FERC regulations are surprisingly interesting!! In theory, gas pipelines are not allowed to have market power. But increasingly, they do have it: gas use is rising, on grid bottlenecks, volatile renewables and AI; while new pipeline investments are being hindered. So who benefits here? Answers are explored in this 13-page report.

There are three major trends underway for gas pipelines in the energy transition. Demand is rising to backstop renewables and power AI data-centers. Pipeline capacity growth is stagnating due to various roadblocks. And yet gas prices are becoming increasingly volatile. These effects are all discussed on pages 2-3.

In any other industry, these conditions — demand surprising to the upside, supply stagnating, and increasing arbitrage — would be a kingmaker. Perfect conditions for incumbents to generate excess returns.

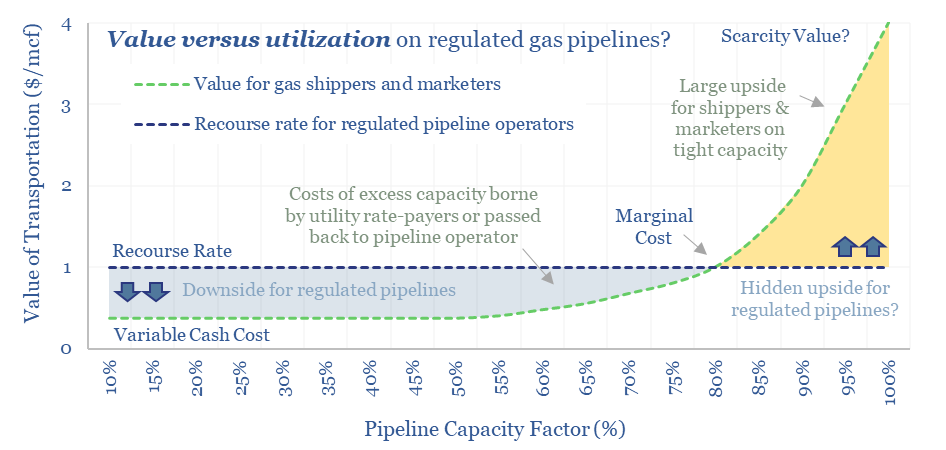

The peculiarity of the US gas pipeline industry is that the companies within this industry are regulated by FERC. Pipeline companies are not allowed to earn excess returns. They must not exercise pricing power, even when they obviously do have it.

Hence the purpose of this note is to explore FERC regulations, to assess what changes in industry conditions might mean for gas pipelines, or conversely, whether these changes will benefit others elsewhere?

A concise overview of regulated gas markets — covering FERC, recourse rates, long-term contracts, open season, firm customers, NPV prioritization, Section 4 and Section 5, capacity scheduling, nominations and capacity release markets — are distilled on pages 5-6.

Ensuring utilization is the most important dimension dictating the economics of pipelines and pipeline companies, as discussed on page 7.

Gas marketers may be the primary beneficiary of evolving market dynamics, for the reasons discussed on page 8.

But can the increasing value of pipelines trickle back to pipeline operators, and boost their returns in ways that are nevertheless compatible with FERC regulations? Our answers to this question are on pages 9-10.

Leading companies in US gas marketing and pipelines are compiled in our screen of US midstream gas, and discussed on pages 11-12.

Implications extend into power markets as well. Increasing market volatility is actually needed as a catalyst to expand energy storage. And similar issues will arise due to power grid bottlenecks. Closing observations are on page 13.