Natural Gas

-

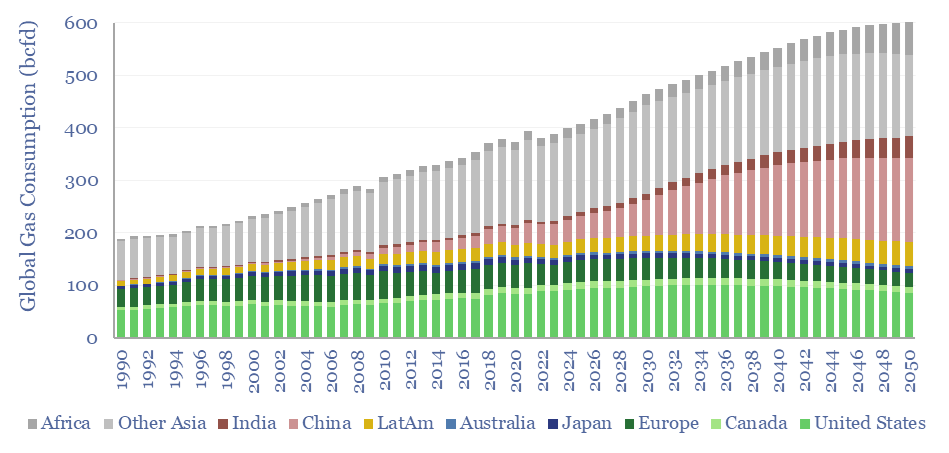

Global gas supply-demand in energy transition?

Global gas supply-demand is predicted to rise from 400bcfd in 2023 to 600bcfd by 2050, in our outlook, while achieving net zero would require ramping gas even further to 800bcfd, as a complement to wind, solar, nuclear and other low-carbon energy. This data-file quantifies global gas demand and supply by country.

