 30-40c/kWh. These numbers are generally lower than for 24-hour storage in lithium ion batteries, comparable to redox flow batteries, but still higher-cost than the costs of 24-hour storage in thermal energy storage systems.