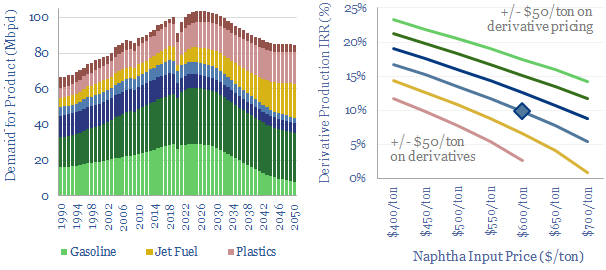

Oil markets are transitioning, with electric vehicles displacing 20Mbpd of gasoline by 2050, while petrochemical demand rises by almost 10Mbpd. So it is often said oil refiners should ‘become crude to chemicals companies’. It depends. This 18-page report charts petrochemical pathways and sees opportunity in chemicals that can absorb surplus BTX.

20Mbpd of gasoline demand is likely to be displaced by 2050, due to the rise of electric vehicles, a world-changing technology, 2-6x more efficient than ICEs and a rapidly improving semiconductor technology, which may ramp up to 200M sales per year by 2050. Our vehicle outlook is discussed here, our oil models are available here, and the key numbers across different regions are re-capped on pages 2-3.

10Mbpd of additional oil may also be needed for petrochemicals by 2050, as plastic demand per capita rises from 60kg pp pa to 80 kg pp pa, driven by demand for advanced polymers and textiles. Global plastic demand is modelled here, and discussed on pages 4-5.

The very same molecules being displaced from the gasoline pool are usable in the plastics industry. They are BTXs, i.e., benzene, toluene and xylenes, produced by reforming of naphtha, and mostly flowed into the gasoline pool today, due to their excellent combustion properties and ‘low knocking’. So BTXs could face a supply glut. Key numbers are explained on page 6.

Which petrochemical processes use BTX? We have identified four key petrochemical categories that can benefit from cheapening BTX feedstocks, and drawn out flow charts and mass balances on pages 7-9.

Economic uplifts. How much can the cash flows and IRRs of petrochemical facilities be uplifted by (a) cheapening naphtha? (b) cheapening BTXs? And thus, is it better to build new naphtha crackers, or simply absorb excess BTXs from existing ones? Our economic analysis answers these questions on pages 10-11, with the conclusions differing by region per pages 12-13.

Is there a risk of being late to the party? Who wants to compete on a cost curve with Aramco’s enormous petrochemical expansion? Or with 3-6MTpa Chinese petrochemical mega-facilities? Some observations on page 14.

Leading downstream chemicals companies that can benefit from cheapening BTX inputs are identified on pages 15-17, alongside our conclusions on the best crude to chemicals opportunities.