The midstream industry moves molecules, especially energy-molecules, and especially in pipelines. Despite the mega-trend of electrification, there are still strong midstream opportunities in the energy transition, backstopping volatility and moving new molecules. This short note captures our top ten conclusions.

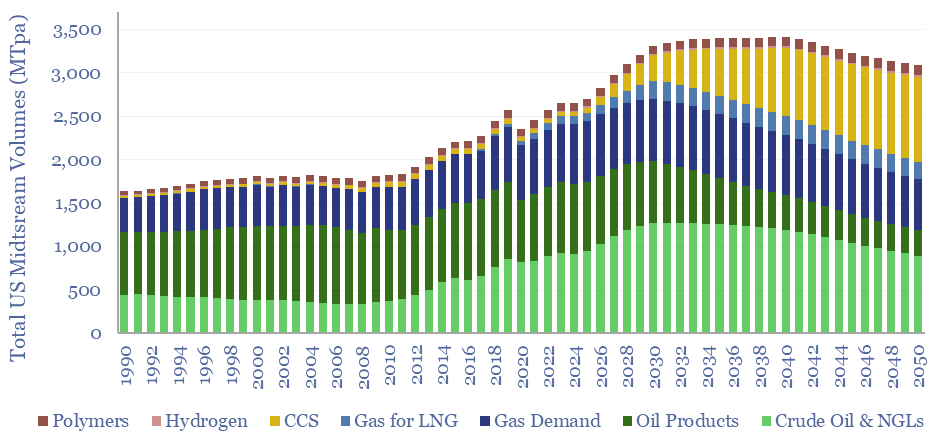

(1) Our overall outlook on the US midstream industry sees the total tonnage of molecules moved rising by 25%, from 2.6GTpa in 2023 to 3.3GTpa in 2030, and then plateauing around these levels. This illustrates that growth opportunities in gas, CCS and some hydrogen value chains outweigh declines in markets such as oil.

(2) Global gas demand doubles in our roadmap to net zero, in order to displace coal; global LNG trebles; while another under-appreciated angle is that growing applications like blue hydrogen, LNG and polymers all require more gas processing within the midstream sector as part of their value chains. Narrowing in on the US market, US gas demand rises 8% by 2030 and 12% by 2035 as captured in our US energy model.

