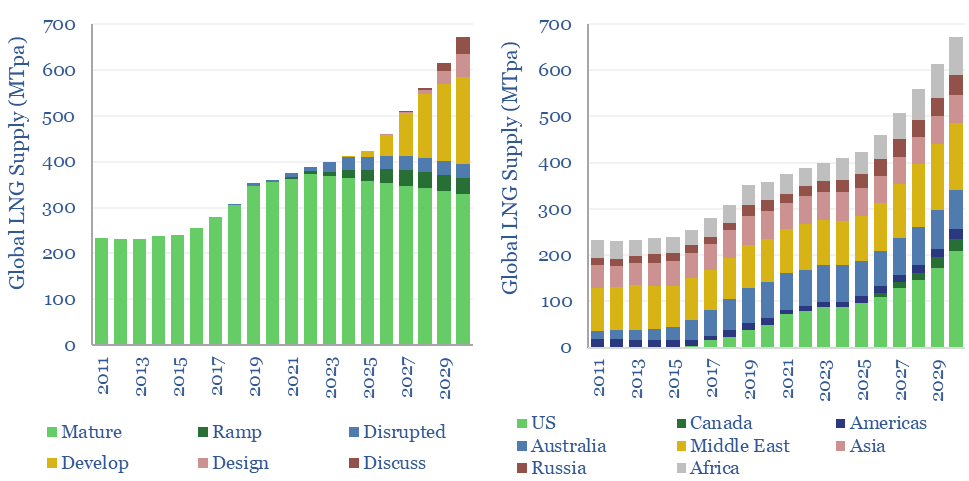

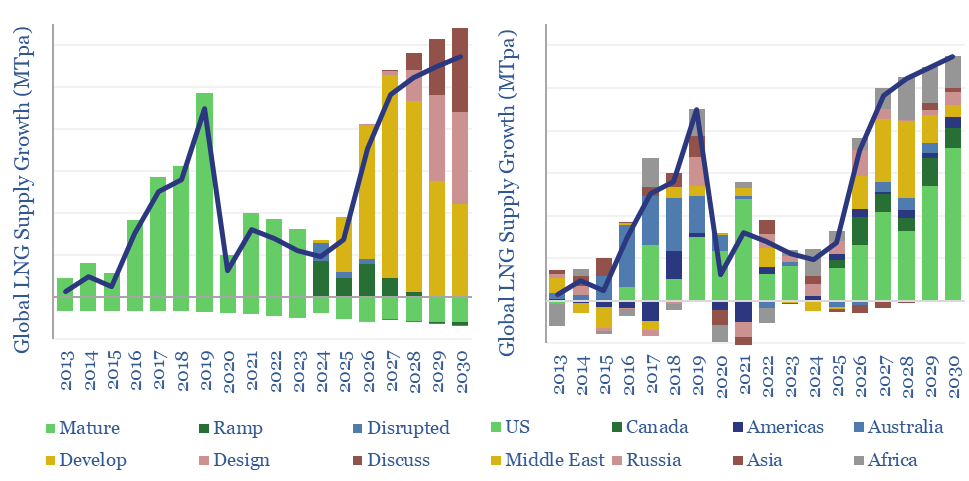

Global LNG output ran at 400MTpa in 2023. This model estimates global LNG production by facility across 140 LNG facilities. Our latest forecasts are that global LNG demand will rise at an 8% CAGR, to reach 670MTpa by 2030, for an absolute growth rate of +40MTpa per year, but the growth is back-end loaded.

Global LNG production in 2024 ran at 400MTpa, of which 22% was from the United States, 20% was from Qatar and 20% was from Australia, as the three largest producers. Over the past decade, global LNG production has risen at +17MTpa each year.

This data-file breaks down global LNG production by facility, across each of 140 LNG plants, assessing recent news flow, and then estimating their production in each year from 2018-2030. For pre-FID facilities, we ascribe a ‘risking factor’, according to their likelihood of being built.

LNG growth in 2024 and 2025 will each be lucky to reach +10MTpa of supply growth (charts above). The sources of the growth are visible in the data-file. But his is the time when the world is most in need of new gas supplies, especially to alleviate Europe’s gas shortages.

