This model captures the costs of liquefied CO2 carriers, i.e., a large-scale marine vessel, carrying CO2 at -50ºC temperature and 6-10 bar of pressure, as part of a CCS value chain. A good rule of thumb is seaborne CO2 shipping costs are $8/ton/1,000-miles, as a total shipping rate of $100k/day must cover the capex of a c$150M newbuild tanker.

Could the LNG industry decarbonize by shipping LNG to gas consumers, then shipping the resultant CO2 away? We recently explored this concept in a detailed research note.

This work envisaged using the same vessel to transport LNG in and CO2 away. It required building new, dedicated, dual-purpose vessels, with ‘Type C’ containment (i.e., they would need to be capable of withstanding 8-10 bar pressures of liquefied CO2, whereas by contrast, today’s fleet of LNG vessels are ‘Type B’, and are not designed to hold pressurized gases).

Using the same vessel? The great advantage is that an LNG tanker is already making a deadhead journey back to the liquefaction facility, thus incremental transportation costs may be as little as $1.3/mcfe and total CO2 abatement costs as little as $100/ton. The great disadvantage is logistical risk and inflexibility. Swapping CO2 and LNG cargoes is do-able but annoying. It also limits the vessel to operating in ‘shuttle mode’ (i.e., no real flexibility to divert cargoes). And dual-purpose ships can end up as jack of both trades, master of neither.

Liquefied CO2 carriers could harness many of the same benefits, decarbonizing LNG in geographies with no nearby CO2 disposal reservoirs; while sharing marine infrastructure with an LNG regas facility; and using the cold stream from re-gassing LNG (at -160C) to chill and liquefy CO2 (-50C). But dedicated CO2 carriers could also be optimized for CO2. And this configuration also imparts more flexibility to the LNG carriers and CO2 carriers.

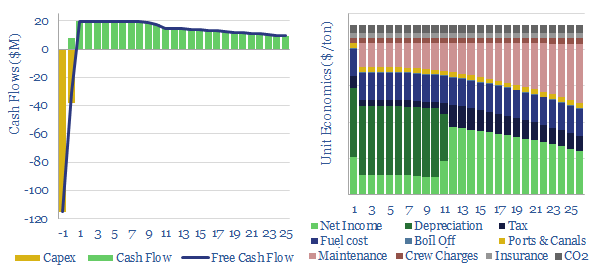

This data-file captures the costs of liquefied CO2 carriers. A $100k/day total shipping cost is required to recoup the capex on a $150M CO2 carrier vessel, and generate a 10% IRR. Costs are broken down in the file, including 20 different capex estimates for large, liquefied CO2 carriers (in $M, m3 and ktons).

In our base case, the total abatement costs likely end up c$25/ton higher using dedicated CO2 carriers versus back-carrying liquefied CO2 in an LNG carrier (at an apples-to-apples transportation distance around 5,000 miles). However, the higher base case costs may be diluted by lower risk, higher flexibility, and the ability to find CO2 disposal closer-by.

Costs are most sensitive to shipping distances. Shipping liquefied CO2 might cost $8/ton within 1,000-miles (i.e., intra basin), rising to c$50/ton at 6,000 miles (trans-Atlantic). Overall, we think liquefied CO2 carriers can be part of decarbonized value chains with total CO2 abatement costs around $100-125/ton, using bridges from our broader CCS research.

A challenge remains in regulation. Carbon markets or CO2 disposal incentives in developed world countries do not currently allow for cross-border transport of CO2. And it will be important to ensure that each ton of CO2 loaded onto a liquefied CO2 carrier is properly sequestered in a well-run CO2 disposal facility.

Another debate is over the size of the CO2 carriers. Today’s CO2 carriers are mostly around 10,000m3 (11kT of CO2e), and within a range of 5,000-30,000 m3. Larger vessels will be more economical. Ideally over 50,000m3. You can stress-test vessel size in the model.

Overall, we do think there is a growing opportunity for the LNG industry to develop decarbonized value chains, using CCS and nature-based solutions. Best placed to capture the opportunity are companies with existing experience in LNG, and LNG shipping. Economics of CO2 shipping in this data-file can also be compared with LNG shipping.