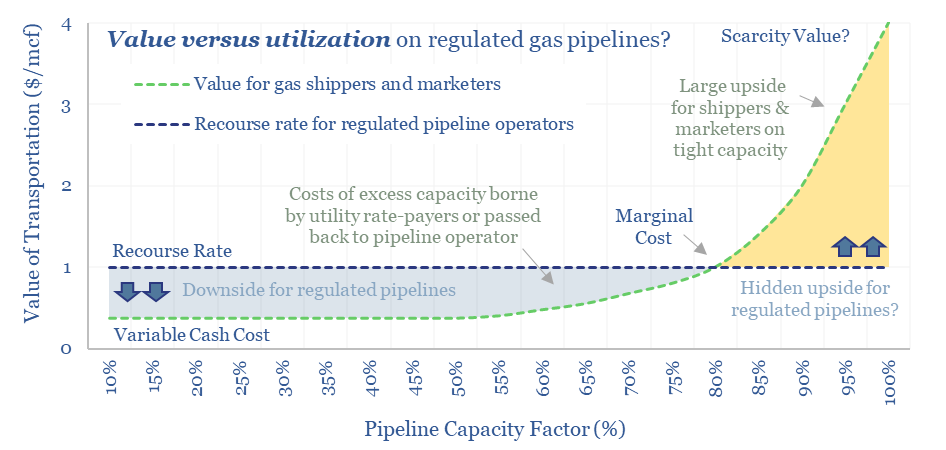

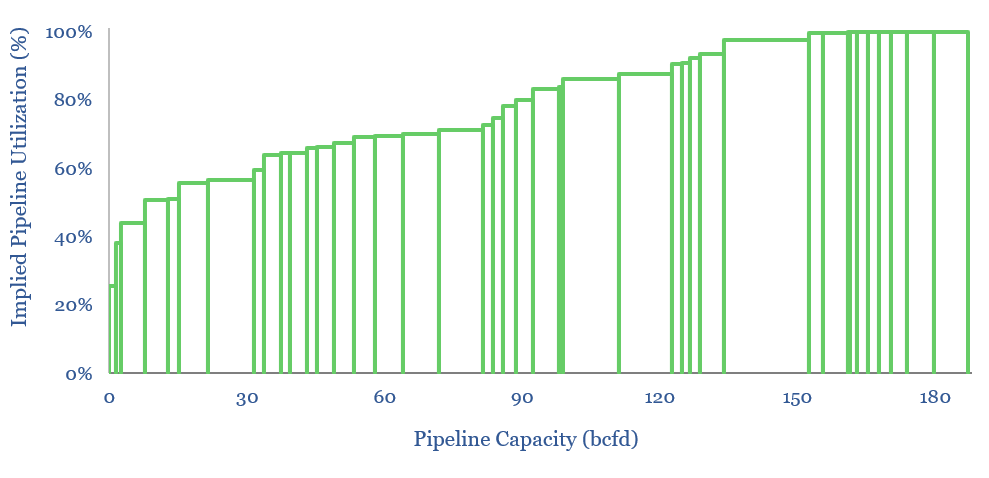

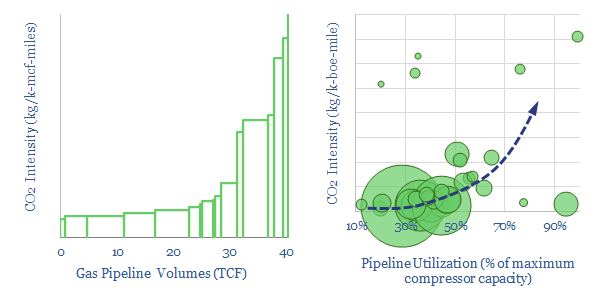

(3) Gas will entrench as the leading backstop for renewables, and especially in the face of power grid bottlenecks, and to power AI data-centers that require reliable round-the-clock power. This will raise the capacity utilization of existing gas transmission lines.