The cavalry arrives in 2026-2030, with the potential for 40-55MTpa of LNG supply growth each year in this time frame (charts above). 50MTpa of the 2026-28 supply growth is from Qatar’s North Field expansion. 20MTpa is from new LNG in Canada.

There is still risk around these projects. Development projects have a habit of sliding to the right, even versus our ‘risked’ forecasts. In our early-2024 model update, for example, we noted 6 final investment decisions, but also 18 projects that were delayed; while we also added 9 new projects to the data-file, but marked 17 past projects as cancelled.

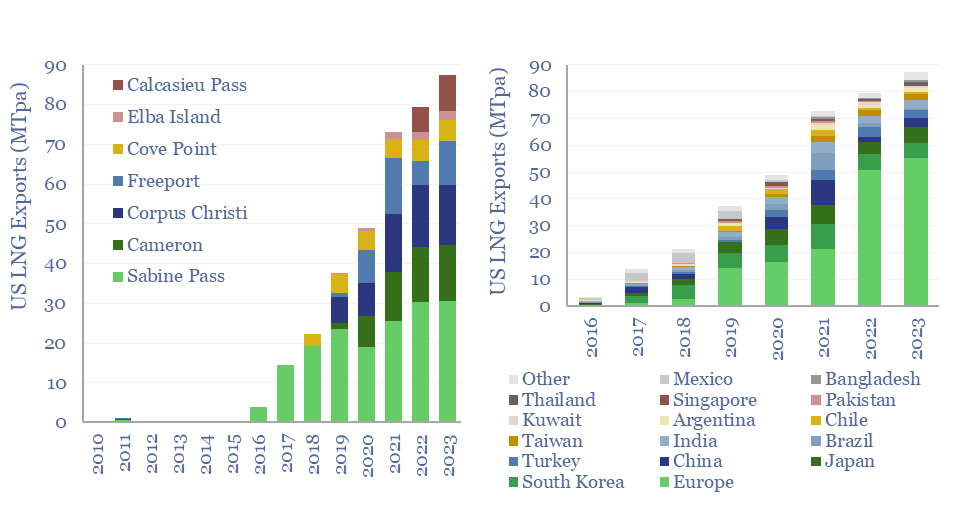

US LNG exports are still seen ramping up to over 200MTpa by 2030, up from 90MTpa in 2023, and despite a recent moratorium on non-FTA approvals from the Biden administration in 2024. This is because 90MTpa of US LNG is already under development. We do see risk to pre-FID US LNG projects, especially as blue hydrogen value chains in the US increasingly compete for the same gas. US LNG exports by facility and by destination are also tabulated in the data-file (charts below).

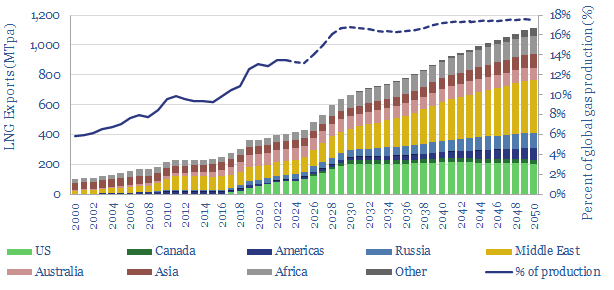

Looking out longer term, we see potential for the global LNG industry to reach 1,100MTpa by 2050 as part of the energy transition. This would take LNG from 10% of global gas a decade ago, through 13.5% of global gas in 2023, and 17% of global gas in 2030-50.

One of the biggest risks for global energy security, in our view, is paralysis in progressing pre- and post-FID LNG projects. In turn, this hands upside to incumbent LNG producers. We also see upside for spot cargoes in a world that is persistently under-supplied with energy yet remains overly cautious of signing long-term contracts.

Global LNG production by facility: model mechanics. This data-file of global LNG supplies works by assigning a “risking level” to each upcoming project. You can flex the output in the ProjectByProject tab to stress test “firm” supplies, various risking levels, and a “best case” production scenario. As a historical record, we have also ‘frozen’ all of our forecasts from 2022 and 2023 in the dark grey tabs. The main database covers our supply forecasts across 140 LNG facilities and projects, other project parameters, and detailed notes.