-

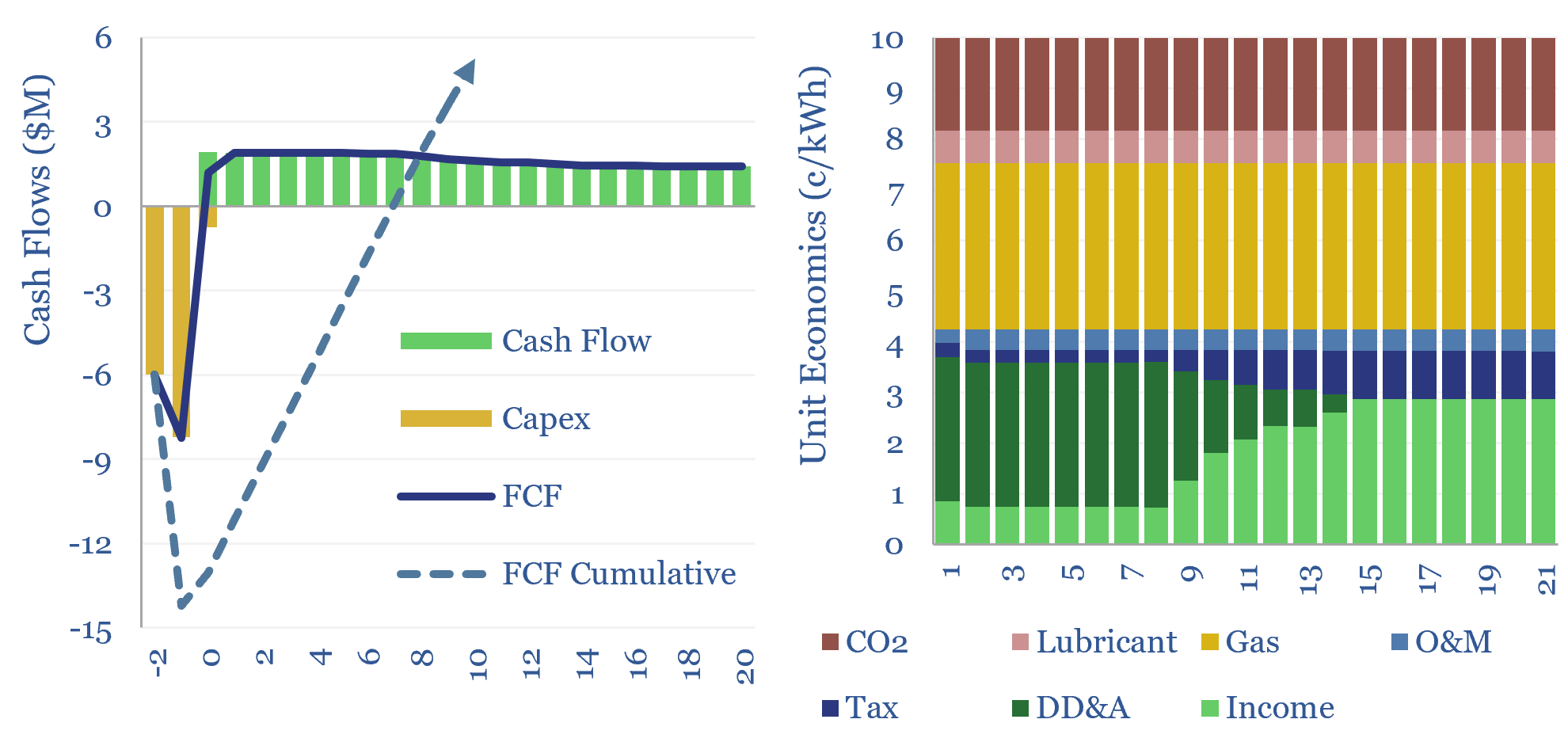

Reciprocating gas engines: levelized costs?

The economics costs of reciprocating gas engines are captured in this data-file. As a rule of thumb, a 5MW recip that costs $1,500/kW, runs with 60% utilization, and 40% efficiency, requires a 8-10c/kWh power price (or levelized cost) to generate a 10% IRR, depending on the CO2 price. Capex costs are derived from prior case…

-

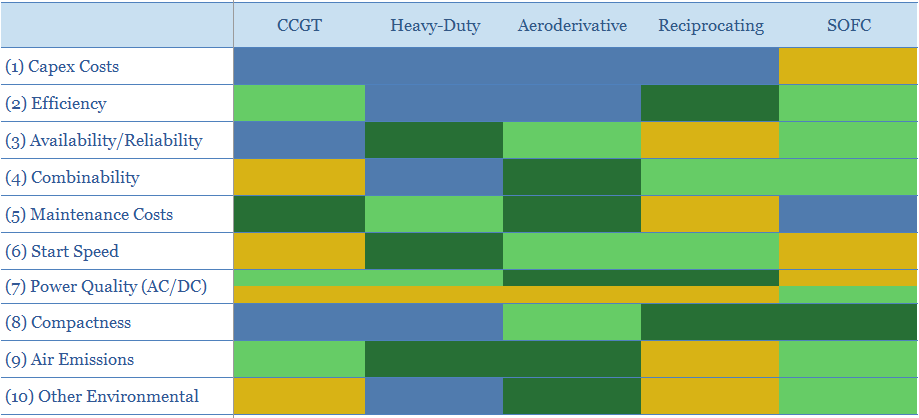

Gas generation: what kind of bear is best?

This 20-page report compares combined cycle gas turbines (CCGTs), heavy-duty gas turbines, aeroderivative gas turbines, reciprocating engines and solid oxide fuel cells (SOFCs), on ten dimensions. No one gas generation technology is best. But modular solutions may increasingly rival CCGTs, especially for energizing AI data-centers?