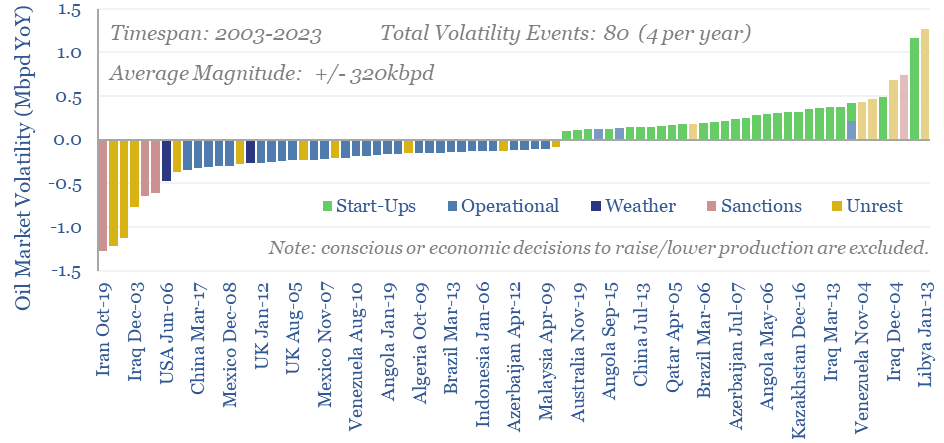

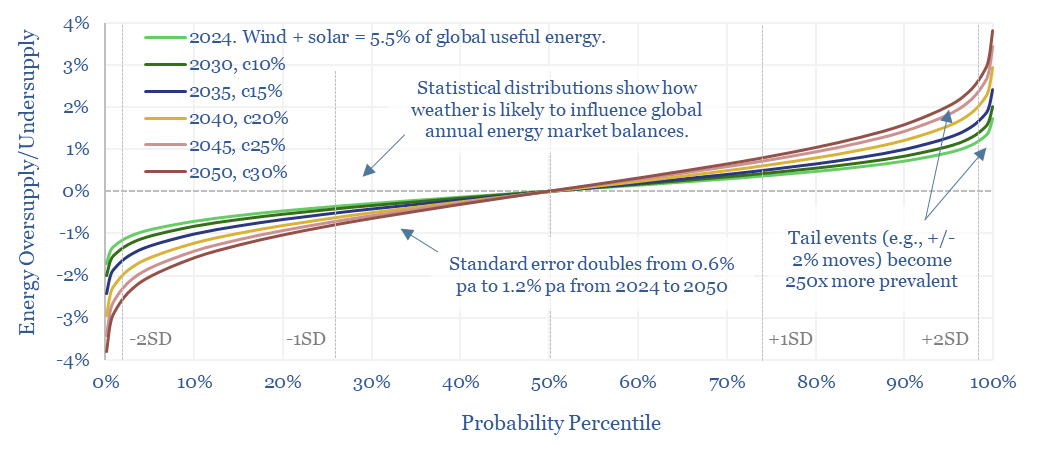

(4) Volatility is also rising in the global energy industry, due to the inherent volatility of solar and wind. Rising volatility increases the value of midstream infrastructure, which by definition, can arbitrage the volatility by moving molecules from areas of low pricing to high pricing.

(5) The upside from tighter capacity and rising volatility primarily accrues to marketers and traders, because of the way pipeline assets are regulated (e.g., by FERC), but some upside inevitably trickles back to the regulated pipelines too, per our 13-page note here.

