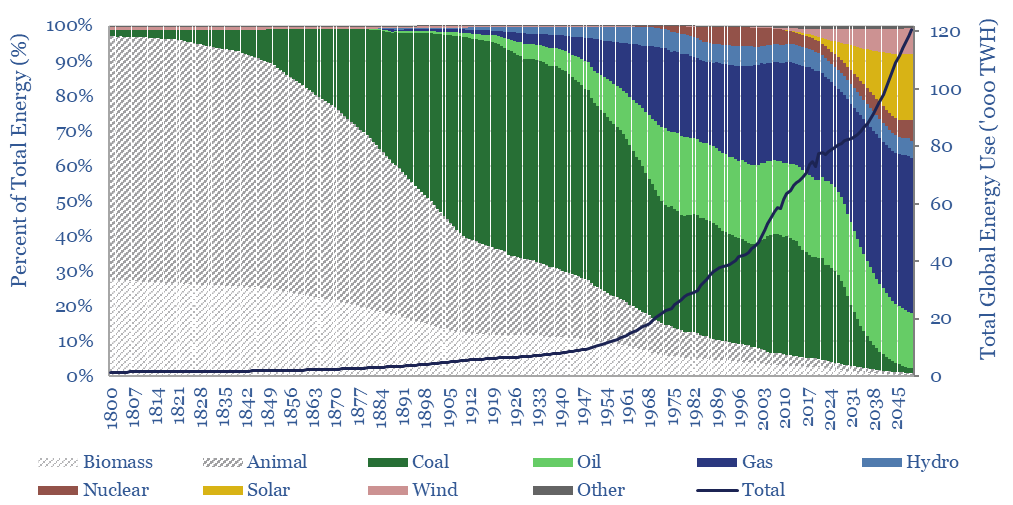

We have attempted a detailed breakdown of global energy demand across 50 categories, to identify emerging opportunities in the energy transition, and suggesting upside to our energy demand forecasts? This 12-page note sets out our conclusions and is intended a useful reference.

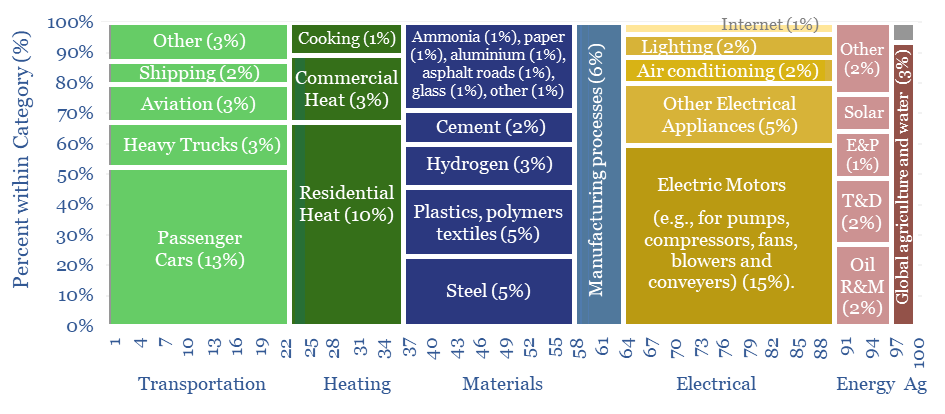

Global energy demand is not really a thing. It is a constellation of over fifty major categories underpinning human civilization. 27 of those categories consume more than 1% of global energy.