-

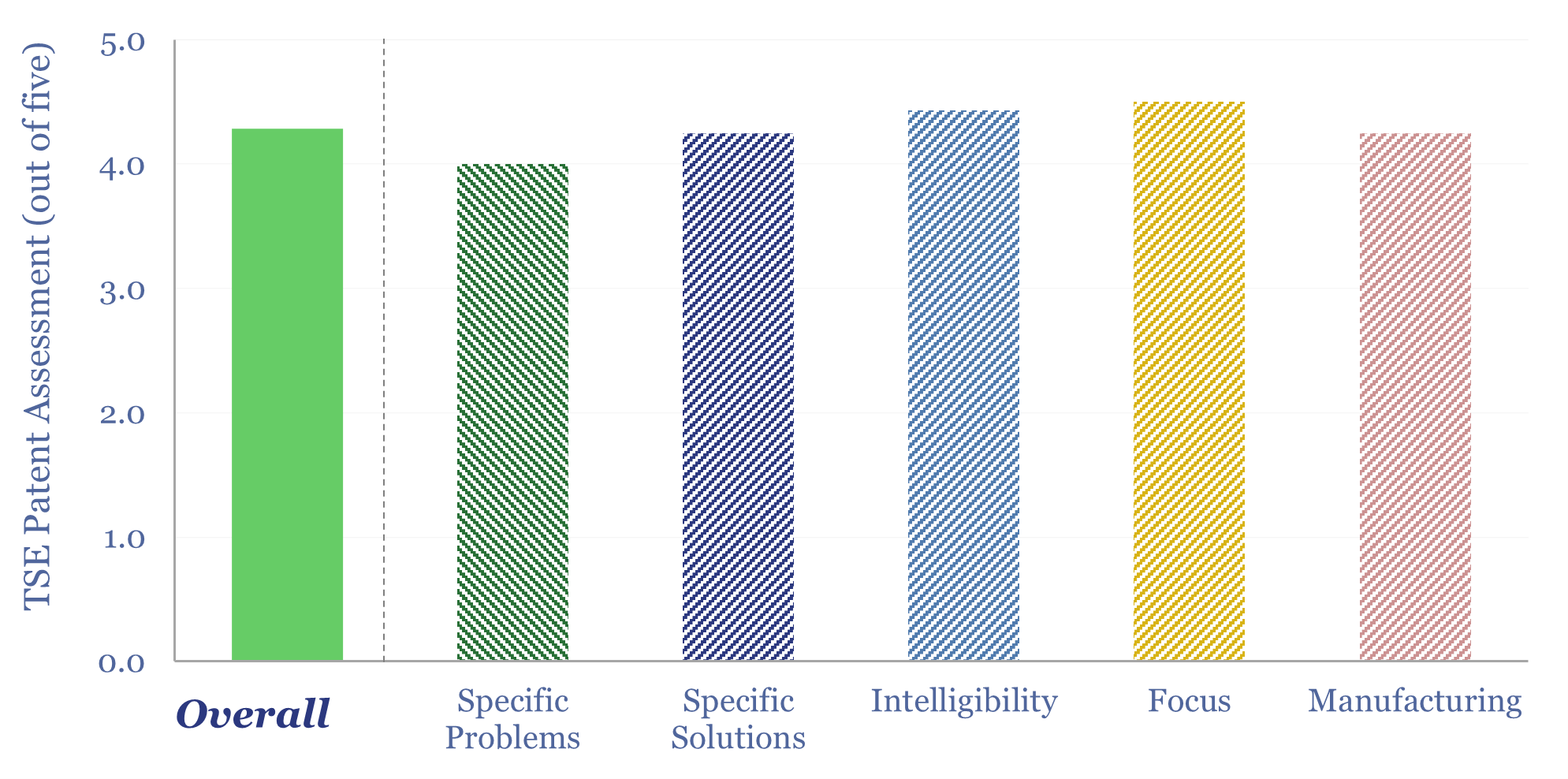

VoltaGrid: mobile micro-grid technology?

VoltaGrid has become the largest provider of mobile, natural gas reciprocating engines in the US, reaching GW-scale in 2025, in order to rapidly energize data centers, e-frac operations in shale, and other micro-grids in mining and industry amidst power grid bottlenecks. This data-file reviewed VoltaGrid’s mobile micro-grid technology and patents.

