The energy industry is going through its greatest ever period of change, to meet the world’s future energy needs, but remove all of the CO2. We help leading decision makers find opportunities in the energy transition, with data-driven research and economic analysis.

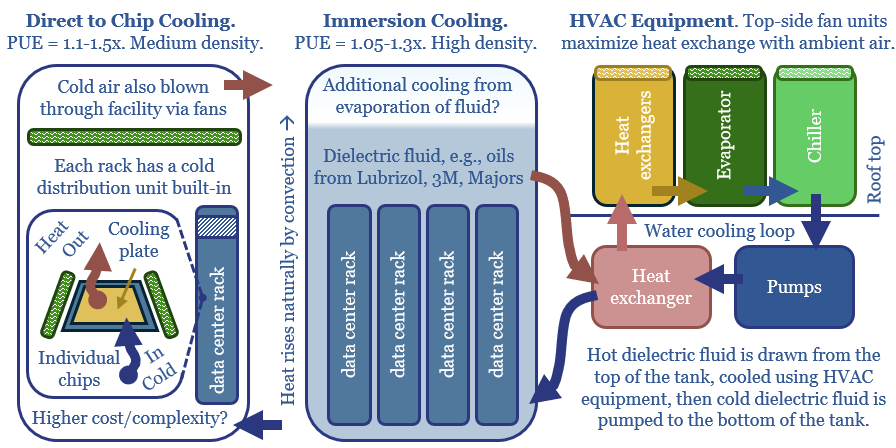

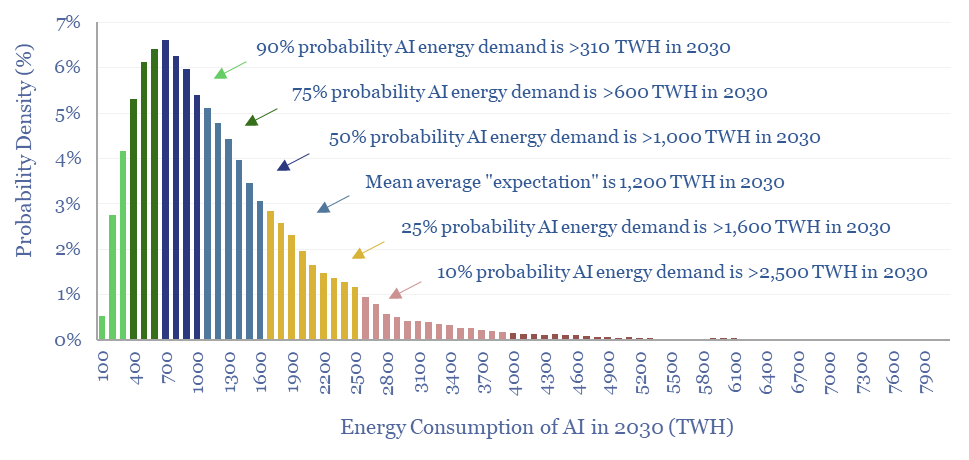

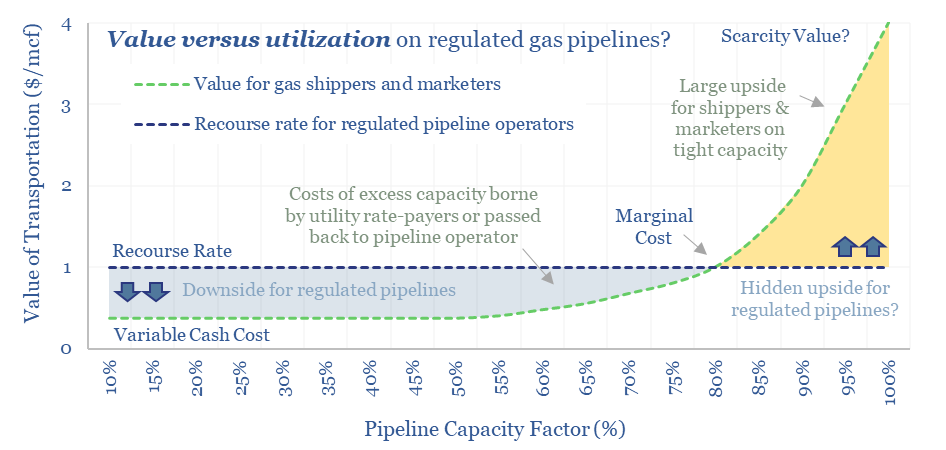

Economic analysis is crucial. We all see hyperbolic headlines, around wind, solar, batteries, hydrogen, fuel cells and other breakthrough technologies. But what is their true impact? Are they technically ready? What do they cost? Where are the risks? What are the resource bottlenecks to ramp them up? Which companies have patented the leading technologies? What role remains for oil, gas, shale or LNG in a decarbonized energy system? And most excitingly, what are the ‘non-obvious’ opportunities that will help the world reach ‘net zero’, but are not yet widely recognized?

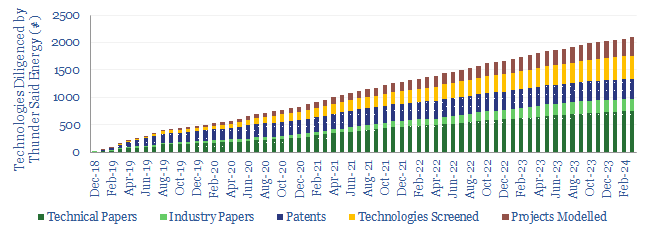

These are the questions that we answer in our energy transition research. Each week we publish a deep-dive report into a specific topic. Each day we also publish new economic datapoints and models. The goal is to make our readers into the smartest decision-makers in the energy transition.

Sign up to our distribution list, to receive our best ideas…

All of our energy transition research is linked TSE insights page Additionally, you can follow us on LinkedIn or Twitter. Full details on our subscription service are linked work with us page. Please scroll down the page for our research philosophy, an overview of our conclusions into the energy transition, and a summary of some of our recent research…