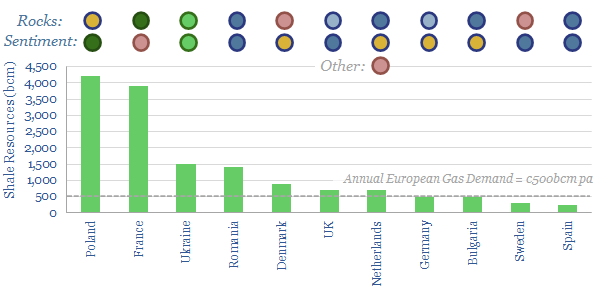

Overview of European shale. Europe has 15 TCM of technically recoverable shale gas resources according to an assessment from the EIA in 2013, which remains the best overview, almost ten years later. This data-file simply aims to provide a helpful overview of the different countries’ rocks and above-ground challenges, tabulating the main formations, TOCs, depths, thicknesses, clay contents and exploration history.

Our first conclusion is how much the world has changed since the early days of European shale exploration, a decade ago, including ten years’ proof that US shale has not caused an entire continent to die a mysterious death. Indeed, US industry, has seemed to gain a mysterious new life. While Europe is now so short of energy that we may need to scale our industry back at a time when we would rather be re-shoring strategic supply chains).

While Europe is now trying to import vast amounts of US shale gas to Europe as LNG (note here), another complementary option, we think is to re-visit the possibilities of European shale; especially in Eastern Europe, which has large, high-quality shale resources, high continued reliance on coal (Poland, Bulgaria) and a growing desire to avoid Russian reliance.

Ukraine has the best shale resources in all of Europe: 4.5% TOC, 1.15% maturity (gas window), low clay and moderate over-pressure. Shell tested these rocks and obtained results good enough to sign a $10bn development agreement that could ramp output up to 20bcm per year. At the time, Ukrainian politicians stated the country could ultimately run a “gas surplus”. This was 2013. Just before Russia’s first invasion. And this Continent-leading Dniepr-Donets shale resource lies in the East of the country, bounded by Kharkiv and Donetsk, near to the current fighting. Which may or may not be a coincidence.

It is difficult to know to what extent Russia fomented broader opposition to European shale. Some of the hysteria seems almost farcical in retrospect. In Romania, in 2013, as Chevron signed an exploration contract, one town saw the largest protest in its entire history (16% of the population), as 8,000 people took to the streets with signs reading “Don’t kill our children”.

(We humbly submit that if you are writing this on a placard, you might not understand what shale gas involves. The simple goal is to produce energy safely, with 50-60% lower carbon than coal (note here) at a marginal cost of $1.5-2/mcf (model here)).

Other countries with good potential, held back only by sentiment are Romania, Germany, UK, Bulgaria and Spain. We remain more cautious on the potential in Sweden and Denmark (the Alum has expelled its gas), Netherlands (population density), Poland (clay makes the rock harder to fracture) and France (continuing to rely on nuclear is its best low-carbon option).

To read more about our overview of European shale, please see our article here.