-

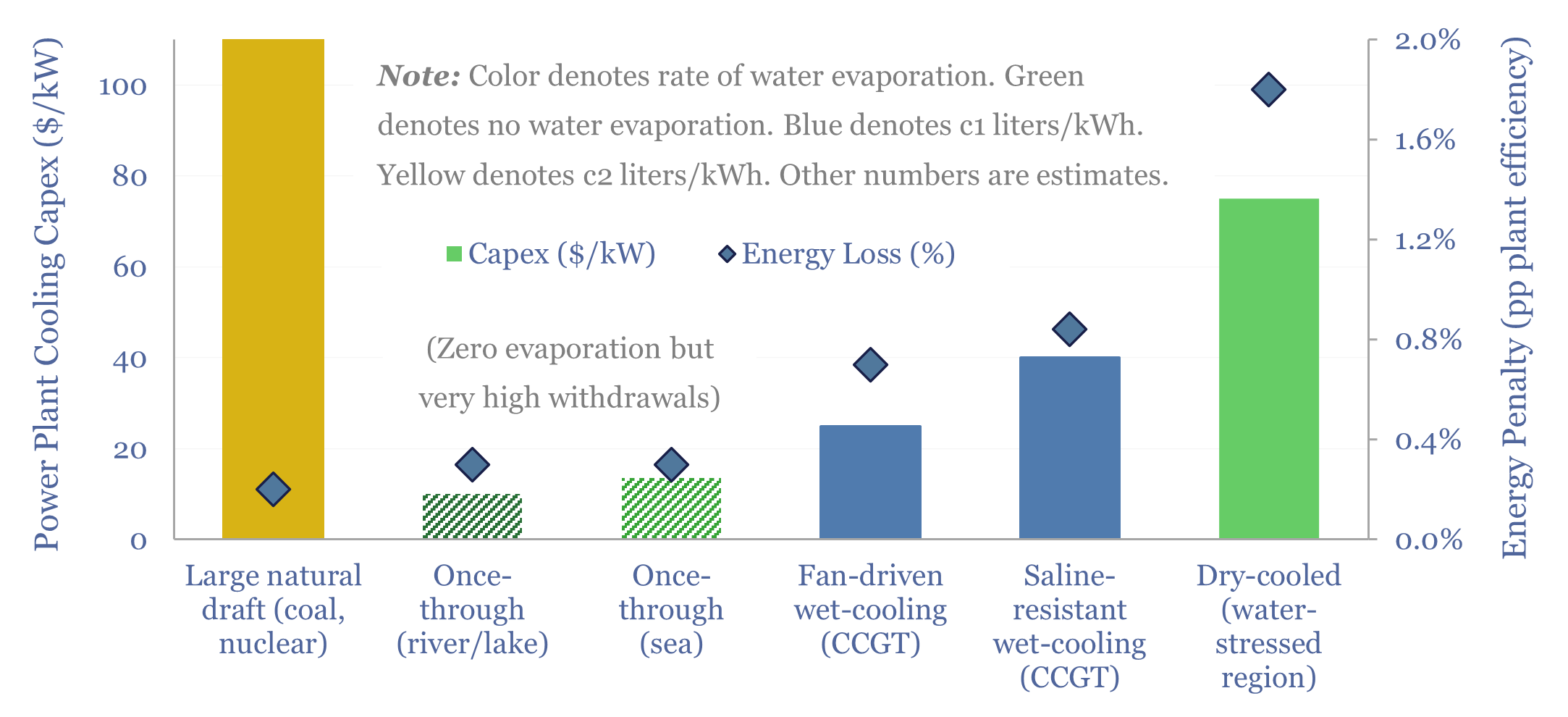

Power plant cooling: adapting for water scarcity?

Water is needed to condense steam, downstream of the steam turbines, in nuclear, coal and CCGT power plants. But thermal power demands and fresh water scarcity are both structurally rising. Hence this 16-page report explores how the energy industry might adapt, trends in power plant cooling, and who benefits.

