Blue hydrogen value chains are starting to boom in the US, as they are technically ready, low cost, and are now receiving enormous economic support from the Inflation Reduction Act. But maybe blue hydrogen tightens global LNG markets by as much as 60MTpa by 2030, keeping global LNG prices above $20/mcf, impacting all global energy markets?

World changing themes often emerge from niches, which initially seem peripheral, technical, easy to overlook (‘the internet’ in the 1990s, ‘sub prime mortgages’ in 2007, some strange new virus cases in January-2020). We increasingly think that US blue hydrogen may be a world changing theme. Something that every serious decision maker in energy really needs to understand.

Blue hydrogen value chains are booming in the US. We recently reviewed these value chains in a deep-dive report into ATRs versus SMRs. Without any incentives, blue hydrogen can be economical at around $1/kg, with CO2 intensity less than 1 kg/kg (90% below grey hydrogen) and in turn, the hydrogen can be used to produce blue ammonia, blue steel, blue chemicals and as a low carbon fuel in itself.

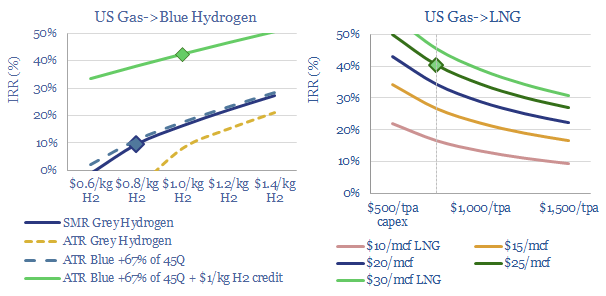

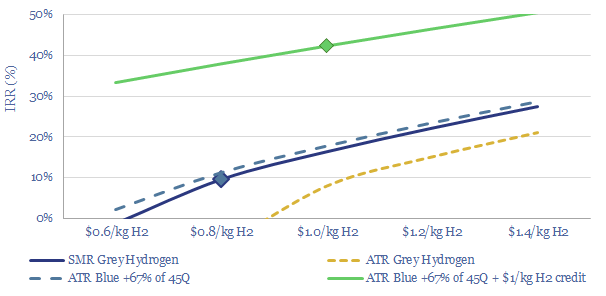

How does the inflation reduction act change US hydrogen economics? Substantively all of the US’s merchant hydrogen today is produced using steam methane reformers, where new production facilities require a $0.8/kg hydrogen price for a 10% IRR. Our model is linked below. But autothermal reformers are likely to gain market share, as they allow for greater portions of the CO2 to be captured, and lowering total CO2 intensity below 1 kg of CO2 per kg of hydrogen. Assuming that these autothermal reformers can sell their clean hydrogen at $1/kg, plus two thirds of the $85/ton CO2 disposal credits available under the Inflation Reduction Act, plus $1/kg hydrogen production incentives (for hydrogen with a CO2 intensity of 0.5-1.5 kg/kg CO2 intensity), this will uplift ATR IRRs above 40% (chart below).

How will the blue hydrogen boom impact US gas demand? This is hard to quantify, because we have seen 20MTpa of blue ammonia projects “come out of nowhere” in the past 12-months, and we expect new projects to continue being announced. We think the US can effectively deliver as much gas as is required for the foreseeable future if producers are offered incentive pricing above $3/mcf (model here). Others are worried about resource depletion. Our US shale production forecasts by basin are here. And clearly demand is going to be tightened by flowing more gas into low-carbon hydrogen products. The blue hydrogen boom is constructive for US gas producers.

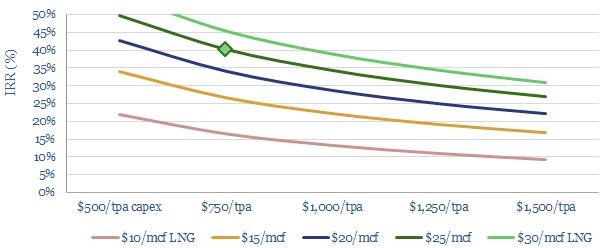

How does the US blue hydrogen boom impact US LNG economics? Natural gas is the key input for both blue hydrogen ATRs and LNG plants. Effectively, both types of facility are competing for natural gas. At the same gas input prices, it might take an $8/mcf long-term LNG sale price to earn a 10% IRR on a new liquefaction facility costing $750/Tpa, based on our LNG liquefaction models. But to rival the 40% IRRs available on a blue hydrogen ATR requires internal gas buyers to be willing to pay around $25/mcf. And this is for a full-carbon product, whereas blue hydrogen is already over 90% decarbonized.

How does the US blue hydrogen boom impact US LNG supplies? Our global LNG supply model sees global LNG supplies ramping up by 280MTpa to almost 700MTpa by 2030, and even this is insufficient to meet global LNG demand, we think.

Of our 280MTpa LNG supply ramp by 2030, almost half, or +130MTpa is meant to come from the US; and of that almost 60MTpa is pre-FID. The 60MTpa is on a ‘risked basis’, for example, a 10MTpa project with 50% chance of proceeding is counted as 5MTpa. In other words, if a boom in US blue hydrogen outcompetes new LNG plants for gas feedstocks, then this could realistically lower total global LNG supplies in 2030 by almost 10%. In what was already set to be an under-supplied market. You can look project by project in the model below.

What does it mean for global gas markets? Europe ramped up its LNG imports from 8bcfd to 15bcfd in 2022, due to Russia’s invasion of Ukraine. We see Europe potentially requiring 15bcfd of gas supplies through 2030, which is equivalent to 110MTpa of LNG supplies. Our European gas and power model is linked below.

Overall, the boom of US blue hydrogen compounds our fears that international energy markets could be very tight throughout the 2020s and 2030s. Our best note into this topic, and our global energy supply demand models are copied below.

In an unexpected way, these industry trends might seem to be very supportive for LNG incumbents, with LNG demand remaining higher for longer, and medium-term supply growth from US LNG being suppressed by competition from booming blue hydrogen value chains. All of our broader conclusions on LNG in the energy transition are linked here.