-

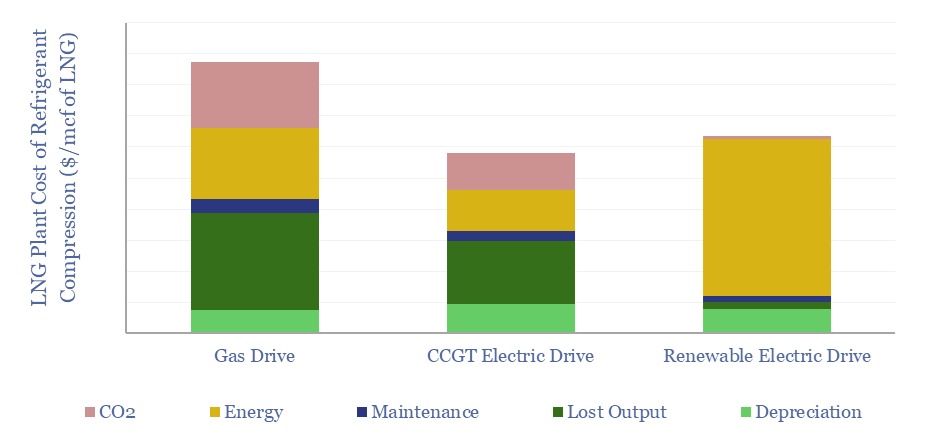

LNG plant compressors: chilling goes electric?

Electric motors were selected, in lieu of industry-standard gas turbines, to power the main refrigeration compressors at three of the four new LNG projects that took FID in 2024. Hence is a change underway in the LNG industry? This 13-page report covers the costs of e-LNG, advantages, challanges, and who benfits from shifting capex.

-

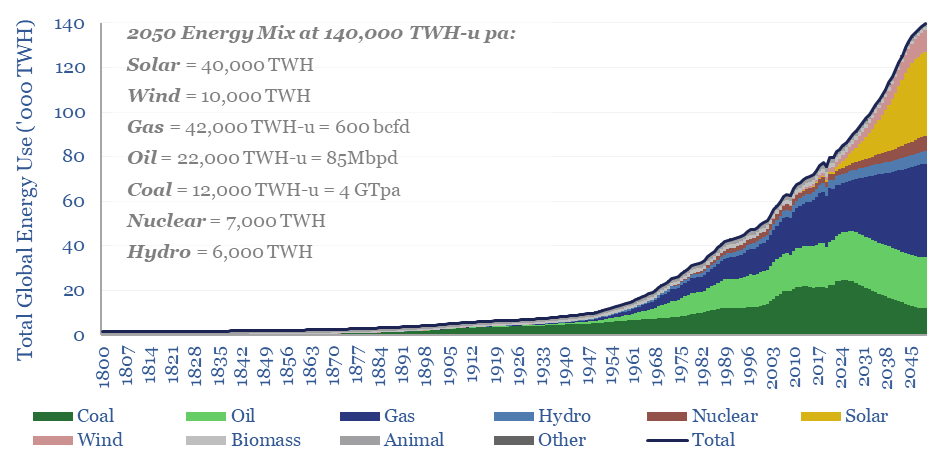

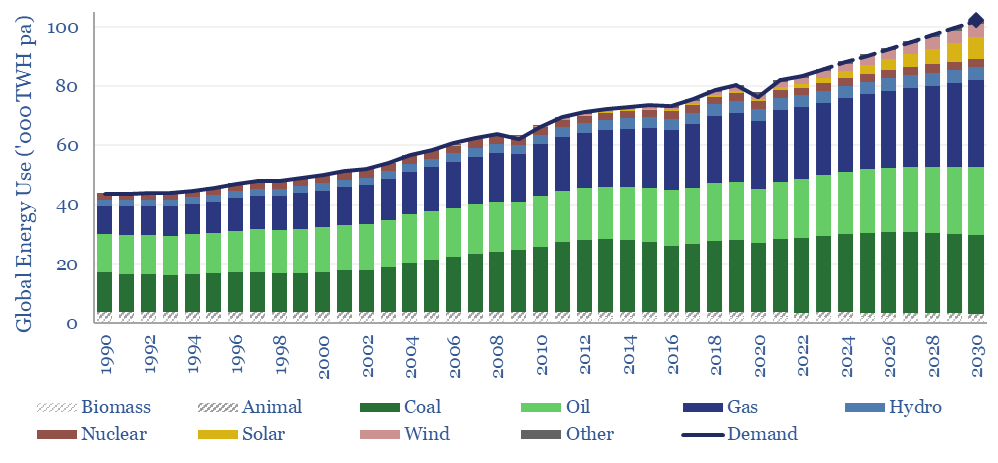

Energy transition: solar and gas -vs- coal hard reality?

This 15-page note outlines the largest changes to our long-term energy forecasts in five years. Over this time, we have consistently underestimated both coal and solar. Both are upgraded. But we also show how coal can peak after 2030. Global gas is seen rising from 400bcfd in 2023 to 600bcfd in 2050.

-

Ten Themes for Energy in 2025?

