Hydrogen

-

Hydrogen: overview and conclusions?

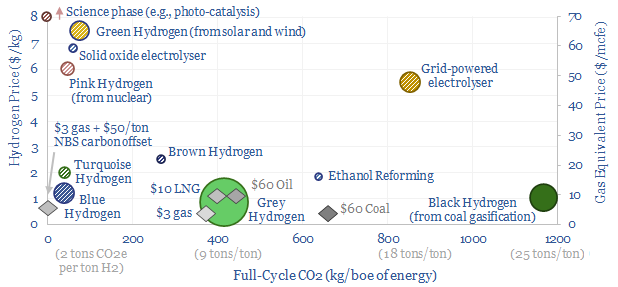

We think the best opportunities in hydrogen will be to decarbonize gas at source via blue and turquoise hydrogen, displacing ‘black hydrogen’ that currently comes from coal, and to produce small-scale feedstock on site via electrolysis for select industries. Others see green hydrogen as a cornerstone of the future energy system. We think there may…

-

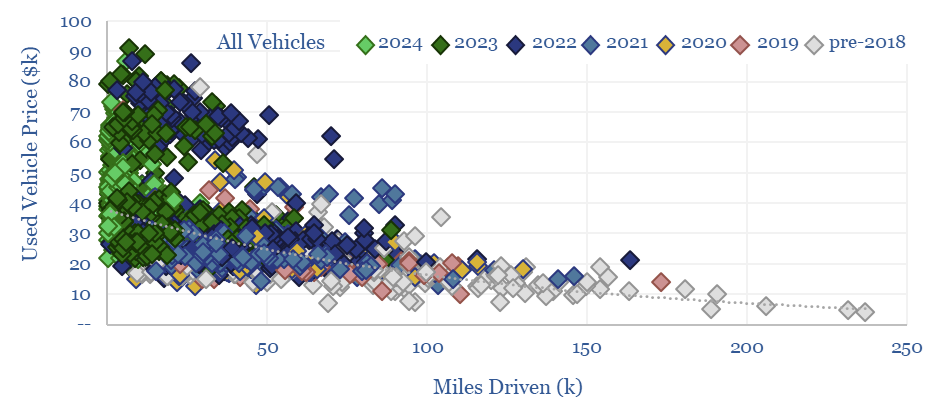

Vehicle depreciation rates: EVs versus ICEs?

This data-file quantifies the cost per mile of vehicle ownership across different categories by correlating second hand car prices with their accumulated mileage. Hybrids and regular passenger cars are most economical. SUVs and EVs are 2x more expensive. Hydrogen vehicles depreciate fastest and will have lost over 90% of their value after 100,000 miles.

-

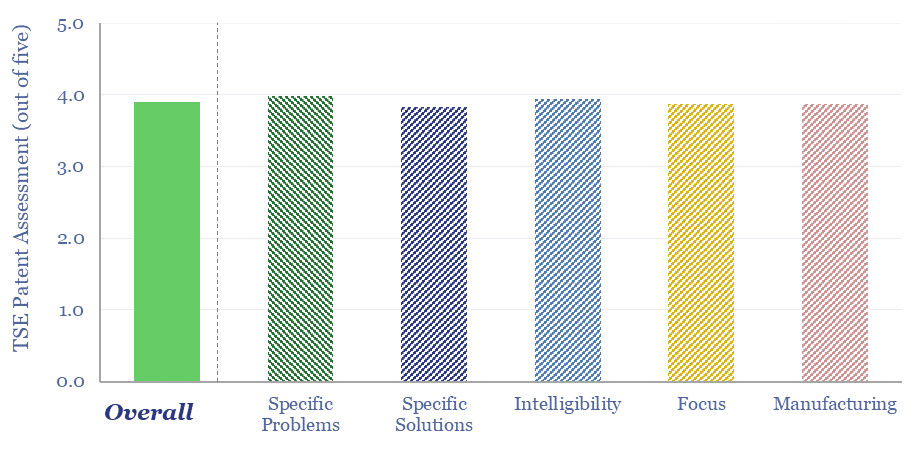

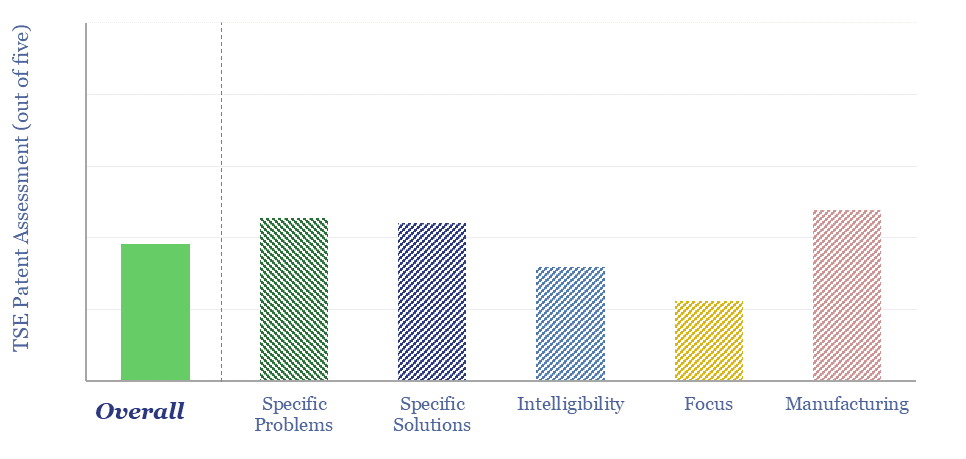

Air Products: ammonia cracking technology?

