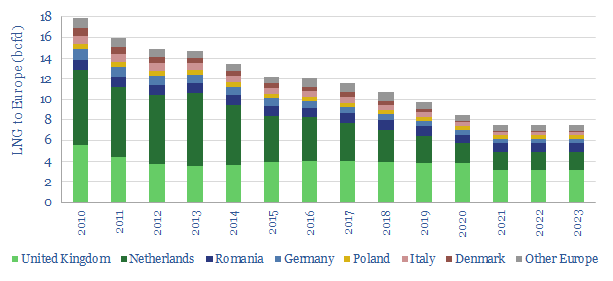

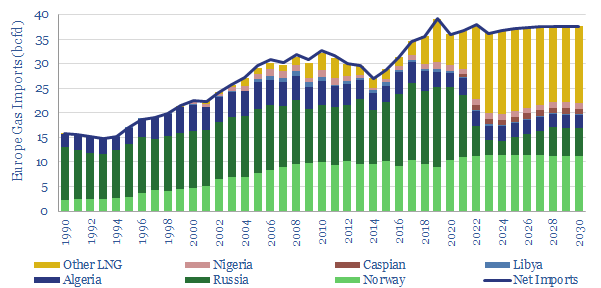

This data-file is our European gas supply-demand model. Balances are assessed in European gas and power markets from 1990 to 2030, reflecting all of our research into the energy transition. 2023-24 gas markets will look better-supplied than they truly are. We think Europe will need to source over 15bcfd of LNG through 2030. A dozen key input variables can be stress-tested in the data-file.

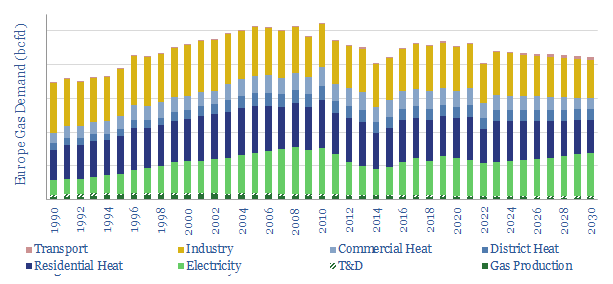

Europe’s gas demand averaged 45bcfd in the decade from 2012 to 2021, of which c30% was consumed in industry, c30% in residential heating, c10% in commercial heating, c25% in electricity generation, and smaller quantities in T&D and transportation (chart below). Gas demand is disaggregated across a dozen different industries in the data-file.

European gas demand fell back below 40bcfd in 2022. We think that one half of the decline can be attributed to a particularly warm winter, and will naturally come back with more normal winter weather. And total demand will run sideways through 2030.

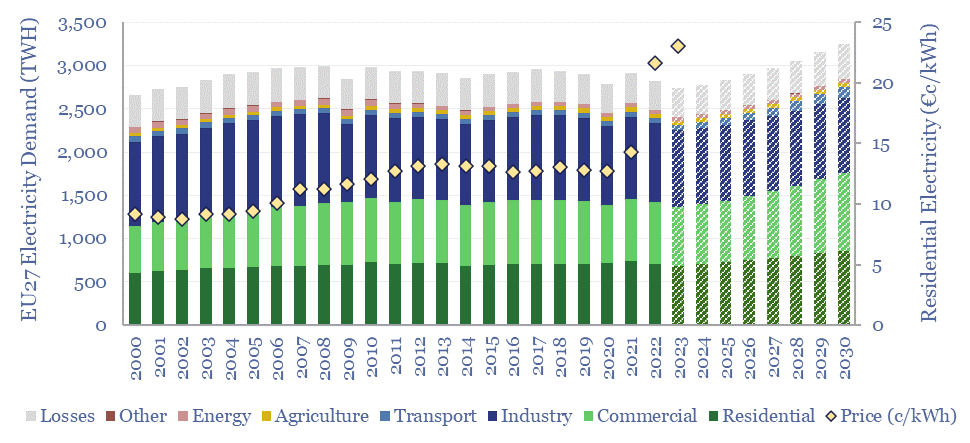

Gas demand in the European power market is actually seen rising from 11bcfd in 2021 to 12bcfd by 2030, as the electrification of heat and vehicles raise overall demand, while decarbonization ambitions are also likely to phase down 2.5x more CO2 intensive coal (chart below).

