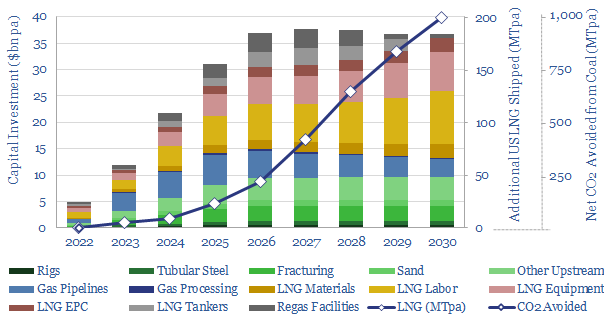

Perceptions in the energy transition are likely to change in 2022, amidst energy shortages, inflation and geopolitical discord. The biggest change will be a re-prioritization of US LNG. At a $7.5/mcf delivered price, there is 200MTpa of upside by 2030, which could also abate 1GTpa of global CO2. This 15-page note outlines our reasoning and conclusions.

Pragmatic solutions are increasingly needed in the energy transition, in order to avoid painful energy shortages, double-digit inflation and geopolitical discord. We review each of these challenges on pages (2-6), concluding that a 50-60% decarbonization solution (i.e., LNG) is increasingly going to seem better than no solution.

Meanwhile, on the other side of the Atlantic Ocean, there is an industry with the capability to supply 200MTpa of incremental gas to Europe (26bcfd), flexibly, for a competitive price point of $7.5/mcf, ramping up in the late-2020s. We outline the economics on pages 7-8.

The CO2 credentials are for 50-60% lower CO2 per unit of delivered energy versus coal. Each MTpa of LNG avoids around 5MTpa of net CO2 emissions. And we expect most of the LNG will be ‘Clear LNG’ with no embedded Scope 1&2 emissions (page 9).

The challenges and bottlenecks for achieving this US LNG ramp are addressed on page 10-14, again integrating across our models. The capex, materials, labor and land bottlenecks are all at least 95% less demanding than an equivalent energy ramp from ‘renewables only’.

Our conclusions are spelled out on page 15, ending with a discussion of ‘who benefits’ from the theme.

Further research. Our outlook on 300 offtake contracts across the global LNG industry is linked here.