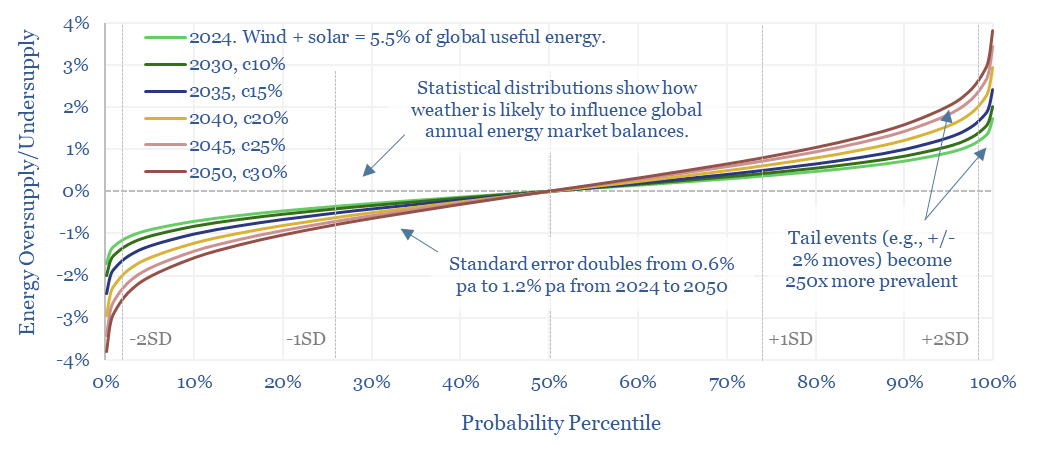

This 14-page note predicts a staggering increase in global energy market volatility, which doubles by 2050, while extreme events that sway energy balances by +/- 2% will become 250x more frequent. A key reason is that the annual output from wind, solar and hydro all vary by +/- 3-5% each year, while wind and solar will ramp from 5.5% to 30% of all global energy. Rising volatility can be a kingmaker for midstream companies and others?

Renewable resources have the advantage of harnessing energy that was there all along, in the form of hydro, wind and solar. Water was already flowing. The wind was already blowing. The sun was already shining.

Renewables do however have the disadvantage of volatile timing. It is not possible to control when it rains, when the sun shines, or when the wind blows. Hence what implications for global energy market volatility, as wind and solar ramp to 30% of useful global energy by 2050?

The volatility of renewables generation is quantified asset-by-asset, country-by-country and globally in this report (database here). Detailed numbers are given for the annual volatility of hydro (page 3), volatility of wind (page 4) and volatility of solar (page 5).

The volatility of today’s incumbent energy sources is 70% lower than for new energies, across global oil production and global gas production, and even this is more a case of voluntarity than volatility (page 6).

Energy demand is also volatile, varying with weather, which impacts variables such as heating degree days, as quantified on page 7.

Random variable statistics can thus be used to predict how mere weather will affect global energy balances, looking out into the future, with differing shares of renewables, on a global basis (pages 9-10), in individual nations (page 11) and for individual asset-owners that may wish to disconnect from the grid and self-generate (page 12).

The numbers are staggering. They risk turning energy analysts into weather forecasters, and have profound implications for national security.

Could midstream companies be the primary beneficiary of rising volatility in the global energy system? Especially in the US, we see natural gas buffering the volatility, and have screened gas transmission and storage infrastructure (pages 13-14).

A strange feature of short-term energy commentary is that spot prices are always over-extrapolated. High prices ‘confirm’ a persistent era of energy shortages. While low prices ‘confirm’ the imminent demise of all hydrocarbons!! Hence we must also brace for the possibility that market multiples will become more volatile on mere weather.