Europe’s indigenous gas supply looks increasingly pathetic. We likely fell below 7bcfd of domestic gas production in 2023, down from a peak of 24bcfd, 20-years ago. Even amidst the supply disruptions of 2022, there is no sign yet that Europe is seriously considering long-term supply growth. Although there is vast potential in European shale.

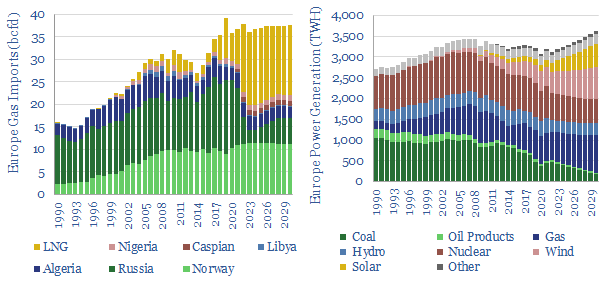

Europe has doubled its reliance on imports over the past 20-30 years, rising from a 40-45% share of final demand in 1990-2004, to an 80-85% share in 2021-25. Thank god for Norway, which is also the cleanest and lowest carbon gas in the world.

Recently, Russian supplies have collapsed, while our outlook sees a large pull on global LNG through 2030. We think this will support LNG prices.

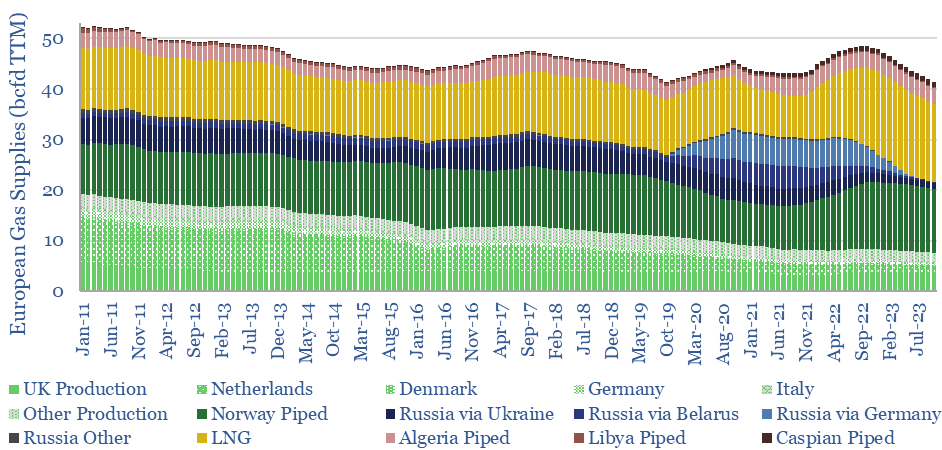

The data file also contains granular data, decomposing gas demand across 8 major categories, plus 13 industrial segments, going back to 1990 (albeit some of the latest data-points are lagged); as well as 15 different supply sources, with monthly data going back a decade (chart below).

All models are wrong, but some models are useful. Hence variables that can be flexed in the model, for stress-testing purposes, include the growth rates of renewables (wind and solar), the rise of electric vehicles, the rise of heat pumps, the phase-out of coal and nuclear, industrial activity, efficiency gains, LNG and hydrogen.

Please download the model to run your own scenarios. Our numbers have changed since the publication of our latest outlook for European natural gas, but if anything, we see the same trends playing out even moreso.