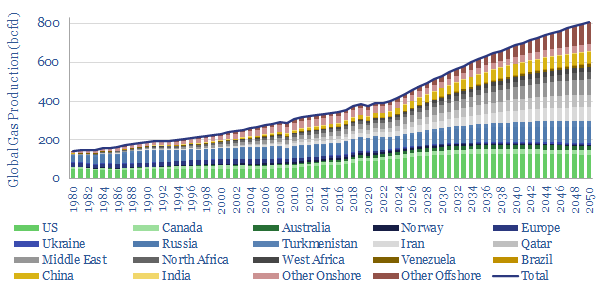

Our roadmap to ‘Net Zero’ requires doubling global gas production from 400bcfd to 800bcfd, as a complement to wind, solar, nuclear and other low-carbon energy. This data-file quantifies global gas production forecasts by country, what do you have to believe about global gas reserves, and is there enough gas?

Global gas production doubled in the c30 years from 1990-2019, rising at a 2.5% CAGR, which is the same trajectory that needs to be sustained to 2050 on our long-term energy market supply-demand balances.

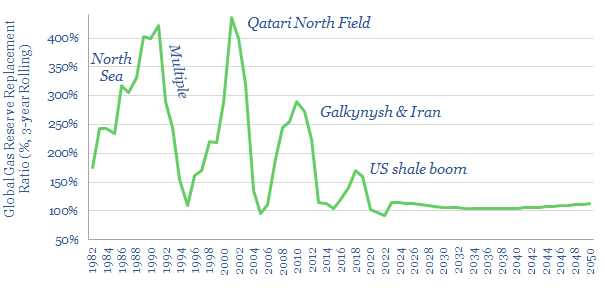

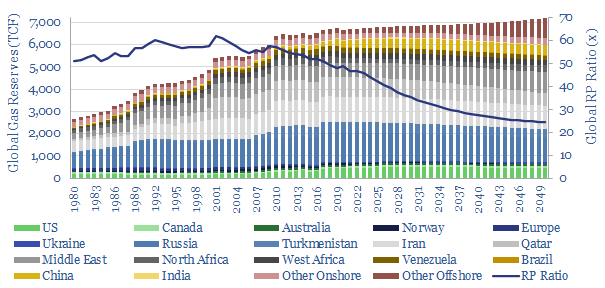

Amazingly, from 1990-2019, global gas reserves increased from 4,000 TCF to 7,000 TCF, for a reserve replacement ratio of 190%, although the numbers have been cyclical and have fallen below 100% in recent years (chart below).

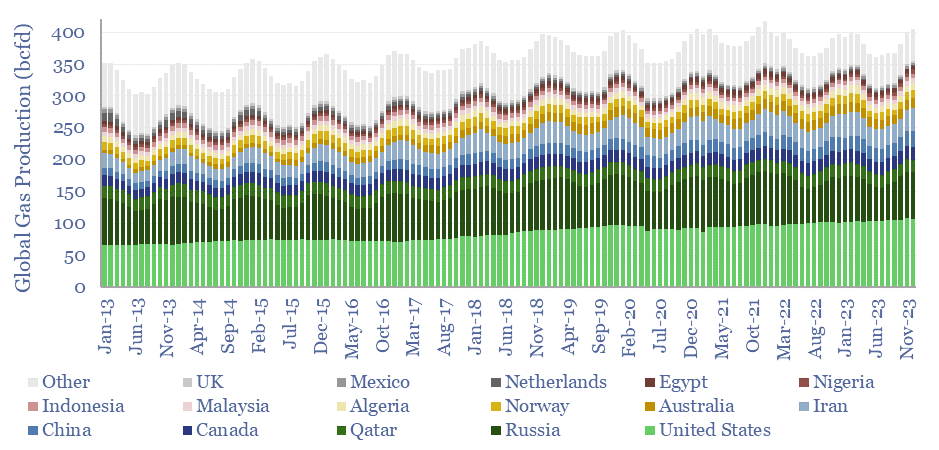

Another fascinating feature of gas markets is their flexibility, shown by plotting monthly gas production by country over time (chart below). In the Northern Hemisphere, production runs 6% higher than the annual average in December-January and 6% lower than average in June-August, as producers consciously flex their output to meet fluctuations in demand. Gas output does not show volatility, but voluntarity!