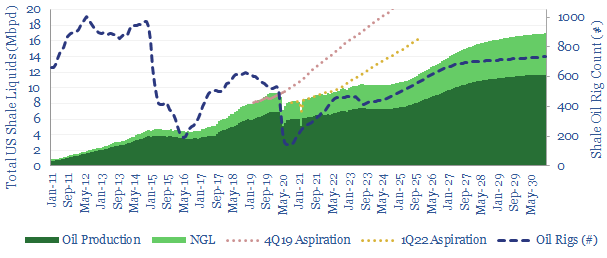

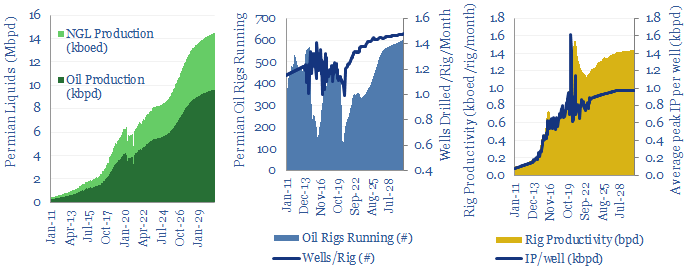

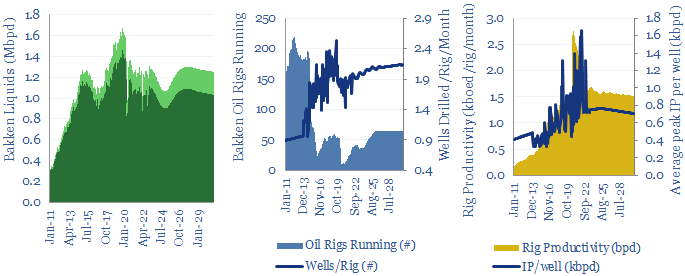

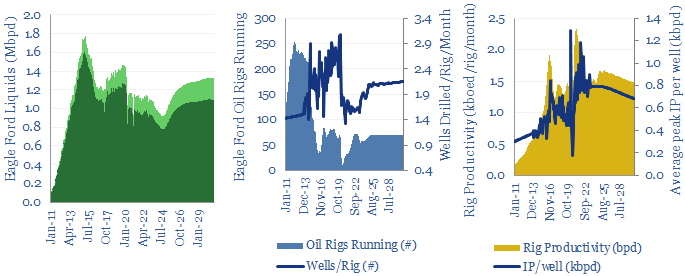

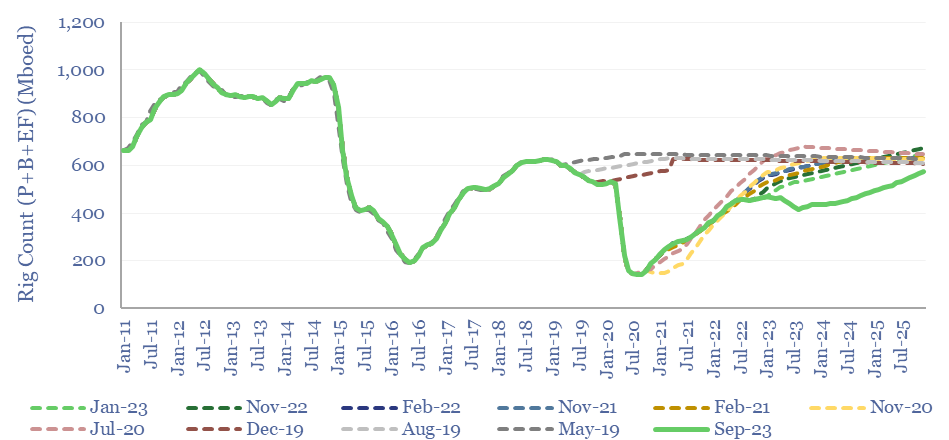

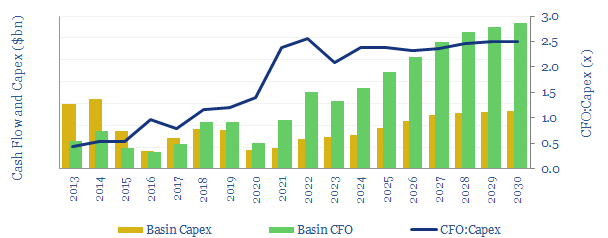

(6) Global oil demand does soften to 85Mbpd by 2050 in our roadmap to net zero, but the mix shift may be more sanguine for midstream companies, scaling back products that tend NOT to be delivered by pipeline (e.g., gasoline) while scaling up products that do (e.g., jet fuel, BTXs, intermediates for polymers). Looking by region, we also see continued growth through 2030 in US shale output.

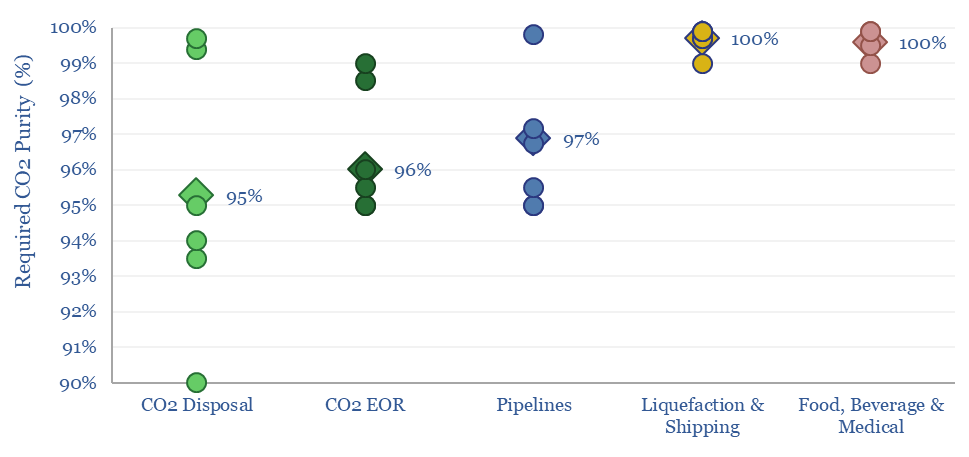

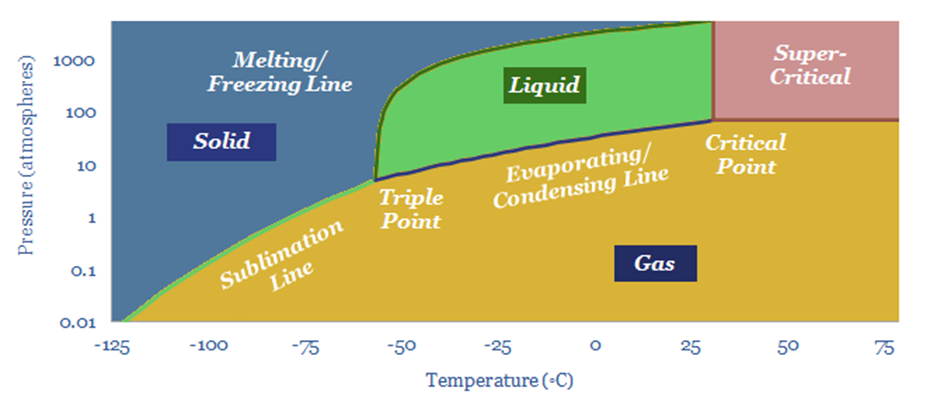

(7) CO2 disposal ramps up most of any new midstream opportunities, from c40MTpa in the early-2020s to 7GTpa globally by 2050, in our roadmap to net zero, across conventional CCS, blue hydrogen, CO2-EOR and novel combustion and next-gen DAC. We think c1GTpa will be in the US. CO2 purity must be >90%, ideally >97%. This is the largest new growth opportunity for midstream companies.