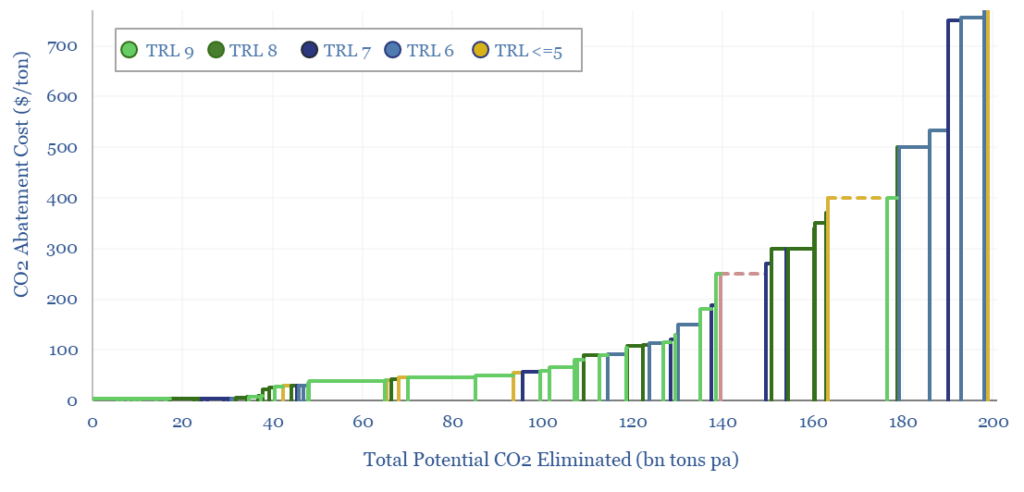

Hence our goals in this note are to disaggregate global energy demand by end use, in order to derive more accurate demand forecasts, and to identify the biggest opportunities for energy efficiency initiatives.

Our methodology for breaking down global energy demand is to look line by line, through all of the economic models, energy intensity models and supply-demand models we have built over the past five years, as explained on pages 2-3. (Note the distinction between primary and useful energy). All of our models are fully auditable for TSE clients.

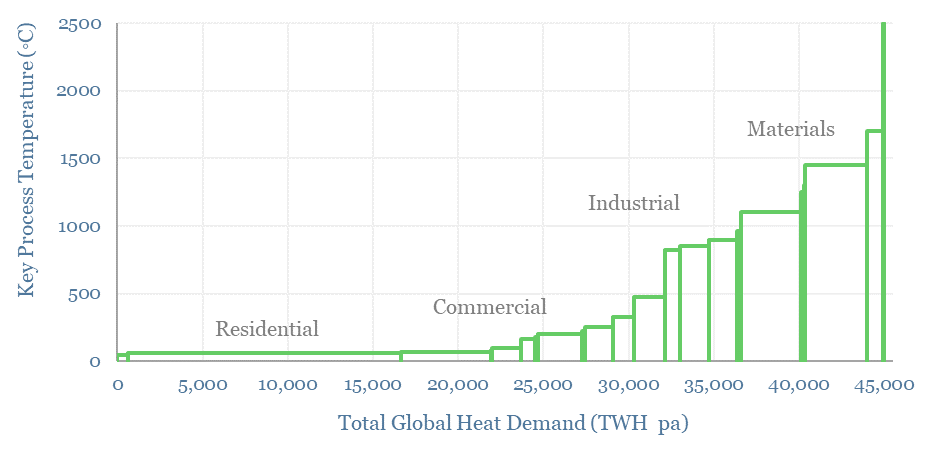

The biggest constituents to global useful energy demand are residential heat (15%), steel (7.5%), plastics (6%), cars (5.4%), commercial heat (5%), hydrogen (4.6%), cement (3%), oil refining (3%), agriculture (3%), aviation (2.6%), air conditioning (2.5%), cooking (2.2%), lighting (2.2%) and shipping (1.4%) (page 4).