Can we de-risk Air Products’s ammonia cracking technology in our roadmaps to net zero, which is crucial to recovering green hydrogen in regions that import green ammonia from projects such as Saudi Arabia’s NEOM. We find strong IP in Air Products’s patents. However, we still see 15-35% energy penalties and $2-3/kg of costs in ammonia…

-

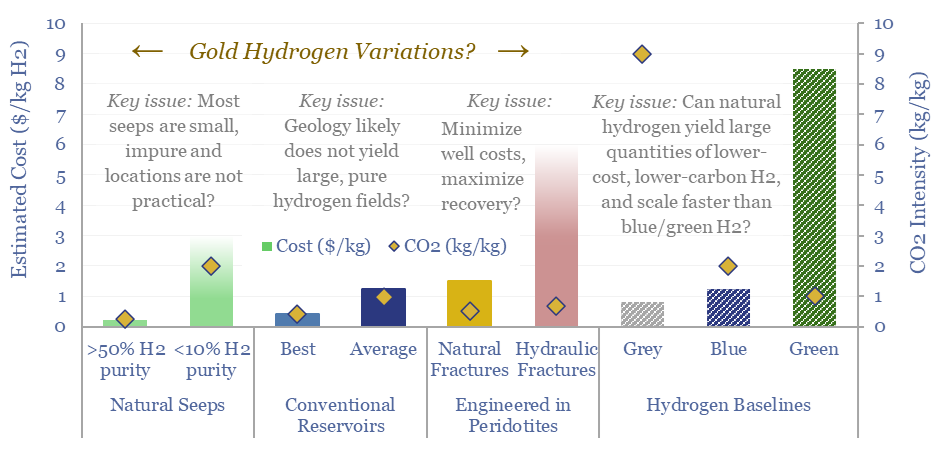

Natural hydrogen: going for gold?

Vast quantities of hydrogen are produced in the Earth’s subsurface, via the Serpentinization of iron-containing Peridotite rocks. Gold, white and orange hydrogen variations aim to harness this hydrogen. This 19-page note explores opportunities, costs and challenges for harvesting H2 out of natural seeps, hydrogen reservoirs or fraccing/flooding Peridotites.

-

Cemvita Factory: microbial breakthroughs?

Cemvita is a private biotech company, based in Houston, founded in 2017. It has isolated and/or engineered more than 150 microbial strains, aiming to valorize waste, convert CO2 to useful feedstocks, mine scarce metals (e.g., direct lithium extraction) and “brew” a variant of gold hydrogen from depleted hydrocarbon reservoirs. This data-file is our Cemvita Factory…

-

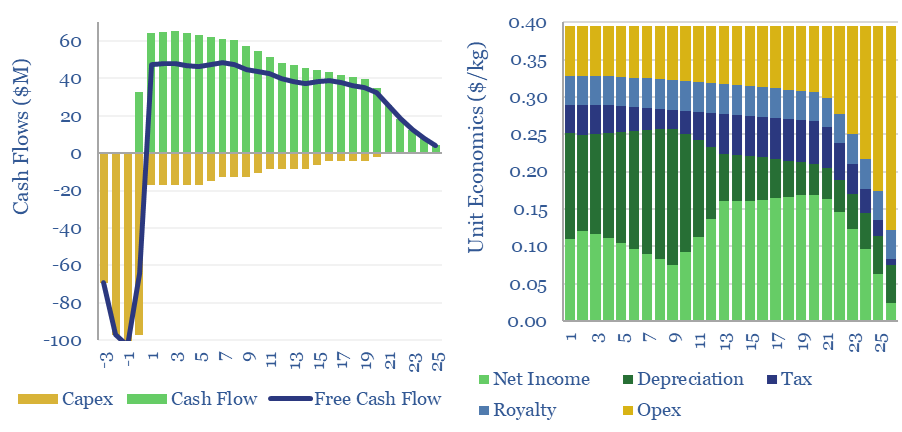

Gold hydrogen: the economics?

Natural hydrogen could be recovered from the Earth’s subsurface, with costs ranging from $0.3-10/kg, and CO2 intensities of 0.2-5.0 kg/kg. This data-file models the economic costs of gold hydrogen, and its sub-variants such as white hydrogen and orange hydrogen.