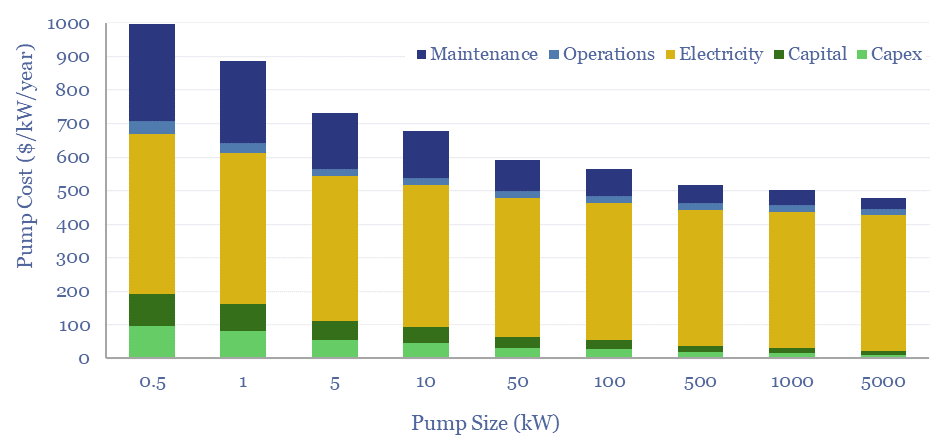

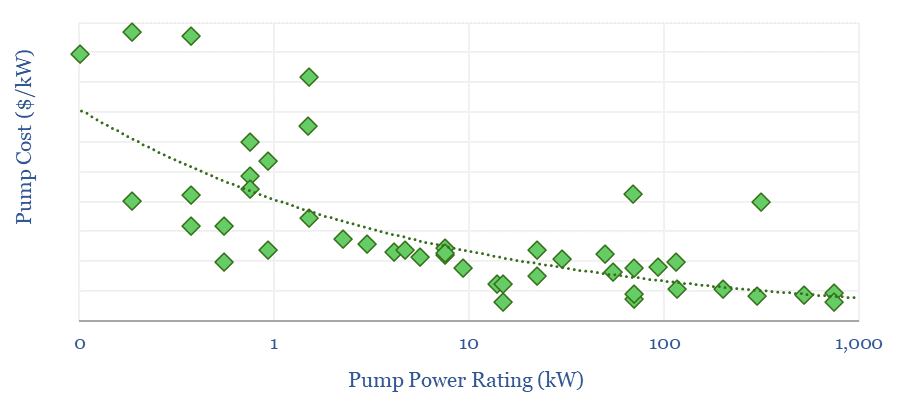

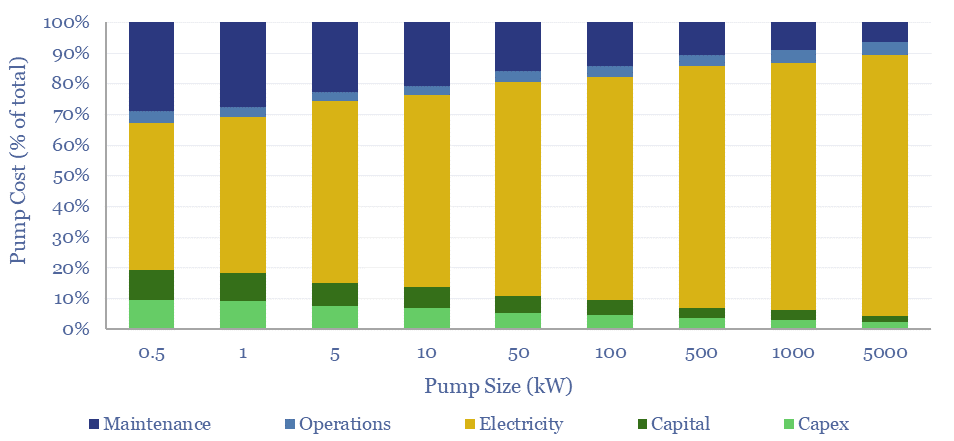

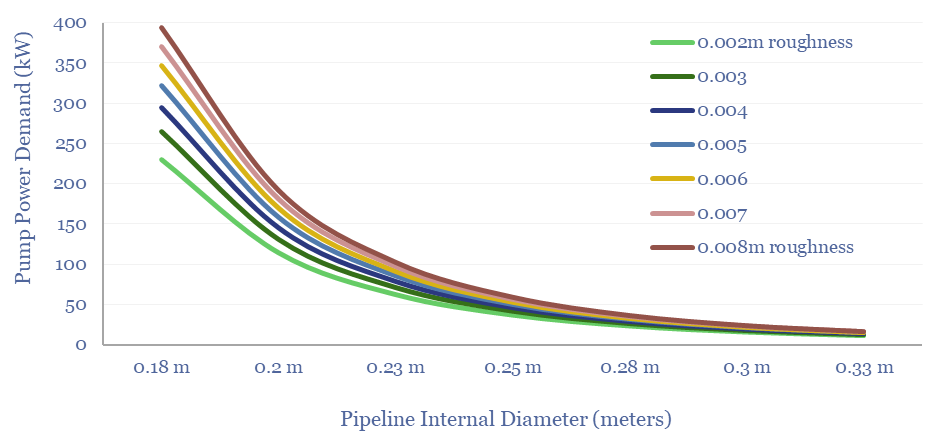

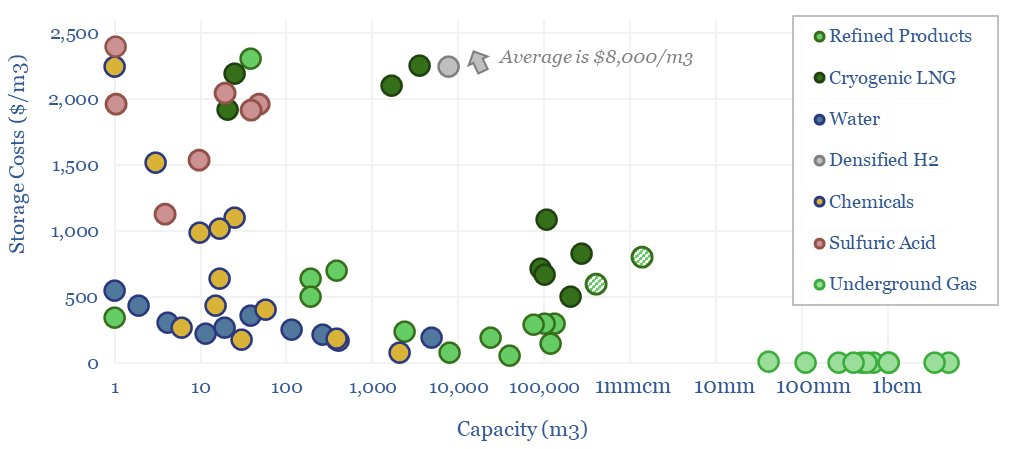

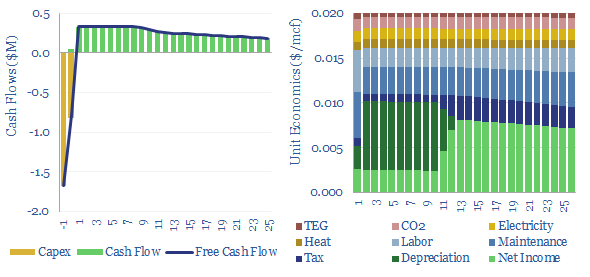

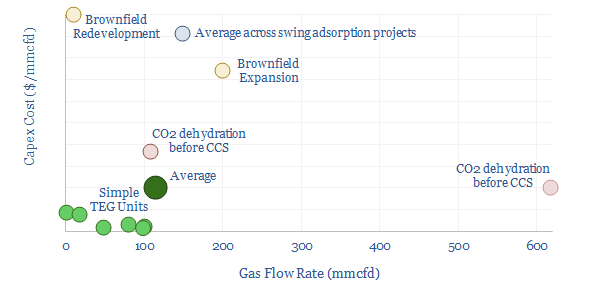

(8) Costs of midstream components are quantified in our research, such as oil pipelines at $2/bbl/1,000km, oil storage at $1.5/bbl, gas pipelines at $1/mcf/1,000km, gas fractionation at $0.7/mcf, gas dehydration at $0.02/mcf, LNG transport at $1-3/mcf, CO2 pipelines at $5/ton/100km, liquefied CO2 shipping at $8/ton/1,000km, CO2 disposal at $20/ton, hydrogen blending, hydrogen transportation, hydrogen storage at $2.5/kg. Underlying components include storage tanks, pumps and compressors.