-

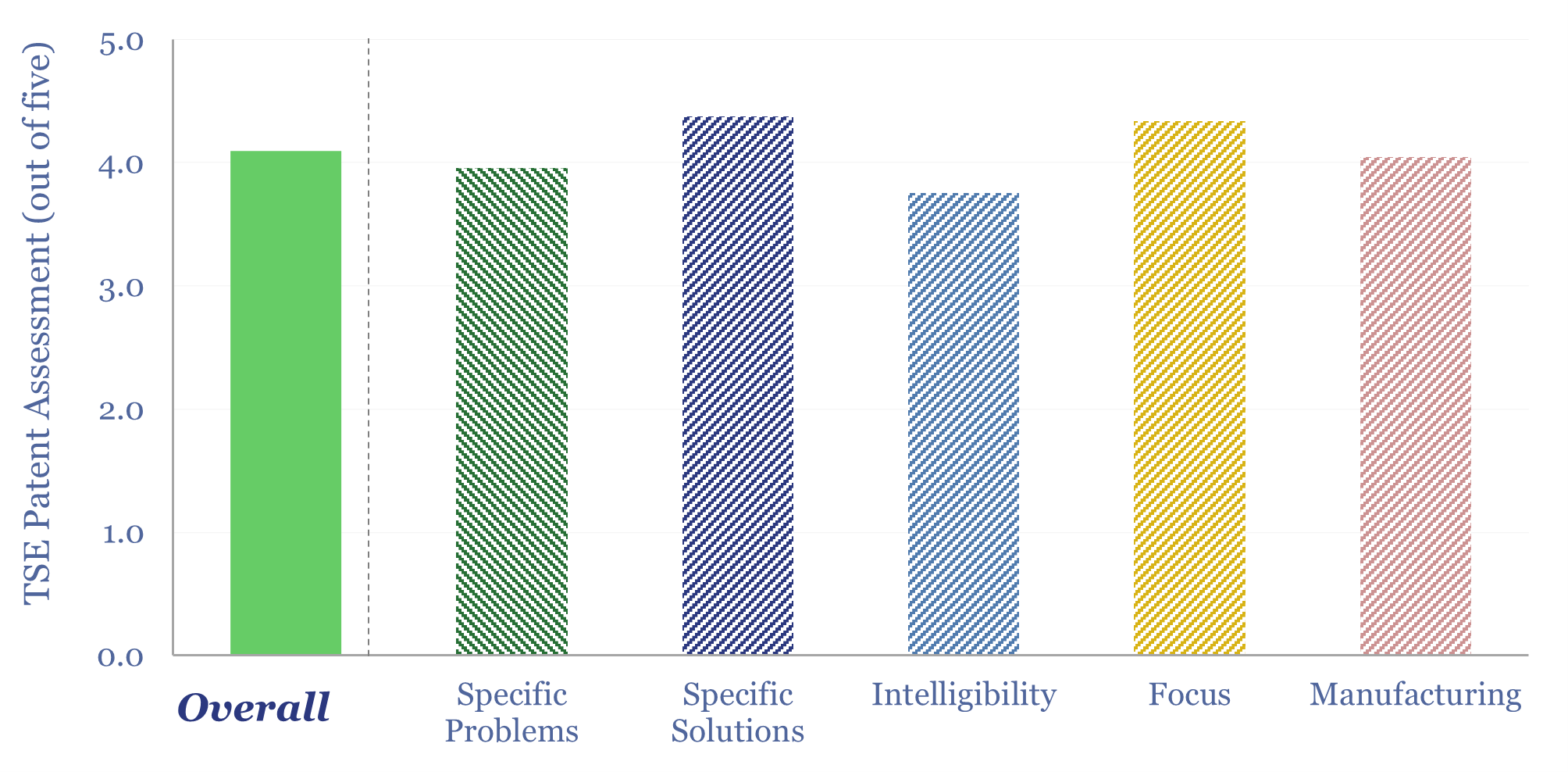

Doosan Enerbility: gas turbine technology?

Doosan Enerbility is a power plant manufacturer, headquartered in Korea, specializing in nuclear plant construction, gas plant construction, offshore wind, civil engineering and parts manuacturing. In this patent review, we assessed Doosan Enerbility gas turbine technology. We can de-risk its claims for a 43%-efficient simple-cycle turbine, 60%+ efficient CCGT, and 1,600ºC turbine inlet temperatures.