-

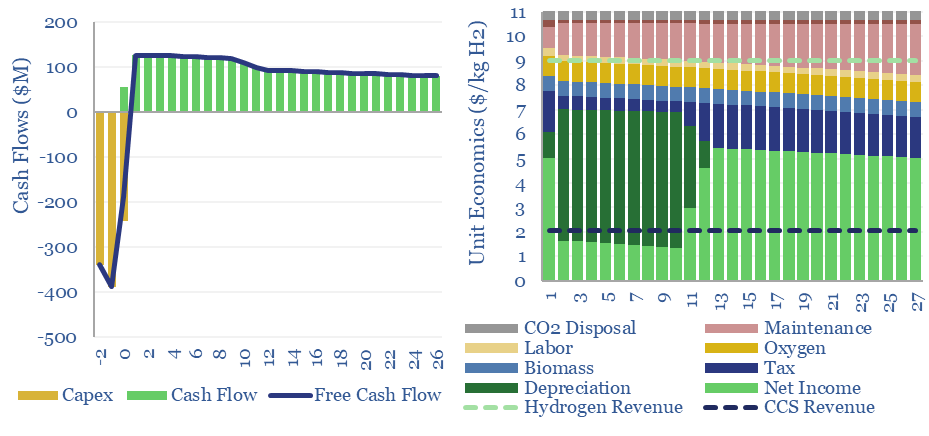

Bright green hydrogen from biomass gasification?

Woody biomass can be converted into clean hydrogen via gasification. If the resultant CO2 is sequestered, each ton of hydrogen may be associated with -20 tons of CO2 disposal. The economies of hydrogen from biomass gasification require $11/kg-e revenues for a 10% IRR on capex of $3,000/Tpa of biomass, or lower, with CO2 disposal incentives.

-

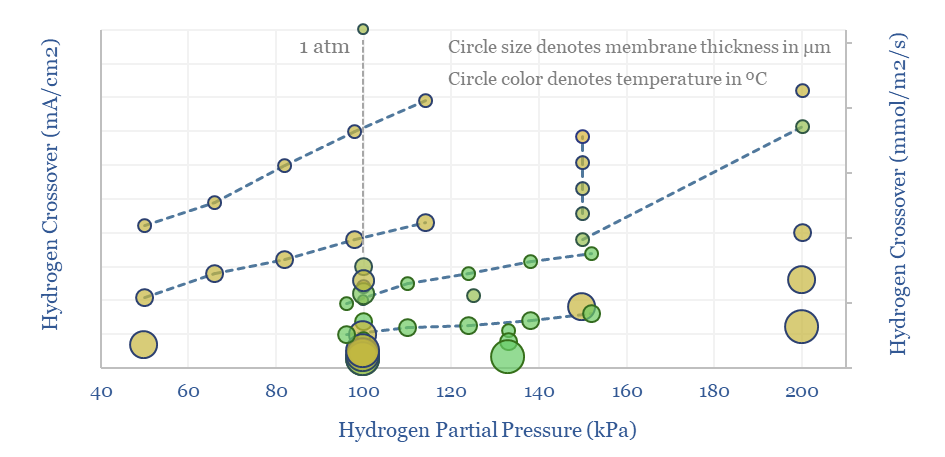

Nafion membranes: costs and hydrogen crossover?

Perfluorinated sulfonate (PFSA) membranes, such as Nafion, are the crucial enabler for PEM electrolyzers, fuel cells and other industrial processes. The market is worth $750M pa. The key challenges are costs, longevity and hydrogen crossover, which are tabulated in this data-file.

-

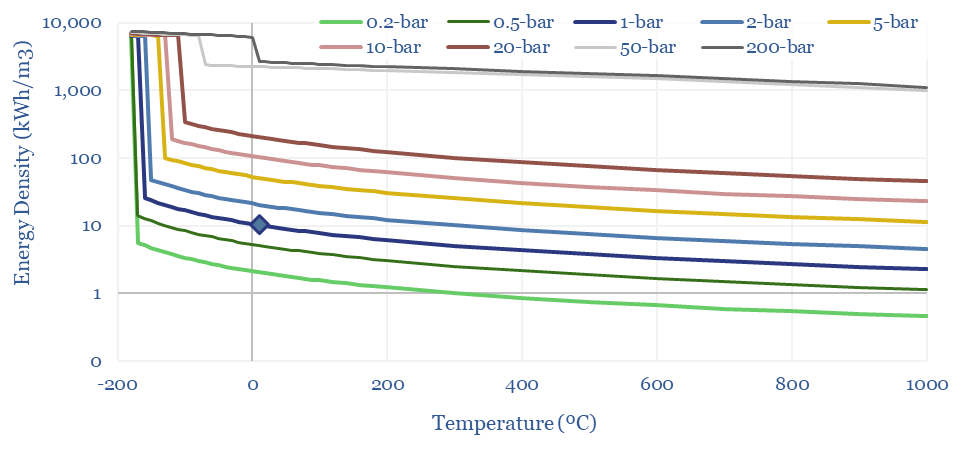

Density of gases: by pressure and temperature?

The density of gases matters in turbines, compressors, for energy transport and energy storage. Hence this data-file models the density of gases from first principles, using the Ideal Gas Equations and the Clausius-Clapeyron Equation. High energy density is shown for methane, less so for hydrogen and ammonia. CO2, nitrogen, argon and water are also captured.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)