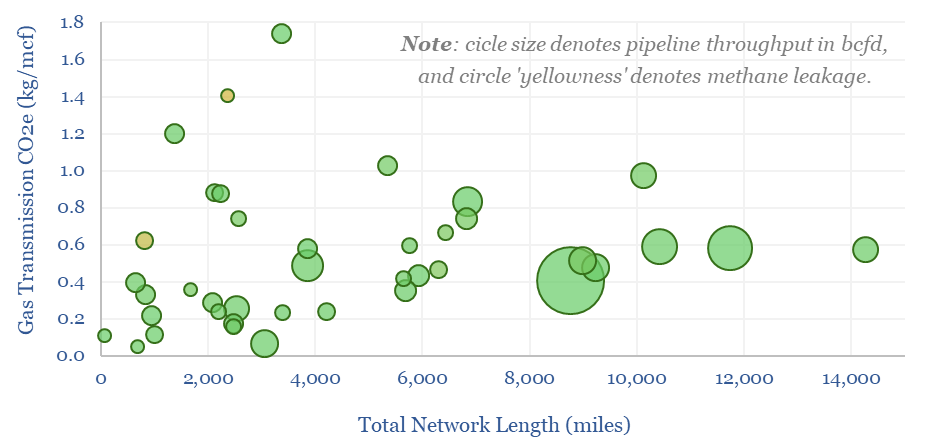

(9) Mitigating methane leaks remains a crucial priority, especially in gas gathering lines. The best opportunities are captured in our report on mitigating methane leaks and by building our more midstream infrastructure to reduce flaring, where as much as 8% of the methane may slip through the flares uncombusted.

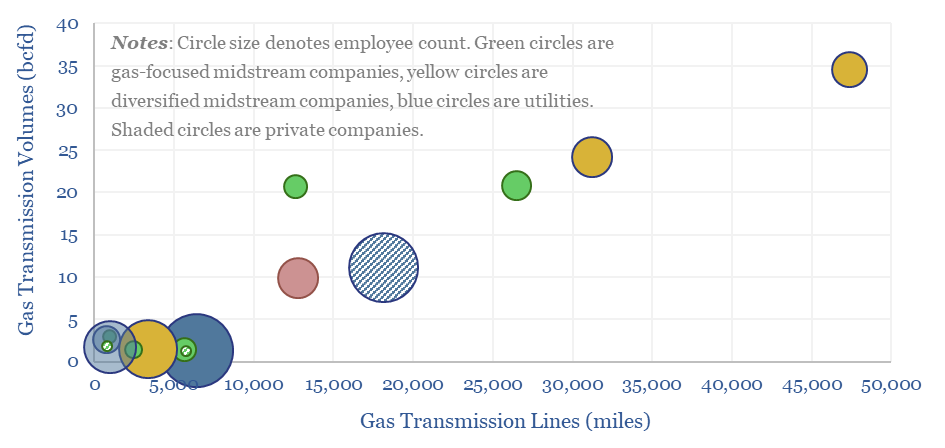

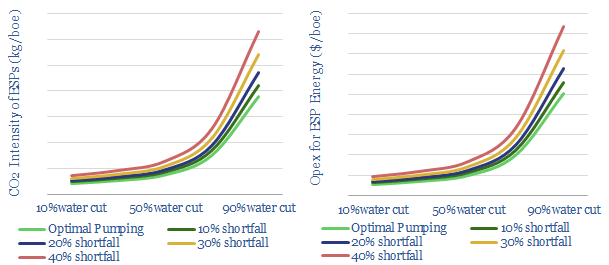

(10) Midstream companies are screened in our work. This includes companies in US gas transmission and gas marketing, and a dozen LNG vessel owners. Gas gathering and processing emits 18 kg/boe of CO2e, across 20 major companies in gas gathering. Downstream gas distribution leaks 0.2% of methane sold, ranked across 15 major companies in gas distribution. We have also screened companies in pipeline technology and flaring reduction technologies.