-

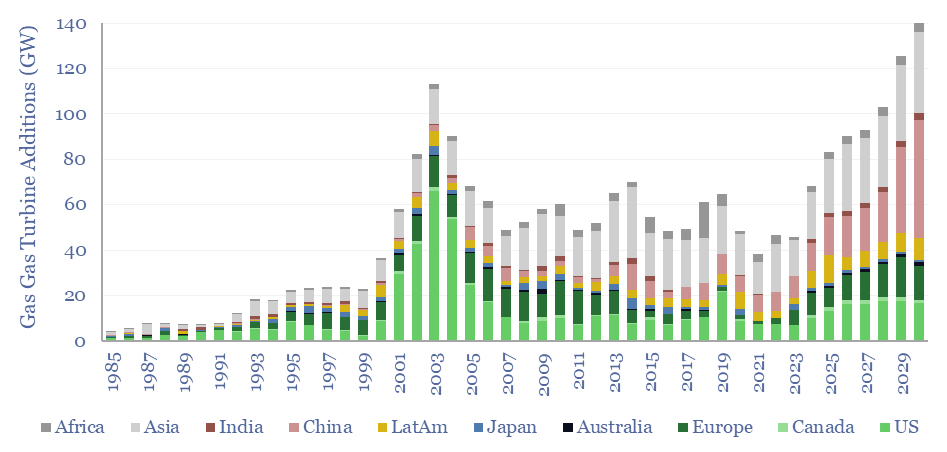

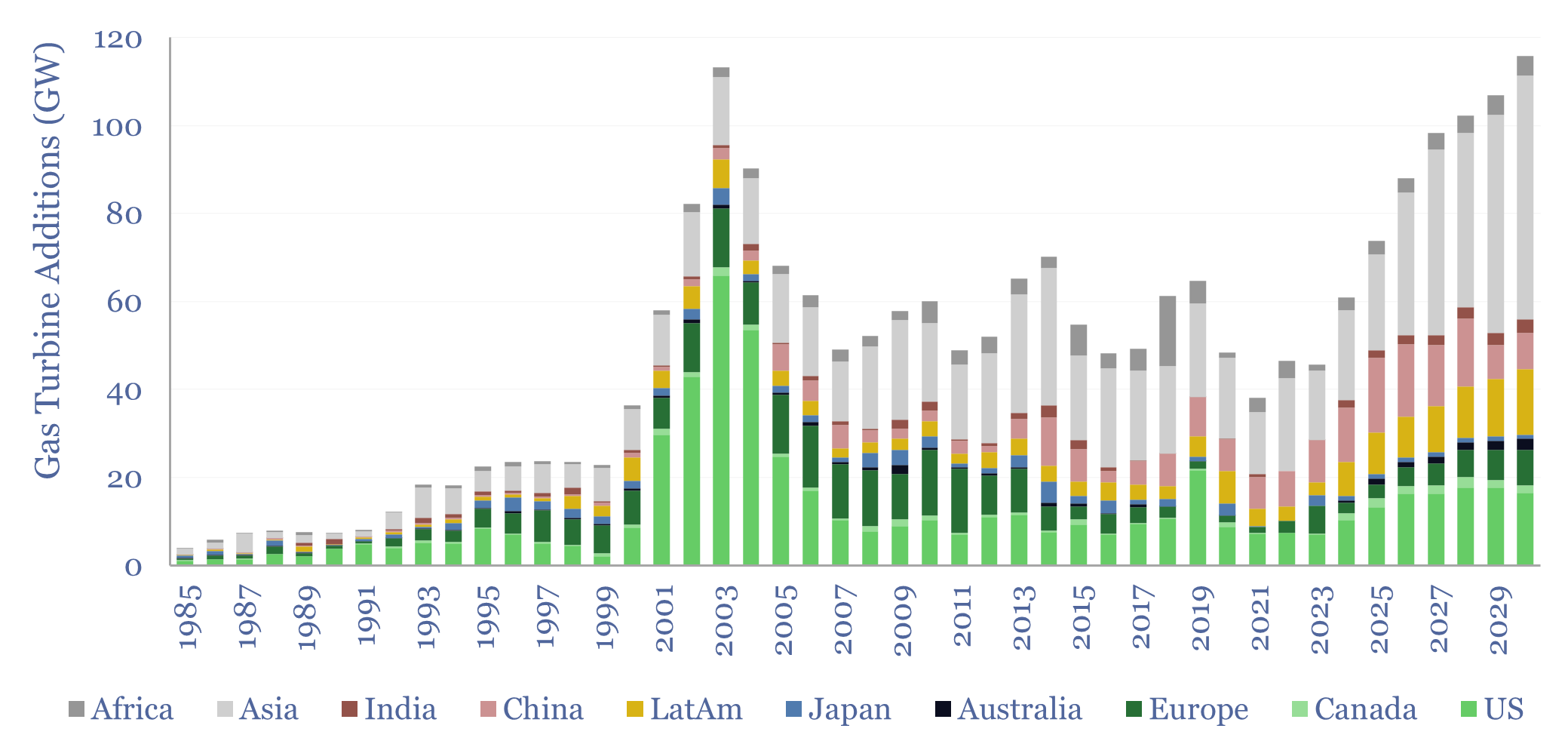

Gas turbines: what outlook in energy transition?

