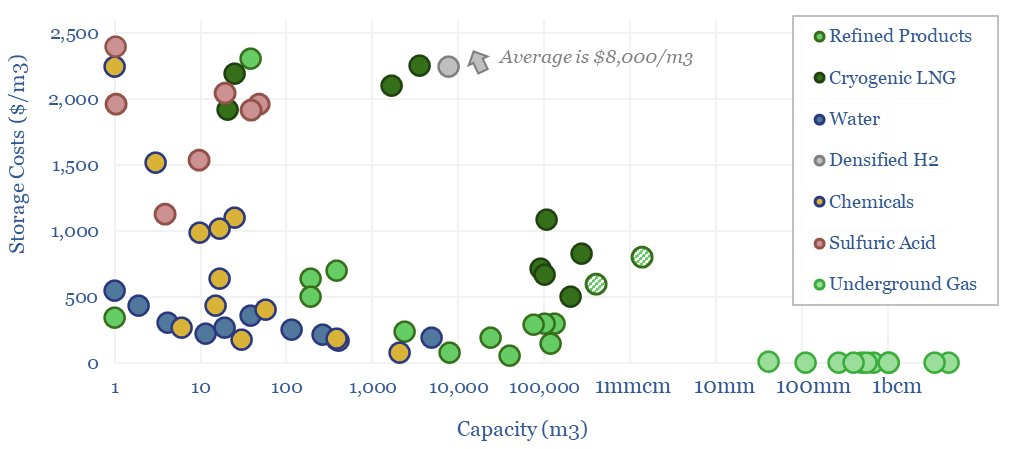

Storage tank costs are tabulated in this data-file, averaging $100-300/m3 for storage systems of 10-10,000 m3 capacity. Costs are 2-10x higher for corrosive chemicals, cryogenic storage, or very large/small storage facilities. Some rules of thumb are outlined below with underlying data available in the Excel.

This data-file tabulates 80 data-points into the costs of storage tanks for water, oil products, chemicals, LNG, natural gas and hydrogen. In both $/m3 terms and $/ton terms.

This matters as storage tanks are used in downstream industry, materials value chains, and in several types of new energies such as redox flow batteries or pumped hydro.

We also think that some industrial facilities may be able to benefit from increasingly volatile power prices, amidst the build out of renewables, by demand shifting, which means timing their electrical loads to the times when renewables are generating. In some cases, this requires increasing the sizes of storage tanks to increase flexibility.

Volatility is also growing in the global energy system, which may allow owners of midstream infrastructure to generate excess returns in years of deep shortages, per our overview of energy market volatility.

A good rule of thumb is that the storage tank costs for storing fluid commodities will average around $100-300/m3 of capacity, at capacities of 10m3 to 10,000 m3, for relatively simple and non-hazardous commodities such as water and fuel.

Generally tank costs fall (in $/m3 terms) as tank capacities rise. Bigger tanks benefit from economies of scale, and this is visible in the chart above for all categories. Although some mega-sized terminals re-inflate.

Costs are typically 3-5x higher for corrosive chemicals that can require double tanks, stainless steel or specialized tank linings. Maybe $1,000/ton is fair here.

Costs are also typically 3-5x higher for storing cryogenic liquids, which can require specialized nickel steel and insulation.

Costs are also 2-3x higher for very small tanks (below 10m3, lacking economies of scale) or very large tanks (on the magnitude of 100,000m3, so large that they need to be stick-built rather than simply purchased as finished modular units).

LNG storage tanks thus come in as some of the most expensive storage facilities in the data-file, because they are very large and cryogenic. Higher capex may be worthwhile to install higher grade tanks that minimize boil-off and improve energy efficiency.

Large-scale hydrogen storage would likely be higher cost than LNG storage, in our view, and the median small-scale facility for cryogenic or ultra-compressed hydrogen storage is estimated to cost $8,000/m3. Please see our hydrogen storage model and broader hydrogen research.

Storage costs are lowest for underground gas storage, with a median $0.4/m3 of storage capacity. The key reason is scale. The average facility in our database can store over 1bcm of gas.

Methodology. Mainly we have aimed to capture tank costs in the data-file, while excluding the costs of their foundations, pumps, valves and installation; but the lines get a little bit blurry, especially for some of the very large tanks.

Context matters. Some of the data-points are supplier quotes, some are estimates for technical papers, and some are disclosed data-points from specific projects. Please download the data-file for the additional context.