This 11-page report sets out our top ten predictions for 2025, across energy, industrials and climate. Sentiment is shifting. New narratives are emerging for what energy transition is. 2025-30 energy markets look well supplied. The value is in regional arbitrage, volatility, grids, AI and solar.

-

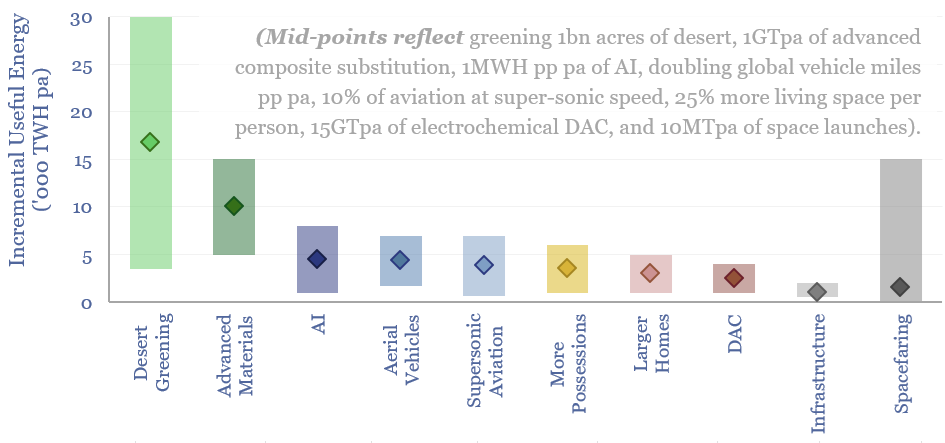

Kardashev scale: a futuristic future of energy?

A Kardashev scale civilization uses all the energy it has available. Hence this 16-page report explores ten futuristic uses for global energy, which could absorb an additional 50,000 TWH pa by 2050 (60% upside), mainly from solar. And does this leap in human progress also allay climate concerns better than pre-existing roadmaps to net zero?

-

Cool concept: absorption chillers, data-centers, fuel cells?!

Absorption chillers perform the thermodynamic alchemy of converting waste heat into coolness. Interestingly, their use with solid oxide fuel cells may have some of the lowest costs and CO2 for powering and cooling AI data-centers. This 14-page report explores the opportunity, costs and challenges.

-

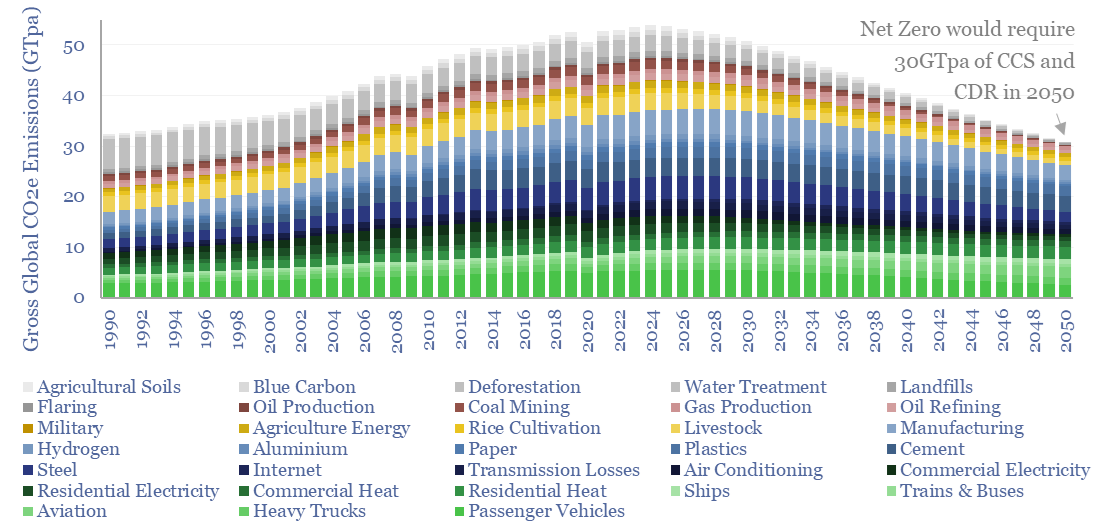

Energy transition: losing faith?

What if achieving Net Zero by 2050 and/or reaching 1.5ºC climate targets now has a 3% chance of success, for reasons that cause decision-makers to backtrack, and instead focus on climate adaptation and broader competitiveness? This 14-page report reviews the challenges. Can our Roadmap to Net Zero be salvaged?

-

Solar trackers: following the times?

Solar trackers are worth $10bn pa. They typically raise solar revenues by 30%, earn 13% IRRs on their capex costs, and lower LCOEs by 0.4 c/kWh. But these numbers are likely to double, as solar gains share, grids grow more volatile, and AI unlocks further optimizations? This 14-page report explores the theme and who benefits?

