The super-giant Mero field in pre-salt Brazil is not like its predecessors. While prolific, it has a 2x higher gas cut, of which c45% is corrosive and environmentally unpalatable CO2. Hence, Petrobras, Shell, TOTAL and two Chinese Majors are pushing the boundaries of deepwater technology. Our new, 16-page note assess four innovation areas, which could unlock $2bn of NPV upside. But the distribution of outcomes remains broad. $4bn is at risk if the CO2-challenges are not overcome.

Page 2 provides background on pre-salt Brazil, especially the flagship Lula project, which a new super-giant, Mero, is trying to emulate.

Page 3-4 contrast Mero to Lula, based on data from flow-tests. Mero has a 2x higher gas-cut and c8x higher CO2.

Page 5 reviews Petrobras’s own internal concerns over CO2-handling at Mero, and how they are expected to sway the decline rates at the field.

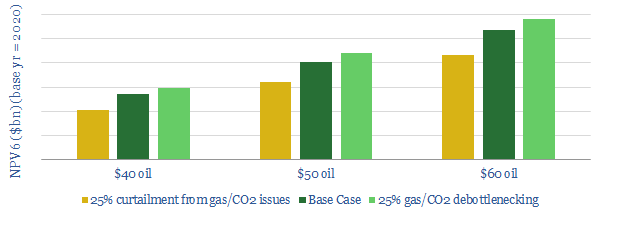

Page 6 outlines our valuation of the Mero oilfield, testing different CO2-handling scenarios. Our full model is also available.

Pages 7-8 review Mero’s FPSO design adaptations, to handle the field’s higher gas and CO2. These will be 2-2.5x larger FPSOs than Lula, by tonnage.

Pages 8-10 illustrate pipeline bottlenecks facing pre-salt Brazil. After considering alternative options (re-injection, LNG), we argue more pipelines may be needed.

Pages 10-12 describe riser innovations, which may help handle the risks of CO2-corrosion at Mero. One option is overly complex. The other is more promising.

Pages 12-16 cover the holy grail for Mero’s CO2, which is subsea CO2 separation. This would be a major industry advance, and unlock further billion-barrel resource opportunities. Upcoming hurdles and challenges are assessed.

Pages 15-16, in particular, cover Shell’s industry-leading deepwater technology, which may be helpful in maximising value from the resource, longer-term.