There is only one way to decarbonise the energy system: leading companies must find economic opportunities in better technologies. No other route can source sufficient capital to re-shape such a vast industry that spends c$2trn per annum. We outline seven game-changing opportunities. Leading energy Majors are already pursuing them in their portfolios, patents and venturing. Others must follow suit.

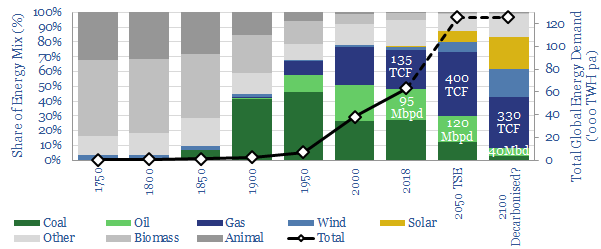

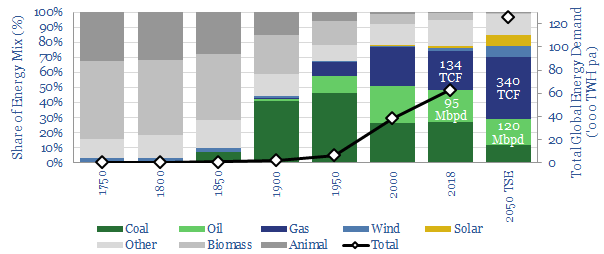

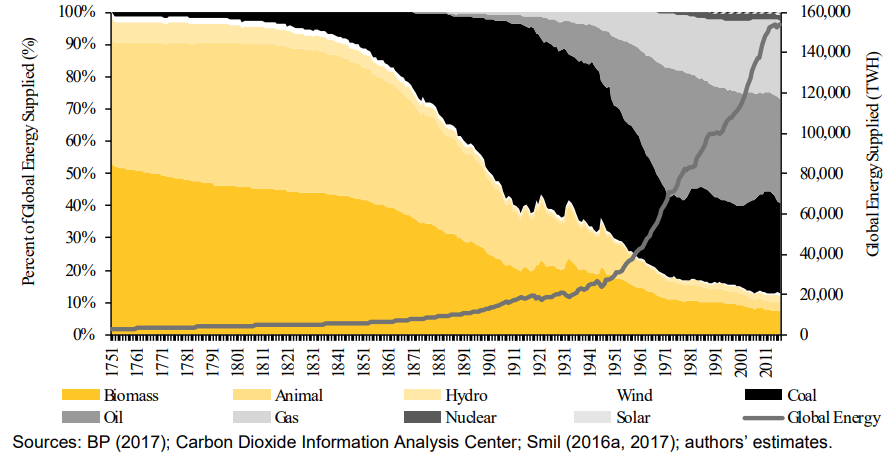

Pages 2-3 show that today’s technologies are not sufficient to decarbonise the global energy system, which will surpass 100,000TWH pa by 2050. Better technologies are needed.

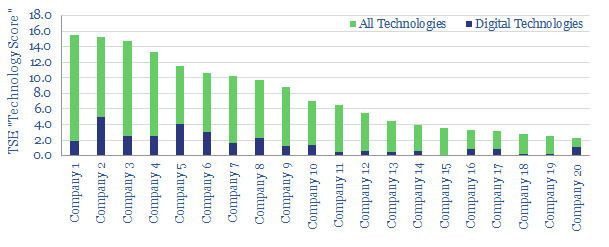

Pages 4-6 show how Oil Majors are starting to accelerate the transition, by developing these game-changing technologies. The work draws on analysis of 3,000 patents, 200 venture investments and other portfolio tilts.

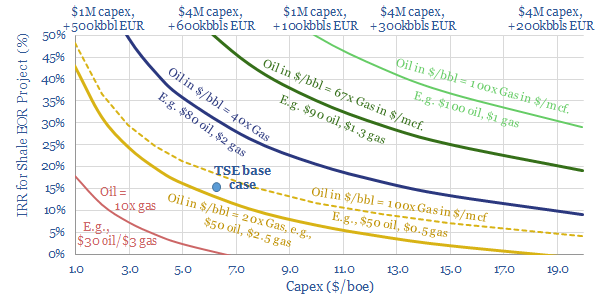

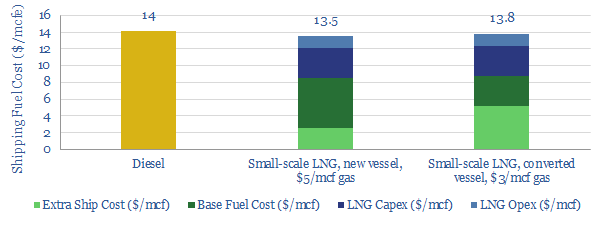

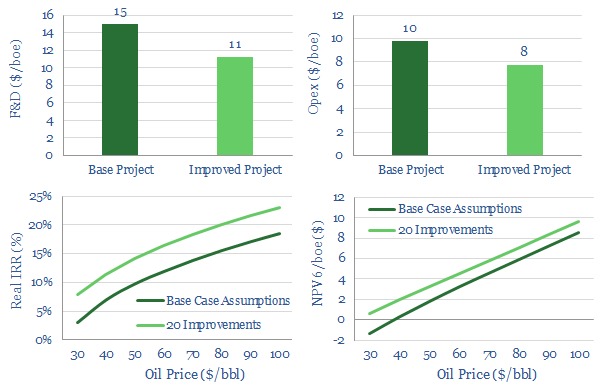

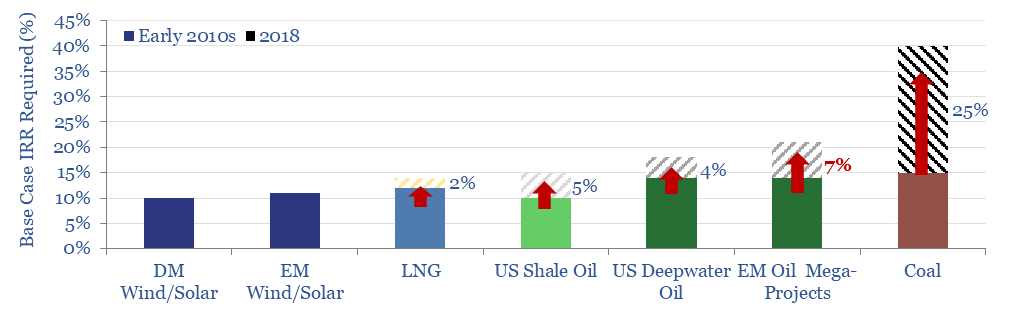

Pages 7-13 profile seven game-changing themes, which can deliver both the energy transition and vast economic opportunities in the evolving energy system. These prospects cover electric mobility, gas, digital, plastics, wind, solar and CCS. In each case, we find leading Oil companies among the front-runners.