-

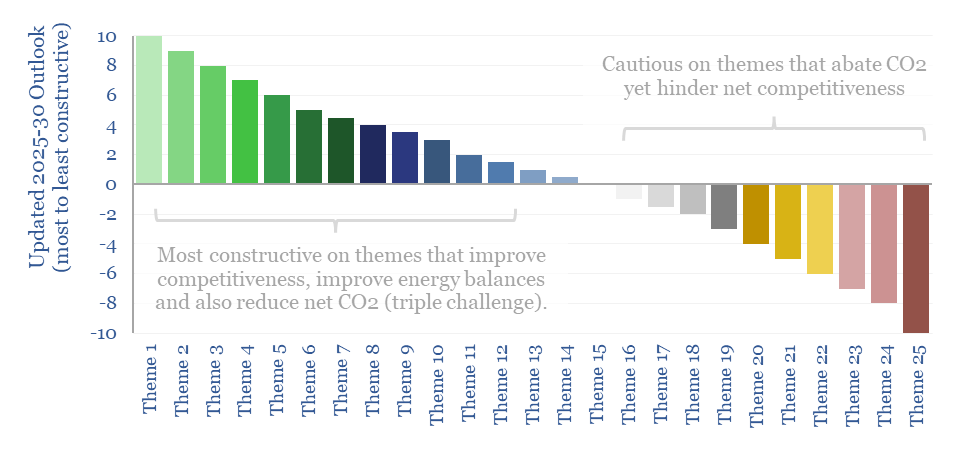

Energy transition: the triple challenge?

Energy transition is a triple challenge: to meet energy needs, abate CO2 and increase competitiveness. History has now shown that ignoring the part about competitiveness gets you voted out of office?! Raising competitiveness will be a focus of the new administration in the US. So this 15-page report discusses energy competitiveness, and updates our outlook.…

-

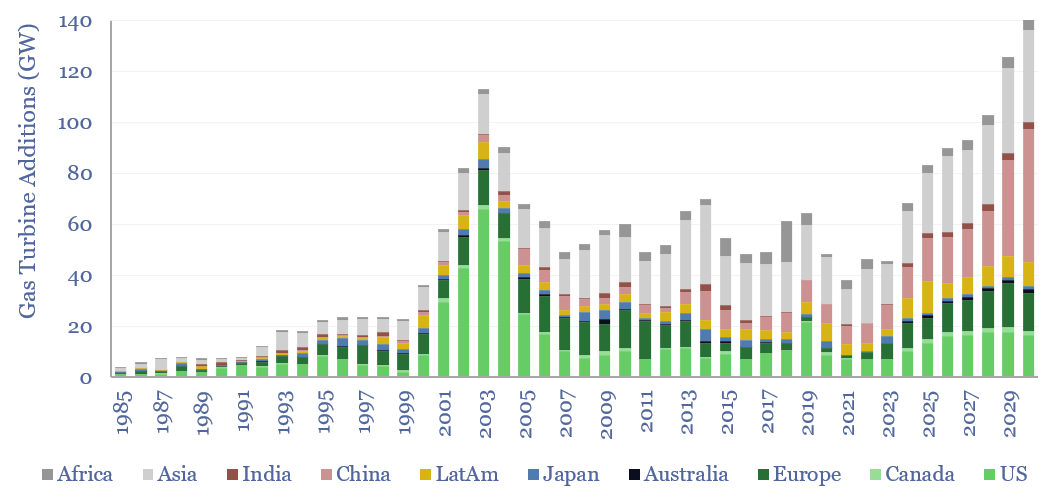

Gas turbines: what outlook in energy transition?

Gas turbines should be considered a key workhorse for a cleaner and more efficient global energy system. Installations will double to 100GW pa in 2024-30, and reach 140GW in 2030, surpassing their prior peak from 2003. This 16-page report outlines four key drivers in our gas turbine outlook, and their implications.

-

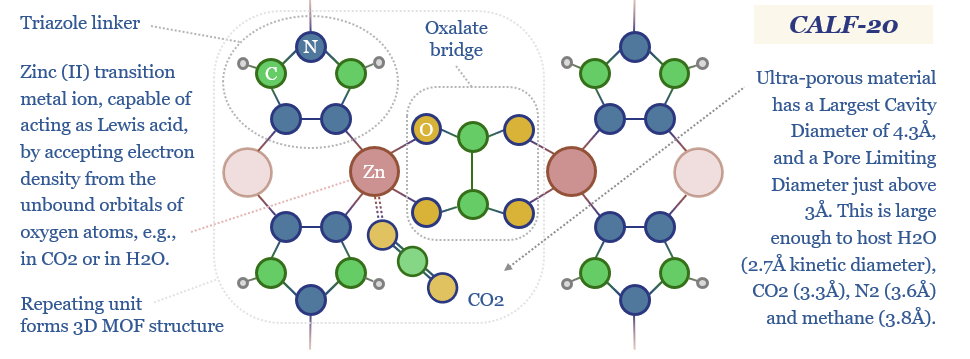

Metal Organic Frameworks: sorting hat?

Metal Organic Frameworks (MOFs) are a game-changer for industrial separation, which consumes c10% of global energy. Activity is surging. This 18-page report reviews MOFs’ recent progress and future promise. As a case study, CALF-20 can deflate CCS costs by c50%, per Svante’s TSA process.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)