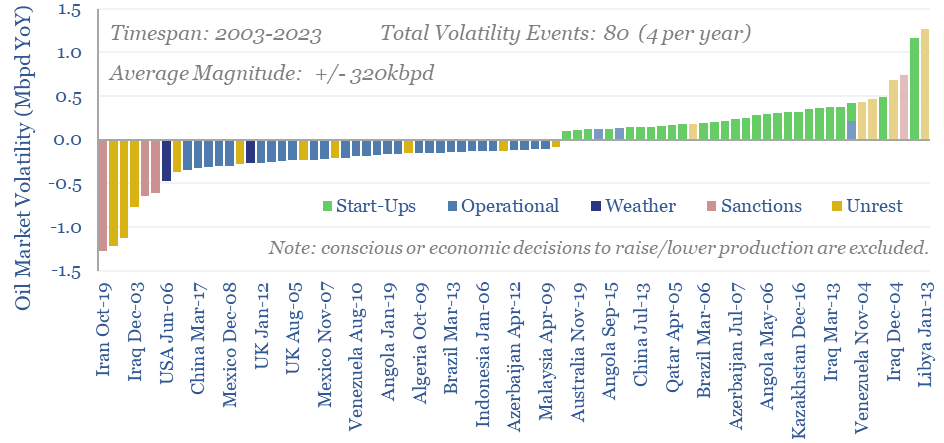

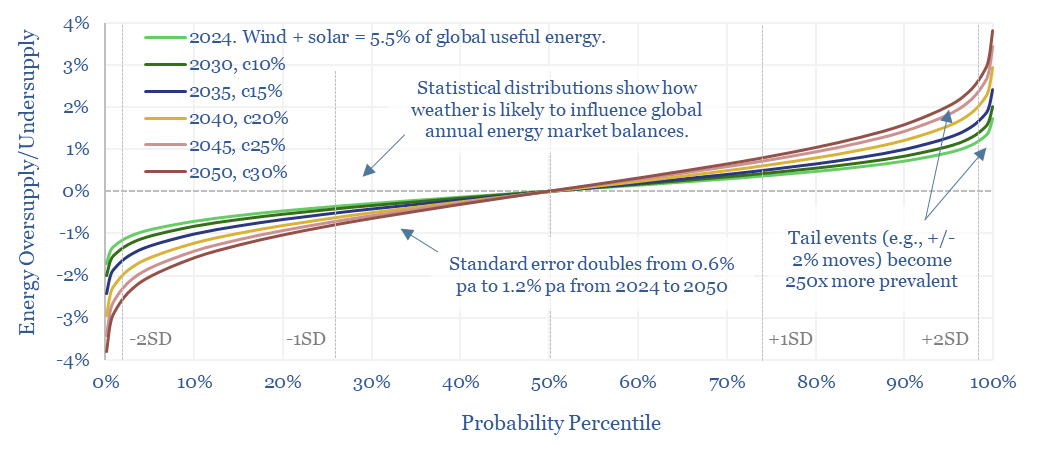

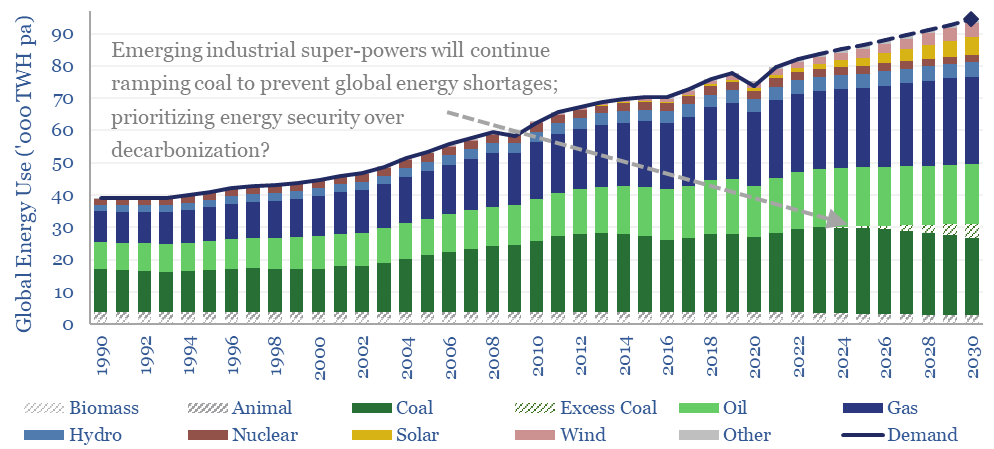

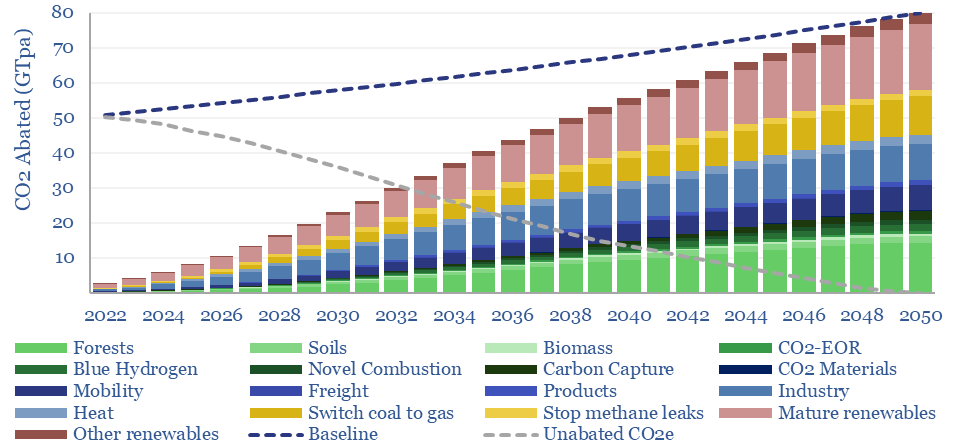

The first key reason for our breakdown is to improve our forecasts for global energy consumption. The trajectory is one of the most active debates in the energy transition, as summarized on pages 5-6.