Gas turbines should be considered a key workhorse for a cleaner and more efficient global energy system. Installations will double to 100GW pa in 2024-30, and reach 140GW in 2030, surpassing their prior peak from 2003. This 16-page report outlines four key drivers in our outlook for gas turbines, and their implications.

-

Global gas turbines by region and over time?

Global gas turbine additions averaged 50 GW pa over the decade from 2015-2024, of which the US was 20%, Europe was 10%, Asia was 50%, LatAm was 10% and Africa was 10%. Yet global gas turbine additions could double to 100 GW pa in 2025-30. This data-file estimates global gas turbine capacity by region and…

-

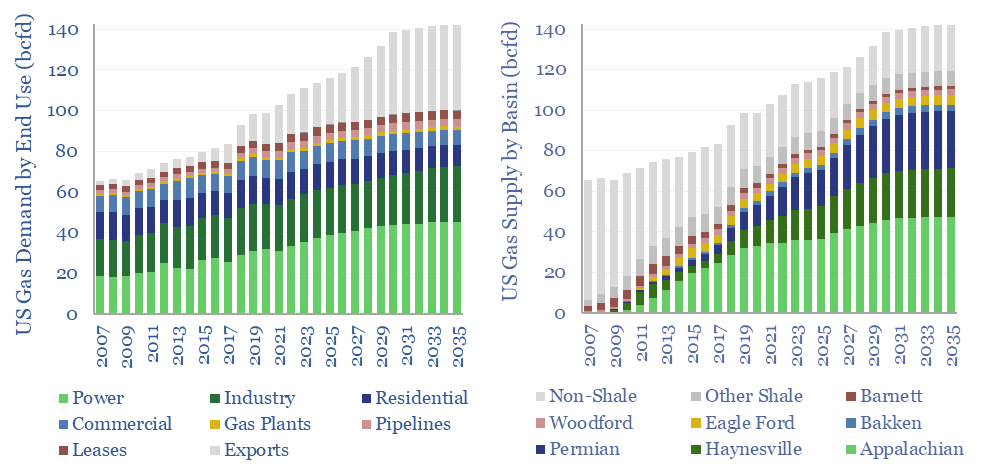

US natural gas: the stuff of dreams?

Modeling US gas supply and demand can be nightmarishly complex. Yet we have evaluated both, through 2035. This 13-page report outlines the largest drivers of demand, requires a +3% pa CAGR from the key US shale gas basins, and argues the balance of probability lies to the upside.

-

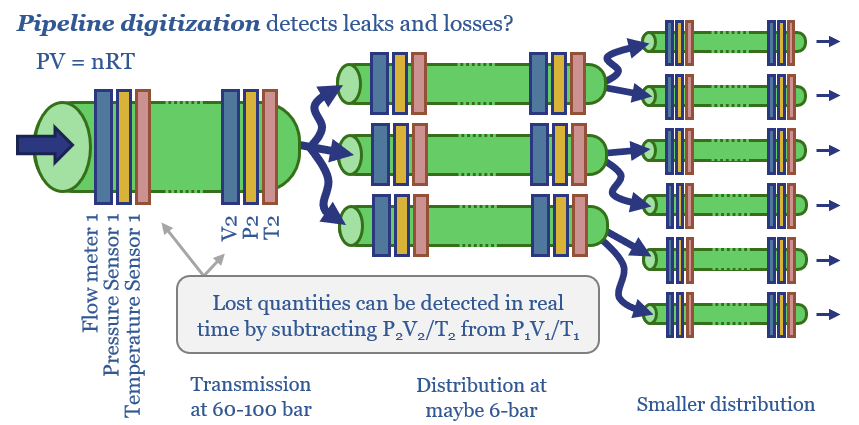

Seeing sense: digitize the downstream gas network?

Greater digitization of gas networks looks increasingly important, as gas, biogas, hydrogen and CCS all aim to shore up their futures. This 15-page note started as a deep-dive into the true leakage rates in downstream gas; and ended up finding opportunities in sensors and pipeline monitoring.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)