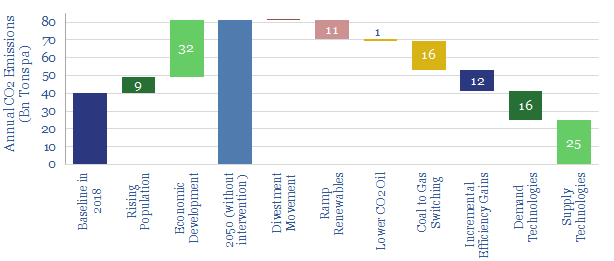

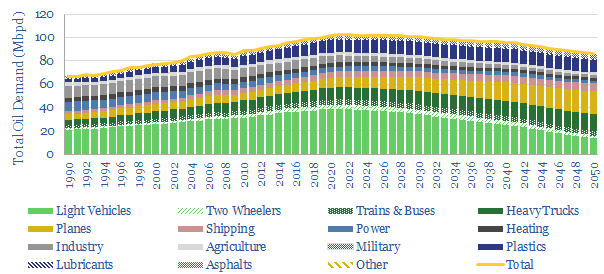

Prioritising low carbon barrels will matter increasingly to investors, as they can reduce total oil industry CO2 by 25%. Hence, these barrels should attract lower WACCs, whereas fears over the energy transition are elevating hurdle rates elsewhere and denting valuations. In Guyana’s case, the upshot could add $8-15bn of NAV, with a total CO2 intensity that could be c50% below the industry average.

Pages 2-3 introduce our framework for decarbonisation of the global energy system. Within oil, this requires prioritising lower carbon over higher carbon oil barrels.

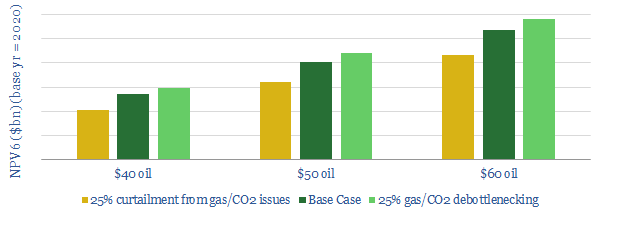

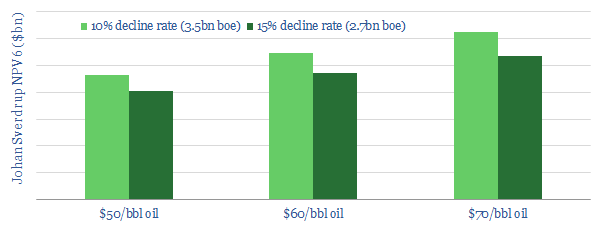

Pages 3-6 outline the economic value in Guyana, which is now at the point where it is hard to move the needle with further resource discoveries.

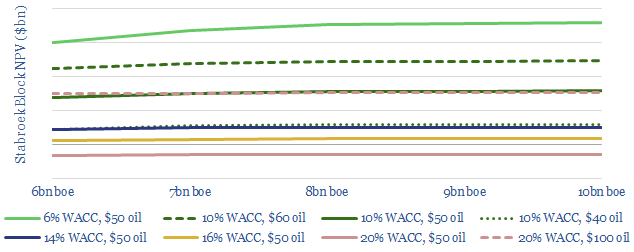

Pages 7-8 show how lower WACCs can be trasnformative to resource value, even more material than increasing oil prices to $100/bbl.

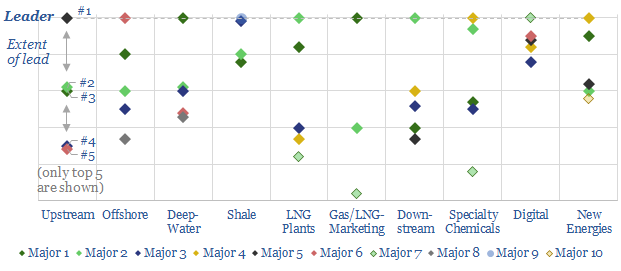

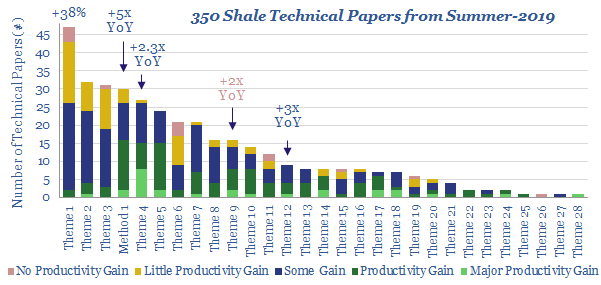

Pages 9-17 outline the top technologies that should minimise Guyana’s CO2 emissions per barrel, including flaring policies, refining quality, midstream proximity, proprietary gas turbine technologies from ExxonMobil’s patents and leading digital technologies around the industry.

Our conclusion is that leading companies must deepen their efforts to minimise CO2 intensities and articulate these initiatives to the market.

Key points on Guyana carbon credentials and oil capital costs are spelled out in the article sent out to our distribution list.