If we look line-by-line through the categories in our breakdown, we would adamantly argue global energy demand will rise by at least 50% in useful terms by 2050, and by 20% in primary terms by 2050 (page 8).

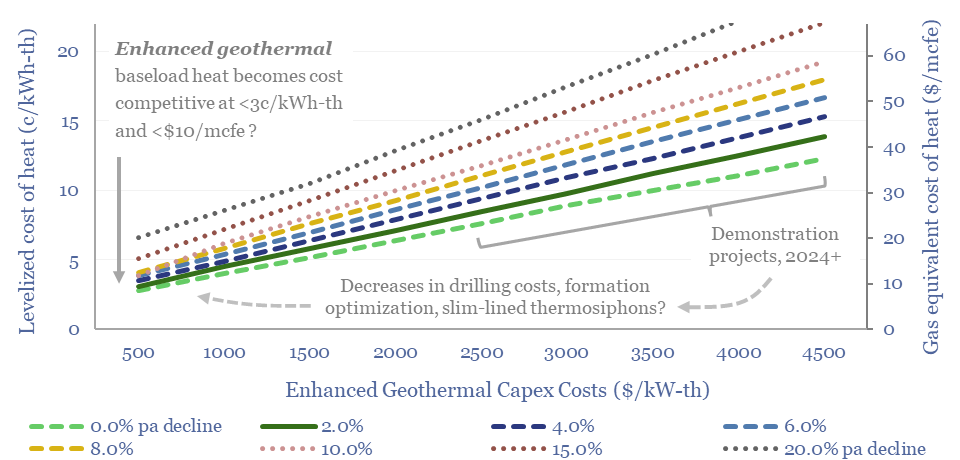

The second key reason for our granular breakdown is to identify the biggest opportunities for energy savings and decarbonization. The biggest categories might seem to offer the biggest savings (page 7). But the most interesting opportunities to us are in the materials sector (page 9) and in recovering waste heat (page 10).

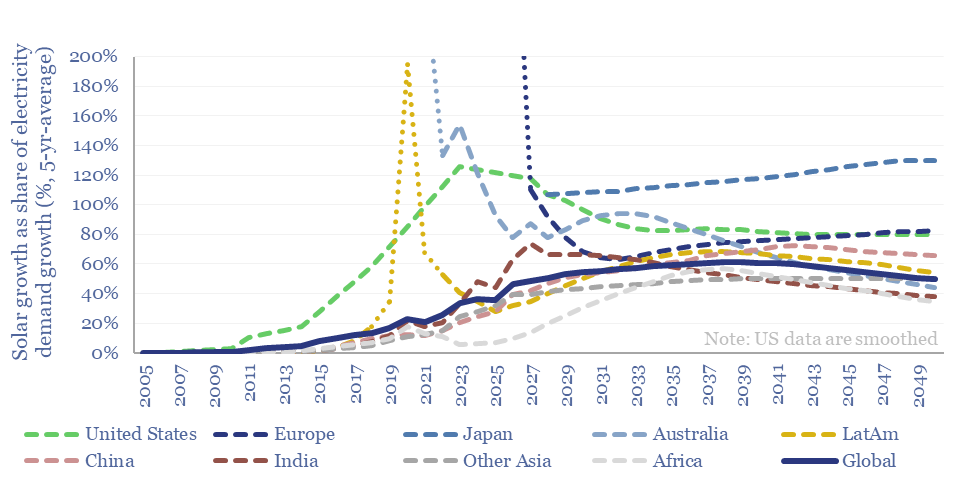

A third observation is that the energy transition is itself likely to stoke demand. Producing over 430GW pa of solar modules now consumes around 1.4% of all useful global energy. Similar numbers are explored for wind, electric vehicles, CCS, hydrogen and energy storage, together with conclusions on pages 11-12.