On our numbers through 2050, as part of the energy transition, a reserve replacement ratio of 107% is needed, while the ‘reserve life’ (RP ratio) will likely also decline from around 50-years today to 25-years in 2050. Please download the data-file for reserve numbers and production numbers by country.

Onshore resource extensions are seen primarily coming from shale, with continued upside in the US, and vast new potential in the Middle East, North Africa and possibly even European shale as a way of replacing Russian gas.

Another offshore cycle is also seen to be necessary, discovering and developing an average of 45 TCF of offshore resources each year in 2023-2050. These are big numbers, equivalent to discovering a large new gas basin (e.g., an “entire Mozambique of gas”) every 3-5 years.

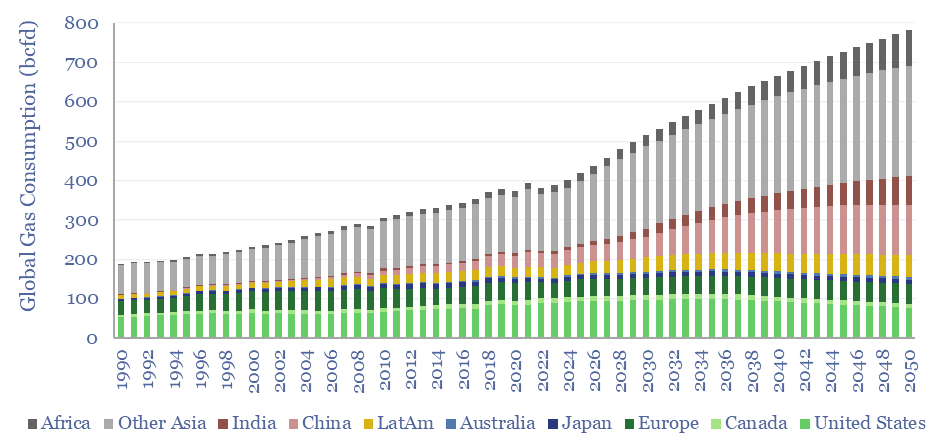

Global gas consumption by region and over time is also estimated in the data-file, flatlining at 150bcfd in the developed world, but rising by 2.5x in the emerging world, with the largest gains needed in India, Africa and China (chart below).

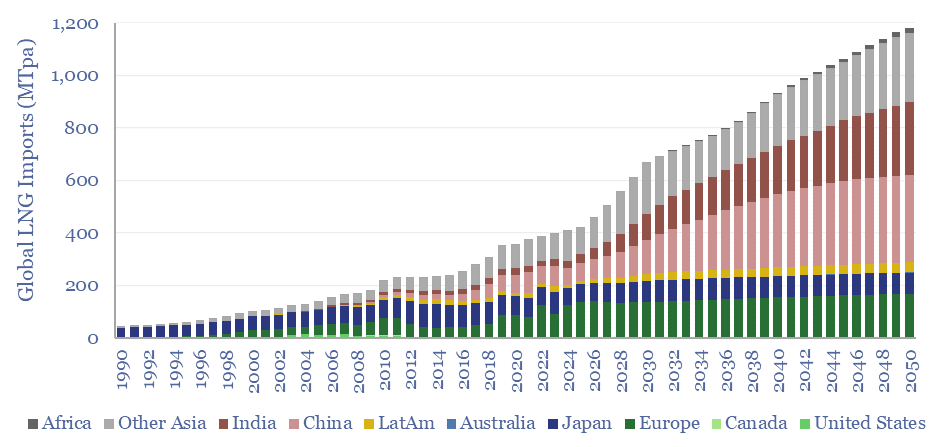

Global LNG demand would also need to treble to meet this ramp-up, linking to our model of global LNG supplies. Within today’s LNG market, 25% flows to Europe, 20% to Japan, and 55% to the emerging world. By 2050, the emerging world would be attracting 80% of global LNG cargoes, with the largest growth in China and India.

Our best guesses for how a doubling of global gas production might unfold is captured in this model of global gas forecasts by country/region. On the other hand, there is no guarantee that coal-to-gas switching will occur on the needed scale for global decarbonization, especially as 2023/24 has seen emerging world countries (India, China) ramping coal instead for energy security reasons.